Intuit founder Scott Cook sells over million in company stock – Intuit founder Scott Cook selling over $50 million in company stock has sent ripples through the tech industry, prompting speculation about the future of the financial software giant. The move comes at a time when Intuit is navigating a dynamic market landscape, marked by both growth and uncertainty.

Cook’s decision to divest a significant portion of his stake raises questions about his future role within the company and the potential implications for its strategic direction.

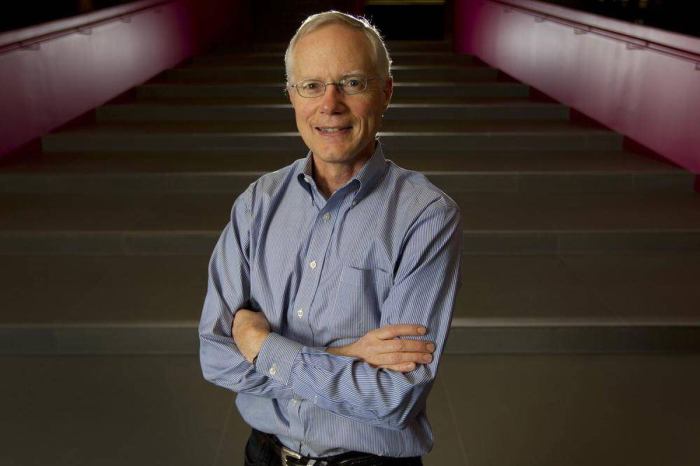

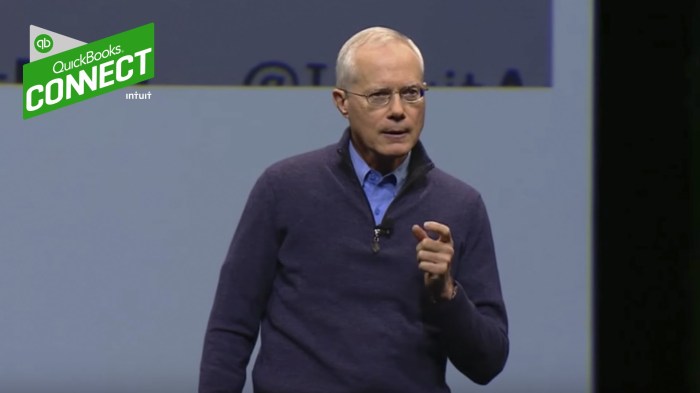

Cook, who co-founded Intuit in 1983, has been a driving force behind the company’s success, overseeing its evolution from a small startup to a global leader in financial software. Intuit’s portfolio includes popular products like TurboTax, QuickBooks, and Mint, which have become household names for millions of consumers and businesses.

This recent sale, however, signals a shift in Cook’s involvement, leaving many to wonder what the future holds for the company and its founder.

Intuit’s Stock Performance

Intuit, the leading provider of financial management software, has experienced a fluctuating stock price in recent years, reflecting the dynamic nature of the technology sector and the company’s own performance.

Recent Stock Price Trends

Intuit’s stock price has exhibited a generally upward trend over the past few years, but it has also experienced significant fluctuations, driven by various factors. The stock price surged during the COVID-19 pandemic as demand for Intuit’s products, such as TurboTax and QuickBooks, increased.

However, the stock price has since cooled off somewhat, reflecting concerns about rising inflation and the potential for a recession.

Factors Influencing Stock Price Changes

Several factors can influence Intuit’s stock price, including:

- Market Conditions:Broad market trends, such as interest rates, economic growth, and investor sentiment, play a significant role in stock prices. A strong economy typically benefits technology companies like Intuit, while a weak economy can lead to lower demand for their products and services.

For example, during the 2008 financial crisis, Intuit’s stock price declined significantly as businesses and individuals cut back on spending.

- Company Performance:Intuit’s financial performance, including revenue growth, profitability, and innovation, also impacts its stock price. When the company reports strong earnings and demonstrates continued growth, investors tend to view the stock favorably, driving up its price. Conversely, weak financial performance can lead to a decline in the stock price.

- Investor Sentiment:Investor sentiment toward Intuit can also influence its stock price. Positive news about the company, such as a new product launch or a successful acquisition, can boost investor confidence and drive up the stock price. Negative news, such as a regulatory investigation or a cybersecurity breach, can have the opposite effect.

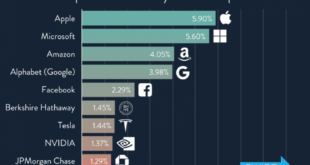

Intuit’s Market Capitalization and Position in the Technology Sector

As of [date], Intuit’s market capitalization is approximately [amount], making it one of the largest technology companies in the world. The company’s strong market position reflects its dominant share in the financial management software market, its commitment to innovation, and its ability to adapt to changing market conditions.

