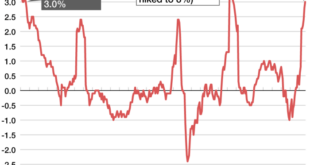

Japan CPI inflation hits 10-mth high in August; BOJ meeting approaches – Japan CPI inflation hits a 10-month high in August; BOJ meeting approaches. The news has sent ripples through the Japanese economy, raising questions about the future of monetary policy and the country’s economic trajectory. With energy prices soaring, …

Read More »China Keeps Loan Prime Rate Unchanged in September

China keeps loan prime rate unchanged in September, signaling a cautious approach by the central bank amidst global economic uncertainties. The Loan Prime Rate (LPR), a benchmark lending rate, plays a pivotal role in shaping borrowing costs for businesses and consumers in China. This decision comes at a time when …

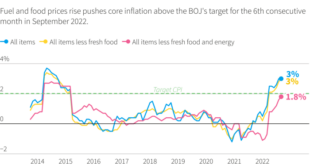

Read More »BOJ Holds Rates, Inflation Steady Rise

BOJ holds interest rates, flags steady growth in inflation, a decision that sends ripples through the global financial landscape. The Bank of Japan’s move to maintain interest rates at their current levels, despite rising inflation, signals a cautious approach to managing economic growth in the face of global uncertainties. This …

Read More »Barclays Doubts Fed Rate Cuts Match Market Expectations

Barclays doubts the Fed will cut as much as currently priced in, a bold statement that throws a wrench into the market’s optimistic outlook. While investors eagerly anticipate significant rate reductions, Barclays argues that the current economic environment doesn’t warrant such aggressive easing. This contrarian view sparks intrigue, prompting a …

Read More »3 Reasons Why US May Slip Into a Recession in 2024

3 reasons why US may slip into a recession over the next 12 months – 3 Reasons Why US May Slip Into a Recession in 2024 sets the stage for a chilling exploration of the economic storm clouds gathering on the horizon. The specter of recession, a word that sends …

Read More »Fed Easing Cycles: A Guide to Understanding Monetary Policy

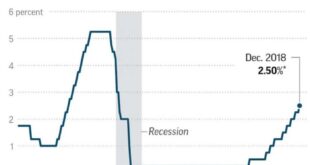

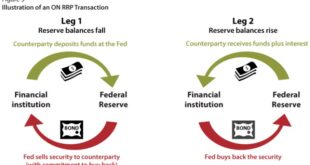

All you need to know about Fed easing cycles – the phrase conjures images of economic fluctuations, interest rate adjustments, and the intricate dance between inflation and growth. But what exactly are Fed easing cycles, and how do they impact our daily lives? The Federal Reserve, the central bank of …

Read More »Waller Defends Feds 50 bps Rate Cut

Waller Defends Fed’s decision to cut by 50 bps sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with captivating storytelling language style and brimming with originality from the outset. In a move that sent ripples through the financial world, …

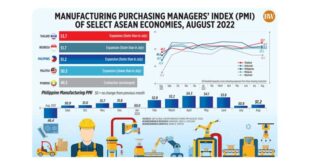

Read More »Manufacturing and Services PMIs Headline Mondays Economic Calendar

Manufacturing and Services PMIs headline Monday’s economic calendar, offering a crucial snapshot of the health of these two vital sectors. These indexes, compiled by purchasing managers, provide a forward-looking gauge of economic activity, reflecting the sentiment and expectations of businesses across the manufacturing and services industries. PMIs are calculated using …

Read More »Feds Bowman Opposed Jumbo Cut, Avoiding Premature Victory Claim on Inflation

Fed’s Bowman voted against jumbo cut to avoid signaling victory on inflation, a move that highlights the ongoing debate within the Federal Reserve about the appropriate pace of interest rate adjustments. While the majority of policymakers opted for a significant rate cut, Bowman’s dissenting vote underscores the complexities of navigating …

Read More »Feds Dot Plot Holds Steady, Jobs Data Takes the Lead

Fed’s ‘dot plot’ signals no rush for another 50bps cut, but jobs data hold sway. The Federal Reserve’s latest “dot plot” – a visual representation of individual policymakers’ interest rate projections – suggests a pause in aggressive rate cuts. However, the strength of the labor market, as reflected in recent …

Read More » CentralPoint Latest News

CentralPoint Latest News