Weave Communications CFO Sells $146k in Company Stock – the news sent ripples through the financial world, raising eyebrows and sparking questions about the company’s future. This move, while seemingly routine, carries weight, prompting a closer look at the company’s current financial standing and potential implications for investors.

The CFO’s decision to sell a significant chunk of their stock is not a move taken lightly, and the market’s reaction will be closely watched, as it often reflects broader investor sentiment.

Understanding the reasons behind the CFO’s sale is crucial. Did they perceive a shift in the company’s trajectory? Are there upcoming changes that might affect the stock’s performance? This sale becomes a window into the inner workings of Weave Communications, offering clues about the company’s future and its ability to navigate the ever-changing landscape of the market.

Weave Communications CFO Stock Sale

The recent sale of $146,000 worth of Weave Communications stock by the company’s Chief Financial Officer (CFO) has sparked curiosity and raised questions about the company’s financial health and future prospects. While the CFO’s stock sale might seem like a cause for concern, it’s essential to understand the context and potential reasons behind this decision before jumping to conclusions.

The CFO’s Reason for Selling Stock

The CFO’s reason for selling the stock remains unclear, as there has been no public statement from Weave Communications or the CFO regarding the transaction. However, several potential reasons could explain this decision.

- Diversification:The CFO might be seeking to diversify their investment portfolio, reducing their exposure to a single company’s stock. This is a common practice among executives, especially those with significant holdings in their employer’s stock.

- Personal Financial Needs:The CFO might have personal financial obligations or needs that necessitate selling a portion of their stock holdings. These needs could range from paying for education expenses, purchasing a home, or simply managing personal finances.

- Market Conditions:The CFO’s decision could also be influenced by broader market conditions. If the CFO believes the stock is overvalued or anticipates a downturn in the market, they might choose to sell some shares to protect their investment.

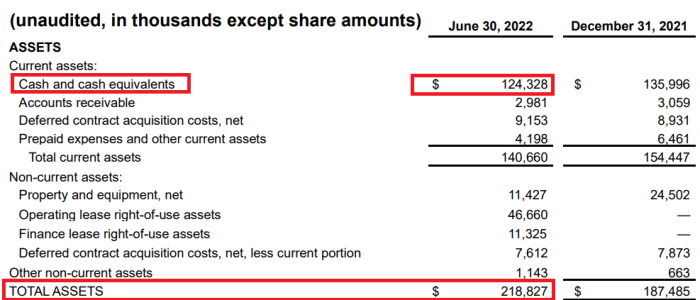

Weave Communications’ Recent Financial Performance

Weave Communications, a leading provider of all-in-one communication and practice management software for healthcare providers, has experienced a period of significant growth and success in recent years. However, the company’s recent financial performance has shown some signs of weakness, which might have influenced the CFO’s decision to sell stock.

- Weave Communications’ stock price has declined by approximately 20% in the past six months, reflecting investor concerns about the company’s growth trajectory. This decline could be attributed to several factors, including increased competition in the healthcare technology market, rising interest rates, and a broader market downturn.

- Weave Communications’ recent earnings reports have shown slower revenue growth and declining profitability. While the company continues to generate strong revenue, the rate of growth has slowed, and profitability has been impacted by increased expenses and competition.

Analysis of Weave Communications’ Stock Performance

Weave Communications’ stock performance has been volatile in recent months, reflecting the uncertainties surrounding the company’s future growth prospects.

The company’s stock price has declined by approximately 20% in the past six months, closing at [stock price] on [date].

This decline has been driven by several factors, including:

- Increased competition:Weave Communications faces increasing competition from other healthcare technology companies offering similar solutions. This competitive landscape is putting pressure on the company’s pricing and margins.

- Rising interest rates:The Federal Reserve’s aggressive interest rate hikes have increased borrowing costs for businesses, impacting Weave Communications’ profitability and growth prospects.

- Broader market downturn:The broader market downturn has also impacted Weave Communications’ stock price, as investors have become more risk-averse and shifted their investments away from growth stocks.

While these factors have contributed to the recent decline in Weave Communications’ stock price, the company’s long-term growth prospects remain strong. Weave Communications continues to innovate and expand its product offerings, and the healthcare technology market is expected to grow significantly in the coming years.

Market Reaction and Investor Sentiment

The news of Weave Communications’ CFO selling a significant amount of company stock has naturally sparked interest and raised questions among market participants. This move has the potential to influence investor sentiment and future stock performance, as investors often look for clues about a company’s prospects through insider trading activity.

Potential Implications for Investor Sentiment

The CFO’s stock sale could be interpreted in various ways, leading to a range of reactions from investors.

