Ambarella CFO sells shares worth over $114k, raising eyebrows and prompting speculation among investors. This move comes at a time when Ambarella, a leading provider of video processing solutions, is navigating a complex landscape within the semiconductor industry. The sale, while seemingly routine, carries a weight of significance, prompting questions about the company’s financial health, future prospects, and the CFO’s own outlook on the company’s direction.

The transaction has ignited a flurry of inquiries about the potential motivations behind the sale. Is it a personal financial decision, a reflection of market trends, or perhaps an indication of inside knowledge about the company’s future? These questions, coupled with the recent performance of Ambarella’s stock, have created a climate of uncertainty for investors.

Ambarella’s Financial Performance: Ambarella CFO Sells Shares Worth Over 4k

Ambarella, a leading provider of computer vision chips, has been experiencing a mixed bag of financial results in recent quarters. While revenue has been relatively stable, the company has faced challenges with profitability and stock price performance.

Revenue and Earnings Trends

Ambarella’s revenue has remained relatively consistent in recent quarters, with a slight decline in the second quarter of 2023 compared to the first quarter. The company reported revenue of $77.8 million in the second quarter, a decrease of 3% from the previous quarter.

However, the company’s earnings have been more volatile. Ambarella reported a net loss of $1.2 million in the second quarter, compared to a net profit of $1.9 million in the first quarter. This decline in profitability was primarily attributed to higher operating expenses and a decrease in gross margins.

Factors Impacting Financial Performance

Several factors have contributed to Ambarella’s recent financial performance, including:

- Increased competition: Ambarella faces increasing competition from other chipmakers, such as Qualcomm and Nvidia, who are expanding into the computer vision market. This competition has put pressure on Ambarella’s pricing and margins.

- Slowing demand for automotive chips: The automotive industry has been impacted by supply chain disruptions and a decline in global vehicle production. This has led to a slowdown in demand for automotive chips, which is a key market for Ambarella.

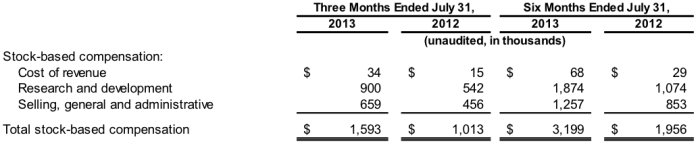

- Rising operating expenses: Ambarella has been investing heavily in research and development to maintain its technological edge. This has resulted in increased operating expenses, which have impacted profitability.

Impact of CFO’s Share Sale on Investor Sentiment

The CFO’s sale of shares worth over $114,000 could potentially raise concerns among investors about the company’s future prospects. While insider sales are not always indicative of a negative outlook, they can be interpreted as a sign of a lack of confidence in the company’s future performance.

This could lead to a decline in investor sentiment and put downward pressure on the stock price.

Insider Trading and Share Sales

The recent sale of Ambarella’s CFO shares, worth over $114,000, has sparked discussions about insider trading and its implications. While the sale itself may not be unusual, the timing and context raise questions about the CFO’s motives and potential market insights.

Potential Reasons for Share Sale

The CFO’s decision to sell shares could be driven by a variety of factors, including personal financial needs, market outlook, or company-specific information.

- Personal Financial Needs:The CFO may have personal financial obligations or investment strategies that necessitate selling shares. This is a common reason for insider trading, especially when individuals need to raise capital or diversify their portfolio.

- Market Outlook:The CFO’s sale could reflect a pessimistic view of the market or a belief that Ambarella’s stock price is likely to decline. This is particularly relevant if the CFO has access to confidential information about the company’s future performance or industry trends.

- Company-Specific Information:The CFO may have access to non-public information about Ambarella’s financial performance, future prospects, or strategic decisions that could impact the stock price. While the sale itself does not necessarily indicate negative news, it could suggest that the CFO is less confident about the company’s future.

Comparison with Previous Insider Trading Activity

It is crucial to compare the CFO’s recent share sale to previous insider trading activity at Ambarella. This analysis helps to determine if the sale is unusual or consistent with historical trends.

- Frequency and Volume:Examining the frequency and volume of previous insider trades by the CFO and other executives can provide insights into their typical trading patterns.

- Timing and Context:Analyzing the timing of previous trades in relation to company announcements, market trends, and other relevant events can reveal potential patterns and motives.

- Price Movements:Comparing the share sale price to the company’s stock price history can indicate if the CFO sold shares at a time when the price was unusually high or low.

Regulatory Implications of Insider Trading

Insider trading is strictly regulated to ensure fairness and transparency in the financial markets.

Insider trading is the buying or selling of a security, in breach of a fiduciary duty or other relationship of trust and confidence, while in possession of material nonpublic information about the security.

You also can investigate more thoroughly about BOJ holds interest rates, flags steady growth in inflation to enhance your awareness in the field of BOJ holds interest rates, flags steady growth in inflation.

- SEC Regulations:The Securities and Exchange Commission (SEC) enforces strict regulations against insider trading.

- Penalties:Violators of insider trading laws face severe penalties, including fines, imprisonment, and even the loss of their jobs.

