Morgan Stanley cuts Infineon price target; maintains “overweight” rating, a move that reflects a nuanced perspective on the semiconductor giant’s future. While acknowledging some near-term headwinds, the investment bank remains bullish on Infineon’s long-term prospects, driven by the company’s strategic focus on key growth areas like automotive and industrial automation.

The decision to lower the price target, however, highlights the evolving dynamics within the semiconductor industry, where cyclical pressures and global economic uncertainties are creating challenges for even industry leaders like Infineon.

Infineon Technologies, a leading provider of semiconductor solutions for automotive, industrial, and other critical applications, has been navigating a complex market environment. The company’s recent financial performance has been impacted by factors such as supply chain disruptions, rising inflation, and slowing global economic growth.

Despite these challenges, Infineon remains committed to its strategic focus on key growth areas, including the electrification of transportation, the rise of smart factories, and the development of advanced technologies like artificial intelligence and 5G.

Infineon Technologies Overview: Morgan Stanley Cuts Infineon Price Target; Maintains “overweight” Rating

Infineon Technologies AG is a global leader in semiconductors, specializing in power management, automotive, industrial, and communication applications. The company designs, manufactures, and markets a wide range of microchips, sensors, and software solutions that power a diverse array of electronic devices and systems.Infineon’s core business revolves around providing essential components for key industries.

Its product segments include:

Power Management

Power management solutions are crucial for optimizing energy efficiency and reliability in various applications. Infineon’s offerings in this segment cater to diverse needs, ranging from power supplies for data centers and industrial equipment to battery management systems for electric vehicles.

Automotive

The automotive sector is a significant growth driver for Infineon. The company’s advanced semiconductor solutions enable critical functions in modern vehicles, including powertrain control, safety systems, and advanced driver-assistance systems (ADAS).

Industrial

Infineon’s industrial semiconductor solutions play a vital role in driving automation, efficiency, and sustainability in industrial applications. These solutions empower smart factories, robotics, and energy management systems.

Communications

Infineon’s communication semiconductors are essential for enabling high-speed data transmission and connectivity in various communication infrastructure and devices. These solutions support 5G networks, data centers, and other high-bandwidth applications.

