Darden Restaurants: Bernstein sees limited upside, Evercore ISI bullish – a tale of two analysts with contrasting views on the future of this restaurant giant. While Bernstein remains cautious, citing potential challenges, Evercore ISI sees a bright future, pointing to growth opportunities and positive trends.

This clash of opinions raises a crucial question for investors: Is Darden poised for a surge, or is a period of stagnation ahead?

Darden Restaurants, the parent company of popular chains like Olive Garden, Longhorn Steakhouse, and Cheddar’s Scratch Kitchen, has long been a fixture in the American dining landscape. The company boasts a diverse portfolio of restaurant concepts, catering to a wide range of tastes and budgets.

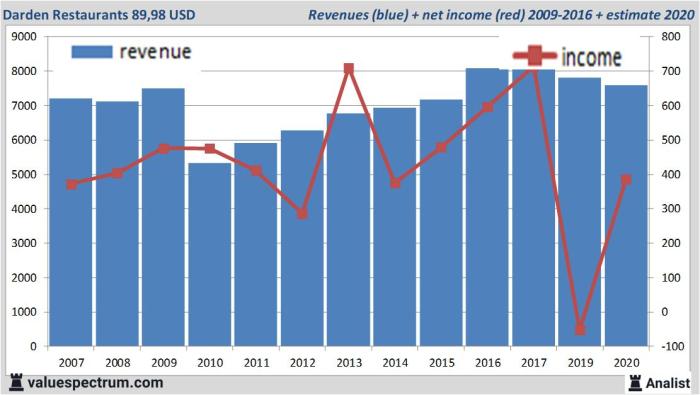

Darden’s financial performance has been a mixed bag in recent years, with challenges stemming from factors like inflation and labor shortages. However, the company has also demonstrated resilience, adapting to changing consumer preferences and investing in technology to enhance the dining experience.

Darden Restaurants Overview

Darden Restaurants, a household name in the American dining scene, is a leading casual dining restaurant company with a rich history and a diverse portfolio of popular brands. The company’s journey, marked by strategic acquisitions, brand expansions, and a commitment to innovation, has cemented its position as a major player in the restaurant industry.

History of Darden Restaurants

Darden Restaurants traces its roots back to 1938 when the first Red Lobster restaurant opened in Orlando, Florida. The company’s growth story is punctuated by significant acquisitions and brand expansions, including:

- 1968:Darden acquired Red Lobster, marking the beginning of its journey as a multi-brand restaurant company.

- 1972:Darden launched Olive Garden, a casual Italian dining chain that quickly gained popularity.

- 1989:Darden acquired The Capital Grille, a high-end steakhouse chain.

- 1991:Darden launched Bahama Breeze, a Caribbean-inspired restaurant chain.

- 1996:Darden acquired Seasons 52, a fresh grill concept.

- 2000:Darden launched Eddie V’s Prime Seafood, a seafood-focused restaurant chain.

- 2007:Darden acquired LongHorn Steakhouse, a casual steakhouse chain.

- 2014:Darden acquired Yard House, a casual dining chain known for its extensive beer selection.

- 2015:Darden acquired Cheddar’s Scratch Kitchen, a casual dining chain specializing in comfort food.

Business Model

Darden operates a multi-brand restaurant model, catering to a diverse range of customer preferences and dining occasions. The company’s brands offer a variety of cuisines, price points, and dining experiences. Darden’s target audience encompasses families, couples, and groups seeking a casual and affordable dining experience.

Darden’s core offerings include a wide selection of menu items, a focus on fresh ingredients, and a commitment to providing excellent customer service.

Financial Performance

Darden has consistently demonstrated strong financial performance, driven by its diversified portfolio and strategic initiatives. Key financial metrics include:

- Revenue:Darden’s revenue has grown steadily over the years, driven by new restaurant openings and same-store sales growth. In fiscal year 2022, Darden reported total revenue of $9.4 billion, a significant increase from the previous year.

- Profitability:Darden’s profitability is reflected in its operating margin, which has consistently remained above industry averages. The company’s focus on cost management and efficiency has contributed to its strong earnings performance.

- Debt Levels:Darden maintains a healthy debt-to-equity ratio, indicating a conservative approach to financing. The company’s strong cash flow generation allows it to manage its debt obligations effectively.