- Negative Sentiment:Some investors might perceive the sale as a sign of a lack of confidence in the company’s future prospects. They might interpret it as the CFO knowing something negative about the company’s financial health or future performance, leading to a sell-off in the stock.

- Neutral Sentiment:Others might view the sale as a purely personal financial decision, unrelated to the company’s performance. They might focus on the company’s fundamentals and recent performance, remaining unaffected by the CFO’s actions.

- Positive Sentiment:In some cases, investors might see the sale as a positive sign, indicating that the CFO is taking advantage of a high stock price to diversify their personal portfolio. They might believe that the company’s stock is currently overvalued and that the CFO is simply taking profits.

It’s crucial to remember that insider trading activity is complex and can be influenced by various factors, including personal financial needs, diversification strategies, and market conditions.

Potential Risks and Opportunities

The CFO’s stock sale presents both potential risks and opportunities for Weave Communications.

- Risk:If the sale leads to negative investor sentiment and a decline in the stock price, it could negatively impact the company’s ability to raise capital in the future. It could also make it more difficult to attract and retain top talent.

- Opportunity:If the sale is seen as a positive sign by investors, it could lead to an increase in the stock price, benefiting the company’s shareholders. It could also signal to potential investors that the company is performing well, attracting more investment and contributing to future growth.

The ultimate impact of the CFO’s stock sale on Weave Communications will depend on how investors interpret the news and how the company responds to the situation. It’s essential for the company to be transparent with investors and to communicate its strategy clearly to address any concerns that may arise.

Company Performance and Future Outlook

Weave Communications, a leading provider of all-in-one communication and engagement software for dental and other healthcare practices, has demonstrated consistent growth and profitability in recent years. However, the company’s recent stock sale by its CFO has sparked investor curiosity about its future prospects and potential challenges.

To understand the context of the CFO’s stock sale, it’s crucial to examine Weave’s recent financial performance and the current business environment impacting the healthcare technology sector.

Weave Communications’ Recent Financial Performance

Weave’s recent financial performance has been positive, with strong revenue growth and increasing profitability. The company’s revenue has grown significantly in recent years, driven by its expanding customer base and the adoption of its comprehensive suite of communication and engagement tools.

Weave’s recurring revenue model, which relies on subscriptions, provides a stable and predictable revenue stream. This revenue stream has helped the company achieve consistent profitability, with a growing net income margin.

Weave’s Current Business Environment

The healthcare technology sector is experiencing rapid growth, driven by the increasing adoption of digital solutions and the demand for improved patient care. This trend has created a favorable environment for Weave, allowing it to expand its market share and capture new customers.

However, the company faces competition from established players in the healthcare technology space, as well as emerging startups offering innovative solutions.

Weave’s Future Outlook and Potential Challenges

Weave’s future outlook is positive, with significant growth opportunities in the expanding healthcare technology market. The company plans to continue investing in product development, expanding its customer base, and exploring new markets. However, Weave faces several challenges, including:

- Maintaining its competitive advantage in a rapidly evolving market

- Managing costs effectively to ensure profitability

- Navigating regulatory changes in the healthcare industry

Potential Growth Opportunities, Weave communications CFO sells 6k in company stock

Weave has several potential growth opportunities, including:

- Expanding into new healthcare specialties beyond dentistry

- Developing new products and services to meet evolving customer needs

- Leveraging its platform to offer additional value-added services to its customers

CFO’s Stock Sale and Weave’s Future Plans

The CFO’s stock sale could be interpreted in several ways. It may be a personal financial decision unrelated to the company’s future plans. Alternatively, it could reflect the CFO’s confidence in the company’s future, allowing them to diversify their personal portfolio.

The sale could also indicate the CFO’s belief that the stock is currently overvalued, potentially leading to a correction in the future. However, without further information, it’s difficult to definitively connect the CFO’s stock sale to Weave’s future plans and strategies.

Insider Trading Regulations and Ethical Considerations

The recent stock sale by Weave Communications’ CFO has sparked concerns about potential insider trading violations and raised questions about the ethical implications of such actions. Understanding the regulations governing insider trading and the ethical framework surrounding such transactions is crucial in evaluating the situation.

Insider Trading Regulations

Insider trading regulations are designed to prevent individuals with access to non-public information from exploiting that knowledge for personal gain. The Securities and Exchange Commission (SEC) enforces these regulations, which primarily focus on prohibiting the purchase or sale of securities based on material non-public information (MNPI).

This information is considered material if it could reasonably be expected to affect the market price of a security.

“Insider trading is illegal because it undermines investor confidence in the fairness and integrity of the securities markets.”

