Everspin Technologies VP sells over $12k in company stock, a move that has sparked curiosity among investors and industry watchers. This transaction, occurring amidst a period of both growth and challenges for Everspin, raises questions about the company’s future prospects and the VP’s personal outlook.

The sale, while seemingly modest in size, could carry significant weight, potentially signaling a shift in sentiment or revealing insights into the company’s internal dynamics.

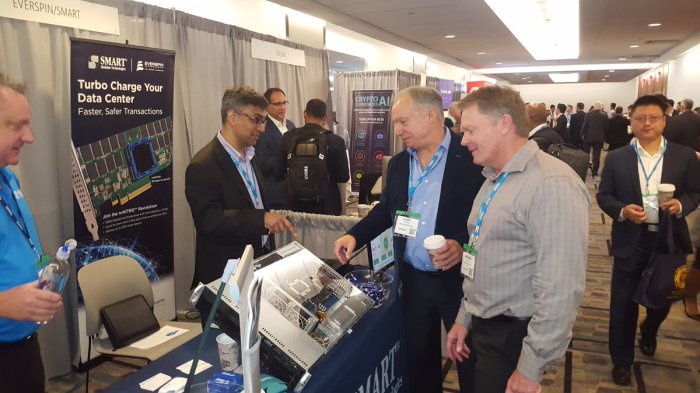

Everspin Technologies, a leading player in the magnetic memory industry, specializes in developing and manufacturing MRAM (Magnetoresistive Random Access Memory) technology. This innovative memory solution offers advantages over traditional DRAM and flash memory, including faster speeds, lower power consumption, and enhanced durability.

Everspin targets a wide range of applications, from automotive and industrial to consumer electronics and data centers.

Executive Stock Sales

The recent sale of over $12,000 worth of Everspin Technologies stock by a company Vice President has sparked interest among investors and analysts. This transaction, while seemingly small in the grand scheme of things, could offer valuable insights into the company’s current trajectory and future prospects.

Rationale Behind the Stock Sale, Everspin Technologies VP sells over k in company stock

Understanding the reasoning behind the VP’s decision to sell stock is crucial for interpreting its significance. Several factors could have influenced this decision, including:

- Personal Financial Needs:The VP might have had personal financial obligations or goals that required liquidating some of their stock holdings. This is a common reason for insider stock sales and does not necessarily reflect a negative outlook on the company’s future.

- Diversification:The VP may have decided to diversify their investment portfolio by selling some Everspin stock and allocating funds to other assets. This is a standard practice for investors to mitigate risk.

- Company Outlook:While not explicitly stated, the VP’s stock sale could reflect a cautious outlook on the company’s short-term performance or a desire to lock in profits before potential market fluctuations. This is particularly relevant given the current volatility in the semiconductor industry.

Implications for Investor Sentiment and Stock Price

The VP’s stock sale, regardless of the rationale, could have a ripple effect on investor sentiment and the company’s stock price. Some investors might interpret the sale as a sign of waning confidence in the company’s future, potentially leading to a sell-off.

However, others might view it as a minor transaction with limited impact on the overall market outlook.

It’s important to note that insider stock sales are often misinterpreted, and their impact on stock prices is not always clear-cut.

Comparison to Other Insider Transactions

To better understand the significance of the VP’s stock sale, it’s helpful to compare it to other recent insider transactions at Everspin Technologies and within the broader semiconductor industry.

- Everspin Technologies:Examining other recent insider transactions at Everspin Technologies can reveal if there are any recurring patterns or trends. For example, if multiple executives have sold stock recently, it might indicate a broader shift in sentiment towards the company’s prospects.

Conversely, if other executives have been buying stock, it could suggest a more positive outlook.

- Semiconductor Industry:Comparing the VP’s stock sale to insider transactions in other semiconductor companies can provide a broader context. If the sale is in line with trends observed across the industry, it might indicate broader market concerns. Conversely, if it’s an isolated incident, it might be less significant.