Recent Financial Performance and Market Position

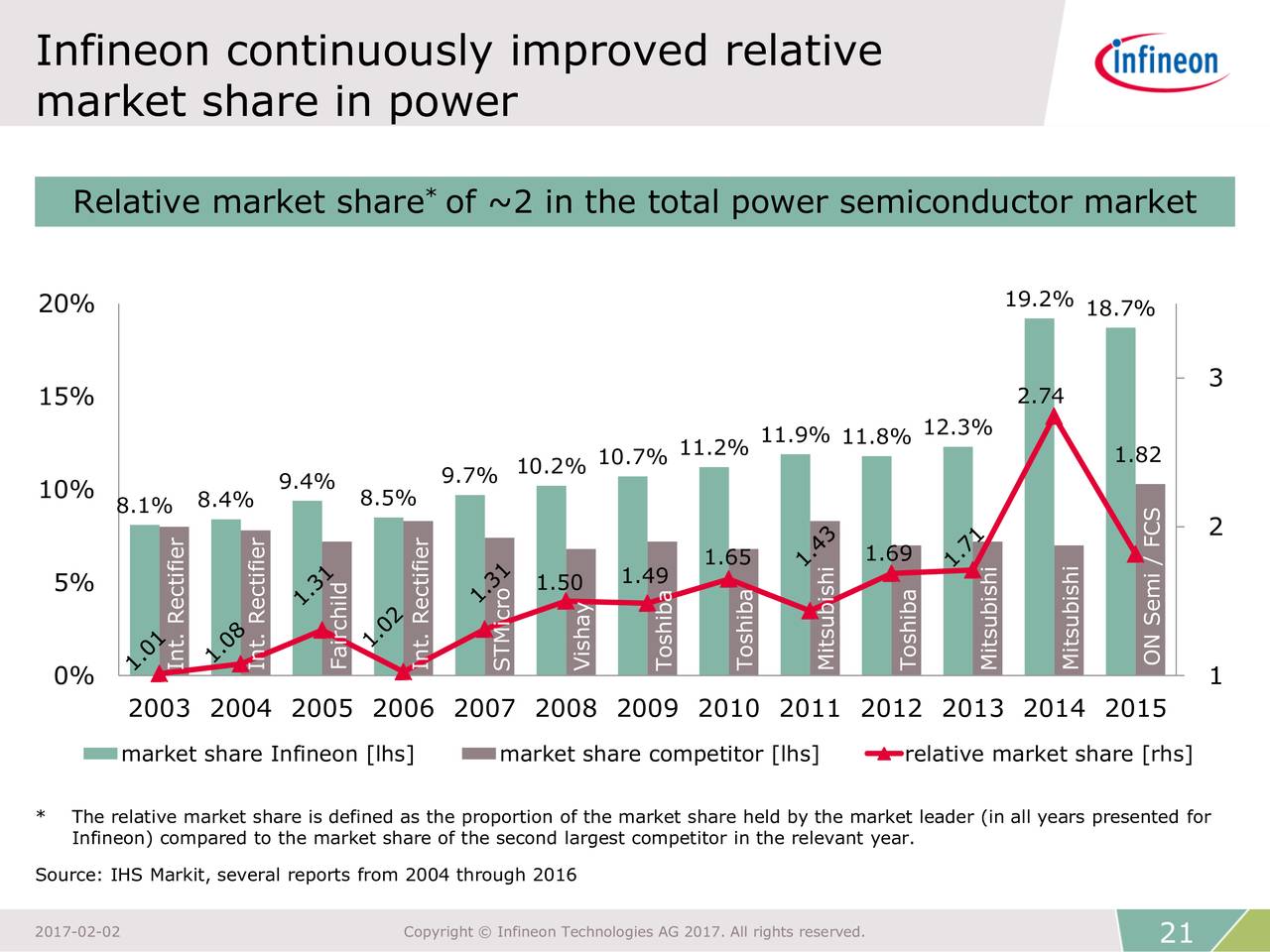

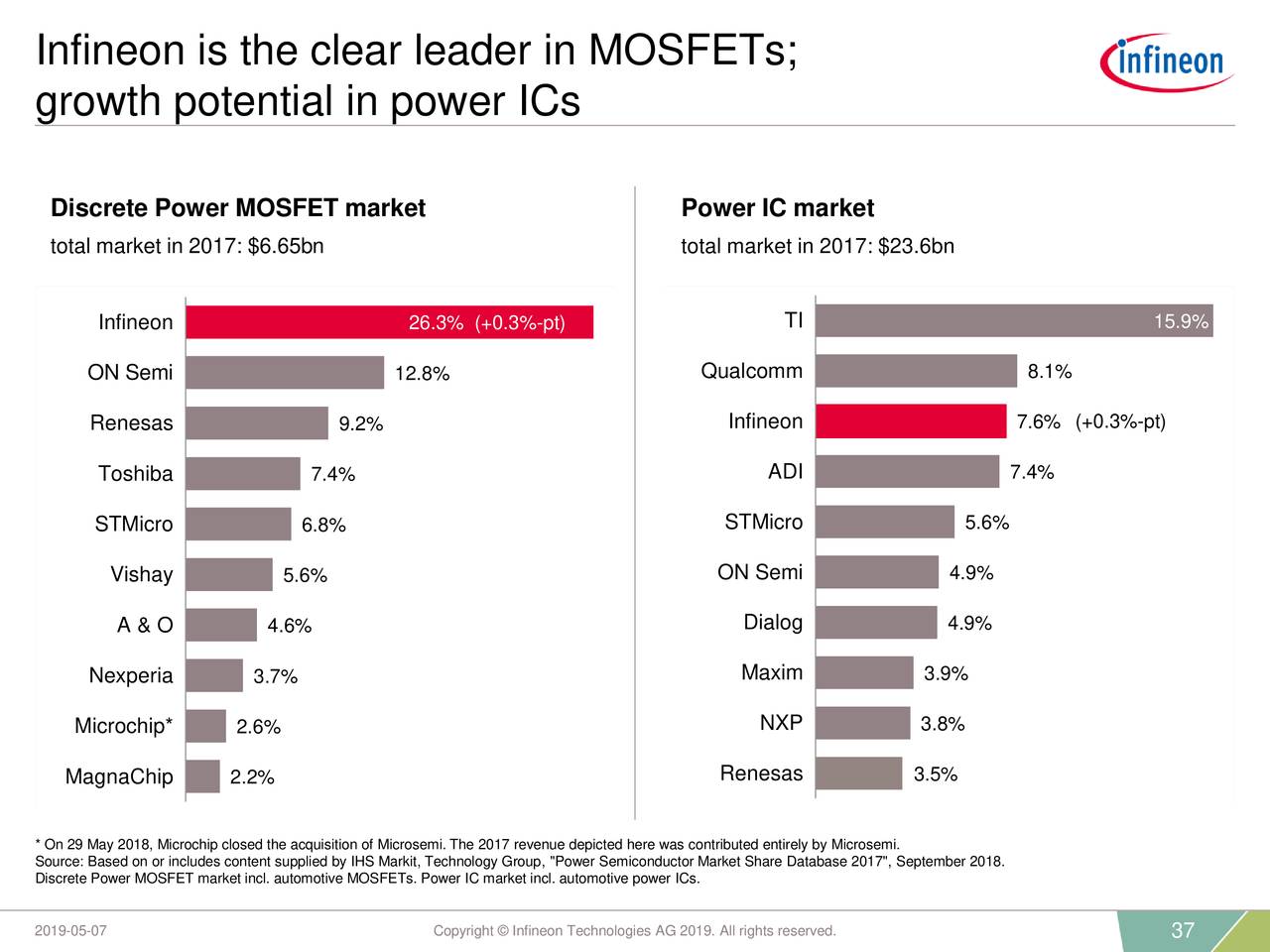

Infineon has consistently demonstrated strong financial performance, driven by robust demand across its key markets. In recent years, the company has experienced significant revenue growth, fueled by the increasing adoption of semiconductors in diverse applications. Infineon’s market position is strong, with a leading share in several key semiconductor segments.

The company benefits from its global reach, extensive product portfolio, and technological expertise.

Strategic Focus and Key Growth Drivers

Infineon’s strategic focus is on driving innovation and expanding its presence in high-growth markets, particularly in areas like electrification, automation, and connectivity. The company is actively investing in research and development to develop cutting-edge semiconductor technologies and solutions. Infineon’s key growth drivers include:

- Electrification:The increasing adoption of electric vehicles and hybrid electric vehicles (HEVs) presents a significant opportunity for Infineon’s power management and automotive semiconductor solutions.

- Automation:The growing trend of automation in industries such as manufacturing, logistics, and agriculture is driving demand for Infineon’s industrial semiconductor solutions.

- Connectivity:The proliferation of connected devices and the expansion of 5G networks are creating opportunities for Infineon’s communication semiconductor solutions.

- Artificial Intelligence (AI):AI is transforming various industries, and Infineon is leveraging its expertise in semiconductor technology to develop AI-enabled solutions.

Morgan Stanley’s Price Target Cut

Morgan Stanley’s decision to lower Infineon’s price target reflects a cautious outlook on the company’s near-term prospects, driven by several key factors. The investment bank’s move underscores the complexities of the semiconductor industry, where cyclical trends, geopolitical tensions, and evolving demand patterns can significantly impact valuations.

Factors Contributing to the Price Target Adjustment, Morgan Stanley cuts Infineon price target; maintains “overweight” rating

The price target adjustment reflects Morgan Stanley’s assessment of the following factors:

- Weakening Demand:The global semiconductor market is experiencing a slowdown in demand, particularly in the automotive and industrial sectors. This is attributed to a combination of factors, including rising inflation, supply chain disruptions, and a potential economic recession.

- Increased Competition:Infineon faces intense competition from other semiconductor manufacturers, particularly in its core markets of automotive and industrial applications. This competitive landscape can put pressure on pricing and profitability.

