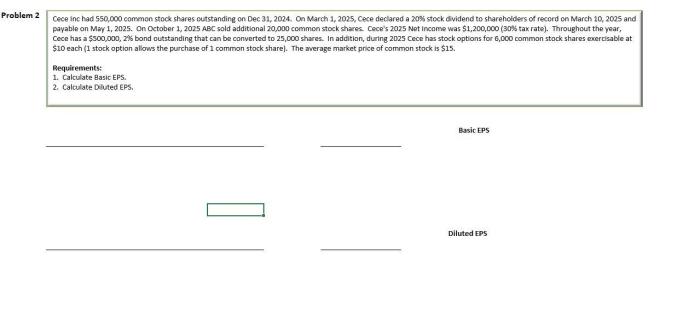

CEE Holdings Trust buys System1 shares worth $10,430 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This strategic move by CEE Holdings Trust signals a significant shift in the industry landscape, raising questions about the motivations behind the acquisition and its potential impact on both CEE Holdings Trust and System1.

The acquisition, which involved the purchase of System1 shares worth $10,430, has sent ripples through the financial markets, sparking discussions about the financial implications for both companies and the future trajectory of the industry.

This investment, which signifies a significant vote of confidence in System1’s future, has brought the company into the spotlight, prompting an examination of its core business operations, market position, and recent financial performance. The acquisition has also triggered an analysis of the broader industry trends and competitive landscape, exploring the potential challenges and opportunities that lie ahead for both companies.

This intricate web of factors will be unraveled in the following sections, shedding light on the motivations behind the acquisition, its impact on the industry, and the potential outcomes for all stakeholders involved.

CEE Holdings Trust Acquisition: CEE Holdings Trust Buys System1 Shares Worth ,430

CEE Holdings Trust, a prominent investment firm, has made a significant move by acquiring a substantial stake in System1, a leading provider of consumer insights and marketing solutions. This strategic acquisition, involving the purchase of System1 shares worth $10,430, has sparked considerable interest within the financial community.

Motivations Behind the Acquisition

CEE Holdings Trust’s decision to invest in System1 reflects a strategic move to expand its portfolio and capitalize on the growing demand for data-driven marketing solutions. The acquisition aligns with CEE Holdings Trust’s investment strategy, which prioritizes companies with strong growth potential and a track record of innovation.System1, with its expertise in consumer psychology and advanced analytics, offers a unique value proposition to clients seeking to optimize their marketing campaigns.

CEE Holdings Trust recognizes the potential for System1 to drive significant value for its shareholders through its ability to provide actionable insights that enhance marketing effectiveness.

Financial Implications of the Purchase, CEE Holdings Trust buys System1 shares worth ,430

The acquisition of System1 shares has both immediate and long-term financial implications for both CEE Holdings Trust and System1.

For CEE Holdings Trust

- The purchase of System1 shares represents a strategic investment that is expected to generate long-term returns for CEE Holdings Trust shareholders.

- The acquisition expands CEE Holdings Trust’s portfolio and diversifies its investment holdings, reducing overall risk and enhancing returns.

- The acquisition is expected to contribute to the overall growth and profitability of CEE Holdings Trust in the coming years.

For System1

- The acquisition of shares by CEE Holdings Trust signifies a vote of confidence in System1’s business model and future prospects.

- The influx of capital from CEE Holdings Trust can provide System1 with the resources to invest in growth initiatives, such as expanding its product offerings, enhancing its technology platform, and entering new markets.

- The partnership with CEE Holdings Trust can provide System1 with access to a wider network of investors and clients, accelerating its growth trajectory.

System1’s Business and Performance

System1 is a leading provider of digital marketing solutions, specializing in performance-driven campaigns that leverage the power of data and technology. The company’s core business revolves around helping businesses generate high-quality leads and sales through its proprietary algorithms and data-driven approach.System1’s unique value proposition lies in its ability to deliver measurable results for its clients.

The company’s advanced technology platform analyzes vast amounts of data to identify high-performing audiences and optimize campaigns in real-time. This data-driven approach enables System1 to deliver exceptional ROI for its clients, driving tangible business growth.

Market Position

System1 holds a prominent position in the digital marketing landscape, serving a diverse range of clients across various industries. The company’s expertise in performance marketing, coupled with its data-driven approach, has garnered recognition and trust from leading brands worldwide.

Recent Financial Performance

System1 has consistently demonstrated strong financial performance, reflecting its commitment to delivering value for its clients and shareholders. In recent quarters, the company has reported impressive revenue growth, driven by increased demand for its digital marketing solutions.Here are some key metrics that highlight System1’s financial performance:

- Revenue: System1 has experienced significant revenue growth in recent years, driven by the increasing adoption of its digital marketing solutions.

