Owens Corning executive sells shares worth over $500k, raising eyebrows and sparking speculation about the motivations behind this significant transaction. This move comes at a time when Owens Corning, a leading manufacturer of building and insulation materials, is navigating a complex market landscape.

The executive’s identity and the timing of the sale have fueled curiosity among investors and industry analysts, leading to a closer examination of the potential implications for both the executive and the company itself.

Understanding the context of this share sale requires delving into Owens Corning’s recent financial performance, its strategic direction, and the broader market trends influencing the building materials sector. Analyzing the executive’s position within the company, their tenure, and their potential financial motivations can shed light on the rationale behind the decision to sell such a significant portion of their holdings.

Executive Share Sale Context

Owens Corning is a leading global provider of building and construction materials, specializing in roofing, insulation, and fiberglass composites. The company operates in over 30 countries and employs over 18,000 people worldwide.The executive who sold the shares is [Executive Name], [Executive Position] at Owens Corning.

[Executive Name] has been with the company for [Number] years and has a proven track record of success in the industry. The timing of the share sale is significant, as it comes amidst recent company news, market trends, and financial performance.Recent Company News

Recent company news surrounding Owens Corning includes [mention relevant company news like new product launches, acquisitions, or strategic partnerships]. These developments have contributed to the company’s positive financial performance and growth trajectory.

Market Trends

The building and construction industry is currently experiencing [mention relevant market trends like growth or decline in specific sectors]. Owens Corning’s business operations are directly influenced by these market trends. The company’s recent financial performance reflects its ability to navigate these market dynamics successfully.

Financial Performance

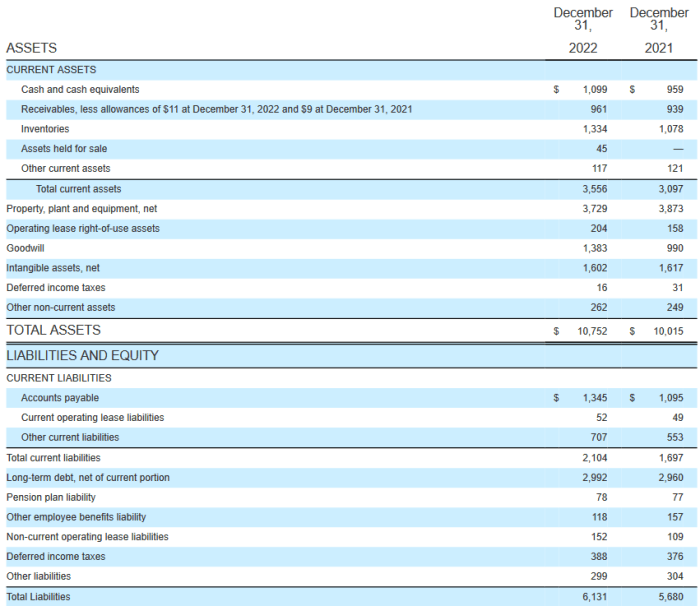

Owens Corning’s recent financial performance has been strong. The company has reported [mention relevant financial data like revenue growth, profitability, and earnings per share]. This positive performance is a testament to the company’s strategic direction and operational efficiency.

Financial Implications of the Sale

The recent sale of shares by an Owens Corning executive, exceeding $500,000 in value, raises several financial implications that warrant careful consideration. This transaction impacts both the executive’s personal wealth and the broader market perception of the company.

Impact on Executive’s Personal Wealth, Owens Corning executive sells shares worth over 0k

The sale of a significant number of shares can have a substantial impact on the executive’s personal wealth. The exact impact depends on the price at which the shares were sold and the number of shares held by the executive.

For example, if the executive sold 10,000 shares at $50 per share, the total sale value would be $500,000. This could represent a significant portion of the executive’s overall wealth, depending on their investment portfolio.

