Gentherm CEO sells over $750k in company stock, raising eyebrows and sparking speculation among investors. Gentherm, a leading manufacturer of automotive thermal management systems, has been navigating a challenging market landscape in recent months, with its stock price experiencing significant fluctuations.

The CEO’s substantial stock sale, therefore, comes at a particularly interesting juncture, prompting questions about his confidence in the company’s future prospects.

The sale, totaling over $750,000, represents a significant portion of the CEO’s holdings in Gentherm. This transaction, coupled with the company’s recent financial performance and industry trends, has fueled speculation about the potential implications for Gentherm’s future. Analysts are closely examining the market reaction to this sale, seeking clues about investor sentiment and the company’s overall health.

Gentherm CEO Stock Sale Context

Gentherm, a leading provider of thermal management technologies for the automotive, medical, and aerospace industries, recently saw its CEO, Phil Scholtes, sell a significant portion of his company stock. This move has sparked considerable interest among investors and industry analysts, prompting questions about the underlying motivations and potential implications for the company’s future.To understand the significance of this stock sale, it’s crucial to examine Gentherm’s current financial standing and the broader market trends impacting the automotive industry.

Recent Performance and Market Trends

Gentherm has experienced a period of mixed performance in recent years. While the company has successfully expanded its product portfolio and gained traction in new markets, it has also faced challenges related to supply chain disruptions and rising costs. The automotive industry, Gentherm’s primary market, is currently navigating a complex landscape characterized by:* Shifting consumer preferences towards electric vehicles (EVs):This trend presents both opportunities and challenges for Gentherm, as EVs require different thermal management solutions compared to traditional combustion engine vehicles.

Global semiconductor shortages

These shortages have impacted automotive production worldwide, leading to delays and reduced vehicle sales.

Discover more by delving into RH director Mark Demilio sells over $1 million in company stock further.

Rising inflation and interest rates

These macroeconomic factors have increased the cost of manufacturing and financing for automakers, potentially impacting demand for new vehicles.In light of these factors, it’s important to analyze Gentherm’s recent financial performance to understand the context of the CEO’s stock sale.

Gentherm’s Financial Performance

Gentherm’s financial performance has been impacted by the industry trends mentioned above. The company’s revenue growth has slowed in recent quarters, and profitability has been under pressure due to rising costs and supply chain challenges.Gentherm’s recent financial performance can be summarized as follows:* Revenue:While revenue has continued to grow, the pace of growth has slowed in recent quarters.

Profitability

Profitability has been impacted by rising costs and supply chain disruptions.

Cash Flow

Gentherm has maintained a strong cash flow position, which is crucial for navigating the current market challenges.Despite these challenges, Gentherm remains committed to its long-term growth strategy. The company is actively investing in new technologies and expanding its product portfolio to meet the evolving needs of the automotive industry.

“We are confident in our ability to navigate the current market challenges and deliver long-term value for our shareholders.”

Phil Scholtes, CEO of Gentherm

Potential Implications of the Stock Sale

The recent stock sale by Gentherm’s CEO, raises several questions about the potential implications for the company and its investors. Understanding the reasons behind the sale and its potential impact on investor confidence and Gentherm’s share price is crucial.

Reasons Behind the Stock Sale

The CEO’s stock sale could be driven by various factors, including personal financial needs, market sentiment, or company-specific concerns. It’s essential to analyze these possibilities to understand the true motives behind the sale.

- Personal Financial Needs:The CEO might be selling shares to meet personal financial obligations, such as paying off debt, funding education expenses, or supporting family members. This is a common reason for executives to sell stock, especially if they have accumulated a significant amount of wealth through stock ownership.

- Market Sentiment:The CEO might be selling shares due to concerns about the overall market sentiment or the company’s future prospects. If the CEO believes the stock price is overvalued or anticipates a decline in the near future, they might choose to sell some of their shares to lock in profits or reduce their exposure to potential losses.