- Geopolitical Risks:The ongoing geopolitical tensions, particularly the Russia-Ukraine war, are creating uncertainty and volatility in the global economy. These tensions can disrupt supply chains, impact demand, and create challenges for businesses operating in the semiconductor industry.

- Inventory Adjustments:Semiconductor companies are adjusting their inventory levels in response to the weakening demand. This could lead to a short-term decline in revenue and earnings as companies reduce production and sell off excess inventory.

Comparison of the New and Previous Price Targets

Morgan Stanley’s new price target represents a significant decrease from the previous target. This adjustment reflects the investment bank’s belief that Infineon’s stock is likely to experience downward pressure in the near term due to the factors mentioned above.

The new price target reflects a more conservative outlook on Infineon’s near-term performance, taking into account the challenging macro environment and the company’s exposure to cyclical industries.

Maintaining “Overweight” Rating

Despite the price target cut, Morgan Stanley maintained its “overweight” rating for Infineon Technologies. This decision reflects the firm’s belief in the company’s long-term growth prospects, even with the current market challenges.

Factors Supporting “Overweight” Rating

Morgan Stanley’s decision to maintain the “overweight” rating is based on several factors that suggest a positive outlook for Infineon despite the price target reduction.

- Strong Position in Growing Markets:Infineon operates in several high-growth markets, such as automotive, industrial automation, and data centers. These markets are expected to experience significant growth in the coming years, driving demand for Infineon’s products.

- Technological Leadership:Infineon is a leader in key semiconductor technologies, including power management, sensors, and microcontrollers. Its technological advancements and innovation capabilities position it to capitalize on emerging trends and maintain its market share.

- Strategic Partnerships:Infineon has established strong partnerships with major players in its target markets. These partnerships provide access to new opportunities and enhance its competitive advantage.

- Long-Term Growth Potential:Despite short-term challenges, Infineon’s long-term growth prospects remain strong. The company is well-positioned to benefit from the increasing demand for semiconductors driven by digitalization and the Internet of Things (IoT).

Implications for Investors

Maintaining the “overweight” rating despite the price target cut suggests that Morgan Stanley believes Infineon remains a compelling investment opportunity for investors.

- Potential for Upside:The “overweight” rating indicates that Morgan Stanley expects Infineon’s share price to outperform the market in the long term.

- Growth Opportunities:Investors seeking exposure to high-growth markets and semiconductor technology advancements may find Infineon an attractive investment option.

- Long-Term Perspective:The “overweight” rating emphasizes the importance of taking a long-term view on Infineon’s prospects, considering its strong position in growing markets and technological leadership.

Market Impact and Investor Sentiment

The price target cut and the maintenance of the “overweight” rating by Morgan Stanley sent mixed signals to the market, prompting a complex reaction from investors. While the lowered price target might have initially discouraged some investors, the continued “overweight” rating reassured others about the company’s long-term prospects.

Impact on Stock Price

The immediate impact on Infineon’s stock price was a slight decline, reflecting the market’s initial reaction to the lowered price target. However, the stock quickly recovered, demonstrating that the “overweight” rating, which signifies a positive outlook on the company’s future performance, outweighed the negative sentiment associated with the price target reduction.

This dynamic reflects the complex nature of investor sentiment, where various factors, such as price targets and ratings, are considered simultaneously.

Market Reaction

The news was met with a mix of reactions from analysts and investors. Some analysts interpreted the price target cut as a sign of caution, highlighting potential challenges in the semiconductor industry. Others, however, emphasized the continued “overweight” rating, highlighting the long-term growth potential of Infineon, particularly in the automotive and industrial sectors.

This mixed reaction reflects the broader uncertainty in the semiconductor market, where factors such as supply chain disruptions, geopolitical tensions, and economic headwinds continue to influence investor sentiment.

Impact on Investor Sentiment and Trading Activity

The price target cut and the “overweight” rating likely had a mixed impact on investor sentiment. Some investors may have become more cautious, potentially reducing their holdings or even selling their shares. However, the “overweight” rating reassured others about the company’s long-term prospects, potentially leading to increased investment or holding onto existing shares.

