Weak Chinese demand likely weighing on luxury sector in second half – Jefferies, a recent report by the investment bank, paints a concerning picture for the luxury industry. This analysis, fueled by China’s economic slowdown and shifting consumer preferences, highlights the potential impact on various luxury goods categories, from high-end fashion to coveted timepieces.

As the world’s largest luxury market, China’s economic climate holds significant sway over the fortunes of global luxury brands.

The report delves into the factors contributing to this weakened demand, including a slowing Chinese economy, a decline in consumer confidence, and evolving consumption patterns. These economic headwinds are pushing luxury brands to re-evaluate their strategies, seeking to navigate the complexities of the Chinese market and mitigate the potential impact of this shifting tide.

Luxury Sector Impact

The whispers of a slowdown in Chinese demand are sending ripples through the luxury sector, particularly as we enter the second half of the year. This shift, driven by a combination of factors including economic uncertainties and changing consumer preferences, could significantly impact the performance of luxury brands across various categories.

Impact Across Luxury Goods Categories

The impact of weakened Chinese demand is likely to be felt differently across various luxury goods categories. For instance, the fashion sector, particularly high-end apparel and accessories, could experience a more pronounced decline due to its reliance on discretionary spending.

On the other hand, categories like jewelry and watches, often considered investments or status symbols, might be less susceptible to immediate shifts in consumer behavior.

Historical Relationship Between Chinese Demand and Luxury Sector Performance

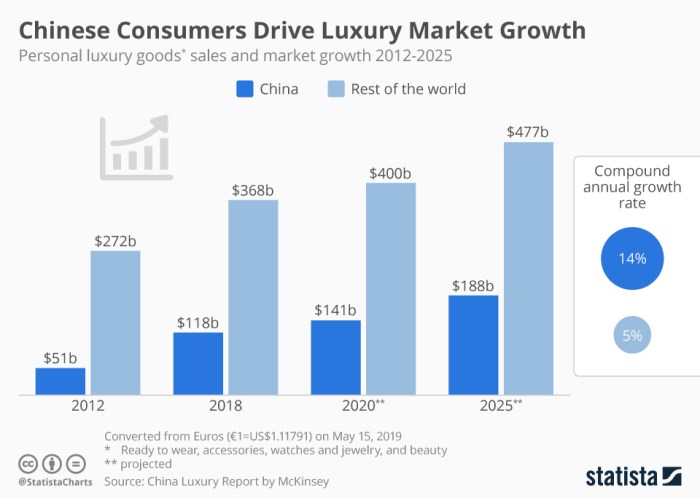

Historically, Chinese demand has played a pivotal role in shaping the trajectory of the luxury sector. The burgeoning Chinese middle class, with its growing disposable income and desire for luxury goods, has been a major driver of growth for luxury brands.

This strong correlation between Chinese demand and luxury sector performance is evident in the significant market share held by China in various luxury goods categories.

Economic Factors in China

The weakening of Chinese demand for luxury goods is a significant factor impacting the luxury sector. This decline is driven by a complex interplay of economic factors that are shaping the Chinese consumer landscape.

Economic Slowdown and Uncertainty

China’s economic growth has slowed in recent years, fueled by a combination of factors. The COVID-19 pandemic significantly impacted economic activity, disrupting supply chains and leading to lockdowns. The government’s zero-COVID policy, while effective in controlling the virus, also hindered economic growth and consumer spending.

- Real Estate Crisis:The Chinese real estate sector, a major driver of economic growth, has experienced a downturn. This is due to concerns about overbuilding and rising debt levels, leading to a decline in property values and investor confidence.

- Regulatory Crackdowns:The Chinese government has implemented stricter regulations on various industries, including technology and education. These measures have impacted business confidence and investment, leading to slower economic growth.

- Global Economic Headwinds:The global economic environment has become more uncertain, with rising inflation and interest rates impacting global trade and investment. This has also contributed to the slowdown in Chinese economic growth.

Consumer Confidence and Luxury Spending

Consumer confidence is a crucial indicator of luxury spending. When consumers are optimistic about the economy and their future prospects, they are more likely to indulge in discretionary purchases, including luxury goods. However, declining economic growth and uncertainty can lead to a decrease in consumer confidence, resulting in a shift towards more cautious spending patterns.

“Luxury spending is often seen as a barometer of consumer confidence and economic prosperity. When consumers are confident about their financial future, they are more likely to spend on luxury goods.”

