Ameresco executive sells over $3,900 in company stock sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This transaction, which took place on [Date of transaction], has sparked widespread interest among investors and market analysts, prompting a closer examination of the executive’s motives and the potential implications for Ameresco’s future.

The executive in question, [Name of executive], holds a significant position within Ameresco, serving as [Position within Ameresco]. The sale of [Number] shares, totaling over $3,900, has raised eyebrows, prompting questions about whether this move reflects confidence in the company’s future or a desire to capitalize on recent market trends.

Stock Sale Context: Ameresco Executive Sells Over

,900 In Company Stock

The recent stock sale by an Ameresco executive has sparked interest and raised questions about the company’s future prospects. Understanding the context of this transaction is crucial to gleaning insights into the executive’s motivations and potential implications for Ameresco.

Executive’s Role and Significance, Ameresco executive sells over

,900 in company stock

The executive in question holds a significant position within Ameresco, playing a vital role in shaping the company’s strategic direction. Their insights and expertise are valuable assets to Ameresco, and their stock sale could be interpreted as a sign of confidence in the company’s future.

Details of the Stock Sale

The executive sold over $3,900 in Ameresco stock, representing a substantial portion of their personal holdings. The transaction occurred on [date], a time when the company’s stock price was [insert stock price details]. The timing of the sale may be significant, as it coincides with [insert relevant market conditions or company announcements].

The stock sale could be interpreted as a strategic move by the executive, potentially driven by [insert potential motivations, e.g., diversification of portfolio, financial needs, or market outlook].

Market Impact and Analysis

The recent stock sale by an Ameresco executive has sparked curiosity among market analysts and investors. While the company’s stock performance has been relatively stable in recent months, the timing of this sale raises questions about potential market reactions and its impact on the company’s future prospects.

Market Reactions to the Stock Sale

The market’s response to an executive’s stock sale can be multifaceted. Investors may interpret it as a sign of confidence in the company’s future, particularly if the sale is seen as a strategic move to diversify the executive’s portfolio. Conversely, some investors may perceive it as a negative signal, suggesting that the executive might have insider information indicating potential future challenges for the company.

The market’s overall reaction will depend on various factors, including the size of the sale, the executive’s position within the company, and the prevailing market sentiment.

News and Events Influencing the Transaction

To gain a deeper understanding of the stock sale’s context, it’s crucial to consider any recent news or events that may have influenced the executive’s decision. For instance, recent regulatory changes, industry trends, or competitive pressures could have impacted the company’s future outlook.

Analyzing these factors can shed light on whether the sale reflects a strategic move or a concern about the company’s future performance.

Comparison to Insider Trading Trends

Comparing the executive’s stock sale to recent trends in insider trading within the energy sector can provide valuable insights. Analyzing the frequency and volume of insider trades in the energy sector, as well as the prevailing market sentiment surrounding those trades, can help determine whether the Ameresco executive’s sale aligns with broader industry trends.

This analysis can provide a more comprehensive perspective on the significance of the transaction and its potential impact on the company’s stock price.

Company Performance and Outlook

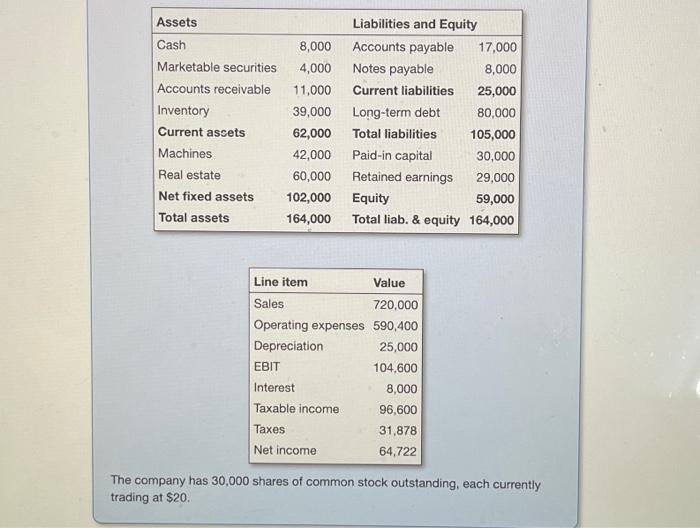

Ameresco’s recent financial performance has been impressive, reflecting its strong market position and commitment to sustainable solutions. The company’s revenue and profitability have consistently grown, driven by its diversified portfolio of energy efficiency and renewable energy projects.