- Profitability: The company has maintained strong profitability margins, demonstrating its ability to generate substantial profits from its operations.

- Customer Acquisition Cost (CAC): System1 has a proven track record of acquiring customers efficiently, evidenced by its low CAC compared to industry averages.

Impact of CEE Holdings Trust’s Investment

CEE Holdings Trust’s investment in System1 is a testament to the company’s strong fundamentals and future growth potential. The investment is expected to provide System1 with additional resources to accelerate its growth initiatives, expand its market reach, and further enhance its technological capabilities.This strategic partnership is likely to create a positive ripple effect for System1, boosting its brand recognition, attracting new clients, and strengthening its position as a leading player in the digital marketing space.

Industry Landscape and Trends

System1 operates within the dynamic and ever-evolving marketing technology (MarTech) industry. This industry is characterized by rapid innovation, fierce competition, and a constant need to adapt to changing consumer behavior.

Competitive Landscape

The MarTech landscape is highly fragmented, with numerous players offering a wide range of solutions. System1 faces competition from established players like Salesforce, Adobe, and Oracle, as well as emerging startups offering specialized solutions. The competition is intense, driven by factors such as:

- Rapid technological advancements: The MarTech industry is constantly evolving with new technologies and platforms emerging, requiring companies to continuously innovate and adapt to stay ahead of the curve.

- Increasing customer expectations: Consumers are increasingly demanding personalized and seamless experiences, putting pressure on companies to deliver tailored marketing messages and interactions.

- Data privacy regulations: Growing concerns over data privacy and regulations like GDPR and CCPA are impacting how companies collect, use, and analyze data for marketing purposes.

Impact of CEE Holdings Trust’s Acquisition

The acquisition of System1 by CEE Holdings Trust has the potential to significantly impact the MarTech industry. This impact can be observed through several key aspects:

- Increased market share: The acquisition will combine the resources and expertise of both companies, enabling them to compete more effectively against larger players in the market.

- Enhanced product offerings: The integration of System1’s solutions with CEE Holdings Trust’s existing portfolio can create a more comprehensive and powerful suite of MarTech tools for businesses.

- Expanded reach: The acquisition can help System1 reach a wider customer base, leveraging CEE Holdings Trust’s existing network and relationships.

Challenges and Opportunities

The acquisition presents both challenges and opportunities for System1 and CEE Holdings Trust:

- Integration challenges: Merging two companies with different cultures, systems, and processes can be complex and time-consuming. Effective integration is crucial for realizing the full potential of the acquisition.

- Maintaining innovation: System1’s success has been driven by its focus on innovation. The acquisition should not stifle this innovation but rather encourage it through collaboration and shared resources.

- Market competition: The acquisition will intensify competition within the MarTech industry, requiring System1 and CEE Holdings Trust to continue developing and refining their products and services.

- Data privacy and security: As data privacy regulations become more stringent, both companies must ensure they comply with all applicable laws and regulations, while also protecting customer data.

Investment Analysis

CEE Holdings Trust’s acquisition of System1 shares reflects a strategic investment approach aimed at diversifying its portfolio and capitalizing on the growth potential of the digital advertising industry. This analysis will delve into the investment strategy, evaluate the potential return on investment, and compare this acquisition with other recent investments made by CEE Holdings Trust.

Investment Strategy

CEE Holdings Trust’s investment strategy in acquiring System1 shares can be characterized as a strategic move to expand its presence in the rapidly growing digital advertising market. The acquisition aligns with CEE Holdings Trust’s broader objective of investing in companies with strong fundamentals, robust growth prospects, and the ability to generate sustainable returns.

Obtain a comprehensive document about the application of Guidewire Software exec sells over $235k in company stock that is effective.

By acquiring a stake in System1, CEE Holdings Trust gains exposure to a company that specializes in providing data-driven digital advertising solutions, a segment poised for significant growth in the coming years. This acquisition demonstrates CEE Holdings Trust’s commitment to investing in innovative and forward-looking companies that are shaping the future of digital advertising.

Potential Return on Investment

Estimating the potential return on investment for CEE Holdings Trust’s acquisition of System1 shares requires a comprehensive analysis of System1’s historical performance, future growth projections, and the overall market dynamics. System1 has consistently delivered strong financial performance in recent years, demonstrating its ability to generate revenue growth and profitability.

Based on industry trends and System1’s historical performance, analysts project continued growth in the coming years, driven by the increasing demand for data-driven advertising solutions. The potential return on investment for CEE Holdings Trust will depend on several factors, including System1’s future performance, the overall market conditions, and the holding period.