Bernstein’s Viewpoint

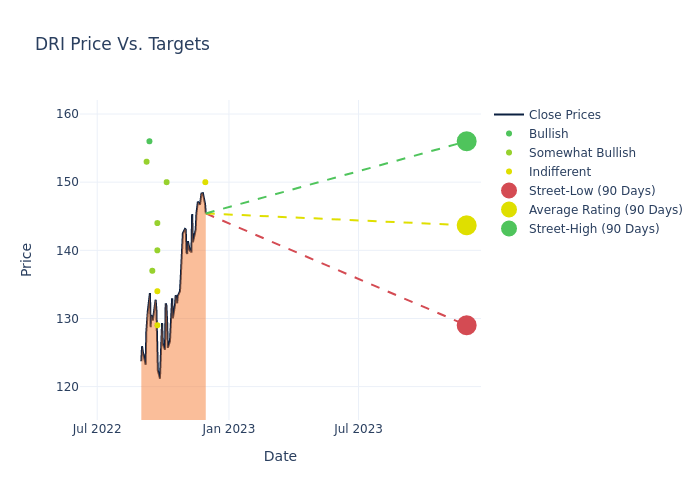

Bernstein, a renowned investment research firm, holds a cautious outlook on Darden Restaurants, believing the company faces limited upside potential in the near future. This perspective stems from a comprehensive analysis of Darden’s current market position, industry dynamics, and potential challenges.

Factors Contributing to Limited Upside

Bernstein’s assessment is driven by several key factors that indicate a constrained growth trajectory for Darden.

- Elevated Inflationary Pressures:The current economic climate is characterized by persistent inflation, impacting consumer spending habits. Bernstein believes that Darden’s ability to raise prices to offset these inflationary pressures may be limited, potentially leading to margin compression. This could be particularly challenging given the competitive nature of the restaurant industry, where consumers are price-sensitive.

- Supply Chain Disruptions:The ongoing global supply chain disruptions continue to pose challenges for businesses across various sectors, including the restaurant industry. Bernstein anticipates that these disruptions could impact Darden’s ability to source ingredients and maintain consistent menu offerings, potentially affecting customer satisfaction and operational efficiency.

- Labor Market Tightness:The labor market remains tight, with a high demand for workers and limited supply. This environment is pushing up labor costs for businesses like Darden. Bernstein believes that the company may struggle to attract and retain qualified staff, potentially leading to operational challenges and reduced service quality.

- Competition:The restaurant industry is highly competitive, with numerous players vying for market share. Bernstein highlights the emergence of new competitors and the aggressive expansion strategies of existing players as significant factors that could limit Darden’s growth prospects.

Evercore ISI’s Bullish Stance

Evercore ISI, a prominent investment bank, holds a decidedly optimistic outlook on Darden Restaurants, a leading casual dining company. They believe Darden is poised for continued growth and success, supported by a number of key factors.

Evercore ISI’s Investment Rating, Darden Restaurants: Bernstein sees limited upside, Evercore ISI bullish

Evercore ISI has assigned Darden Restaurants an “Outperform” rating, indicating their strong belief that the company’s stock will outperform the broader market. This bullish stance is driven by a confluence of factors, including Darden’s robust financial performance, strategic initiatives, and favorable industry trends.

Key Factors Driving Evercore ISI’s Bullish Stance

Evercore ISI highlights several key factors underpinning their bullish outlook on Darden:* Strong Financial Performance:Darden has consistently delivered solid financial results, demonstrating its ability to navigate market challenges and generate consistent profitability.

Strategic Initiatives

Darden has undertaken strategic initiatives to enhance its brand portfolio, expand its digital presence, and optimize its operations, positioning itself for sustained growth.

Favorable Industry Trends

The casual dining sector is experiencing positive trends, driven by factors such as consumer demand for value-oriented dining experiences and the growth of off-premise dining.

Management Team

Darden’s management team is recognized for its strong leadership, operational expertise, and commitment to shareholder value.

Growth Opportunities and Positive Trends

Evercore ISI anticipates Darden to benefit from several growth opportunities and positive trends:* Menu Innovation:Darden continues to innovate its menus, introducing new and exciting items to appeal to a wider range of diners.

Digital Expansion

Darden is expanding its digital capabilities, investing in online ordering, delivery, and loyalty programs to enhance customer convenience and engagement.

Restaurant Expansion

Darden is strategically expanding its restaurant footprint, targeting high-growth markets and optimizing its location strategy.

Cost Management

Darden is focused on managing costs effectively, optimizing its supply chain, and leveraging technology to improve efficiency.

