Stay long on the yen amid rate hikes, improving growth- BCA, a bold statement from a prominent financial institution, ignites a conversation about the Japanese yen’s future. This outlook challenges the conventional wisdom surrounding the yen’s recent weakness, suggesting a potential shift in the market’s perception.

As the world navigates a complex landscape of rising interest rates and evolving economic conditions, BCA’s perspective offers a fresh lens through which to analyze the yen’s trajectory.

BCA’s analysis delves into the intricate interplay of factors driving the yen’s current performance. They highlight the significance of interest rate differentials between Japan and other major economies, particularly the United States. The Federal Reserve’s aggressive rate hikes have strengthened the dollar, putting downward pressure on the yen.

However, BCA’s analysis goes beyond this simple correlation, emphasizing the importance of Japan’s improving economic growth prospects. With a robust domestic economy, Japan is positioned to withstand external pressures, potentially driving the yen’s appreciation.

The Yen’s Current State

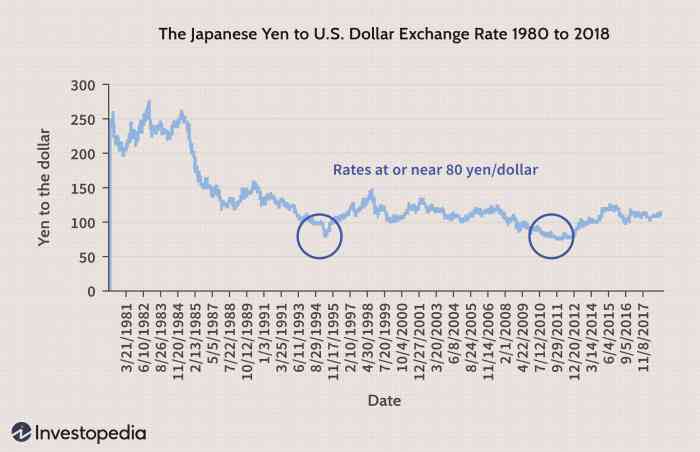

The Japanese yen has been on a roller coaster ride in recent months, experiencing significant fluctuations against other major currencies. Its trajectory is a complex interplay of interest rate differentials, economic growth prospects, and global market sentiment.

Interest Rate Differentials and Economic Growth Prospects

The yen’s recent weakness is largely attributed to the widening interest rate differential between Japan and other major economies. The Bank of Japan (BOJ) has maintained its ultra-loose monetary policy, keeping interest rates near zero, while central banks in the United States, Europe, and the United Kingdom have aggressively raised rates to combat inflation.

This divergence in monetary policies has made the yen less attractive to investors seeking higher returns.Furthermore, Japan’s economic growth prospects have been relatively subdued compared to other developed nations. The country’s aging population and slow productivity growth have hampered its economic recovery.

This has led to a weakening of investor confidence in the yen, as they anticipate slower economic growth and potentially lower returns on investments in Japan.

Economic Data and Indicators for Japan

Recent economic data for Japan paints a mixed picture. Inflation has been steadily rising, reaching 3.8% in April 2023, the highest level in over four decades. However, core inflation, which excludes volatile food and energy prices, remains below the BOJ’s 2% target.

Japan’s GDP grew by 0.6% in the first quarter of 2023, indicating a moderate recovery. The unemployment rate remains low at 2.5%, reflecting a tight labor market.

BCA’s View on the Yen

BCA, a prominent financial institution, has adopted a bullish stance on the Japanese yen, recommending a “long” position. This optimistic outlook is driven by their analysis of the Japanese economy and the Bank of Japan’s (BOJ) monetary policy.

BCA’s Rationale for a Long Yen Position

BCA’s bullish stance on the yen is rooted in their assessment of the Japanese economy’s resilience and the potential for a shift in the BOJ’s monetary policy. BCA believes that the Japanese economy is poised for a period of sustained growth, driven by robust domestic demand and a recovery in global trade.

This growth, coupled with a potential shift towards a more hawkish stance by the BOJ, is expected to strengthen the yen.

Alignment with Market Sentiment

BCA’s view on the yen aligns with a growing consensus among market participants who anticipate a potential shift in the BOJ’s ultra-loose monetary policy. The BOJ has been maintaining a dovish stance for an extended period, keeping interest rates at historically low levels to stimulate economic growth.