Source

McKinsey & Company

The Chinese luxury market has witnessed a significant increase in spending over the past decade. However, recent economic headwinds and geopolitical tensions have impacted consumer sentiment, leading to a slowdown in luxury spending. This is evident in the declining sales of luxury brands in China.

Impact on Luxury Sector

The weakening of Chinese demand for luxury goods is a significant concern for the luxury sector. China is a major market for luxury brands, and any decline in demand from this region can have a substantial impact on their global sales.Luxury brands are responding to this shift in consumer behavior by adapting their strategies.

Some brands are focusing on more affordable price points and product categories, while others are expanding their online presence to reach a wider audience.

Jefferies’ Analysis

Jefferies, a global investment bank, has issued a report highlighting the potential impact of weakening Chinese demand on the luxury sector in the second half of 2023. Their analysis delves into the factors driving this trend and offers predictions for the industry’s future.

Jefferies’ Analysis and Predictions

Jefferies’ analysis points to a confluence of factors contributing to the slowdown in Chinese demand for luxury goods. These include:

- Economic Slowdown:China’s economic growth has slowed in recent months, impacting consumer spending power and discretionary income.

- Geopolitical Tensions:Ongoing geopolitical tensions, particularly with the United States, have created uncertainty and impacted consumer confidence.

- Shifting Consumer Preferences:Chinese consumers are increasingly prioritizing experiences and domestic brands over luxury goods.

Based on these factors, Jefferies predicts that the luxury sector will face headwinds in the second half of 2023, with slower growth rates and potentially even declines in sales. The report highlights that the impact will be particularly pronounced in sectors heavily reliant on Chinese consumers, such as fashion, jewelry, and watches.

Comparison with Other Market Research

While Jefferies’ analysis is in line with other market research reports, there are some key differences. Some reports emphasize the impact of rising inflation and interest rates on consumer spending, while others highlight the potential for luxury brands to mitigate the slowdown by focusing on emerging markets and digital channels.

Get the entire information you require about Insider Trading Roundup: Thursday’s Top Buys and Sells Revealed on this page.

Implications for Investors

Jefferies’ analysis has significant implications for investors in the luxury sector. The report suggests that investors should be cautious in their approach to the sector, considering the potential for slower growth and even declines in share prices. Investors may need to reassess their investment strategies and consider diversifying their portfolios to mitigate risk.

Strategies for Luxury Brands: Weak Chinese Demand Likely Weighing On Luxury Sector In Second Half – Jefferies

Luxury brands are facing a significant challenge due to weakening Chinese demand. To navigate this headwind, they need to adopt strategic approaches that focus on diversifying markets, enhancing customer experiences, and adapting their offerings to evolving consumer preferences.

Strategies to Mitigate the Impact of Weak Chinese Demand

Luxury brands can implement several strategies to mitigate the impact of weak Chinese demand. These strategies aim to diversify their customer base, enhance brand appeal, and optimize their operations for greater efficiency and resilience.

Market Diversification Strategies

- Expanding into Emerging Markets:Luxury brands can explore new markets with growing affluent populations, such as India, Southeast Asia, and Latin America. This strategy diversifies their revenue streams and reduces dependence on a single market.

- Targeting New Customer Segments:Luxury brands can focus on attracting younger generations, such as Gen Z and Millennials, who have different spending habits and preferences. This involves adapting marketing strategies and product offerings to appeal to these demographics.

- Developing Online Presence:Luxury brands can leverage e-commerce platforms to reach a wider audience, particularly in regions with limited physical store presence. This strategy allows them to expand their reach and offer a more convenient shopping experience.

Customer Experience Enhancement

- Personalized Experiences:Luxury brands can leverage data analytics to understand customer preferences and offer personalized experiences, such as tailored product recommendations, exclusive events, and personalized communication.

- Exceptional Customer Service:Providing exceptional customer service is crucial for building brand loyalty. This includes offering personalized assistance, seamless returns and exchanges, and dedicated customer support channels.

- Unique Brand Storytelling:Luxury brands can leverage storytelling to connect with customers on an emotional level. This involves crafting compelling narratives that highlight the brand’s history, craftsmanship, and values.

Product and Service Innovation

- Developing Sustainable Products:Luxury consumers are increasingly concerned about sustainability. Brands can cater to this demand by developing eco-friendly products and transparently communicating their sustainability initiatives.

- Offering Exclusive Experiences:Luxury brands can create exclusive experiences, such as private shopping events, behind-the-scenes tours, or personalized consultations, to enhance the value proposition for their customers.

