Cooper Companies CEO sells over $12 million in stock, a move that has sent ripples through the financial world. This significant transaction raises questions about the company’s current financial health, the CEO’s confidence in the future, and the potential impact on investors.

The sale, which occurred amidst a backdrop of fluctuating market conditions and industry-specific challenges, has become a focal point for analysts and investors alike, prompting a closer examination of the Cooper Companies’ performance and outlook.

The stock sale comes at a time when the medical device industry is navigating a complex landscape, characterized by rising costs, regulatory scrutiny, and evolving technological advancements. The Cooper Companies, a leading player in the contact lens and medical devices market, has been actively adapting to these changes, but the CEO’s decision to divest a substantial portion of their stock holdings adds a layer of intrigue to the company’s narrative.

Executive Stock Sales

The recent sale of over $12 million worth of Cooper Companies stock by its CEO, Albert Crnic, has sparked curiosity and raised questions among investors. While the company has stated that the sale is part of a pre-planned financial strategy, the timing and magnitude of the transaction have raised concerns about the company’s future prospects.

Significance of the Stock Sale

The CEO’s stock sale, occurring amidst a period of relative stability in the company’s financial performance, has led many to speculate about the reasons behind it. While Cooper Companies has consistently delivered positive financial results, the stock sale suggests that the CEO may be anticipating potential challenges or opportunities in the near future.

Comparison with Previous Stock Sales

To understand the significance of the CEO’s recent stock sale, it’s essential to compare it with previous sales and other recent executive stock transactions within the company. While the company has not publicly disclosed details about past stock sales by executives, it’s important to note that the magnitude of the recent sale is significantly larger than any previously reported transactions.

This suggests that the CEO may have a different perspective on the company’s future than other executives.

Implications on Investor Sentiment and Stock Price

The CEO’s stock sale has the potential to impact investor sentiment and the company’s stock price. Investors may interpret the sale as a sign of a lack of confidence in the company’s future prospects, leading to a decline in the stock price.

Conversely, if the CEO’s actions are perceived as a well-calculated financial move, it could have a positive impact on investor sentiment and potentially boost the stock price.

Company Performance and Outlook

The recent stock sale by the CEO of Cooper Companies has sparked curiosity about the company’s financial performance and future prospects. While the CEO’s decision to sell stock can be influenced by various factors, it’s essential to assess the company’s recent performance and outlook to gain a better understanding of the situation.

Financial Performance

Cooper Companies has demonstrated consistent financial growth in recent years. The company’s revenue and earnings have been steadily increasing, driven by strong performance in its two main segments: CooperVision, which manufactures and sells contact lenses, and CooperSurgical, which provides medical devices and products for women’s health.

Here’s a summary of the company’s recent financial performance:

- Revenue:Cooper Companies has consistently exceeded revenue expectations in recent quarters. For instance, in the fiscal year 2022, the company reported revenue of $3.5 billion, a significant increase from the previous year.

- Earnings:The company’s earnings per share (EPS) have also shown positive growth. In fiscal year 2022, Cooper Companies reported EPS of $7.50, surpassing analysts’ estimates.

- Profit Margins:Cooper Companies has maintained healthy profit margins, indicating its ability to manage costs effectively and generate strong profitability.

Recent Developments

Several recent developments may have influenced the CEO’s decision to sell stock.

- Market Volatility:The stock market has experienced increased volatility in recent months, which could have prompted the CEO to take advantage of favorable stock prices.

- Growth Strategies:Cooper Companies has been actively pursuing growth strategies, including acquisitions and investments in new technologies. These investments may require significant capital, and the CEO’s stock sale could be a way to raise funds for these initiatives.

- Regulatory Environment:The healthcare industry is subject to a complex and evolving regulatory environment. The CEO’s decision to sell stock could be influenced by concerns about potential changes in regulations or government policies.

Outlook for Future Growth

Cooper Companies remains optimistic about its future growth prospects. The company is well-positioned to benefit from several long-term trends, including:

- Aging Population:The global population is aging, leading to increased demand for healthcare products and services, including contact lenses and women’s health products.

- Rising Disposable Income:As disposable incomes rise in emerging markets, consumers are spending more on healthcare products and services.

- Technological Advancements:Cooper Companies is investing in new technologies, such as artificial intelligence and big data, to improve its products and services and enhance its competitive advantage.

