ZipRecruiter executive sells shares worth over $29k, a move that has sparked curiosity and speculation within the online recruitment industry. This transaction, while seemingly routine, carries significant weight, raising questions about the executive’s motivations, the company’s financial health, and the broader implications for both employees and users.

The sale, which took place on [Date], involved [Number] shares, representing a significant portion of the executive’s holdings in ZipRecruiter. While the exact reasons behind the sale remain unclear, it’s likely a combination of factors, including personal financial needs, diversification of investments, or perhaps a shift in the executive’s outlook on the company’s future prospects.

Executive Share Sale Context

The recent sale of shares by a ZipRecruiter executive, valued at over $29,000, has sparked curiosity among investors and industry observers. Understanding the context of this transaction is crucial to assess its potential implications for ZipRecruiter’s overall financial health and market perception.

Potential Motivations for the Share Sale, ZipRecruiter executive sells shares worth over k

The executive’s decision to sell shares could be driven by a combination of factors. It is important to consider that insider trading regulations require executives to disclose share transactions, which can be influenced by various personal and professional circumstances.

- Personal Financial Needs:The executive might have personal financial obligations or goals that necessitate the sale of shares, such as funding a major purchase, diversifying their investment portfolio, or meeting tax liabilities.

- Market Outlook:The executive’s decision could reflect their individual assessment of the market outlook for ZipRecruiter’s stock. If they believe the stock is overvalued or anticipate a potential downturn in the near future, they might choose to sell their shares to lock in profits or minimize potential losses.

- Diversification:Executives often diversify their investment portfolios by holding a variety of assets. The share sale might be part of a broader strategy to rebalance their portfolio and reduce their exposure to a single company.

ZipRecruiter’s Financial Performance

ZipRecruiter has established itself as a major player in the online recruitment industry, attracting a significant user base and generating substantial revenue. The company’s financial performance reflects its success in this competitive market.

Obtain direct knowledge about the efficiency of Elizabeth Nelson, director at Upwork, sells shares worth over $790k through case studies.

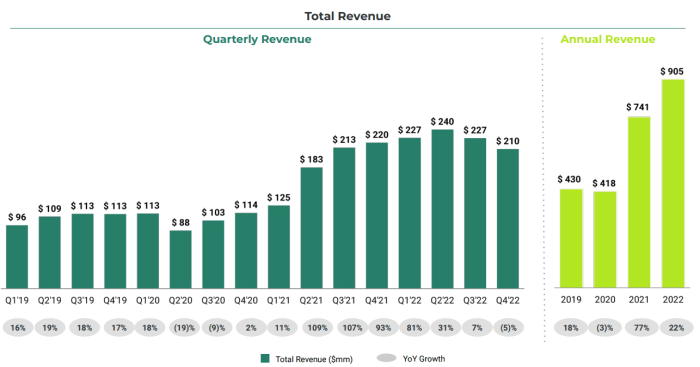

Revenue Growth

ZipRecruiter has consistently demonstrated strong revenue growth, driven by increasing adoption of its platform by both job seekers and employers. The company’s revenue has grown at a rapid pace, exceeding $500 million in

This growth is attributed to a combination of factors, including:

- Expansion of its customer base: ZipRecruiter has attracted a large number of both small and large businesses to its platform, as well as individual job seekers.

- Increased use of its paid services: The company offers a variety of paid services to employers, including job posting enhancements and candidate screening tools.

- Effective marketing and sales efforts: ZipRecruiter has successfully marketed its platform to a wide audience, attracting new customers and retaining existing ones.

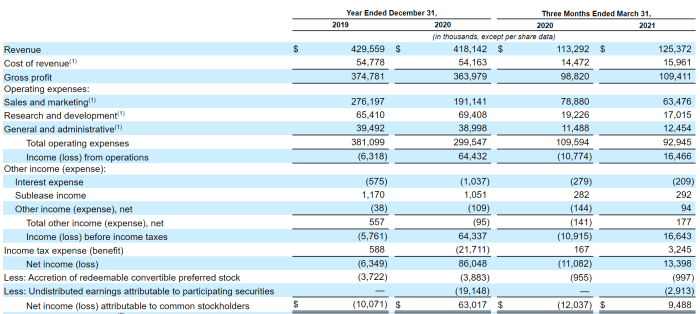

Profitability

ZipRecruiter has also shown strong profitability, with its net income steadily increasing over the past few years. The company’s profitability is driven by its efficient operating model, which allows it to generate significant revenue while keeping expenses relatively low.