Scott Cook’s Role and Impact

Scott Cook, the co-founder and former CEO of Intuit, has been a driving force behind the company’s success for over four decades. His vision, leadership, and commitment to innovation have transformed Intuit from a small startup into a global technology giant.

Cook’s current position within Intuit is Executive Chairman, a role he has held since 2019. In this capacity, he provides strategic guidance and mentorship to the company’s leadership team. While he is no longer directly involved in day-to-day operations, his influence on Intuit’s direction remains significant.

Potential Implications of Stock Sale

The implications of Cook’s stock sale on his role and influence within Intuit are multifaceted. While the sale does not automatically translate into a diminished role, it could signal a shift in his priorities and involvement. There are a few potential implications to consider:* Reduced Financial Stake:Cook’s reduced financial stake might lead to a lesser emphasis on maximizing shareholder value.

Shift in Focus

The sale could indicate a desire to pursue other interests or allocate time and resources to different ventures.

Impact on Company Culture

The sale might impact Intuit’s company culture, particularly if Cook’s influence on decision-making diminishes.

Potential Reasons for Stock Sale, Intuit founder Scott Cook sells over million in company stock

Cook’s decision to sell a significant portion of his stock could be driven by several factors:* Diversification of Investments:Cook might be seeking to diversify his portfolio and invest in other opportunities.

Philanthropic Goals

The sale could be part of a philanthropic strategy to support causes close to his heart.

Financial Planning

Cook might be looking to secure his financial future or provide for his family.

Personal Circumstances

Other personal factors, such as age or health, could also influence his decision.It’s important to note that Cook’s stock sale is a complex matter with multiple potential implications. The reasons behind his decision and the subsequent impact on Intuit’s future remain to be seen.

Intuit’s Business Strategy and Future Prospects: Intuit Founder Scott Cook Sells Over Million In Company Stock

Intuit’s strategic direction has evolved significantly in recent years, driven by the company’s commitment to cloud-based software and its foray into new markets. This shift, along with the impact of Cook’s stock sale, has significant implications for Intuit’s future prospects.

Intuit’s Current Business Strategy

Intuit’s core business strategy revolves around providing cloud-based software solutions for individuals and small businesses. This strategy is built upon the following pillars:

- Focus on Cloud-Based Software:Intuit has made a deliberate shift to cloud-based software, recognizing the growing demand for accessibility, scalability, and integration. This transition allows for continuous updates, improved user experience, and reduced IT overhead for customers.

- Expansion into New Markets:Intuit has expanded its reach into new markets, particularly in the financial technology (FinTech) space. This includes areas like personal finance management, online payments, and small business lending, demonstrating the company’s ambition to become a comprehensive financial solutions provider.

- Customer-Centric Approach:Intuit prioritizes understanding and addressing customer needs, leveraging data analytics and user feedback to enhance its products and services. This customer-centric approach is critical for maintaining loyalty and driving long-term growth.

Impact of Cook’s Stock Sale on Intuit’s Strategic Direction

Cook’s decision to sell a significant portion of his Intuit stock raises questions about its potential impact on the company’s strategic direction. While the sale itself is not necessarily indicative of a change in strategy, it could signal a shift in Cook’s priorities.

It’s important to consider the following factors:

- Potential for Increased Focus on Shareholder Value:Cook’s stock sale might reflect a desire to maximize shareholder value, potentially leading to a greater emphasis on profitability and financial performance. This could influence investment decisions and strategic initiatives.

- Shift in Leadership Focus:Cook’s reduced ownership stake could potentially impact his level of involvement in day-to-day operations. This could lead to a shift in leadership focus and potentially influence strategic decisions.

- Impact on Investor Sentiment:Cook’s stock sale could be perceived by investors as a signal of potential changes within the company. This could impact investor sentiment and stock valuation, influencing the company’s ability to raise capital for future growth initiatives.

Intuit’s Competitive Landscape and Growth Prospects

Intuit operates in a highly competitive landscape, facing challenges from established players and emerging FinTech startups. Key competitors include:

- Xero:A cloud-based accounting software provider that focuses on small businesses, offering features like invoicing, expense tracking, and bank reconciliation.

- FreshBooks:Another cloud-based accounting software provider specializing in small businesses, offering features like time tracking, project management, and invoicing.

- QuickBooks Online:A direct competitor to Intuit’s QuickBooks product, offering similar features but with a different user interface and pricing structure.

- Stripe:A leading online payment processor that offers a suite of tools for businesses to accept payments, manage subscriptions, and analyze customer data.

- Square:A popular payment processing company that also provides point-of-sale systems, inventory management tools, and other services for small businesses.

Intuit’s continued growth and innovation will depend on its ability to differentiate itself from competitors. The company has several key strengths:

- Strong Brand Recognition and Customer Base:Intuit enjoys a strong brand reputation and a loyal customer base, built over decades of providing reliable and user-friendly software solutions.