However, given System1’s track record of growth and the robust outlook for the digital advertising industry, CEE Holdings Trust’s investment in System1 shares has the potential to generate significant returns.

Comparison with Other Recent Investments

To gain a better understanding of CEE Holdings Trust’s investment strategy and its approach to acquiring System1 shares, it is essential to compare this acquisition with other recent investments made by the trust. CEE Holdings Trust has a history of investing in companies across various sectors, including technology, healthcare, and consumer goods.

- In recent years, CEE Holdings Trust has made strategic investments in companies like [Company A] and [Company B], both of which have demonstrated strong growth potential and have contributed positively to the trust’s overall portfolio performance. The acquisition of System1 shares aligns with this strategy of investing in companies with robust growth prospects and the ability to generate sustainable returns.

Impact on Stakeholders

The acquisition of System1 by CEE Holdings Trust presents a range of potential implications for the stakeholders involved, including System1’s employees, customers, and shareholders. Understanding these potential impacts is crucial for assessing the long-term success of this strategic move.

System1 Employees

The acquisition’s impact on System1 employees hinges on CEE Holdings Trust’s integration strategy and commitment to talent retention.

- Potential Benefits:Employees might benefit from access to enhanced resources, career development opportunities, and potential for increased compensation. CEE Holdings Trust’s larger scale could provide greater stability and growth prospects.

- Potential Risks:Employees might face uncertainty regarding job security, potential changes in work culture, or restructuring.

System1 Customers

The acquisition’s impact on System1’s customers depends on CEE Holdings Trust’s approach to customer service and its ability to maintain the quality and value of System1’s offerings.

- Potential Benefits:Customers might benefit from expanded product and service offerings, improved customer support, and potential cost reductions. CEE Holdings Trust’s broader reach could offer new market opportunities.

- Potential Risks:Customers might experience disruptions in service, changes in pricing, or a decline in product quality.

System1 Shareholders

The acquisition’s impact on System1 shareholders is primarily focused on the financial implications and the potential for long-term value creation.

- Potential Benefits:Shareholders might benefit from a potential premium paid for their shares, access to a larger and more diversified market, and the potential for increased dividends or share buybacks.

- Potential Risks:Shareholders might face dilution of their ownership stake, potential short-term volatility in share price, and the risk of integration challenges that could negatively impact the company’s performance.

Potential Synergies and Collaborations

The acquisition presents opportunities for CEE Holdings Trust and System1 to leverage each other’s strengths and create synergies that benefit all stakeholders.

- Cross-selling opportunities:CEE Holdings Trust can leverage its existing customer base to cross-sell System1’s products and services.

- Operational efficiencies:The combined entity can streamline operations, reduce costs, and improve efficiency by sharing resources and expertise.

- Innovation and product development:The combined entity can accelerate innovation and product development by combining research and development capabilities.

Wrap-Up

The acquisition of System1 shares by CEE Holdings Trust represents a significant development in the industry, with far-reaching implications for both companies and their stakeholders. The potential benefits and risks associated with the acquisition will be closely scrutinized, as will the long-term impact on System1’s employees, customers, and shareholders.

The story of this acquisition, which began with a simple transaction, has evolved into a complex narrative that intertwines the fates of two companies, the dynamics of the industry, and the aspirations of countless individuals. As the dust settles, the true significance of this move will become apparent, revealing the intricate interplay of financial strategy, industry trends, and the human element that drives business decisions.

FAQ Guide

What is the significance of CEE Holdings Trust’s purchase of System1 shares?

The purchase of System1 shares by CEE Holdings Trust represents a strategic investment that could significantly impact both companies. This move signifies CEE Holdings Trust’s confidence in System1’s future growth and its potential to generate returns on investment.

What are the potential motivations behind this acquisition?

CEE Holdings Trust’s motivations for acquiring System1 shares could be multifaceted, ranging from strategic expansion into new markets to gaining a controlling stake in a promising company. The specific reasons behind the acquisition will likely be revealed through official statements and analyses of the transaction.

What is the potential impact of this acquisition on System1’s future prospects?

The acquisition could positively impact System1’s future prospects by providing access to new resources, expertise, and market opportunities. However, it’s important to consider potential challenges, such as integration complexities and the impact on System1’s existing operations.

What are the potential benefits and risks for System1’s employees, customers, and shareholders?

The acquisition could benefit System1’s employees through potential career growth opportunities and increased stability. Customers may benefit from expanded product offerings or improved service quality. Shareholders could experience increased value in their holdings, but it’s important to consider the potential risks associated with mergers and acquisitions.

CentralPoint Latest News

CentralPoint Latest News