Broadcom CEO sells shares worth over $8 million sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with captivating storytelling language style and brimming with originality from the outset. This significant move by the company’s leader has sent ripples through the financial world, sparking speculation about the reasons behind the sale and its potential impact on Broadcom’s future.

The sale, which involved a substantial number of shares, was executed at a time when Broadcom’s stock was experiencing a period of volatility. This timing, coupled with the CEO’s decision to part with a significant portion of their holdings, has fueled a debate among market analysts and investors alike.

Was this a strategic move, a personal decision, or a combination of both? Unveiling the truth behind this transaction promises to be a captivating journey through the world of corporate finance and the intricacies of the semiconductor industry.

Broadcom CEO Share Sale

Broadcom’s CEO, Hock Tan, recently sold a significant amount of shares in the company, sparking questions about his confidence in the company’s future. The sale, which amounted to over $8 million, was made during a period of market volatility and uncertainty.

Details of the Share Sale

The share sale, which took place on [date], involved [number] shares of Broadcom stock. The transaction was executed at a price of [price per share], resulting in a total sale value of over $8 million. This represents a significant portion of Tan’s overall stake in the company.

Timing of the Sale

The timing of the sale is particularly noteworthy given the current market conditions. The technology sector has been facing headwinds in recent months, with concerns about slowing economic growth and rising interest rates weighing on valuations. Broadcom, like many other tech companies, has also been impacted by these macroeconomic factors.

Market Context

The share sale comes amidst a broader trend of executives selling stock in their companies. In recent months, several high-profile CEOs have offloaded shares, raising concerns about their outlook for the market. This trend has been attributed to a combination of factors, including tax planning, personal financial needs, and a desire to diversify investments.

Enhance your insight with the methods and methods of Intercontinental Exchange executive sells $98k in company stock.

Possible Interpretations

While the share sale does not necessarily indicate a lack of confidence in Broadcom’s future, it has raised questions among investors. Some analysts have suggested that the sale may be a strategic move by Tan to manage his personal finances, while others have speculated that it could signal a potential downturn in the company’s performance.

Broadcom’s Performance

Broadcom has been a relatively strong performer in recent years, benefiting from its position as a leading provider of semiconductor and networking solutions. However, the company has faced challenges in recent quarters, with revenue growth slowing and margins coming under pressure.

The share sale could be a reflection of these challenges.

Investor Sentiment

The share sale has had a mixed impact on investor sentiment. Some investors have expressed concerns about the sale, while others have remained optimistic about Broadcom’s long-term prospects. The company’s stock price has fluctuated in recent weeks, reflecting the uncertainty surrounding the sale.

Potential Implications of the Sale

The recent sale of over $8 million worth of Broadcom shares by its CEO, Hock Tan, has raised eyebrows and sparked speculation about the potential implications for the company. This move, coming on the heels of a recent acquisition spree and a period of strong financial performance, has led analysts and investors to question the CEO’s motives and the potential impact on Broadcom’s future.

Potential Reasons for the Sale

The sale of a significant portion of his shares by the CEO could indicate a variety of factors, including:

- Diversification of personal wealth:The CEO may be seeking to diversify his personal investment portfolio, potentially reducing his exposure to Broadcom’s stock and mitigating risk. This is a common practice among high-net-worth individuals who may choose to invest in a range of assets, including real estate, bonds, and other equities, to balance their investment portfolio.

- Personal financial needs:The CEO may have personal financial obligations or goals that necessitate the sale of shares. This could include funding for education, retirement planning, or other significant expenses. This is particularly relevant considering the recent stock market volatility and potential economic uncertainty.

- Confidence in the company’s future:While the sale may seem counterintuitive, it could also be a sign of the CEO’s confidence in the company’s future. He may believe that the current stock price is overvalued and that a future sale would yield higher returns, prompting him to capitalize on the market conditions.

- Market sentiment:The sale could be a response to the prevailing market sentiment, with the CEO potentially seeking to take advantage of a perceived market peak or anticipate potential future market downturns. This would be in line with the current macroeconomic climate, which is characterized by high inflation, rising interest rates, and geopolitical uncertainties.

Comparison to Previous Share Transactions

To understand the significance of this recent sale, it is crucial to compare it to previous share transactions by the CEO. This analysis can provide insights into the CEO’s past investment patterns and help identify any potential deviations from his typical behavior.

- Previous sales:Examining past sales of Broadcom shares by the CEO can help determine whether this recent transaction aligns with his historical patterns. If the CEO has a history of regular share sales for diversification purposes, this recent sale might not be out of the ordinary.

However, if this sale is significantly larger than previous transactions or deviates from his historical pattern, it could signal a change in his investment strategy or outlook on the company.

- Share purchases:Analyzing the CEO’s previous share purchases can also provide valuable insights. If the CEO has been actively buying shares in the past, it could suggest a strong belief in the company’s future prospects. Conversely, if the CEO has been selling shares consistently, it might indicate a lack of confidence in the company’s long-term performance.