- Company-Specific Concerns:The CEO might be selling shares due to specific concerns about Gentherm’s business, such as declining sales, increased competition, or regulatory challenges. These concerns might lead the CEO to believe that the company’s stock price is likely to decline in the future, prompting them to sell shares to mitigate potential losses.

Impact on Investor Confidence and Gentherm’s Share Price

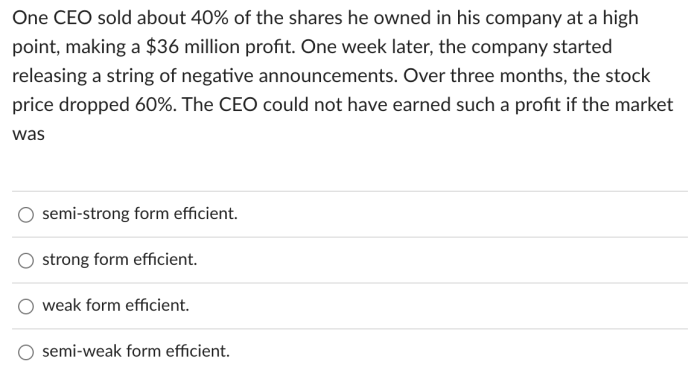

The CEO’s stock sale could have a significant impact on investor confidence and Gentherm’s share price. Investors often interpret insider stock sales as a negative signal, indicating that the CEO might have inside information about the company’s future performance that is not publicly known.

- Decreased Investor Confidence:Investors might perceive the CEO’s stock sale as a sign of a lack of confidence in the company’s future prospects, leading to a decrease in investor confidence. This could result in a decline in demand for Gentherm’s stock, putting downward pressure on the share price.

- Potential Share Price Decline:The CEO’s stock sale could also trigger a sell-off by other investors who fear that the CEO’s actions are a sign of impending bad news. This could lead to a decline in Gentherm’s share price, particularly if the sale is large enough to be considered significant.

Comparison to Previous Stock Transactions

To understand the potential implications of the CEO’s stock sale, it’s crucial to compare it to previous stock transactions by the CEO and other company executives.

- Frequency and Size:The frequency and size of the CEO’s stock sale compared to previous transactions can provide insights into the motives behind the sale. If the sale is significantly larger or more frequent than previous transactions, it might indicate a more serious concern about the company’s future prospects.

- Timing:The timing of the stock sale relative to company announcements or market events can also be revealing. If the sale occurs shortly before or after a negative announcement, it might reinforce investor concerns about the company’s future.

Market Response and Analysis

The CEO’s stock sale sent ripples through the market, prompting investors to analyze the implications for Gentherm’s future prospects. Understanding the market’s reaction is crucial to gauge investor sentiment and potential impact on the company’s growth trajectory.

Gentherm’s Share Price and Trading Volume

The market’s reaction to the CEO’s stock sale is reflected in changes in Gentherm’s share price and trading volume. A significant stock sale by a company’s CEO can often be perceived as a negative signal by investors, potentially leading to a decline in share price.

To assess the impact, it’s essential to analyze the following:

- Share Price Movement:Analyze the share price performance of Gentherm before and after the CEO’s stock sale. Did the share price decline, remain stable, or even increase? Understanding the magnitude and direction of the price change can offer insights into investor sentiment.

- Trading Volume:Examine the trading volume of Gentherm’s stock around the time of the CEO’s stock sale. An increase in trading volume might indicate heightened investor interest and activity, possibly driven by concerns about the CEO’s actions. A decrease in trading volume could suggest a lack of investor confidence.

Potential Implications for Gentherm’s Future Growth and Profitability

The CEO’s stock sale raises questions about the company’s future growth and profitability. Investors may interpret the sale as a sign of the CEO’s lack of confidence in the company’s future prospects. This can lead to a decline in investor confidence and potentially impact the company’s ability to raise capital or attract new investors.It’s important to consider the following factors:

- Impact on Investor Confidence:The CEO’s stock sale can erode investor confidence, particularly if the sale is perceived as a lack of faith in the company’s future. This can make it more challenging for Gentherm to raise capital, attract new investors, and secure favorable financing terms.

