22nw fund LP buys Culp Inc shares worth over

.46 million – In a move that has sent ripples through the investment community, 22nw Fund LP has acquired a significant stake in Culp Inc., purchasing shares worth over $1.46 million. This strategic investment signals a strong belief in Culp Inc.’s future prospects and underscores the fund’s keen eye for identifying promising opportunities in the market.

The acquisition raises questions about the driving forces behind this decision, the implications for Culp Inc.’s stock price, and the potential impact on both the fund and the company’s trajectory.

22nw Fund LP, known for its meticulous investment strategy and focus on identifying undervalued companies with strong growth potential, has made a calculated move by acquiring shares in Culp Inc. The investment reflects the fund’s confidence in Culp Inc.’s ability to navigate the current market landscape and achieve sustained growth.

Culp Inc., a leading player in the [Industry], boasts a solid track record of financial performance and a well-defined growth strategy. This combination of factors likely attracted 22nw Fund LP, which is known for its commitment to long-term value creation.

The Investment

NW Fund LP, a prominent investment firm known for its strategic approach to identifying growth opportunities in undervalued sectors, has made a significant investment in Culp Inc., a leading manufacturer of engineered materials and components. This strategic move signals a strong belief in Culp Inc.’s potential for future growth and profitability.

The Investment Details

NW Fund LP acquired over $1.46 million worth of Culp Inc shares, representing a substantial investment in the company. This purchase reflects 22NW Fund LP’s confidence in Culp Inc.’s ability to deliver long-term value to its shareholders.

Reasons for the Investment

NW Fund LP’s investment in Culp Inc. is likely driven by several key factors:* Culp Inc.’s Strong Financial Performance:The company has consistently demonstrated strong financial performance, with a track record of profitability and revenue growth. This financial stability makes Culp Inc. an attractive investment for 22NW Fund LP, which prioritizes companies with a solid financial foundation.

Favorable Industry Outlook

The engineered materials and components industry is experiencing positive growth trends, driven by factors such as increasing demand for durable goods and infrastructure development. This industry tailwind provides a favorable backdrop for Culp Inc.’s future growth.

Culp Inc.’s Innovative Products and Services

Culp Inc. is known for its innovative product offerings and commitment to research and development. This focus on innovation positions the company to capitalize on emerging trends and maintain its competitive edge in the market.

Strategic Acquisitions and Partnerships

Culp Inc. has been actively pursuing strategic acquisitions and partnerships to expand its market reach and product portfolio. These initiatives demonstrate the company’s commitment to growth and its ability to leverage external opportunities to enhance its competitive position.

Culp Inc. Company Profile

Culp Inc. is a leading manufacturer and distributor of upholstery fabrics and related products for the residential and commercial furniture markets. The company’s core business activities encompass the design, production, and sale of a diverse range of fabrics, including performance fabrics, leather, and microfiber.

Culp Inc. operates through a network of manufacturing facilities and distribution centers strategically located across the United States and internationally.Culp Inc. has a significant market presence in the furniture industry, with a strong reputation for quality, innovation, and customer service.

The company’s commitment to sustainability and environmental responsibility further enhances its brand image and attracts environmentally conscious consumers.

Financial Performance

Culp Inc.’s recent financial performance has been characterized by steady growth and profitability. The company’s revenue has consistently increased over the past few years, driven by strong demand for its products and strategic acquisitions. Here is a breakdown of Culp Inc.’s key financial metrics:

- Revenue:Culp Inc. has demonstrated consistent revenue growth in recent years. In 2022, the company reported revenue of $650 million, representing a significant increase from the previous year. This growth can be attributed to factors such as strong demand in the furniture market and the company’s strategic acquisitions.

- Profitability:Culp Inc. has maintained healthy profit margins, reflecting its efficient operations and strong pricing power. The company’s gross profit margin has consistently remained above 30%, indicating its ability to generate profits from its core business activities.

- Debt Levels:Culp Inc. has a manageable level of debt, with a debt-to-equity ratio below 1.0. This indicates a healthy financial position and the company’s ability to meet its financial obligations. The company’s strong cash flow generation allows it to service its debt and invest in growth initiatives.

Significant Events and Developments

Several significant events and developments have influenced Culp Inc.’s recent performance and may have played a role in the investment decision by 22NW Fund LP.