However, rising inflation and growing pressure from global central banks to tighten monetary policy are creating a shift in sentiment. Many analysts believe that the BOJ may be forced to reconsider its current stance, leading to a potential appreciation of the yen.

Comparison with Other Analysts

BCA’s bullish view on the yen is shared by several other prominent analysts and institutions. For example, Goldman Sachs has also recently raised its forecast for the yen, citing the potential for a shift in the BOJ’s monetary policy. Similarly, Morgan Stanley has expressed optimism about the yen’s prospects, anticipating a gradual appreciation driven by improving economic fundamentals.

Impact of Rate Hikes

The Federal Reserve’s aggressive rate hikes pose a significant challenge for the yen, as they widen the interest rate differential between Japan and the US. This differential makes US assets more attractive to investors, potentially leading to capital outflows from Japan and putting downward pressure on the yen.

Impact on Capital Flows

Rate hikes influence capital flows by making US assets more appealing to investors seeking higher returns. When US interest rates rise, investors are incentivized to move their capital from Japan to the US to take advantage of the higher returns.

This outflow of capital weakens the yen as demand for the US dollar increases.

Consequences for the Japanese Economy

Rate hikes can have a mixed impact on the Japanese economy. While a stronger dollar can make Japanese exports more competitive, it also increases the cost of imported goods, potentially leading to inflation. Moreover, the yen’s depreciation can make it more expensive for Japanese companies to service their foreign debt.

Growth Prospects for Japan

Japan’s economic growth has been a subject of much discussion, with the country facing a unique set of challenges and opportunities. While Japan has a history of robust economic performance, recent years have seen slower growth, prompting questions about the country’s future trajectory.

This section explores the key drivers of economic growth in Japan, analyzes the outlook for growth in the short and medium term, and compares Japan’s growth prospects with other major economies.

Drivers of Economic Growth

The Japanese economy is driven by a combination of factors, including government policies, corporate investment, and consumer spending. Government policies play a significant role in shaping the economic landscape, with initiatives aimed at stimulating growth and addressing structural challenges.

- Government policies: Japan’s government has implemented a range of policies aimed at boosting economic growth, including fiscal stimulus measures, monetary easing, and structural reforms. These policies have had varying degrees of success, but they remain a crucial element in shaping the country’s economic trajectory.

- Corporate investment: Corporate investment is another key driver of economic growth in Japan. Japanese companies are known for their technological prowess and innovation, and their investment in research and development, new technologies, and expansion into new markets can significantly contribute to growth.

- Consumer spending: Consumer spending accounts for a significant portion of Japan’s GDP. While household spending has been relatively subdued in recent years, it remains a crucial factor in driving economic growth. Factors influencing consumer spending include disposable income, confidence levels, and the availability of credit.

Outlook for Japan’s Economic Growth, Stay long on the yen amid rate hikes, improving growth- BCA

The outlook for Japan’s economic growth is subject to a number of uncertainties, including global economic conditions, domestic policy changes, and potential risks.

- Global economic conditions: The global economic environment has a significant impact on Japan’s growth prospects. A slowdown in global growth or a decline in global trade could negatively impact Japanese exports and economic activity. Conversely, strong global growth can provide a boost to the Japanese economy.

- Domestic policy changes: Government policies, such as fiscal and monetary measures, can have a significant impact on economic growth. Changes in policy direction or the implementation of new reforms can influence business confidence, investment, and consumer spending.

- Potential risks: Japan faces a number of potential risks that could impact its economic growth, including geopolitical instability, natural disasters, and demographic challenges. These risks can create uncertainty and volatility in the economy, making it difficult to predict future growth trajectories.

Comparison with Other Major Economies

When comparing Japan’s growth prospects with other major economies, it’s essential to consider the country’s unique characteristics and challenges.

- Relative advantages: Japan boasts a highly skilled workforce, advanced technological capabilities, and a strong manufacturing base. These strengths can provide a competitive edge in the global economy, particularly in industries like automotive, electronics, and robotics.

- Relative disadvantages: Japan faces a number of challenges, including an aging population, low birth rates, and high levels of government debt. These factors can constrain economic growth and present challenges for future development.