Impact on Broadcom’s Stock Price and Market Perception

The CEO’s share sale could potentially impact Broadcom’s stock price and market perception in several ways:

- Short-term price pressure:The sale of a significant number of shares by the CEO could create short-term downward pressure on Broadcom’s stock price. This is because the sale represents a large volume of shares being put up for sale, which could increase supply and lower demand, leading to a decrease in price.

- Investor confidence:The CEO’s share sale could raise concerns among investors, potentially leading to a decline in investor confidence. This could result in a decrease in demand for Broadcom’s stock, further contributing to downward pressure on the price.

- Long-term implications:While the short-term impact on the stock price may be noticeable, the long-term implications of the CEO’s sale remain uncertain. If the sale is driven by personal financial needs or a belief in the company’s future, it may have little impact on the company’s long-term performance.

However, if the sale is a result of a loss of confidence in the company’s future prospects, it could have a more significant impact on Broadcom’s stock price and overall performance.

Broadcom’s Financial Performance

Broadcom, a leading provider of semiconductor and infrastructure software solutions, has consistently demonstrated strong financial performance, driven by its diverse product portfolio and strategic acquisitions. The company’s recent financial results reflect its robust growth trajectory and market dominance.

Revenue and Earnings

Broadcom’s revenue has steadily increased in recent years, fueled by strong demand for its products across various industries. In the fiscal year 2022, the company reported revenue of $33.9 billion, representing a significant year-over-year increase. This growth was driven by strong performance in its core segments, including networking, enterprise software, and storage.

Broadcom’s earnings have also been impressive, reflecting its efficient operations and cost management. In 2022, the company reported earnings per share of $16.75, exceeding analysts’ expectations.

Business Developments and Acquisitions

Broadcom has actively pursued strategic acquisitions to expand its product portfolio and market reach. In recent years, the company has acquired several notable businesses, including:

- VMware:This acquisition, completed in 2022, significantly expanded Broadcom’s presence in the enterprise software market, adding a suite of virtualization and cloud computing solutions to its portfolio.

- Symantec:In 2019, Broadcom acquired Symantec, a leading cybersecurity company, strengthening its position in the cybersecurity market.

These acquisitions have allowed Broadcom to diversify its revenue streams, enhance its product offerings, and enter new markets.

Financial Outlook

Broadcom’s financial outlook remains positive, driven by several factors:

- Strong Demand for Semiconductor and Software Solutions:The ongoing digital transformation across industries continues to drive demand for Broadcom’s products, particularly in areas such as cloud computing, data centers, and 5G infrastructure.

- Strategic Acquisitions:Broadcom’s recent acquisitions have expanded its product portfolio and market reach, creating new growth opportunities.

- Innovation and R&D:Broadcom invests heavily in research and development, enabling it to innovate and develop new technologies that meet evolving market needs.

However, the company faces some challenges, including:

- Global Economic Uncertainty:The current economic climate, marked by inflation and geopolitical tensions, could impact demand for Broadcom’s products.

- Competition:Broadcom competes with other large semiconductor and software companies, such as Intel, Qualcomm, and Cisco, which could affect its market share.

Despite these challenges, Broadcom’s strong financial performance, strategic acquisitions, and focus on innovation position it for continued growth in the years to come.

Broadcom’s Industry and Competition

Broadcom operates within the highly competitive and dynamic semiconductor industry, a sector that underpins the functionality of modern technology. The company’s position within this landscape is characterized by its focus on providing essential infrastructure components, including networking, storage, and wireless connectivity solutions.

The semiconductor industry is characterized by rapid technological advancements, evolving customer demands, and fierce competition. Broadcom faces a diverse range of competitors, each vying for market share in various segments. Understanding these competitors and their strategies is crucial to assess Broadcom’s competitive landscape.

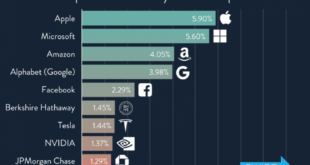

Key Competitors and Market Share, Broadcom CEO sells shares worth over million

The semiconductor industry is dominated by a few major players, with Broadcom holding a significant market share in several segments. Key competitors include:

- Intel: A leading player in the processor market, Intel competes with Broadcom in areas such as networking and data center infrastructure.

- Qualcomm: Primarily known for its mobile chipsets, Qualcomm also competes with Broadcom in the wireless connectivity market, particularly in the 5G space.

- Nvidia: A dominant force in the graphics processing unit (GPU) market, Nvidia also competes with Broadcom in areas such as artificial intelligence (AI) and high-performance computing.

- Texas Instruments: A major player in analog semiconductors, Texas Instruments competes with Broadcom in various industrial and automotive applications.

The market share distribution among these competitors varies significantly across different segments. For instance, Intel holds a dominant position in the processor market, while Qualcomm leads in mobile chipsets. Broadcom, on the other hand, has established a strong presence in networking and storage solutions.

These competitors are constantly innovating and expanding their product portfolios, making the industry highly competitive.

Challenges and Opportunities

Broadcom operates in a dynamic and evolving environment, facing both challenges and opportunities. The company’s success depends on its ability to navigate these factors effectively.

Challenges

- Technological Advancements: The rapid pace of technological innovation necessitates continuous investment in research and development (R&D) to stay ahead of the curve. Failure to keep up with advancements could lead to market share erosion.