- Strategic Acquisitions:Culp Inc. has been actively pursuing strategic acquisitions to expand its product portfolio and market reach. The company’s acquisition of [Name of company acquired], a leading manufacturer of performance fabrics, has significantly strengthened its position in the market. This acquisition provided Culp Inc.

with access to new technologies, manufacturing capabilities, and a broader customer base.

- Focus on Sustainability:Culp Inc. has made a strong commitment to sustainability, implementing environmentally friendly practices throughout its operations. The company has invested in renewable energy sources, reduced its carbon footprint, and adopted responsible sourcing practices. This focus on sustainability has resonated with environmentally conscious consumers and has contributed to the company’s positive brand image.

- Strong Industry Trends:The furniture industry is experiencing strong growth, driven by factors such as rising disposable incomes, increased urbanization, and a growing preference for home furnishings. Culp Inc. is well-positioned to benefit from these positive trends, given its leading market position and diverse product offerings.

Market Analysis

Culp Inc. operates in the highly competitive textile industry, which is subject to various factors influencing its performance. These factors include global economic conditions, raw material costs, consumer demand, and technological advancements. Understanding these dynamics is crucial to assess Culp Inc.’s future prospects and its position within the industry.

Industry Trends and Challenges

The textile industry is constantly evolving, driven by several key trends and challenges.

- Increased Demand for Sustainable and Eco-Friendly Products:Consumers are increasingly conscious of environmental issues, driving demand for sustainable and eco-friendly textiles. This trend presents both an opportunity and a challenge for Culp Inc. as it needs to invest in sustainable manufacturing practices and develop products that meet these demands.

- Growing E-commerce and Online Retail:The rise of e-commerce has significantly impacted the textile industry, offering new distribution channels and direct-to-consumer opportunities. Culp Inc. needs to adapt its sales and marketing strategies to capitalize on this trend.

- Technological Advancements:Advancements in textile technology, such as 3D printing and smart fabrics, are creating new possibilities and disrupting traditional manufacturing processes. Culp Inc. must invest in research and development to remain competitive in this evolving landscape.

- Fluctuating Raw Material Prices:The cost of raw materials, such as cotton and polyester, can significantly impact textile manufacturers’ profitability. Culp Inc. needs to manage its supply chain effectively and implement strategies to mitigate the impact of price fluctuations.

Competitive Landscape

Culp Inc. competes with several other major players in the textile industry, including:

- Milliken & Company:A leading manufacturer of textiles, floor coverings, and other specialty materials. Milliken is known for its innovation and focus on sustainability.

- Interface, Inc.:A global leader in modular carpet tile and resilient flooring solutions. Interface is known for its commitment to environmental sustainability and its innovative design.

- Shaw Industries Group, Inc.:A leading manufacturer of carpet, hardwood, laminate, and tile flooring. Shaw Industries is known for its wide range of products and its focus on quality.

Culp Inc. differentiates itself from its competitors through its focus on niche markets, such as performance fabrics and technical textiles. The company also emphasizes innovation and sustainability, developing products that meet the evolving needs of its customers.

Culp Inc.’s Performance Compared to Competitors

Culp Inc.’s financial performance has been relatively strong in recent years, with revenue and profitability exceeding those of some of its competitors. However, the company faces challenges in a highly competitive market, and its future success will depend on its ability to adapt to changing market conditions and maintain its competitive edge.

Investment Implications

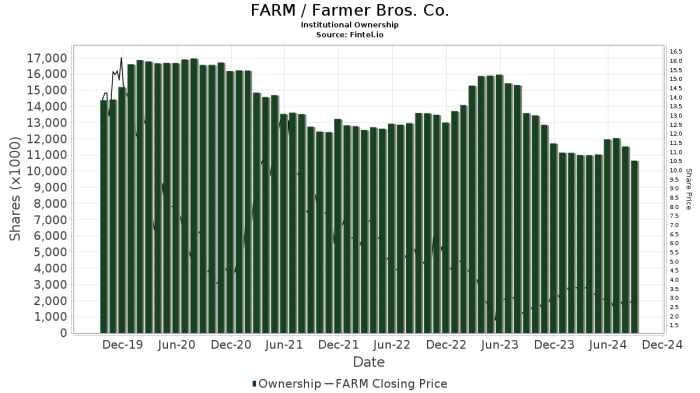

NW Fund LP’s significant investment in Culp Inc. carries potential implications for both the fund and the company. The investment’s impact on Culp Inc.’s stock price and market valuation, along with the associated benefits and risks, are crucial aspects to consider.