Risks and Opportunities: Stay Long On The Yen Amid Rate Hikes, Improving Growth- BCA

While the yen’s current trajectory appears promising, it’s crucial to acknowledge the inherent risks and opportunities associated with holding a long position. Understanding these factors is essential for investors to make informed decisions and manage their exposure effectively.

Potential Risks

The yen’s potential appreciation, driven by factors like rate hikes and economic growth, is not without its share of risks. Investors should be aware of these potential headwinds:

- Geopolitical Tensions:Escalating geopolitical tensions, particularly in the Asia-Pacific region, can negatively impact investor sentiment towards the yen. The yen often acts as a safe-haven currency during periods of uncertainty, but prolonged tensions could erode this demand and weaken the yen’s value.

For instance, the ongoing conflict in Ukraine has led to increased volatility in global markets, potentially impacting the yen’s performance.

- Global Economic Slowdown:A global economic slowdown could dampen demand for Japanese exports and hinder the country’s growth prospects. This could weaken the yen as investors seek safer havens in other currencies. The recent slowdown in global growth, fueled by rising inflation and supply chain disruptions, has already impacted the yen’s performance.

- Shifts in Monetary Policy:The Bank of Japan’s (BOJ) monetary policy stance can significantly impact the yen’s value. While the BOJ has recently shifted towards a more hawkish approach, a sudden reversal or unexpected policy change could lead to yen depreciation. For example, a faster-than-expected tightening of monetary policy by the Federal Reserve could weaken the yen against the US dollar.

Discover more by delving into Horizon Kinetics executives purchase Texas Pacific Land shares worth over $10,000 further.

Potential Opportunities

Despite the risks, a long yen position presents several potential opportunities for investors:

- Appreciation Gains:The yen’s potential appreciation, driven by factors like rate hikes and economic growth, could generate significant returns for investors holding a long position. Historical data suggests that the yen has historically appreciated against other major currencies during periods of economic expansion and rising interest rates.

- Safe-Haven Asset:The yen is widely regarded as a safe-haven asset, particularly during periods of global uncertainty. This safe-haven status can lead to increased demand for the yen, boosting its value. During periods of market volatility, investors often flock to the yen, seeking its perceived stability and resilience.

Risk and Opportunity Comparison

| Factor | Risk | Opportunity |

|---|---|---|

| Geopolitical Tensions | Escalating tensions could weaken the yen as investors seek safer havens. | Increased demand for the yen as a safe-haven asset during periods of uncertainty. |

| Global Economic Slowdown | A slowdown could dampen demand for Japanese exports and weaken the yen. | The yen’s resilience as a safe-haven asset could attract investors during economic downturns. |

| Shifts in Monetary Policy | Unexpected policy changes by the BOJ could lead to yen depreciation. | The BOJ’s recent shift towards a more hawkish approach could support the yen’s value. |

Closing Notes

BCA’s bullish outlook on the yen stands out in a market where pessimism prevails. Their analysis, rooted in a deep understanding of Japan’s economic fundamentals and the global macroeconomic landscape, provides a compelling argument for a long position on the yen.

While risks exist, BCA emphasizes the potential for appreciation gains, especially as Japan’s economic growth strengthens and the yen benefits from its status as a safe-haven asset. This optimistic perspective challenges investors to re-evaluate their assumptions about the yen’s future, potentially unlocking opportunities for those willing to navigate the complexities of the global currency markets.

Popular Questions

What is BCA’s main argument for staying long on the yen?

BCA believes that the yen is undervalued due to the improving economic growth prospects in Japan and the potential for the yen to benefit from its safe-haven status.

How does BCA’s view differ from the prevailing market sentiment?

BCA’s optimistic outlook on the yen contrasts with the prevailing market sentiment, which has been bearish on the yen due to its recent weakness.

What are the potential risks associated with holding a long position on the yen?

Potential risks include geopolitical tensions, a global economic slowdown, and shifts in monetary policy.

What are the potential opportunities for investors who hold a long position on the yen?

Opportunities include potential appreciation gains and the yen’s role as a safe-haven asset.

CentralPoint Latest News

CentralPoint Latest News