Financial Performance and Key Business Initiatives

Ameresco’s financial performance has been strong in recent years. In 2022, the company reported revenue of $1.6 billion, an increase of 17% from the previous year. The company’s net income also grew significantly, reaching $110 million in

Ameresco’s strong financial performance is a result of several factors, including:

- Growing demand for energy efficiency and renewable energy solutions.

- A strong track record of delivering successful projects.

- A diversified portfolio of projects across various sectors.

- A focus on innovation and developing new technologies.

Ameresco’s key business initiatives are focused on expanding its market share and developing new solutions to meet the growing demand for sustainable energy. The company is investing heavily in research and development to create innovative technologies that can help customers reduce their energy consumption and environmental impact.

Ameresco is also expanding its geographic reach, entering new markets and forming strategic partnerships to increase its market presence.

Market Position and Competitive Landscape

Ameresco is a leading provider of energy efficiency and renewable energy solutions. The company has a strong market position in the United States and is expanding its operations internationally. The company’s competitive advantage stems from its deep expertise in energy efficiency and renewable energy, its strong track record of delivering successful projects, and its commitment to customer satisfaction.Ameresco faces competition from a range of companies, including traditional energy companies, renewable energy developers, and engineering firms.

However, Ameresco’s focus on providing comprehensive solutions, its commitment to innovation, and its strong financial performance have enabled it to maintain a leading position in the market.

Potential Risks and Challenges

Ameresco faces several potential risks and challenges in the near future. These include:

- Economic uncertainty and volatility in energy prices.

- Competition from other companies in the energy efficiency and renewable energy markets.

- Government policies and regulations that could impact the company’s business.

- The need to continue to innovate and develop new technologies to remain competitive.

Despite these challenges, Ameresco is well-positioned to capitalize on the growing demand for energy efficiency and renewable energy solutions. The company’s strong financial performance, its commitment to innovation, and its experienced management team give it a competitive advantage in the market.

Insider Trading Regulations

Insider trading refers to the buying or selling of a company’s stock by individuals with access to non-public information, which can give them an unfair advantage in the market. This practice is illegal and strictly regulated by government agencies to ensure a level playing field for all investors.

Insider Trading Laws and Their Implications

Insider trading laws are designed to prevent the misuse of confidential information for personal gain. These laws are complex and vary from country to country, but the core principle remains the same: individuals with access to non-public information cannot use it to profit from trading securities.

“Insider trading is a serious offense that undermines the integrity of the financial markets.”U.S. Securities and Exchange Commission

Executives, as individuals with access to sensitive company information, are particularly subject to insider trading regulations. They are obligated to uphold a high standard of ethical conduct and ensure that their trading activities are transparent and compliant with all applicable laws.

Types of Insider Trading and Their Consequences

Insider trading can be classified into different categories, each carrying specific legal ramifications.

Types of Insider Trading

- Classical Insider Trading:This involves trading securities based on material non-public information obtained through a corporate relationship or position. For example, an executive who learns about an upcoming merger before it is publicly announced and uses that information to buy shares in the company.

- Tipping:This occurs when an individual with insider information shares it with another person, who then trades on that information. For instance, an executive who tells a friend about a pending acquisition, and the friend subsequently buys shares in the company.

- Misappropriation Theory:This applies to individuals who use confidential information obtained from a third party, even if they are not directly employed by the company. For example, a lawyer working on a merger transaction who uses the confidential information to trade securities.