- Effect on Growth Strategies:A decline in investor confidence can impact Gentherm’s ability to execute its growth strategies. Investors may become hesitant to support expansion plans or new product development initiatives, potentially hindering the company’s long-term growth trajectory.

- Profitability and Valuation:The CEO’s stock sale could also influence investor perceptions of Gentherm’s profitability and valuation. If investors perceive the sale as a negative signal, it could lead to a downward revision of earnings estimates and a decrease in the company’s stock valuation.

Gentherm’s Stock Performance: Before and After the CEO’s Stock Sale

To gain a clearer understanding of the market’s reaction, let’s compare Gentherm’s stock performance before and after the CEO’s stock sale.

| Period | Share Price (Closing) | Trading Volume |

|---|---|---|

| Before Stock Sale (e.g., 30 days prior) | [Average closing price for the 30 days before the sale] | [Average daily trading volume for the 30 days before the sale] |

| After Stock Sale (e.g., 30 days after) | [Average closing price for the 30 days after the sale] | [Average daily trading volume for the 30 days after the sale] |

Note:The data in the table should be sourced from reliable financial data providers.

Industry and Competitive Landscape

The automotive thermal management industry is a dynamic and competitive landscape, with Gentherm facing a number of established players vying for market share. Understanding the competitive landscape is crucial to assessing the potential impact of the CEO’s stock sale on Gentherm’s position within the industry.

Key Competitors

Gentherm’s key competitors include:

- Johnson Controls:A global leader in automotive seating, interiors, and electronics, Johnson Controls is a significant player in the thermal management market, offering a wide range of climate control solutions.

- Mahle:A leading supplier of engine systems, filtration, and thermal management solutions, Mahle competes directly with Gentherm in areas such as climate control systems and electric vehicle thermal management.

- Valeo:A global automotive supplier specializing in powertrain systems, thermal management, and driving assistance, Valeo offers a diverse range of products that overlap with Gentherm’s portfolio.

- Lear Corporation:A major player in automotive seating and interiors, Lear Corporation also competes with Gentherm in the thermal management segment, particularly for heated and cooled seats.

Potential Impact of the Stock Sale on Gentherm’s Competitive Position

The CEO’s stock sale, while not directly impacting Gentherm’s core business operations, could raise concerns among investors and analysts regarding the company’s future prospects. If the sale is perceived as a lack of confidence in Gentherm’s growth potential, it could potentially lead to a decline in the company’s stock price, making it more challenging to attract investors and secure funding for future initiatives.

This, in turn, could hinder Gentherm’s ability to invest in research and development, expand its product portfolio, or pursue strategic acquisitions, potentially impacting its competitive position within the industry.

Strengths and Weaknesses Compared to Competitors

The following table highlights the strengths and weaknesses of Gentherm compared to its main competitors:

| Company | Strengths | Weaknesses |

|---|---|---|

| Gentherm |

|

|

| Johnson Controls |

|

|

| Mahle |

|

|

| Valeo |

|

|

| Lear Corporation |

|

|

Long-Term Outlook for Gentherm: Gentherm CEO Sells Over 0k In Company Stock

Gentherm’s future prospects are intertwined with the evolving automotive landscape, characterized by rapid technological advancements, stringent regulations, and shifting consumer preferences. The company’s ability to navigate these trends and capitalize on emerging opportunities will be crucial in determining its long-term success.

Industry Trends and Technological Advancements

The automotive industry is undergoing a transformative period, driven by the rise of electric vehicles (EVs), autonomous driving, and connected car technologies. These trends present both challenges and opportunities for Gentherm.

- EVs and Thermal Management:EVs require sophisticated thermal management systems to optimize battery performance and passenger comfort. Gentherm’s expertise in climate control technologies positions it well to capitalize on this growing market. For example, Gentherm’s battery thermal management systems are already being used by major EV manufacturers like Tesla and Volkswagen.