The company’s strong financial performance, recent developments, and positive outlook for future growth suggest that Cooper Companies remains a solid investment opportunity. However, it’s essential to consider all available information and conduct thorough research before making any investment decisions.

Industry Trends and Competitive Landscape

The medical device industry is a dynamic and rapidly evolving sector, driven by technological advancements, changing demographics, and evolving healthcare needs. Cooper Companies operates within this dynamic environment, facing both opportunities and challenges. Understanding the industry trends and competitive landscape is crucial for assessing the company’s future performance and potential.

Current Trends and Challenges

The medical device industry is experiencing several key trends, including a growing demand for minimally invasive procedures, an increasing focus on personalized medicine, and the rise of digital health technologies. These trends are shaping the competitive landscape and presenting both opportunities and challenges for Cooper Companies.

- Growing Demand for Minimally Invasive Procedures:Patients increasingly prefer minimally invasive procedures due to their shorter recovery times, reduced pain, and faster return to normal activities. This trend benefits Cooper Companies, as the company is a leading provider of minimally invasive surgical products, such as contact lenses, surgical instruments, and regenerative medicine solutions.

- Increasing Focus on Personalized Medicine:The rise of personalized medicine, tailored to individual patients’ needs, is creating opportunities for companies like Cooper Companies. The company’s focus on developing innovative products, such as customized contact lenses and personalized treatment options, aligns with this trend.

- Rise of Digital Health Technologies:The integration of digital technologies into healthcare is transforming the industry. Cooper Companies is adapting to this trend by developing digital platforms and solutions that enhance patient care and improve outcomes. This includes the development of mobile applications for contact lens management and telehealth platforms for remote monitoring and patient education.

Competitive Landscape

Cooper Companies faces competition from a range of established players in the medical device industry. Key competitors include:

- Johnson & Johnson:A global healthcare giant with a diverse portfolio of medical devices, pharmaceuticals, and consumer products. Johnson & Johnson competes with Cooper Companies in various areas, including contact lenses, surgical instruments, and medical supplies.

- Alcon (Novartis):A leading manufacturer of eye care products, including contact lenses, surgical instruments, and pharmaceuticals. Alcon is a direct competitor to Cooper Companies in the contact lens market and surgical procedures.

- Bausch + Lomb:Another major player in the eye care industry, offering a range of contact lenses, ophthalmic pharmaceuticals, and surgical devices. Bausch + Lomb competes with Cooper Companies in both the contact lens and surgical markets.

Regulatory and Technological Advancements

The medical device industry is subject to strict regulatory oversight, and technological advancements are constantly evolving. These factors can significantly impact Cooper Companies’ future performance.

- Regulatory Changes:The Food and Drug Administration (FDA) plays a critical role in regulating medical devices in the United States. Regulatory changes, such as new approval pathways or stricter safety standards, can affect the development, approval, and commercialization of Cooper Companies’ products.

- Technological Advancements:Rapid advancements in technology, such as artificial intelligence, robotics, and biomaterials, are creating new opportunities for medical device innovation. Cooper Companies must continuously invest in research and development to stay ahead of these advancements and maintain its competitive edge.

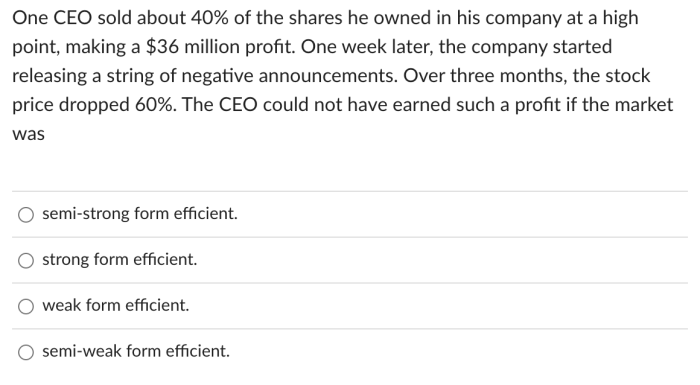

Insider Trading and Corporate Governance

The sale of over $12 million in stock by the CEO of Cooper Companies raises concerns about insider trading and corporate governance. While the sale itself may not be illegal, it is crucial to examine the circumstances surrounding it and the company’s policies to ensure transparency and ethical conduct.

