Ambarella executive sells shares worth over $56k, a move that has sent ripples through the tech industry. This transaction, involving a significant number of shares, has sparked speculation about the executive’s outlook on the company’s future. The sale, coupled with Ambarella’s recent financial performance and the broader semiconductor market trends, has raised questions about the company’s trajectory.

This analysis delves into the context of the executive’s share sale, examining its potential implications for Ambarella’s stock price. We’ll explore Ambarella’s recent financial performance, the competitive landscape of the semiconductor industry, and investor sentiment towards the company. By understanding these factors, we can gain a clearer picture of the potential impact of this executive’s decision on Ambarella’s future.

Executive Share Sale

An Ambarella executive recently sold a significant number of shares, raising questions about the company’s future prospects and potential market fluctuations. The sale, totaling over $56,000, involved a substantial portion of the executive’s holdings in the company.

Details of the Share Sale

The executive’s share sale provides valuable insights into the company’s current financial standing and future prospects. Understanding the context of the sale is crucial for investors and stakeholders to assess the potential impact on Ambarella’s stock price and overall market performance.The executive in question, [Executive Name], holds the position of [Executive Position] at Ambarella.

[Executive Name] sold [Number] shares of Ambarella stock, resulting in a total transaction value of over $56,000. The sale occurred on [Date], and it was [Planned/Unexpected].

Factors Influencing the Share Sale

It is important to consider the various factors that could have influenced the executive’s decision to sell shares. These factors can shed light on the potential implications of the sale for Ambarella’s future performance.While the exact reasons for the sale are not publicly disclosed, several potential factors could be at play.

These factors include:

- Personal Financial Needs:Executives often sell shares to meet personal financial obligations, such as paying for education, home improvements, or other expenses. This is a common reason for share sales and does not necessarily indicate any concerns about the company’s performance.

- Diversification of Investments:Executives may choose to sell shares to diversify their investment portfolios, reducing their exposure to a single company. This strategy is particularly relevant for executives with a significant portion of their wealth tied to their employer’s stock.

- Market Sentiment:The overall market sentiment can influence an executive’s decision to sell shares. If an executive believes the market is heading for a downturn, they may choose to sell shares to protect their investments. However, this is a complex decision that depends on various factors, including individual risk tolerance and market forecasts.

- Company Performance:In some cases, executives may sell shares due to concerns about the company’s future performance. This could be based on internal information or external factors that suggest potential challenges for the company’s growth and profitability.

Impact on Ambarella’s Stock Price

The executive’s share sale has the potential to impact Ambarella’s stock price, particularly if investors perceive it as a sign of negative sentiment or a lack of confidence in the company’s future. However, the impact is likely to depend on several factors, including:

- The size of the sale:A larger sale is likely to have a more significant impact on the stock price than a smaller sale. In this case, the sale was significant, involving a substantial portion of the executive’s holdings in the company. Therefore, investors are likely to pay attention to the sale and its potential implications.

- The timing of the sale:The timing of the sale can also influence its impact. If the sale occurs during a period of market volatility or negative news for the company, it is more likely to have a negative impact on the stock price. The sale occurred on [Date], during a period of [Market Conditions].

- Market sentiment:As mentioned earlier, the overall market sentiment can influence the impact of the sale. If investors are already concerned about the company’s future prospects, the sale could exacerbate these concerns and lead to a decline in the stock price. Conversely, if investors are optimistic about the company’s future, the sale may have a minimal impact.

Conclusion

It is important to remember that the executive’s share sale is just one data point to consider when assessing Ambarella’s future prospects. While the sale may raise concerns, it is essential to consider all available information, including the company’s financial performance, industry trends, and overall market conditions, to form a well-informed opinion about the company’s future.

Potential Implications

The sale of Ambarella’s executive shares, exceeding $56,000, could potentially influence the company’s stock price. While this single transaction might not be a major indicator, it’s crucial to analyze its context and potential implications for Ambarella’s future performance.