The overall impact on trading activity is difficult to assess, as it is influenced by a multitude of factors, including the broader market sentiment and the specific investment strategies of individual investors.

Examine how Blue Foundry Bancorp executive acquires $11k in stock can boost performance in your area.

Future Outlook and Key Considerations

Infineon’s future trajectory hinges on a complex interplay of global macroeconomic trends, technological advancements, and evolving market dynamics. While the company enjoys a strong position in the semiconductor industry, several factors could significantly impact its performance.

Key Factors Influencing Future Performance

The following factors will significantly influence Infineon’s future performance:

- Global Economic Growth:Infineon’s success is closely tied to the overall health of the global economy. A robust economic environment, characterized by strong industrial production and consumer spending, typically translates into increased demand for semiconductors, benefiting Infineon. Conversely, a recessionary environment could dampen demand, impacting Infineon’s revenue and profitability.

- Technological Advancements:The rapid pace of technological innovation, particularly in areas like automotive, industrial automation, and data centers, presents both opportunities and challenges for Infineon. The company needs to continuously invest in research and development to maintain its technological edge and capitalize on emerging trends.

- Supply Chain Dynamics:The global semiconductor industry faces ongoing supply chain challenges, including component shortages and geopolitical tensions. Infineon’s ability to navigate these complexities, ensure stable supply chains, and manage costs effectively will be crucial for its long-term success.

- Competition:The semiconductor industry is fiercely competitive, with established players and emerging startups vying for market share. Infineon must continually innovate, differentiate its products and services, and build strong customer relationships to maintain its competitive edge.

Potential Risks and Opportunities

Infineon faces both risks and opportunities in its future growth:

- Geopolitical Risks:The ongoing trade tensions between the United States and China, along with other geopolitical uncertainties, could disrupt Infineon’s global operations and supply chains.

- Cybersecurity Threats:The increasing sophistication of cybersecurity threats poses a significant risk to Infineon and its customers, particularly in critical infrastructure and automotive applications.

- Emerging Technologies:The rapid development of new technologies, such as artificial intelligence (AI) and quantum computing, could disrupt Infineon’s existing markets and create new opportunities.

- Talent Acquisition:Attracting and retaining skilled engineers and technical personnel is critical for Infineon’s innovation and growth. The company faces competition from other tech giants for top talent.

Key Takeaways and Insights

The recent price target cut by Morgan Stanley highlights the ongoing challenges facing Infineon. While the “overweight” rating reflects a positive long-term outlook, the company’s future performance will depend on its ability to navigate a complex and evolving market landscape.

End of Discussion

The decision by Morgan Stanley to lower Infineon’s price target while maintaining an “overweight” rating reflects the delicate balance between short-term challenges and long-term opportunities in the semiconductor industry. While the market may be experiencing some near-term headwinds, Infineon’s strategic positioning and commitment to innovation suggest that the company is well-equipped to navigate these challenges and emerge stronger in the long run.

The move by Morgan Stanley highlights the importance of considering both the immediate market dynamics and the long-term growth potential when evaluating investment opportunities in the technology sector.

Detailed FAQs

What are the key factors that led to Morgan Stanley’s decision to lower Infineon’s price target?

Morgan Stanley’s decision to lower Infineon’s price target was likely driven by a combination of factors, including concerns about near-term economic headwinds, the potential impact of slowing global demand on semiconductor sales, and the ongoing challenges in the supply chain.

However, it’s important to note that the investment bank remains bullish on Infineon’s long-term prospects.

What are the implications of Morgan Stanley maintaining its “overweight” rating despite the price target cut?

The “overweight” rating indicates that Morgan Stanley believes Infineon is likely to outperform its peers in the long term, even though the near-term outlook may be challenging. This suggests that the investment bank sees value in Infineon’s strategic focus on key growth areas and its ability to navigate the current market environment.

How did the market react to Morgan Stanley’s announcement?

The market reaction to Morgan Stanley’s announcement was mixed. While the price target cut may have initially caused some downward pressure on Infineon’s stock price, the maintenance of the “overweight” rating suggests that investors remain optimistic about the company’s long-term potential.

CentralPoint Latest News

CentralPoint Latest News