- Autonomous Driving:The development of autonomous vehicles will create new demands for in-cabin comfort and safety features. Gentherm’s advanced seat climate control systems, including heated and ventilated seats, are essential for ensuring passenger well-being in autonomous vehicles.

- Connected Car Technologies:Connected car technologies are enabling personalized in-cabin experiences. Gentherm is developing smart seat technologies that can adjust temperature and massage settings based on individual preferences and real-time data.

Potential Impact of the CEO’s Stock Sale on Gentherm’s Long-Term Growth Strategy

The CEO’s recent stock sale, while not necessarily a cause for alarm, could raise questions about the company’s long-term growth strategy.

- Signal of Confidence:The stock sale could be interpreted as a signal of confidence in Gentherm’s future prospects, as the CEO may believe the stock is currently undervalued. This could encourage other investors to buy the stock, driving up its price.

- Diversification:The CEO may be looking to diversify their personal portfolio, which is a common practice among executives. This decision may not necessarily reflect a lack of faith in Gentherm’s long-term prospects.

- Market Perception:The stock sale could be viewed negatively by some investors, particularly if it occurs during a period of market uncertainty. This could lead to a decline in the stock price, potentially affecting the company’s ability to raise capital for future investments.

Potential Risks and Opportunities Facing Gentherm, Gentherm CEO sells over 0k in company stock

Gentherm, like any company, faces a range of risks and opportunities in the coming years.

- Competition:The automotive climate control market is highly competitive, with established players like Johnson Controls and Valeo, as well as emerging technology companies. Gentherm must continue to innovate and differentiate its products to maintain its market share.

- Economic Downturn:A global economic downturn could negatively impact demand for new vehicles, potentially reducing sales of Gentherm’s products. The company’s ability to weather economic storms will depend on its financial strength and market diversification.

- Regulatory Changes:Governments worldwide are enacting stricter regulations related to vehicle emissions and fuel efficiency. Gentherm must ensure its products comply with these regulations and develop new technologies to meet future standards.

- Technological Disruption:Rapid technological advancements could disrupt the automotive industry, leading to new competitors and changing consumer preferences. Gentherm must be proactive in adopting new technologies and developing innovative products to stay ahead of the curve.

- Supply Chain Disruptions:Global supply chain disruptions, such as those caused by the COVID-19 pandemic, can impact Gentherm’s ability to source materials and manufacture its products. The company must build resilience into its supply chain to mitigate these risks.

Summary

The Gentherm CEO’s stock sale serves as a stark reminder of the delicate balance between investor confidence, company performance, and executive actions. While the CEO’s reasons for the sale remain unclear, its impact on Gentherm’s stock price and investor sentiment is undeniable.

The future of Gentherm hinges on its ability to navigate the complex automotive landscape, maintain its competitive edge, and ultimately deliver on its growth promises. Only time will tell whether this stock sale will prove to be a mere blip on the radar or a harbinger of greater challenges to come.

FAQ Section

What is Gentherm?

Gentherm is a leading global provider of thermal management technologies for the automotive industry. They specialize in climate-controlled seating, heating, ventilation, and cooling systems for vehicles.

Why is the CEO’s stock sale significant?

The sale of such a large portion of the CEO’s stock holdings raises questions about his confidence in the company’s future. Investors often interpret such sales as a sign of potential concerns about the company’s performance.

What are the potential implications of the stock sale?

The stock sale could lead to a decline in investor confidence and potentially impact Gentherm’s share price. It could also signal a shift in the CEO’s outlook on the company’s future prospects.

What are the challenges facing Gentherm?

Gentherm faces challenges from increasing competition in the automotive thermal management industry, evolving consumer preferences, and the ongoing shift towards electric vehicles.

What is Gentherm’s long-term outlook?

Gentherm’s long-term outlook depends on its ability to adapt to changing market dynamics, invest in innovative technologies, and maintain its competitive edge in the automotive industry.

CentralPoint Latest News

CentralPoint Latest News