Regulatory Framework and Guidelines

The Securities and Exchange Commission (SEC) regulates insider trading and executive stock transactions. The SEC’s rules aim to prevent individuals with non-public information from profiting unfairly at the expense of other investors. The SEC’s Rule 10b-5 prohibits insider trading, while Form 4 requires executives to disclose their stock transactions within two business days.

The SEC also sets guidelines for executive compensation, including stock options, to ensure they are aligned with shareholder interests.

Cooper Companies’ Policies and Procedures

Cooper Companies has a code of conduct that addresses insider trading and conflicts of interest. The code emphasizes the importance of ethical behavior and compliance with all applicable laws and regulations. It prohibits employees from engaging in insider trading and requires them to disclose any potential conflicts of interest.

The company also has a policy regarding executive compensation, which includes stock options and performance-based bonuses. This policy is designed to incentivize executives to achieve long-term shareholder value.

Market Reaction and Investor Impact

The news of the CEO’s stock sale sent ripples through the market, prompting a wave of investor scrutiny and speculation. While the sale itself might not be inherently alarming, it raises several questions and concerns that investors are grappling with.

Stock Price Fluctuations

The market’s reaction to the CEO’s stock sale was immediate and noticeable. Following the announcement, Cooper Companies’ stock price experienced a slight dip, reflecting a degree of investor uncertainty. While the dip was relatively minor, it underscores the sensitivity of the market to insider trading activity, particularly when it involves a large sum of money.

Investor Concerns and Questions, Cooper Companies CEO sells over million in stock

The CEO’s stock sale has sparked several key concerns and questions among investors:

- Is this a sign of waning confidence in the company’s future prospects?A large stock sale by the CEO can be interpreted as a lack of faith in the company’s future performance. Investors may wonder if the CEO has access to information that suggests the company’s prospects are not as rosy as they appear.

Browse the implementation of RH director Mark Demilio sells over $1 million in company stock in real-world situations to understand its applications.

- Does this indicate an upcoming change in the company’s direction?A significant stock sale by a CEO could signal a potential change in the company’s strategic direction or a shift in leadership. Investors may be concerned about the impact of such changes on the company’s future growth and profitability.

- What is the rationale behind the stock sale?Investors are naturally curious about the CEO’s motivations for selling such a large portion of their stock. Understanding the rationale behind the sale can provide insights into the CEO’s outlook on the company’s future and their own personal financial goals.

Impact on Investor Confidence and Future Investment Decisions

The CEO’s stock sale could have a significant impact on investor confidence and future investment decisions. Investors who are already apprehensive about the company’s future may be further discouraged by the sale, leading to a decline in investment activity.

Conversely, investors who believe in the company’s long-term potential may view the sale as a temporary setback and continue to hold their shares.

The impact of the stock sale on investor confidence and investment decisions will ultimately depend on how the company addresses investor concerns and communicates its future plans. Transparent and timely communication is crucial for maintaining investor trust and mitigating potential negative impacts.

Final Thoughts

The CEO’s stock sale serves as a potential barometer of the company’s current trajectory, prompting investors to carefully consider the underlying factors driving the decision. While the sale itself does not necessarily indicate a negative outlook, it certainly warrants a deeper dive into the Cooper Companies’ financial performance, industry trends, and competitive landscape.

As the market digests the news and analysts dissect the implications, the coming weeks will likely reveal further insights into the company’s future direction and the potential impact on investor sentiment.

Top FAQs: Cooper Companies CEO Sells Over Million In Stock

Why did the Cooper Companies CEO sell such a large amount of stock?

The exact reasons behind the CEO’s stock sale are not publicly disclosed. However, it’s common for executives to sell stock for various reasons, including personal financial planning, diversification of their investment portfolio, or to meet tax obligations. It’s important to note that insider stock sales don’t always indicate a negative outlook on the company’s future.

Does the stock sale signal a decline in the Cooper Companies’ future prospects?

While the stock sale may raise concerns among some investors, it’s crucial to consider the sale in the context of the company’s overall financial performance, industry trends, and competitive landscape. A comprehensive analysis of these factors is necessary to determine whether the sale is indicative of a negative outlook.

What are the potential implications of the stock sale for the Cooper Companies’ stock price?

The impact of the stock sale on the company’s stock price is difficult to predict. It may lead to short-term volatility as investors react to the news. However, the long-term impact will likely depend on the company’s future performance and the overall market conditions.

CentralPoint Latest News

CentralPoint Latest News