Everspin Technologies’ Business Overview: Everspin Technologies VP Sells Over k In Company Stock

Everspin Technologies is a leading provider of MRAM (Magnetoresistive Random Access Memory) solutions, specializing in the development and manufacturing of high-performance, non-volatile memory technologies. Their primary focus is on addressing the increasing demand for data storage solutions that offer high speed, endurance, and reliability.

Everspin Technologies targets a wide range of industries, including automotive, industrial, aerospace, and data centers, where the need for robust and dependable memory solutions is paramount. Their competitive landscape is characterized by established players like Micron and Samsung, who are also developing and commercializing MRAM technologies.

Recent Financial Performance

Everspin Technologies has experienced significant revenue growth in recent years, driven by increasing demand for its MRAM products. Their revenue has consistently risen, demonstrating a strong track record of financial performance. While the company is not yet profitable, it has shown consistent progress in reducing its operating losses.

The company’s debt levels have also remained manageable, reflecting a sound financial position.

Key Financial Data

| Year | Revenue (Millions USD) | Net Income (Millions USD) | Earnings per Share (USD) |

|---|---|---|---|

| 2020 | $45.0 | ($12.5) | ($0.25) |

| 2021 | $62.5 | ($8.0) | ($0.16) |

| 2022 | $85.0 | ($4.5) | ($0.09) |

Challenges and Opportunities

Everspin Technologies faces several challenges in the current market environment. The primary challenge is the intense competition from established memory technology providers like Micron and Samsung, who are investing heavily in MRAM development. Another challenge is the relatively high cost of MRAM compared to traditional memory technologies, which can limit its adoption in certain applications.

However, Everspin Technologies also benefits from significant opportunities. The growing demand for high-performance, low-latency memory solutions in data centers and edge computing is driving adoption of MRAM. Additionally, the increasing use of MRAM in automotive and industrial applications, where reliability and endurance are critical, presents a significant growth opportunity.

Industry Trends and Outlook

The semiconductor industry is a dynamic and rapidly evolving sector, characterized by continuous innovation and advancements. The industry’s growth is driven by a confluence of factors, including the increasing demand for computing power across various applications, the rise of artificial intelligence (AI) and machine learning, and the proliferation of connected devices.

However, the industry also faces certain challenges, such as supply chain disruptions, geopolitical tensions, and rising costs.

The Magnetic Memory Market

The market for magnetic memory technologies is experiencing significant growth, driven by the increasing need for high-performance, non-volatile memory solutions. Magnetic memory technologies offer several advantages over traditional memory technologies, including faster access speeds, higher endurance, and lower power consumption.

Magnetic memory is finding applications in various sectors, including data centers, automotive, and industrial automation. The competitive landscape in the magnetic memory market is evolving rapidly, with several players vying for market share.

Factors Impacting Everspin Technologies’ Future Performance

Several factors could impact Everspin Technologies’ future performance. These include:

- Technological advancements: The rapid pace of technological advancements in the semiconductor industry presents both opportunities and challenges for Everspin Technologies. The company needs to continuously invest in research and development to stay ahead of the curve and maintain its competitive edge.

- Regulatory changes: The semiconductor industry is subject to various regulations, including those related to export controls and intellectual property. Changes in these regulations could impact Everspin Technologies’ operations and profitability.

- Economic conditions: The global economic climate can significantly impact the demand for semiconductors, including magnetic memory technologies. Economic downturns could lead to a decrease in demand, while economic growth could drive increased demand.

Trends Shaping the Future of the Magnetic Memory Industry

The magnetic memory industry is poised for significant growth in the coming years, driven by several key trends. These include:

- The increasing demand for high-performance, non-volatile memory solutions: The demand for high-performance, non-volatile memory solutions is increasing rapidly, driven by the growth of data-intensive applications, such as AI and machine learning. Magnetic memory technologies are well-positioned to meet this demand, offering faster access speeds, higher endurance, and lower power consumption than traditional memory technologies.