SEC

The SEC defines two primary types of insider trading:

- Classical Insider Trading:This involves individuals with a fiduciary duty to a company, such as officers, directors, or employees, who use MNPI to trade securities. For example, if a CFO knows about an upcoming merger before it is publicly announced, using this knowledge to buy company stock would be considered classical insider trading.

- Tippee Insider Trading:This occurs when someone receives MNPI from an insider and uses it to trade securities. For instance, if a friend of the CFO is told about the upcoming merger before the public announcement and uses this information to buy stock, they would be considered a tippee involved in insider trading.

Ethical Implications of the CFO’s Stock Sale

The CFO’s stock sale raises ethical concerns, particularly if the sale was based on MNPI. While the specific details of the sale and the information available to the CFO are unknown, the situation warrants careful consideration.

- Breach of Trust:CFOs hold a position of trust within a company and are expected to act in the best interests of the company and its shareholders. Selling stock based on MNPI can be seen as a breach of this trust, as it potentially disadvantages other shareholders who are unaware of the information.

- Damage to Reputation:Insider trading allegations can severely damage the reputation of a company and its executives. Even if no wrongdoing is proven, the mere suspicion of insider trading can erode investor confidence and negatively impact the company’s stock price.

- Public Perception:The public perception of the CFO’s actions is also important. If the sale is perceived as unethical or illegal, it can damage the company’s image and its relationship with customers and investors.

Similar Instances of Insider Trading

Numerous high-profile cases of insider trading have occurred throughout history, highlighting the significant consequences of such actions. Some notable examples include:

- Martha Stewart:The former CEO of Martha Stewart Living Omnimedia was convicted of insider trading in 2004 after selling stock in ImClone Systems based on information she received from her broker about the company’s upcoming drug rejection. The case illustrated the potential legal and reputational ramifications of insider trading.

- Raj Rajaratnam:The former hedge fund manager was convicted in 2011 of insider trading charges for using illegal tips from insiders at various companies to make millions of dollars. The case highlighted the pervasive nature of insider trading and the lengths to which individuals may go to gain an unfair advantage in the market.

Impact on Employees and Stakeholders

The CFO’s stock sale, while seemingly a personal financial decision, can have a ripple effect throughout Weave Communications, impacting employees, investors, and the company’s overall standing. Understanding these potential implications is crucial for navigating the situation effectively.

The news of the CFO’s stock sale could spark concerns among employees and stakeholders. Employees may wonder if this signals a lack of confidence in the company’s future, potentially impacting their morale and commitment. Investors might interpret the sale as a sign of insider knowledge about potential challenges ahead, leading to decreased confidence in the company’s trajectory.

The potential impact on employee morale and company culture is significant, as it can affect productivity, innovation, and overall employee satisfaction.

Employee Morale and Company Culture

The CFO’s stock sale could raise questions about the company’s future prospects and the leadership’s faith in its success. Employees might feel uncertain about their job security and the long-term viability of the company, potentially leading to decreased morale and productivity.

A dip in employee morale can also affect company culture, leading to a less collaborative and positive work environment.

“A decline in employee morale can have a direct impact on productivity, innovation, and overall employee satisfaction. This can ultimately affect the company’s ability to attract and retain top talent.”

Discover how A-Mark Precious Metals executive sells over $4.1 million in company stock has transformed methods in this topic.

Weave Communications needs to address these concerns transparently and proactively. Communicating the rationale behind the CFO’s stock sale and emphasizing the company’s continued commitment to its employees and stakeholders can help alleviate anxieties and maintain a positive work environment.

Epilogue

The CFO’s stock sale, while a single event, serves as a microcosm of the complex interplay between company performance, investor confidence, and market dynamics. It highlights the delicate balance that businesses must maintain to navigate the ever-evolving economic landscape. As we dissect the motivations behind this sale and analyze the potential implications for Weave Communications, one thing remains clear: the story is far from over.

The market’s response, the company’s future plans, and the impact on employees and stakeholders will continue to unfold, offering valuable insights into the world of finance and the forces that shape it.

Expert Answers: Weave Communications CFO Sells 6k In Company Stock

What is Weave Communications?

Weave Communications is a company that provides software and services for businesses in the healthcare industry. Their platform helps healthcare providers manage patient communication, scheduling, and other aspects of their practice.

Why would a CFO sell their own company stock?

There are several reasons why a CFO might sell their own company stock. It could be for personal financial reasons, to diversify their portfolio, or because they have a different outlook on the company’s future than the market.

What are the potential risks and opportunities associated with the CFO’s stock sale?

The CFO’s stock sale could signal a lack of confidence in the company’s future, which could lead to a decline in investor sentiment and the stock price. However, it could also be a strategic move to raise capital for future growth or investments.

CentralPoint Latest News

CentralPoint Latest News