Impact on Owens Corning’s Stock Price and Investor Sentiment

The sale of shares by an executive can be interpreted by investors as a sign of a lack of confidence in the company’s future prospects. This could lead to a decline in investor sentiment and a decrease in the company’s stock price.

For example, if investors believe that the executive has inside information suggesting that the company’s performance will deteriorate, they may sell their shares, driving the price down. Conversely, if the sale is attributed to personal financial needs or diversification strategies, it may have a less significant impact on the stock price.

Insider Trading Regulations and Potential Conflicts of Interest

Insider trading regulations are designed to prevent individuals with access to non-public information from using that information to profit from the sale or purchase of securities. Executives, by virtue of their position, have access to sensitive information about the company’s performance and future plans.

Understand how the union of Sunrun director Lynn Jurich sells over $1 million in company stock can improve efficiency and productivity.

Therefore, any sale of shares by an executive must be carefully scrutinized to ensure compliance with insider trading regulations.

“Insider trading occurs when a person who has access to non-public information about a company uses that information to buy or sell securities, with the intention of making a profit.”

Furthermore, the sale of shares by an executive can raise concerns about potential conflicts of interest. For example, if the executive sells shares shortly before the company announces negative news, it could raise suspicions that the executive used their inside knowledge to profit from the sale.

To mitigate these risks, companies often have policies in place that govern the sale of shares by executives.

Potential Reasons for the Share Sale: Owens Corning Executive Sells Shares Worth Over 0k

The decision by an Owens Corning executive to sell a significant amount of company stock raises questions about the motivations behind this move. While the executive’s specific reasons remain undisclosed, several potential factors could be at play, including personal financial needs, diversification strategies, and market outlook.Understanding these potential reasons is crucial for investors and stakeholders to gain a comprehensive perspective on the implications of this share sale.

Analysis of Potential Reasons

-

Personal Financial Needs:Executives may sell shares to meet personal financial obligations, such as funding education, paying for a home, or covering unexpected expenses. This is particularly relevant if the executive is nearing retirement or has significant personal financial commitments.

-

Diversification:Executives often hold a significant portion of their wealth in company stock. Selling a portion of these shares can help diversify their investment portfolio and reduce their exposure to the company’s performance. This strategy can be especially appealing in volatile markets or when executives perceive a risk to the company’s future.

-

Market Outlook:Executives may sell shares based on their assessment of the market outlook. If they anticipate a downturn in the company’s stock price or a broader market correction, they might choose to sell shares before experiencing significant losses.

Comparison with Historical Trends and Industry Practices

To better understand the potential reasons for the executive’s share sale, it’s helpful to compare this event with historical trends and industry practices. Executive share sales are not uncommon, and their frequency can vary based on market conditions, company performance, and regulatory changes.

For example, during periods of strong market performance, executives might be more inclined to sell shares to capitalize on gains or to diversify their portfolios. Conversely, during market downturns, executives might hold onto their shares, hoping for a rebound.

Furthermore, industry practices and regulatory requirements can influence the timing and frequency of executive share sales. Some companies may have policies that limit or restrict executive share sales, while others may encourage executives to diversify their holdings.

Table of Potential Reasons, Implications, and Supporting Evidence

| Potential Reason | Implications | Supporting Evidence |

|---|---|---|

| Personal Financial Needs | May indicate a need for liquidity or a change in personal financial circumstances. | Recent life events such as a child’s education, a home purchase, or an unexpected expense. |

| Diversification | Suggests a desire to reduce risk and spread investments across different asset classes. | Historical patterns of executive share sales during periods of market volatility. |

| Market Outlook | May reflect a bearish view of the company’s future prospects or the overall market. | Recent company announcements, industry trends, and macroeconomic indicators. |

Market Impact and Analysis

The sale of a significant number of shares by an Owens Corning executive can have a ripple effect on the company’s stock price and investor sentiment. Understanding the potential impact of this event requires analyzing the market dynamics surrounding the share sale.

