Nvidia’s principal accounting officer sells shares worth over $520,000 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with captivating storytelling language style and brimming with originality from the outset.

The sale, which took place on [Date of Sale], involved [Number of Shares Sold] shares, generating a significant sum for the officer. This transaction has sparked curiosity among investors and industry analysts, prompting questions about the underlying motivations and potential implications for the tech giant.

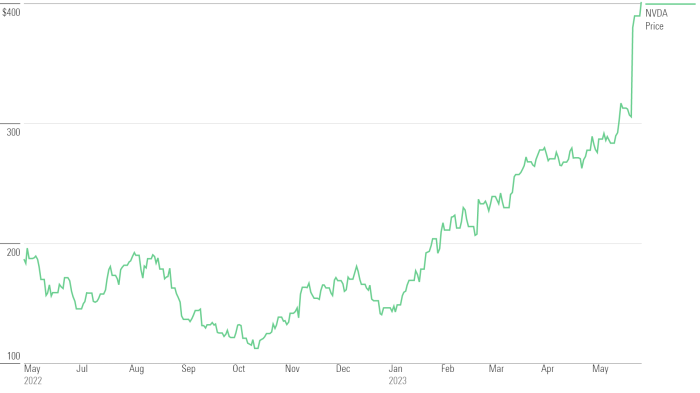

The sale comes amidst a period of [Positive or Negative] financial performance for Nvidia, with the company reporting [Brief Summary of Recent Financial Performance]. The tech sector, in general, has been experiencing [Brief Summary of Current Market Trends], which adds another layer of complexity to the situation.

Understanding the context surrounding the share sale is crucial for discerning its potential impact on Nvidia’s stock price and the broader market.

Ethical Considerations and Corporate Governance

The recent sale of Nvidia shares by its principal accounting officer has raised significant ethical concerns and sparked scrutiny regarding the company’s corporate governance practices. This event underscores the importance of robust internal controls and ethical conduct within publicly traded companies to maintain investor confidence and prevent insider trading.

Insider Trading and Ethical Considerations

Insider trading, the practice of buying or selling securities based on non-public information, is a serious violation of securities laws and ethical principles. It creates an unfair advantage for those with access to privileged information and undermines the integrity of the market.

In this case, the principal accounting officer’s knowledge of Nvidia’s financial performance and future prospects could potentially have influenced their decision to sell shares. This raises questions about whether they acted on non-public information, giving them an unfair advantage over other investors.

Understand how the union of Kim Kardashians Icy Back Reveal: Leather Look Selfie can improve efficiency and productivity.

Corporate Governance and Internal Controls

Effective corporate governance plays a crucial role in mitigating insider trading risks. Companies must establish strong internal controls and procedures to prevent the misuse of confidential information. This includes:

- Clear Insider Trading Policies:Companies should have well-defined policies that prohibit insider trading and Artikel the consequences for violations. These policies should be communicated to all employees, including senior executives.

- Pre-clearance Procedures:Companies should require employees, especially those with access to material non-public information, to seek pre-clearance before engaging in any trading activities. This ensures that trades are not based on insider information.

- Trading Monitoring Systems:Companies should implement systems to monitor employee trading activity, identifying any suspicious patterns or transactions that may indicate insider trading. These systems can help detect and prevent violations.

- Employee Training:Regular training on insider trading regulations and ethical conduct is essential to educate employees about the risks and consequences of such activities.

Potential Conflicts of Interest, Nvidia’s principal accounting officer sells shares worth over 0,000

The sale of shares by Nvidia’s principal accounting officer raises concerns about potential conflicts of interest. The officer’s position as a key financial decision-maker within the company could have influenced their decision to sell shares. While it’s possible that the sale was unrelated to any confidential information, the close proximity to the officer’s role raises questions about potential biases or motivations.

Companies must establish clear policies and procedures to address potential conflicts of interest and ensure that decisions are made in the best interests of the company and its shareholders.

Conclusion: Nvidia’s Principal Accounting Officer Sells Shares Worth Over 0,000

The sale of shares by Nvidia’s principal accounting officer raises intriguing questions about insider trading regulations, corporate governance, and investor sentiment. While the reasons for the sale remain unclear, the transaction serves as a reminder of the delicate balance between personal financial decisions and the potential impact on a company’s reputation and market value.

As investors and analysts continue to scrutinize the situation, the story of Nvidia’s share sale is sure to unfold with further twists and turns, offering valuable insights into the complexities of the financial world.

FAQ Summary

What are the potential consequences of insider trading violations?

Insider trading violations can result in significant penalties, including fines, imprisonment, and even the loss of a person’s job.

How does corporate governance play a role in preventing insider trading?

Corporate governance practices aim to ensure transparency, accountability, and ethical behavior within a company. Strong internal controls and procedures can help mitigate insider trading risks.

What is the impact of insider trading on investor confidence?

Insider trading can erode investor confidence in the fairness and integrity of the market. It can lead to a perception of unfair advantage and undermine trust in the financial system.

CentralPoint Latest News

CentralPoint Latest News