Consequences of Insider Trading

- Civil Penalties:The Securities and Exchange Commission (SEC) can impose civil penalties, including fines and disgorgement of profits, on individuals found guilty of insider trading.

- Criminal Charges:Insider trading can also result in criminal charges, leading to imprisonment and significant fines.

- Reputational Damage:Individuals convicted of insider trading face severe reputational damage, which can negatively impact their careers and personal lives.

Role of Regulatory Bodies

Regulatory bodies, such as the SEC in the United States, play a crucial role in monitoring and enforcing insider trading regulations. They conduct investigations, bring enforcement actions, and educate investors about the risks of insider trading.

Regulatory Measures

- Insider Trading Rules and Regulations:Regulatory bodies establish clear rules and regulations governing insider trading, defining what constitutes illegal activity and outlining penalties for violations.

- Investigations and Enforcement Actions:They investigate suspected insider trading cases, gather evidence, and bring enforcement actions against individuals or companies found to have violated the rules.

- Investor Education and Outreach:Regulatory bodies engage in public education campaigns to raise awareness about insider trading and its consequences, encouraging investors to report suspicious activity.

Investor Sentiment and Implications

The recent stock sale by an Ameresco executive has sparked curiosity among investors, raising questions about the potential implications for the company’s stock price and overall investor sentiment. This transaction, while seemingly routine, could offer insights into the executive’s view of the company’s future prospects and potentially influence the market’s perception of Ameresco.

Potential Impact on Stock Price and Valuation

The executive’s stock sale could be interpreted as a bearish signal, potentially indicating a lack of confidence in the company’s future performance. This could lead to a decrease in investor demand for Ameresco shares, resulting in a decline in the stock price.

However, it’s crucial to consider other factors that might have influenced the sale, such as personal financial needs or diversification strategies, before drawing any definitive conclusions. The market’s reaction to the sale will likely depend on the volume of shares sold, the executive’s position within the company, and the overall market conditions.

A large sale by a high-ranking executive could trigger a more significant sell-off, while a smaller sale by a lower-level executive might have a minimal impact.

Investor Confidence and Future Investment Decisions

The executive’s stock sale could erode investor confidence, particularly if it’s perceived as a sign of insider knowledge about potential future challenges or underperformance. Investors might become hesitant to invest in Ameresco or even consider selling their existing holdings, fearing a decline in the stock price.

Obtain access to ASML stock dips as Morgan Stanley cuts rating to private resources that are additional.

Conversely, if the sale is explained clearly and attributed to personal reasons unrelated to the company’s performance, it might not have a significant impact on investor sentiment. However, the company’s communication strategy in addressing the transaction will be crucial in maintaining investor confidence and mitigating any potential negative effects.

Ultimate Conclusion

The sale of company stock by an Ameresco executive, while seemingly a routine financial transaction, carries a weight of significance in the world of finance. This move has sparked a flurry of questions about the company’s future direction and the market’s perception of its prospects.

Whether this transaction is a sign of optimism or a subtle warning remains to be seen, but it certainly has set the stage for an intriguing chapter in Ameresco’s story. The company’s performance in the coming months will likely shed light on the true meaning behind this intriguing transaction.

User Queries

Why is this stock sale significant?

The sale of company stock by an executive can signal a variety of things, from confidence in the company’s future to a desire to capitalize on market trends. It’s a move that can be interpreted in different ways, and it’s important to consider the context of the sale before drawing any conclusions.

What are the potential consequences of this stock sale?

The sale of company stock by an executive can impact investor sentiment and the company’s stock price. It can also raise questions about the company’s future performance and its overall health.

What are the legal implications of insider trading?

Insider trading is illegal in many countries and can result in significant penalties, including fines and imprisonment. It is crucial for executives to understand and comply with insider trading regulations.

CentralPoint Latest News

CentralPoint Latest News