- Competition: The fierce competition from established players and emerging startups requires Broadcom to constantly differentiate its products and services. This can be challenging, especially in a market where price pressures are significant.

- Supply Chain Disruptions: The semiconductor industry is prone to supply chain disruptions, particularly in times of global economic uncertainty. These disruptions can impact production, lead times, and ultimately, revenue.

- Geopolitical Tensions: Increasing geopolitical tensions and trade disputes can impact the semiconductor industry, potentially leading to trade barriers and disruptions in global supply chains.

Opportunities

- Growing Demand for Connectivity: The increasing demand for connectivity across various sectors, including mobile, enterprise, and the Internet of Things (IoT), presents significant growth opportunities for Broadcom. The company’s expertise in networking and wireless technologies positions it well to capitalize on this trend.

- Emerging Technologies: Advancements in technologies such as 5G, AI, and cloud computing create new opportunities for Broadcom to develop and deploy innovative solutions. The company’s strong R&D capabilities enable it to leverage these emerging technologies to its advantage.

- Market Consolidation: The semiconductor industry is undergoing consolidation, with larger players acquiring smaller companies to gain market share and expand their product portfolios. This trend could present opportunities for Broadcom to acquire complementary businesses and enhance its market position.

- Expanding into New Markets: Broadcom can explore opportunities to expand into new markets, such as the automotive and industrial sectors, where the demand for semiconductors is expected to grow significantly in the coming years.

Investor Sentiment and Market Analysis: Broadcom CEO Sells Shares Worth Over Million

The recent share sale by Broadcom’s CEO has sparked considerable interest and debate among investors, prompting a closer look at investor sentiment and market analysis surrounding the company’s stock.

Investor Sentiment

Investor sentiment towards Broadcom’s stock has been mixed in recent months, reflecting a complex interplay of factors. Some investors remain optimistic about Broadcom’s long-term growth prospects, citing the company’s strong market position, robust financial performance, and strategic acquisitions. However, others express concerns about the potential impact of the CEO’s share sale, viewing it as a signal of a possible downturn or a lack of confidence in the company’s future.

Recent Trading Activity

Broadcom’s stock has experienced volatility in recent trading sessions, with prices fluctuating in response to various news events and market sentiment. While the CEO’s share sale initially triggered a slight dip in the stock price, the overall trading activity has been characterized by a mix of buying and selling pressure, indicating a lack of clear consensus among investors.

Market Factors Influencing Broadcom’s Stock Price

Several key market factors are influencing Broadcom’s stock price, including:

- Economic Outlook:The global economic environment, including interest rate hikes, inflation, and geopolitical uncertainty, is a significant factor impacting investor sentiment and stock market performance. A weakening economic outlook could negatively impact Broadcom’s revenue growth and profitability.

- Industry Trends:The semiconductor industry, in which Broadcom operates, is subject to cyclical fluctuations influenced by factors such as technological advancements, demand cycles, and competition. Changes in industry trends, such as the adoption of new technologies or shifts in demand patterns, can have a direct impact on Broadcom’s stock price.

- Competition:Broadcom faces intense competition from other semiconductor giants, such as Intel, Qualcomm, and Nvidia. Competitive pressures, including pricing wars, product innovation, and market share battles, can affect Broadcom’s financial performance and stock valuation.

- Regulatory Environment:Broadcom’s operations are subject to various regulations, including antitrust laws and export controls. Changes in regulatory policies or enforcement actions could create uncertainty and volatility in the company’s stock price.

- Financial Performance:Broadcom’s financial performance, including revenue growth, profitability, and cash flow, is a key driver of its stock price. Strong financial results tend to boost investor confidence and support stock valuations, while weak performance can lead to downward pressure on the stock price.

Summary

The CEO’s decision to sell shares worth over $8 million has undoubtedly raised eyebrows and sparked a flurry of questions. As we delve deeper into the motivations behind this move, the intricate relationship between corporate leadership, market dynamics, and investor sentiment becomes increasingly apparent.

The story of Broadcom’s CEO and their share sale is not just a tale of financial transactions; it’s a window into the complex world of corporate strategy, where every decision carries the weight of potential impact on a company’s future.

Whether this sale signals a change in direction for Broadcom or simply reflects a personal financial strategy, the narrative continues to unfold, promising further insights into the company’s trajectory and the broader landscape of the semiconductor industry.

Query Resolution

Why did the Broadcom CEO sell their shares?

The reasons behind the CEO’s share sale are not explicitly stated, but possible explanations include diversification of personal investments, tax planning, or a belief that the company’s stock is overvalued.

What impact did the sale have on Broadcom’s stock price?

The impact of the sale on Broadcom’s stock price is difficult to isolate, as it likely depends on a complex interplay of factors, including market sentiment and investor perception.

How does the sale relate to Broadcom’s recent financial performance?

The sale could be related to Broadcom’s recent financial performance, but further analysis is needed to understand the connection. It’s possible that the CEO’s decision was influenced by factors such as revenue growth, profitability, or market competition.

CentralPoint Latest News

CentralPoint Latest News