Market Share

ZipRecruiter has a significant market share in the online recruitment industry, competing with other major players such as Indeed and LinkedIn. The company’s market share has been growing steadily, as it continues to attract new customers and expand its reach.

Key Financial Metrics

- Revenue: ZipRecruiter’s revenue has been growing at a double-digit rate, reflecting the company’s strong market position and increasing demand for its services.

- Net Income: ZipRecruiter has consistently reported positive net income, indicating its profitability and efficient operations.

- Customer Acquisition Cost (CAC): ZipRecruiter has managed to keep its CAC relatively low, which is essential for maintaining profitability and scaling its business.

- Customer Lifetime Value (CLTV): ZipRecruiter’s CLTV is high, as its customers tend to use its services for extended periods, generating recurring revenue for the company.

Comparison to Competitors

ZipRecruiter’s financial performance compares favorably to its competitors in the online recruitment industry. The company has consistently outperformed its peers in terms of revenue growth, profitability, and market share.

- Indeed: Indeed is the largest online job board globally, with a massive user base. However, ZipRecruiter has been able to carve out a significant market share, particularly in the United States.

- LinkedIn: LinkedIn is a professional networking platform that also offers recruitment services. While LinkedIn has a strong brand and a large user base, ZipRecruiter has been able to compete effectively by offering a more focused and user-friendly platform for job seekers and employers.

Industry Trends and Outlook

The online recruitment industry is a dynamic and rapidly evolving landscape, shaped by technological advancements, economic conditions, and shifting workforce demographics. This section will delve into the current state of the industry, highlighting key trends and challenges, and exploring potential growth opportunities and risks for ZipRecruiter in the future.

Technological Advancements

Technological advancements have played a significant role in shaping the online recruitment industry. Artificial intelligence (AI) and machine learning (ML) are increasingly being used to automate tasks, such as screening resumes, matching candidates with jobs, and providing personalized job recommendations.

These technologies have the potential to improve efficiency and effectiveness in the recruitment process.

- AI-powered chatbotsare being used to handle initial interactions with job seekers, providing information about job openings and answering basic questions. This allows recruiters to focus on more complex tasks, such as interviewing and onboarding.

- Data analyticsis used to analyze job market trends and identify the most effective recruitment strategies. This data can help companies target the right candidates and improve their hiring success rates.

Economic Conditions

Economic conditions can have a significant impact on the online recruitment industry. During periods of economic growth, businesses are more likely to hire new employees, leading to increased demand for recruitment services. However, during economic downturns, businesses may reduce hiring, leading to a decline in demand for recruitment services.

- The rise of remote workhas created new opportunities for online recruitment platforms, as companies are increasingly looking to hire talent from around the world. This trend has been accelerated by the COVID-19 pandemic, as many businesses have adopted remote work policies.

- The increasing cost of healthcare and other benefitsis putting pressure on businesses to find ways to reduce their hiring costs. This has led to an increased demand for cost-effective recruitment solutions, such as online job boards and recruitment agencies.

Changing Workforce Demographics

The workforce is becoming increasingly diverse, with more women, minorities, and older workers entering the labor force. This trend is creating new opportunities for online recruitment platforms to reach a wider pool of talent.

- The gig economyis also growing, with more people choosing to work as independent contractors or freelancers. This has created a new market for online recruitment platforms that specialize in connecting businesses with freelance talent.

- The increasing importance of soft skills, such as communication, teamwork, and problem-solving, is creating new challenges for online recruitment platforms. These platforms need to find ways to assess soft skills effectively, as they are becoming increasingly important for job success.

Closing Notes: ZipRecruiter Executive Sells Shares Worth Over k

The executive’s share sale serves as a microcosm of the complexities surrounding the online recruitment industry. It underscores the delicate balance between individual financial decisions and the collective sentiment surrounding a company’s future. As ZipRecruiter navigates the ever-evolving landscape of online recruitment, the impact of this transaction will be closely watched by investors, employees, and users alike.

Clarifying Questions

Why is the executive’s share sale significant?

The sale highlights potential changes in the executive’s outlook on the company’s future or their personal financial needs. It also raises questions about ZipRecruiter’s financial health and investor sentiment.

What impact might the sale have on ZipRecruiter’s stock price?

The sale could impact investor confidence, potentially leading to a decline in the stock price if investors perceive it as a negative signal. However, the impact depends on the overall market conditions and the company’s performance.

How might this sale affect ZipRecruiter’s employees?

The sale could impact employee morale, especially if it’s seen as a sign of a lack of confidence in the company’s future. However, it’s important to consider other factors like overall company performance and communication from leadership.

CentralPoint Latest News

CentralPoint Latest News