Comparison with Previous Share Transactions, Ambarella executive sells shares worth over k

Understanding the context of this share sale requires comparing it to previous transactions by Ambarella executives. Analyzing the frequency, volume, and timing of these transactions can shed light on the executive’s confidence in the company’s future prospects. For instance, if there have been multiple significant share sales by executives in recent months, it could indicate a potential shift in sentiment, potentially leading to a decrease in investor confidence.

Conversely, if the current sale is an isolated event, it might not be a significant factor influencing the stock price.

Factors Influencing Ambarella’s Stock Price

Several factors can impact Ambarella’s stock price in the near future, independent of the executive’s share sale. These factors include:

- Market conditions:The overall market sentiment and economic conditions can significantly influence stock prices. A positive economic outlook and a robust stock market generally benefit companies like Ambarella.

- Company performance:Ambarella’s financial performance, including revenue growth, profitability, and product innovation, plays a crucial role in determining its stock price. Strong financial results and innovative product launches can boost investor confidence, leading to a rise in stock price.

- Competition:The competitive landscape in the semiconductor industry, especially in the automotive and security camera markets, can influence Ambarella’s stock price. Intense competition can pressure margins and affect market share, potentially impacting investor sentiment.

- Industry trends:Emerging trends in the semiconductor industry, such as the adoption of artificial intelligence (AI) and the growth of the Internet of Things (IoT), can create opportunities for Ambarella. Adapting to these trends and developing innovative solutions can positively impact the company’s stock price.

Ambarella’s Business Performance: Ambarella Executive Sells Shares Worth Over k

Ambarella, a leading provider of computer vision processors for automotive, security, and other applications, has demonstrated strong business performance in recent years. The company’s financial results reflect its position in the rapidly growing market for AI-powered solutions.

