Upwork executive sells over $100k in company stock, a move that has sent ripples through the industry. This significant transaction raises questions about the executive’s motivations, the potential impact on Upwork’s stock price, and the implications for the company’s future.

The sale comes at a time when Upwork, a leading online platform for freelancers and businesses, is navigating a dynamic landscape of evolving industry trends and competitive pressures. The executive’s decision to part with such a substantial portion of their stock holdings has sparked widespread speculation and analysis, with experts dissecting the potential reasons behind the move and its broader implications for the company’s future.

The sale has also triggered a wave of analysis among investors, who are closely scrutinizing the potential impact on Upwork’s stock price and the company’s overall financial performance. The stock sale, occurring amidst a backdrop of fluctuating market conditions, has fueled discussions about the future direction of Upwork and the potential implications for its stakeholders, including freelancers, clients, and investors.

Implications for Upwork’s Future

The recent stock sale by an Upwork executive raises questions about the company’s future trajectory. While the sale itself may not directly impact Upwork’s day-to-day operations, it can provide valuable insights into the executive’s perspective on the company’s future prospects and potential strategic shifts.

Impact on Upwork’s Business Strategy

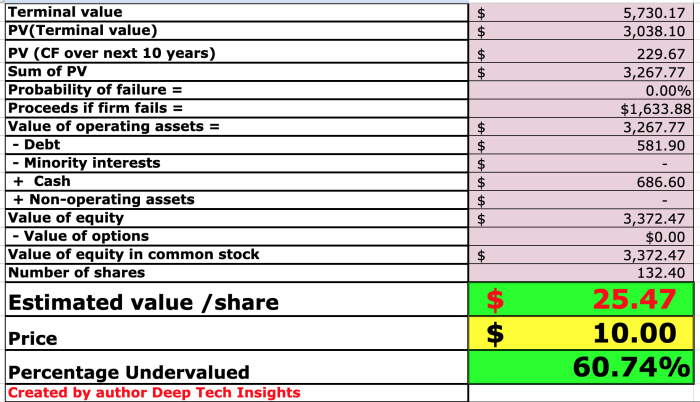

The stock sale could indicate a potential shift in Upwork’s business strategy. The executive’s decision to sell shares could be influenced by factors such as a belief that the company’s stock is currently overvalued or a desire to diversify their investment portfolio.

The executive’s decision to sell shares could reflect a belief that the company’s stock is currently overvalued or a desire to diversify their investment portfolio.

It is important to note that this is just one possible interpretation, and other factors could also be at play. However, the sale does raise questions about Upwork’s future business direction and potential strategic adjustments.

Impact on Employee Morale and Company Culture

The stock sale could impact employee morale and company culture, particularly if it is perceived as a sign of a lack of confidence in the company’s future. Employees may be concerned about the company’s long-term prospects, which could lead to decreased motivation and productivity.

The stock sale could impact employee morale and company culture, particularly if it is perceived as a sign of a lack of confidence in the company’s future.

On the other hand, if the executive provides a clear explanation for the stock sale and emphasizes their continued commitment to Upwork’s success, it could help to mitigate any negative impact on employee morale.

Obtain access to Viking therapeutics CEO sells over $15m in company stock to private resources that are additional.

Impact on Upwork’s Relationships with Clients and Freelancers, Upwork executive sells over 0k in company stock

The stock sale could also impact Upwork’s relationships with clients and freelancers. If the sale is perceived as a sign of a lack of confidence in the company’s future, it could lead to concerns about Upwork’s ability to provide a stable platform for both clients and freelancers.

The stock sale could impact Upwork’s relationships with clients and freelancers. If the sale is perceived as a sign of a lack of confidence in the company’s future, it could lead to concerns about Upwork’s ability to provide a stable platform for both clients and freelancers.

Upwork needs to actively address any concerns that may arise from the stock sale and assure clients and freelancers of its commitment to providing a reliable and sustainable platform.

Regulatory Considerations: Upwork Executive Sells Over 0k In Company Stock

The executive’s stock sale, while significant, needs to be examined within the framework of relevant securities laws and regulations. This scrutiny is particularly important given the potential impact such a transaction can have on market sentiment and investor confidence.

Compliance with Securities Laws and Regulations

The compliance of the stock sale with relevant securities laws and regulations is paramount. The Securities and Exchange Commission (SEC) closely monitors insider trading activities, especially by high-ranking executives. The SEC’s regulations are designed to prevent insider trading, which is the use of non-public information for personal gain.

- The executive’s stock sale must comply with the SEC’s Form 4 filing requirements, which mandate the reporting of insider transactions within two business days. This transparency ensures that investors have access to information about potential insider trading activities.

- The executive must also adhere to the SEC’s insider trading rules, which prohibit the use of material non-public information (MNPI) for personal gain. The sale of stock must be based on publicly available information and not on any confidential or proprietary information known only to the executive.

- The executive’s stock sale should also be aligned with the company’s insider trading policies and procedures. These policies are designed to prevent insider trading and ensure compliance with SEC regulations.

Comparison to Other Insider Trading Cases

Comparing the executive’s stock sale to other insider trading cases in the tech industry can provide context and highlight potential red flags.

- In 2012, the SEC investigated allegations of insider trading at Google. The case involved a former Google employee who allegedly shared confidential information about Google’s financial performance with his friend, who then traded on that information. This case highlights the importance of maintaining confidentiality and adhering to insider trading regulations.

- In 2016, the SEC charged a former Tesla employee with insider trading based on information about the company’s upcoming battery technology. This case illustrates the potential for insider trading to occur even in emerging technologies, where information can be highly valuable.

Final Review

The Upwork executive’s stock sale, a significant event in the company’s recent history, serves as a catalyst for a deeper examination of the dynamics at play within the online freelancing industry. The sale’s impact on Upwork’s stock price, investor sentiment, and future business strategy will be closely watched by industry observers and stakeholders alike.

The implications of this transaction extend beyond the immediate financial consequences, prompting broader discussions about the role of executive compensation, insider trading, and the evolving landscape of the online gig economy.

Quick FAQs

What is the significance of the $100,000 stock sale in the context of Upwork’s financial performance?

The significance lies in the potential insights it provides into the executive’s confidence in the company’s future prospects and the overall market sentiment surrounding Upwork’s performance.

What are the potential regulatory implications of the stock sale?

The stock sale must comply with relevant securities laws and regulations, and any potential violations or irregularities would attract scrutiny from regulatory authorities.

How might the stock sale affect employee morale and company culture?

The sale could impact employee morale if perceived as a sign of a lack of confidence in the company’s future, particularly if the executive’s decision is not adequately communicated and explained.

CentralPoint Latest News

CentralPoint Latest News