- Transparency and Disclosure:Transparency in financial reporting is essential to maintaining market integrity. Companies are required to disclose insider trading activities to ensure that investors have access to all relevant information.

Ambarella’s Business Outlook

Ambarella, a leading provider of computer vision processors, is navigating a complex landscape within the semiconductor industry. While the company faces various challenges, it also possesses significant growth opportunities. This analysis delves into Ambarella’s current market position, key growth drivers, and strategic approach to navigating the evolving economic and industry trends.

Ambarella’s Market Position and Competitive Landscape

Ambarella occupies a niche position within the semiconductor industry, specializing in computer vision processors. This focus has positioned the company as a key player in the rapidly growing markets for automotive ADAS (Advanced Driver-Assistance Systems), security cameras, and drones. However, Ambarella faces intense competition from established semiconductor giants like Qualcomm and NVIDIA, which are also expanding their presence in the computer vision market.

Ambarella’s Growth Drivers and Potential Challenges

Ambarella’s growth hinges on several key factors:

- The increasing adoption of ADAS and autonomous driving technologies. The global automotive market is undergoing a significant transformation towards driver assistance and autonomous driving features. This trend is expected to drive demand for Ambarella’s computer vision processors, which are essential for enabling these technologies.

- The expansion of the smart home and security camera market. As homes become increasingly connected, the demand for smart home devices, including security cameras, is rising. Ambarella’s processors are well-suited for these applications, offering high-performance image processing and low power consumption.

- The growth of the drone industry. Drones are finding applications in various sectors, including delivery, surveillance, and agriculture. Ambarella’s processors play a critical role in enabling the advanced features of drones, such as autonomous flight and object recognition.

However, Ambarella also faces several challenges:

- The cyclical nature of the semiconductor industry. The semiconductor industry is subject to cyclical fluctuations in demand, which can impact Ambarella’s revenue and profitability.

- Intense competition from larger players. Ambarella competes with industry giants like Qualcomm and NVIDIA, which have deeper resources and broader product portfolios. This competition puts pressure on Ambarella to innovate and differentiate its offerings.

- The evolving nature of the computer vision market. The computer vision market is rapidly evolving, with new technologies and applications emerging constantly. Ambarella needs to adapt quickly to these changes to maintain its competitiveness.

Ambarella’s Strategic Approach to Navigating the Current Economic Environment and Industry Trends, Ambarella CFO sells shares worth over 4k

Ambarella has adopted a multi-pronged strategy to navigate the challenges and capitalize on the opportunities in the semiconductor industry:

- Focusing on niche markets. Ambarella has chosen to focus on specific market segments, such as automotive ADAS and security cameras, where it can leverage its expertise and build a strong competitive position.

- Investing in research and development. Ambarella invests heavily in research and development to stay ahead of the technological curve and develop innovative products that meet the evolving needs of its customers.

- Building strategic partnerships. Ambarella has formed strategic partnerships with key players in its target markets, including automotive manufacturers, security camera providers, and drone manufacturers. These partnerships provide access to new markets and technologies.

Impact on Investors

The CFO’s sale of shares, while seemingly a personal financial decision, can have a significant impact on investor confidence in Ambarella. Investors often view insider transactions as a signal of the company’s future prospects.

Stock Market Reaction and Implications

The news of the CFO’s share sale could lead to a variety of reactions in the stock market. A short-term sell-off might occur as investors react to the perceived negative signal. However, the long-term implications depend on several factors, including the company’s overall financial performance, industry trends, and the market’s overall sentiment.

Key Takeaways for Investors

The following table summarizes the key takeaways for investors based on the available information:

| Key Takeaway | Explanation |

|---|---|

| CFO’s share sale may signal a lack of confidence in the company’s future prospects. | Investors often interpret insider selling as a bearish signal, suggesting that the executive may have knowledge of potential challenges ahead. |

| The stock market reaction could be volatile in the short term. | The news could trigger a sell-off, but the long-term impact depends on various factors. |

| Investors should carefully consider the company’s overall financial performance and industry trends before making investment decisions. | The CFO’s share sale is just one piece of information, and investors should conduct thorough due diligence before making any investment decisions. |

Ultimate Conclusion

The CFO’s share sale serves as a stark reminder of the intricate dynamics at play within the world of corporate finance. While the sale itself may be a seemingly ordinary transaction, its implications are far-reaching. The move has triggered a cascade of questions about Ambarella’s future, the market’s perception of the company, and the intricate relationship between insider trading, investor confidence, and corporate transparency.

Essential Questionnaire

What is Ambarella’s primary business?

Ambarella is a leading provider of video processing solutions, specializing in chips and software for a variety of applications, including automotive, security, and consumer electronics.

What are the potential reasons for the CFO’s share sale?

The reasons could range from personal financial needs to a strategic outlook on the market or company-specific information. It’s important to note that insider trading regulations require disclosure of such transactions, and the CFO’s sale may not necessarily reflect a negative view of the company.

How does this sale impact investor sentiment towards Ambarella?

The impact can be varied. Some investors may see it as a negative sign, while others may not give it much weight. It ultimately depends on individual investor perspectives and how they interpret the transaction within the broader context of Ambarella’s business and market conditions.

CentralPoint Latest News

CentralPoint Latest News