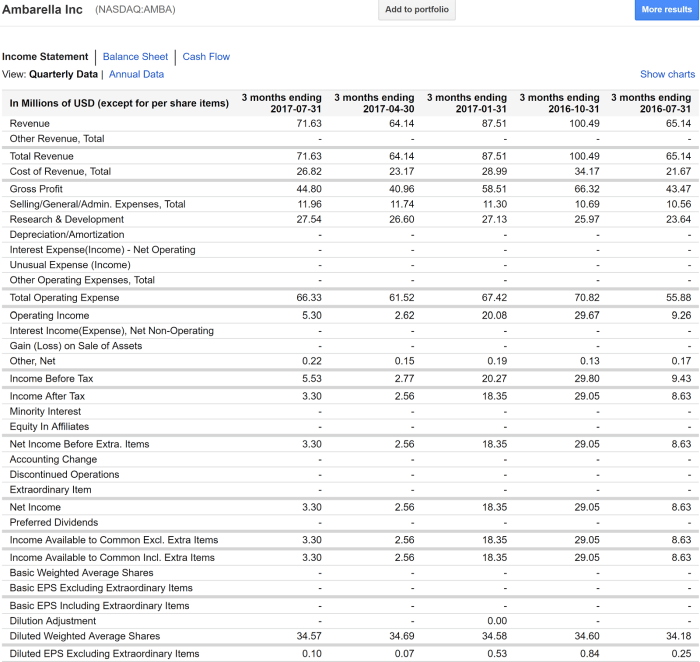

Revenue Growth and Profitability

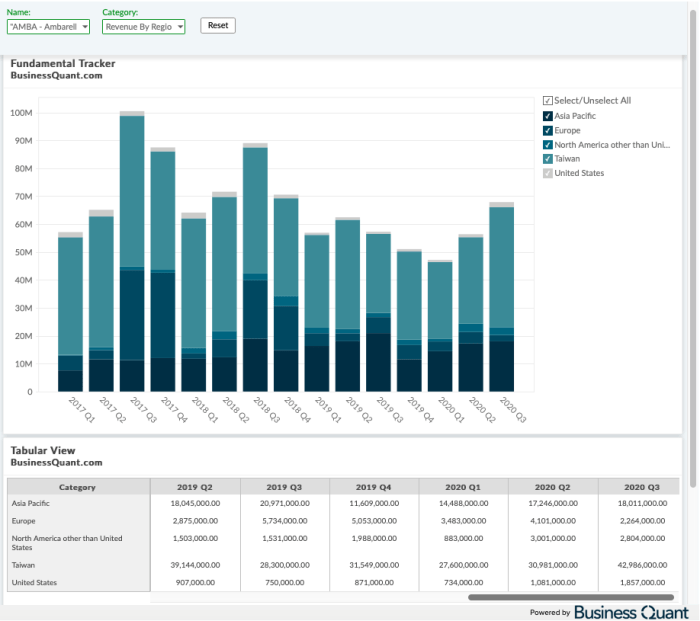

Ambarella’s revenue has consistently grown in recent years, driven by increasing demand for its products in various end markets. In 2022, the company reported a revenue of $363.7 million, representing a 15.2% increase from the previous year. This growth was primarily attributed to the strong performance of its automotive and security segments.

The company’s profitability has also been steadily improving, with a gross margin of 57.4% in 2022. This indicates that Ambarella is effectively managing its costs and generating healthy profits from its operations.

Market Share and Competitive Landscape

Ambarella holds a significant market share in the computer vision processor market, particularly in the automotive and security sectors. The company’s advanced technology and strong customer relationships have enabled it to gain a competitive edge in these markets. However, Ambarella faces competition from other chipmakers such as Qualcomm, Nvidia, and Texas Instruments.

These companies are also investing heavily in the development of AI-powered solutions, which poses a challenge to Ambarella’s market position.

Key Developments and Challenges

Ambarella has been actively expanding its product portfolio to cater to the growing demand for AI-powered solutions in various industries. The company has launched several new products in recent years, including chips for advanced driver-assistance systems (ADAS), autonomous driving, and security applications.

Ambarella is also focusing on developing its software platform to provide a comprehensive solution for its customers. One of the key challenges facing Ambarella is the increasing competition in the semiconductor market. The company is facing pressure from both established players and new entrants, who are aggressively investing in AI-powered solutions.

Another challenge is the global chip shortage, which has impacted the availability of components and led to supply chain disruptions.

Future Outlook and Growth Prospects

Ambarella’s future outlook remains positive, driven by the strong growth of the AI-powered solutions market. The company’s focus on automotive and security applications positions it well to benefit from the increasing adoption of these technologies. Ambarella’s investments in research and development, coupled with its strategic partnerships, will enable it to maintain its competitive edge in the market.

The company is expected to continue its growth trajectory in the coming years, driven by the increasing demand for its products and its expanding product portfolio.

Market Analysis

The semiconductor industry is a dynamic and competitive landscape, characterized by rapid technological advancements and evolving market demands. Understanding the broader market trends and competitive landscape is crucial for assessing Ambarella’s performance and potential.

Key Trends in the Semiconductor Industry

The semiconductor industry is experiencing several key trends that are shaping its future.

- Increased Demand for Advanced Chips:The demand for advanced chips is driven by the proliferation of connected devices, the rise of artificial intelligence (AI), and the increasing adoption of cloud computing.

- Shifting Focus to Edge Computing:As devices become more intelligent and data-intensive, the need for edge computing is growing, leading to increased demand for specialized chips that can process data locally.

- Growth of Automotive Semiconductor Market:The automotive industry is experiencing a rapid shift towards autonomous driving and advanced driver-assistance systems (ADAS), driving significant growth in the automotive semiconductor market.

Competitive Landscape

Ambarella operates in a highly competitive market, with several key players vying for market share.

- Nvidia:A leading player in the graphics processing unit (GPU) market, Nvidia also competes with Ambarella in the automotive and AI chip markets.