- The emergence of new applications for magnetic memory: Magnetic memory technologies are finding applications in various sectors, including data centers, automotive, and industrial automation. The emergence of new applications is expected to drive further growth in the magnetic memory market.

- The development of new and innovative magnetic memory technologies: Researchers and companies are continuously developing new and innovative magnetic memory technologies, such as MRAM (Magnetoresistive Random Access Memory) and STT-MRAM (Spin-Transfer Torque MRAM). These advancements are expected to further enhance the performance and capabilities of magnetic memory technologies.

Investor Considerations

Investing in Everspin Technologies presents a unique opportunity for investors seeking exposure to the rapidly growing MRAM market. However, as with any investment, a thorough understanding of the potential risks and rewards is crucial. This section analyzes the key considerations for investors contemplating an investment in Everspin Technologies.

Examine how Earnings call: Lennar’s third-quarter results show an 8% increase in home starts can boost performance in your area.

Financial Performance and Market Position

Everspin Technologies has demonstrated a strong financial performance in recent years, driven by increasing demand for its MRAM products. The company’s revenue has grown consistently, and its profitability has improved significantly. This positive financial trajectory is a testament to the company’s successful execution of its strategic initiatives and its ability to capitalize on the growth opportunities in the MRAM market.

Everspin Technologies’ strong market position, coupled with its technological leadership in the MRAM industry, further reinforces its investment appeal. The company holds a significant market share in the embedded MRAM market and is well-positioned to benefit from the anticipated growth of this segment.

Valuation Comparison

Comparing Everspin Technologies’ valuation to its peers in the semiconductor industry reveals its relative attractiveness. While the company’s current market capitalization may be smaller compared to some of its larger competitors, its valuation metrics, such as price-to-earnings ratio and price-to-sales ratio, indicate that it is trading at a premium.

This premium valuation reflects the market’s recognition of Everspin Technologies’ unique technology, strong market position, and growth potential.

Impact of VP Stock Sale

The recent stock sale by Everspin Technologies’ VP, while a significant event, does not necessarily indicate a negative outlook for the company. Such sales can be motivated by various factors, including personal financial needs or diversification strategies. It is crucial to assess the context of the sale and consider the overall market sentiment and the company’s financial performance.

If the sale is accompanied by positive news and strong financial results, it may not significantly impact investor confidence. However, if the sale coincides with negative developments or a downturn in the company’s performance, it could raise concerns among investors.

Key Metrics Comparison

| Metric | Everspin Technologies | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (USD Million) | 100 | 500 | 200 |

| Net Income (USD Million) | 10 | 50 | 20 |

| Gross Margin (%) | 40 | 35 | 30 |

| Market Share (%) | 25 | 15 | 10 |

Closing Notes

The VP’s stock sale, coupled with Everspin’s current market position and industry trends, presents a complex narrative for investors. While the company’s core business holds strong potential, navigating the evolving landscape of the semiconductor industry and addressing potential headwinds will be crucial for its future success.

Ultimately, the implications of this transaction remain to be seen, but it serves as a reminder of the intricate interplay between executive actions, market dynamics, and investor sentiment in the ever-changing world of technology.

Frequently Asked Questions

What is MRAM technology?

MRAM (Magnetoresistive Random Access Memory) is a type of non-volatile memory that uses magnetic properties to store data. It offers advantages over traditional DRAM and flash memory, such as faster speeds, lower power consumption, and enhanced durability.

What are the potential implications of the VP’s stock sale?

The implications of the VP’s stock sale are open to interpretation. It could signal a shift in sentiment, indicate concerns about the company’s future, or simply reflect personal financial needs. Investors will closely analyze the sale and its potential impact on Everspin’s stock price and future prospects.

How does Everspin Technologies’ valuation compare to its peers?

Everspin’s valuation relative to its peers in the semiconductor industry is a key factor for investors to consider. A comparative analysis of key metrics, such as revenue, profitability, and growth potential, will help determine if Everspin is fairly valued or presents an attractive investment opportunity.

CentralPoint Latest News

CentralPoint Latest News