Analyst Divergence: Key Considerations

The contrasting perspectives of Bernstein and Evercore ISI on Darden Restaurants highlight a significant divergence in analyst opinion. This disparity stems from different interpretations of market conditions, company-specific factors, and future growth prospects. Understanding these contrasting viewpoints is crucial for investors considering Darden Restaurants, as it sheds light on the potential risks and rewards associated with this investment.

Check what professionals state about Nvidia’s principal accounting officer sells shares worth over $520,000 and its benefits for the industry.

Factors Contributing to Analyst Divergence

The divergence in analyst opinions on Darden Restaurants can be attributed to several key factors, including:

- Macroeconomic Outlook:Bernstein’s cautious stance likely reflects concerns about the broader macroeconomic environment, particularly inflation and potential consumer spending pullback. This view is supported by recent data indicating rising inflation and consumer sentiment declining.

- Competition and Industry Dynamics:The restaurant industry is highly competitive, with numerous players vying for market share. Bernstein may be concerned about the potential for increased competition from new entrants and existing rivals, particularly in the casual dining segment.

- Company-Specific Factors:Evercore ISI’s bullish stance could be based on Darden’s strong track record of operational efficiency, its robust brand portfolio, and its ability to navigate challenges. The company’s focus on value-oriented offerings, its loyalty programs, and its commitment to technology-driven innovation may be contributing to Evercore ISI’s positive outlook.

- Valuation and Growth Prospects:Bernstein’s view may be influenced by a more conservative valuation approach, potentially considering the stock already priced for growth. Conversely, Evercore ISI may see greater upside potential, anticipating continued growth in earnings and dividends.

Darden’s Future Prospects

Darden Restaurants, a leader in the casual dining sector, finds itself navigating a dynamic landscape shaped by evolving consumer preferences, intensified competition, and the transformative influence of technology. To understand Darden’s future prospects, we must delve into the broader industry trends that impact its trajectory, assess its competitive positioning, and explore its strategic initiatives.

Industry Trends Shaping Darden’s Future

The restaurant industry is characterized by its constant evolution, driven by factors such as shifting consumer demographics, evolving dining preferences, and technological advancements. Understanding these trends is crucial for Darden to maintain its competitive edge.

- Changing Consumer Spending Patterns:The restaurant industry is sensitive to economic fluctuations, with consumer spending on dining out often being discretionary. During periods of economic uncertainty, consumers may cut back on restaurant visits, opting for more affordable options or cooking at home. Darden must navigate these shifts by offering value-driven menus and promotions, while also catering to consumers seeking premium experiences.

- Rise of Delivery and Takeout:The convenience of delivery and takeout services has become increasingly popular, particularly among younger generations. Darden has responded to this trend by investing in digital platforms and partnerships with third-party delivery services. This strategy allows Darden to tap into a growing market segment and offer a wider range of options to consumers.

- Focus on Health and Wellness:Consumers are increasingly conscious of their health and well-being, leading to a demand for healthier menu options. Darden has introduced lighter fare and more plant-based options across its brands to cater to this evolving preference. This focus on healthy and sustainable options not only aligns with consumer trends but also enhances Darden’s brand image.

- Technological Advancements:Technology is transforming the restaurant industry, impacting everything from ordering and payment to customer engagement. Darden has implemented technology to streamline operations, enhance customer experiences, and gather valuable data insights. This includes online ordering platforms, mobile payments, and loyalty programs.

Last Point: Darden Restaurants: Bernstein Sees Limited Upside, Evercore ISI Bullish

The divergent perspectives of Bernstein and Evercore ISI highlight the complexities of investing in the restaurant industry. Darden’s future hinges on its ability to navigate a dynamic market, adapt to evolving consumer tastes, and effectively manage costs. While Bernstein’s cautionary outlook underscores the potential risks, Evercore ISI’s bullish stance underscores the company’s growth potential.

Ultimately, investors must weigh the competing narratives and make their own informed decisions based on their individual risk tolerance and investment goals.

FAQ Resource

What are the key factors that drive Bernstein’s cautious outlook on Darden?

Bernstein’s cautious stance is primarily driven by concerns about Darden’s ability to maintain profitability in the face of rising costs and labor shortages. They also express concerns about the company’s competitive landscape and its ability to attract and retain customers in a crowded market.

What are the key factors that drive Evercore ISI’s bullish outlook on Darden?

Evercore ISI’s bullish stance is fueled by their belief that Darden is well-positioned to benefit from the recovery in consumer spending and the growing demand for casual dining. They also highlight the company’s strong brand recognition, its commitment to innovation, and its ability to adapt to changing consumer preferences.

CentralPoint Latest News

CentralPoint Latest News