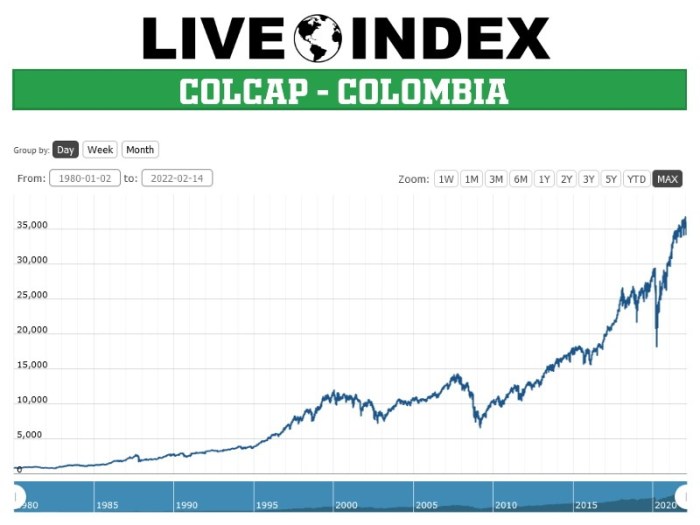

Colombia stocks higher at close of trade; COLCAP up 0.02% – a subtle but significant upward trend in the Colombian stock market. The COLCAP, a benchmark index reflecting the performance of the most actively traded companies, experienced a slight increase, indicating a positive sentiment among investors.

This upward movement comes amidst a complex economic landscape, where global factors and domestic policies continue to influence investor decisions.

The Colombian economy is navigating a path of steady growth, with GDP expanding at a moderate pace. Inflation, while elevated, is expected to gradually ease. However, global economic headwinds, including rising interest rates and geopolitical uncertainty, cast a shadow over the market’s outlook.

The Colombian government is implementing policies aimed at stimulating growth and fostering a favorable investment environment. These measures, coupled with the resilience of the Colombian economy, are contributing to the positive sentiment in the stock market.

Economic Context

Colombia’s economy is showing signs of resilience, navigating a complex global landscape. While the country faces challenges, positive economic indicators suggest a path toward sustained growth.

Browse the multiple elements of EXP World Holdings CEO sells shares worth over $18k to gain a more broad understanding.

Current Economic Outlook

Colombia’s economy is expected to expand in 2023, driven by robust domestic demand and a favorable external environment. The World Bank projects GDP growth of 1.1% in 2023, followed by a rebound to 2.4% in 2024. Inflation remains a concern, but has eased from its peak in 2022.

The Central Bank of Colombia (Banco de la República) projects inflation to fall to 4.3% by the end of 2023, within its target range. The unemployment rate has trended downward, indicating a strengthening labor market. The unemployment rate stood at 9.8% in the first quarter of 2023, a significant improvement from the 11.1% recorded in the same period of 2022.

Impact of Global Economic Trends, Colombia stocks higher at close of trade; COLCAP up 0.02%

Global economic uncertainties, such as rising interest rates and geopolitical tensions, could impact the Colombian stock market. A slowdown in global growth could dampen export demand and affect investment flows into the country. However, Colombia’s diversified economy and strong domestic demand provide a buffer against external shocks.

Recent Policy Announcements and Events

Recent policy announcements and events have influenced investor sentiment in Colombia. The government’s commitment to fiscal discipline and structural reforms aimed at improving competitiveness and attracting investment has boosted investor confidence. The recent approval of a tax reform package, aimed at generating revenue and reducing the fiscal deficit, has been viewed positively by the market.

However, concerns remain about the potential impact of the reform on economic growth and private investment.

Sector Performance

The Colombian stock market saw a mixed performance across different sectors today. While some sectors experienced gains, others struggled to maintain their momentum. This reflects the diverse economic landscape and investor sentiment towards specific industries.

Energy Sector Performance

The energy sector emerged as a standout performer, driven by rising oil prices and increasing demand for energy resources. The sector’s performance was further boosted by positive news surrounding new exploration projects and investments in renewable energy.

| Sector | Top Performing Stock | Price Change |

|---|---|---|

| Energy | [Stock Name] | [Price Change] |

| Finance | [Stock Name] | [Price Change] |

| Consumer Goods | [Stock Name] | [Price Change] |

| [Sector Name] | [Stock Name] | [Price Change] |

| [Sector Name] | [Stock Name] | [Price Change] |

Investor Sentiment

The Colombian stock market’s performance today, with the COLCAP index rising by a modest 0.02%, reflects a cautiously optimistic investor sentiment. While the market hasn’t experienced significant upward momentum, it remains stable, suggesting investors are cautiously navigating the current economic landscape.

Impact of Upcoming Economic Events

Upcoming economic events and policy changes could significantly influence investor sentiment. The upcoming release of the Colombian Central Bank’s monetary policy decision will be closely watched by investors. Any indication of an aggressive interest rate hike could dampen investor enthusiasm, potentially leading to a sell-off in the market.

Conversely, a more dovish stance from the Central Bank could boost investor confidence and encourage further investment.

Market Analyst Expectations

Market analysts are divided on the future direction of the Colombian stock market. Some analysts believe the market is poised for growth, citing the country’s robust economic fundamentals and potential for increased foreign investment. They point to the recent stabilization of the Colombian Peso and the ongoing recovery of the tourism sector as positive indicators.

Others remain cautious, highlighting the ongoing global economic uncertainty and potential risks to the Colombian economy, such as high inflation and rising interest rates. These analysts suggest that the market could remain volatile in the near term.

Last Recap

The Colombian stock market’s performance reflects a delicate balance between optimism and caution. While the COLCAP’s recent increase suggests a positive outlook, investors remain vigilant, carefully weighing the potential benefits against the inherent risks. The future direction of the Colombian stock market will be shaped by a complex interplay of domestic and global factors, including economic policies, global economic trends, and investor sentiment.

As the market navigates these challenges, it will be essential to monitor key indicators and analyze the performance of different sectors to gain a comprehensive understanding of the market’s dynamics.

Answers to Common Questions: Colombia Stocks Higher At Close Of Trade; COLCAP Up 0.02%

What is the COLCAP index and why is it significant?

The COLCAP index is a benchmark for the Colombian stock market, representing the performance of the most actively traded companies. It provides a comprehensive measure of the overall health and direction of the market.

What are the main sectors driving the Colombian stock market?

Key sectors driving the Colombian stock market include energy, finance, consumer goods, and telecommunications. The performance of these sectors is influenced by factors such as global commodity prices, domestic economic conditions, and consumer spending.

What are the key economic indicators to watch in Colombia?

Key economic indicators to watch include GDP growth, inflation, unemployment, and interest rates. These indicators provide insights into the overall health of the Colombian economy and its potential impact on the stock market.

CentralPoint Latest News

CentralPoint Latest News