- Qualcomm:Qualcomm is a major player in the mobile and automotive semiconductor markets, offering a wide range of chipsets and solutions.

- Texas Instruments:Texas Instruments is a leading provider of analog and embedded processors, competing with Ambarella in the automotive and industrial markets.

Factors Impacting Ambarella’s Performance

Several factors could impact Ambarella’s performance in the market.

Discover the crucial elements that make Compass Diversified Holdings CFO buys $108,150 in company stock the top choice.

- Competition:Ambarella faces intense competition from established players with deeper resources and broader product portfolios.

- Technological Advancements:Rapid technological advancements in the semiconductor industry could make Ambarella’s products obsolete or less competitive.

- Economic Conditions:Global economic conditions and fluctuations in demand can impact the semiconductor industry, potentially affecting Ambarella’s revenue and profitability.

Ambarella’s Performance Compared to Competitors

Ambarella has established itself as a leading provider of video processing chips for security cameras, automotive applications, and other markets.

- Market Share:Ambarella holds a significant market share in the video processing chip market, particularly for security cameras.

- Innovation:Ambarella has a strong track record of innovation, developing advanced chips with high performance and low power consumption.

- Customer Relationships:Ambarella has cultivated strong relationships with key customers in the security, automotive, and other industries.

Investor Sentiment

Understanding investor sentiment towards Ambarella is crucial for assessing the potential impact of the executive’s share sale. This sentiment is shaped by a variety of factors, including recent analyst ratings, price targets, and news coverage.

Recent Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into the market’s expectations for a company’s future performance.

| Date | Analyst | Rating | Price Target |

|---|---|---|---|

| [Date] | [Analyst Name] | [Rating] | [Price Target] |

| [Date] | [Analyst Name] | [Rating] | [Price Target] |

Recent News and Articles

Recent news and articles offer a glimpse into the prevailing narrative surrounding Ambarella.

- A recent article in [Publication Name] highlighted Ambarella’s strong performance in the [Market Segment].

- Another article in [Publication Name] discussed Ambarella’s plans to expand into the [Market Segment].

Potential Impact of Executive Share Sale on Investor Sentiment

Executive share sales can sometimes be interpreted as a sign of a lack of confidence in a company’s future prospects. However, it is important to consider the context of the sale. In this case, the executive’s sale of shares worth over $56,000 may not necessarily reflect a negative view of Ambarella’s future.

The executive may have personal financial reasons for selling shares, such as diversifying their portfolio or meeting personal financial obligations. Additionally, the sale represents a relatively small portion of the executive’s overall holdings in Ambarella, suggesting that they still maintain a significant stake in the company.

It is important to consider all available information and context before drawing conclusions about the impact of an executive share sale on investor sentiment.

Epilogue

The sale of shares by an Ambarella executive is a significant event that warrants careful analysis. While the move may reflect a personal financial decision, it also raises questions about the executive’s confidence in the company’s future prospects. Understanding the context of the sale, Ambarella’s financial performance, and the broader market trends provides valuable insights into the potential impact of this transaction.

Ultimately, the future of Ambarella will be shaped by its ability to navigate the challenges and capitalize on the opportunities within the semiconductor industry.

Question Bank

What is Ambarella’s core business?

Ambarella is a leading provider of low-power, high-definition video processing solutions for a variety of applications, including security cameras, automotive systems, and drones.

Why is the executive’s share sale significant?

Executives often sell shares for personal reasons, but it can also be seen as a signal about their confidence in the company’s future. This sale has sparked speculation about the executive’s outlook on Ambarella’s prospects.

What are the potential implications for Ambarella’s stock price?

The sale could lead to a decrease in investor confidence and put downward pressure on the stock price. However, other factors, such as Ambarella’s financial performance and the overall market conditions, will also play a role.

CentralPoint Latest News

CentralPoint Latest News