- Introducing New Product Categories:Luxury brands can explore new product categories that align with emerging trends and consumer preferences. This can involve expanding into areas like sustainable fashion, technology, or wellness.

Strategies and their Potential Benefits and Drawbacks, Weak Chinese demand likely weighing on luxury sector in second half – Jefferies

| Strategy | Potential Benefits | Potential Drawbacks ||—|—|—|| Market Diversification | Reduced dependence on a single market, increased revenue streams, access to new customer segments | Higher marketing costs, challenges in understanding local market dynamics, potential cultural barriers || Customer Experience Enhancement | Increased brand loyalty, improved customer satisfaction, enhanced brand reputation | Requires significant investment in technology and personnel, potential for data privacy concerns || Product and Service Innovation | Differentiation from competitors, appeal to evolving consumer preferences, enhanced brand image | Risk of product failure, potential for cannibalization of existing products, need for ongoing investment in research and development |

Long-Term Outlook

The long-term outlook for Chinese demand in the luxury sector remains positive, despite the recent slowdown. China’s burgeoning middle class, rising disposable incomes, and a growing desire for premium goods continue to drive demand. However, several factors could influence future demand trends, leading to a nuanced outlook for the coming years.

Factors Influencing Future Demand

The future of Chinese luxury demand is influenced by a complex interplay of economic, social, and political factors.

- Economic Growth:China’s economic growth trajectory will significantly impact luxury spending. Continued economic expansion and rising disposable incomes will fuel demand for luxury goods. Conversely, any economic slowdown or instability could dampen consumer sentiment and lead to reduced spending.

- Government Policies:Chinese government policies, particularly those related to income inequality and luxury consumption, can influence demand. Policies promoting wealth redistribution or discouraging excessive spending on luxury goods could impact consumer behavior.

- Shifting Consumer Preferences:Chinese consumers are becoming increasingly sophisticated and discerning in their luxury choices. They are demanding higher quality, unique experiences, and personalized services. Brands that can cater to these evolving preferences will be well-positioned to capture market share.

- Digitalization and E-commerce:The rapid growth of online retail and social media platforms has significantly impacted luxury consumption in China. Brands that leverage digital channels to reach consumers, build brand awareness, and offer personalized experiences will be successful.

- Sustainability and Ethical Considerations:Chinese consumers are increasingly concerned about sustainability and ethical sourcing practices. Luxury brands that demonstrate commitment to these values will resonate with this segment of the market.

Potential Scenarios for Chinese Demand

The future of Chinese luxury demand can be visualized through several potential scenarios, each reflecting a different combination of factors:

- Scenario 1: Continued Growth and Expansion:China’s economy continues to grow at a healthy pace, fueling rising disposable incomes and a growing middle class. Luxury brands see strong demand across categories, driven by a desire for premium products, experiences, and status symbols.

- Scenario 2: Moderate Growth and Diversification:China’s economic growth slows down, but remains stable. Consumers become more discerning and focus on quality, craftsmanship, and unique experiences over mere brand names. Demand shifts towards niche luxury brands and personalized services.

- Scenario 3: Economic Slowdown and Uncertainties:China experiences a significant economic slowdown or instability, leading to a decline in consumer confidence and luxury spending. Brands face a challenging environment, with demand concentrated on essential goods and services.

Concluding Remarks

The report serves as a wake-up call for luxury brands, urging them to adapt and diversify their strategies. The luxury sector’s dependence on Chinese demand has become increasingly apparent, and the potential for a prolonged downturn poses a significant challenge.

However, amidst the uncertainty, opportunities for innovation and strategic repositioning exist. By understanding the evolving dynamics of the Chinese market and adjusting their approach accordingly, luxury brands can position themselves for long-term success, even in the face of these headwinds.

FAQ

What are the main economic factors contributing to the weakening of Chinese demand for luxury goods?

The report identifies several key economic factors, including a slowing Chinese economy, a decline in consumer confidence, and a shift in consumer preferences towards experiences and domestic brands.

How might the impact of weak Chinese demand differ across various luxury goods categories?

The report suggests that the impact could vary depending on the specific category. For example, fashion and accessories might be more susceptible to fluctuations in consumer confidence, while watches and jewelry could see more resilience due to their investment value.

What are some strategies that luxury brands can implement to mitigate the impact of weak Chinese demand?

Luxury brands can consider strategies such as diversifying their customer base, focusing on e-commerce and digital marketing, and offering more personalized experiences to cater to evolving consumer preferences.

CentralPoint Latest News

CentralPoint Latest News