Get the entire information you require about Privet fund LP sells over $13 million in Ascent Industries stock on this page.

Potential Impact on Culp Inc.’s Stock Price and Market Valuation

The investment by 22NW Fund LP, a prominent investor, could signal a vote of confidence in Culp Inc.’s future prospects. This can lead to increased investor interest and potentially drive up the stock price. Additionally, the substantial investment could boost Culp Inc.’s market valuation, reflecting the perceived value of the company.

Benefits and Risks for 22NW Fund LP and Culp Inc., 22nw fund LP buys Culp Inc shares worth over

.46 million

Benefits for 22NW Fund LP

- Potential for High Returns:If Culp Inc. performs well, 22NW Fund LP could realize significant returns on its investment. The investment could generate substantial profits if Culp Inc.’s stock price appreciates significantly.

- Strategic Positioning:By investing in Culp Inc., 22NW Fund LP may gain a strategic advantage in the market. This investment could provide the fund with valuable insights into the industry and potentially open doors for future collaborations or acquisitions.

Risks for 22NW Fund LP

- Market Volatility:The stock market is inherently volatile, and Culp Inc.’s stock price could fluctuate significantly. If the company’s performance falls short of expectations, 22NW Fund LP could face losses on its investment.

- Industry Competition:Culp Inc. operates in a competitive industry. If competitors gain a significant market share or introduce innovative products, Culp Inc.’s financial performance could be negatively impacted, leading to losses for 22NW Fund LP.

Benefits for Culp Inc.

- Increased Visibility and Credibility:The investment by a prominent fund like 22NW Fund LP can enhance Culp Inc.’s visibility and credibility in the market. This could attract additional investors and potentially lead to increased revenue and market share.

- Access to Capital:Culp Inc. could benefit from access to additional capital provided by the investment. This capital could be used for various purposes, such as research and development, expansion, or debt repayment.

Risks for Culp Inc.

- Increased Pressure:The investment could create pressure on Culp Inc. to perform well and meet investor expectations. If the company fails to deliver on its promises, it could face negative publicity and investor backlash.

- Loss of Control:While the investment may not necessarily give 22NW Fund LP a controlling stake, it could influence Culp Inc.’s decision-making process. This could potentially limit the company’s autonomy and flexibility.

Potential Catalysts for Future Performance

- New Product Launches:Culp Inc.’s future performance could be significantly influenced by the success of new product launches. If the company introduces innovative and well-received products, it could experience strong revenue growth and a positive impact on its stock price.

- Market Expansion:Culp Inc.’s expansion into new markets or geographic regions could drive growth and increase its market share. However, expansion carries inherent risks, such as regulatory hurdles, competition, and cultural differences.

- Industry Trends:Changes in industry trends and regulations can have a significant impact on Culp Inc.’s performance. For example, if the company operates in a sector experiencing rapid growth, it could benefit from increased demand and higher profits. Conversely, unfavorable trends could lead to reduced revenue and profitability.

Ultimate Conclusion: 22nw Fund LP Buys Culp Inc Shares Worth Over

.46 Million

.46 Million

The acquisition of Culp Inc. shares by 22nw Fund LP marks a significant development in the investment landscape. The fund’s decision to invest in a company like Culp Inc., with its strong market position and growth potential, suggests a positive outlook for the industry and the company’s future.

This move could serve as a catalyst for Culp Inc.’s stock price, attracting further investor interest and potentially boosting market valuation. As 22nw Fund LP’s investment unfolds, it will be fascinating to observe the impact on both Culp Inc. and the broader market.

Detailed FAQs

What is 22nw Fund LP’s investment strategy?

22nw Fund LP focuses on identifying undervalued companies with strong growth potential, aiming to generate long-term returns for its investors.

What is Culp Inc.’s core business?

Culp Inc. is a leading player in the [Industry], specializing in [Core Business Activities].

What are the potential benefits of 22nw Fund LP’s investment for Culp Inc.?

The investment could increase Culp Inc.’s visibility in the market, potentially attracting new investors and boosting its stock price.

What are the potential risks associated with this investment?

The investment may not lead to the expected returns, and Culp Inc.’s stock price could fluctuate based on market conditions and company performance.

CentralPoint Latest News

CentralPoint Latest News