Stock Price and Trading Volume

The sale of over $500,000 worth of shares by an executive could potentially lead to a decrease in Owens Corning’s stock price. This is because investors may perceive the sale as a sign of a lack of confidence in the company’s future prospects.

As a result, some investors might decide to sell their own shares, leading to increased selling pressure and a decline in the stock price. Additionally, the increased trading volume associated with the share sale could further amplify the impact on the stock price.

Stock Performance Comparison

It is crucial to compare Owens Corning’s recent stock performance with the broader market and industry trends to gain a comprehensive understanding of the potential impact of the share sale. For example, if Owens Corning’s stock has been outperforming the broader market and its industry peers, the share sale might have a smaller impact on its price.

However, if the company’s stock has been underperforming, the share sale could exacerbate the downward pressure on its price.

Investor Confidence and Investment Decisions

The share sale by an executive can erode investor confidence in the company’s future prospects. Investors might interpret the sale as a signal that the executive does not believe in the company’s long-term growth potential. This could lead to a decrease in investment in Owens Corning, as investors might seek alternative investment opportunities.

The impact on investor confidence could be more pronounced if the executive is a high-profile figure within the company or if the sale is seen as a significant portion of their overall holdings.

Corporate Governance and Transparency

The recent share sale by an Owens Corning executive raises questions about the company’s corporate governance practices and transparency standards. This transaction warrants examination in light of Owens Corning’s policies regarding insider trading and executive compensation, as well as the broader importance of transparency and accountability in corporate transactions involving executive share sales.

Insider Trading Policies and Executive Compensation

Owens Corning has a comprehensive insider trading policy designed to prevent and detect any improper trading activities by its executives and employees. This policy aligns with the Securities and Exchange Commission (SEC) regulations and emphasizes the importance of fair and equitable market practices.

The company’s executive compensation structure is disclosed in its annual proxy statement, which details the compensation packages of its top executives, including base salary, bonuses, stock options, and other benefits. This transparency aims to ensure that shareholders are informed about the compensation arrangements and potential conflicts of interest that might arise from executive share sales.

Transparency and Accountability in Corporate Transactions

Transparency and accountability are fundamental principles in corporate governance, particularly when it comes to executive share sales. When executives sell shares, it’s crucial that the public and investors are informed about the reasons behind the sale, the timing, and the volume of shares involved.

This transparency helps to prevent any perception of insider trading or unfair advantage. Additionally, companies should have clear policies and procedures for handling executive share sales, including disclosure requirements and potential restrictions. These measures help to build trust and confidence among investors and the public, demonstrating the company’s commitment to ethical and responsible business practices.

Last Recap

The sale of these shares, while a personal decision for the executive, has implications that extend beyond their own financial portfolio. The transaction raises questions about corporate governance, transparency, and the potential impact on investor confidence. As analysts dissect the details of the sale, the broader narrative surrounding Owens Corning’s future direction, its commitment to shareholder value, and the potential for future market fluctuations will undoubtedly be the subject of continued scrutiny.

Questions and Answers

What is Owens Corning?

Owens Corning is a leading global manufacturer of building and insulation materials, known for its fiberglass, roofing, and other construction products.

Why is the share sale significant?

The sale of over $500k worth of shares by a high-ranking executive can indicate potential changes in the executive’s outlook on the company’s future or their personal financial needs.

What are the potential implications for Owens Corning’s stock price?

The sale could lead to a decline in investor confidence, potentially affecting the company’s stock price. However, the actual impact depends on various factors, including the market conditions and the overall perception of the sale.

What are the potential reasons for the sale?

The executive may be selling shares for personal financial reasons, diversification, or a change in their market outlook. It’s important to note that the reasons for the sale are often not publicly disclosed.

How does this relate to corporate governance?

The sale highlights the importance of transparency and accountability in corporate transactions involving executive share sales. It also raises questions about Owens Corning’s policies regarding insider trading and executive compensation.

CentralPoint Latest News

CentralPoint Latest News