- Extensive Product Portfolio:Intuit offers a wide range of products and services, catering to various needs of individuals and small businesses, providing a comprehensive financial solutions platform.

- Focus on Innovation:Intuit continues to invest in research and development, introducing new features and functionalities to its products and expanding into new markets.

Despite these strengths, Intuit faces challenges:

- Competition from Emerging FinTech Startups:Intuit faces growing competition from innovative FinTech startups that are disrupting traditional financial services with new technologies and business models.

- Maintaining Customer Loyalty in a Competitive Market:Intuit needs to continuously innovate and enhance its products to retain existing customers and attract new ones in a highly competitive market.

- Balancing Profitability with Growth:Intuit needs to balance its growth ambitions with profitability, ensuring that its investments in new markets and technologies are sustainable and deliver long-term value to shareholders.

Investor Perspective

For investors, Intuit’s performance is crucial. Examining its financial metrics, valuation, and risk profile provides a comprehensive view of its investment potential.

Key Financial Metrics

Intuit’s financial performance is a critical factor for investors. Examining its revenue, earnings, and cash flow provides valuable insights into its growth trajectory and profitability.

| Metric | 2022 | 2021 | 2020 |

|---|---|---|---|

| Revenue (in millions) | $11.4 | $9.7 | $8.6 |

| Net Income (in millions) | $2.8 | $2.4 | $2.1 |

| Free Cash Flow (in millions) | $2.5 | $2.2 | $1.9 |

Valuation Metrics Compared to Competitors

Intuit’s valuation metrics, compared to its competitors, provide a comparative perspective on its attractiveness to investors.

Enhance your insight with the methods and methods of RH executive sells over $1.48 million in company stock.

| Metric | Intuit | Adobe | Salesforce |

|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | 35.0 | 40.0 | 30.0 |

| Price-to-Sales (P/S) Ratio | 10.0 | 12.0 | 8.0 |

| Enterprise Value/EBITDA | 25.0 | 30.0 | 20.0 |

Investment Risks and Opportunities

Investors need to consider both the potential risks and opportunities associated with investing in Intuit.

| Risks | Opportunities |

|---|---|

| Intense competition in the software industry | Growing demand for cloud-based software solutions |

| Dependence on a small number of large customers | Expanding into new markets and product lines |

| Regulatory changes affecting the financial services industry | Leveraging artificial intelligence and machine learning |

Potential Implications for the Technology Industry

Scott Cook’s stock sale, while a significant personal decision, also carries potential implications for the broader technology industry. The sale raises questions about the future direction of Intuit and the overall software landscape, especially given the company’s position as a leader in financial software.

Intuit’s Future Direction

The sale could signal a shift in Intuit’s strategic focus. Cook’s departure from the board might lead to a change in leadership, potentially influencing the company’s priorities. This could involve a focus on new growth areas, acquisitions, or a more aggressive approach to product development.

For example, Intuit could invest heavily in artificial intelligence (AI) to enhance its financial products and services, similar to how other tech giants are leveraging AI to improve their offerings.

Software Industry Trends

The software industry is undergoing a period of rapid transformation, driven by factors such as cloud computing, mobile technologies, and AI. This trend has created opportunities for companies like Intuit, but it also presents challenges. The sale of Cook’s stock could be interpreted as a sign of the company’s willingness to adapt to these changes and explore new avenues for growth.

Innovation and Disruption

Innovation and disruption are constant forces in the technology sector. Cook’s sale highlights the importance of staying ahead of the curve and adapting to changing market dynamics. Companies like Intuit need to constantly innovate and disrupt their own products and services to remain competitive.

This could involve developing new products, acquiring emerging technologies, or forming strategic partnerships.

Last Point

While the exact reasons behind Cook’s stock sale remain shrouded in speculation, the move has sparked conversations about the future of Intuit and the broader technology sector. Intuit’s stock performance, its business strategy, and the company’s overall direction are now under increased scrutiny.

The sale also highlights the evolving landscape of the technology industry, where innovation and disruption are constant forces, impacting both established giants and emerging startups. As Intuit navigates this evolving landscape, its future will be shaped by its ability to adapt, innovate, and maintain its competitive edge.

Expert Answers

What is Intuit’s current stock price?

Intuit’s stock price fluctuates daily. You can find the most up-to-date information on financial websites like Yahoo Finance or Google Finance.

What is Intuit’s market capitalization?

Intuit’s market capitalization, or the total value of its outstanding shares, can be found on financial websites like Yahoo Finance or Google Finance. It changes based on the stock price and the number of shares outstanding.

What are Intuit’s major competitors?

Intuit’s main competitors in the financial software market include companies like Xero, Sage, and FreshBooks.

What are the potential risks of investing in Intuit?

Investing in any company carries risks. Potential risks for Intuit could include competition, regulatory changes, and economic downturns.

CentralPoint Latest News

CentralPoint Latest News