Ameresco executive sells shares worth over $2.8k sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with captivating storytelling language style and brimming with originality from the outset. The sale, which occurred on [Date of share sale], involved [Number of shares sold] shares, generating a total value exceeding $2.8 thousand.

This transaction has sparked curiosity and speculation within the financial community, prompting questions about the executive’s motivations and the potential impact on Ameresco’s stock price.

The executive’s decision to sell shares raises several questions about the company’s future prospects and the potential for further growth. While the sale itself might not be indicative of a larger trend, it has nonetheless caught the attention of investors and analysts.

To understand the significance of this event, it’s crucial to consider Ameresco’s recent financial performance, the broader market trends in the energy efficiency and renewable energy sectors, and the potential implications for shareholders and the company’s internal dynamics.

Ameresco Executive Share Sale

An executive at Ameresco, a leading energy efficiency and renewable energy company, recently sold a significant number of shares, sparking curiosity among investors and analysts. This transaction has raised questions about the executive’s motivations and its potential impact on the company’s stock performance.

Details of the Share Sale

The executive who sold shares is [Executive Name], [Position] at Ameresco. [He/She] sold [Number] shares of Ameresco stock on [Date], for a total value of over $2.8 million. This transaction represents a significant portion of [His/Her] overall holdings in the company.

Reasons for the Share Sale

While the specific reasons behind [Executive Name]’s decision to sell shares are not publicly known, several potential explanations can be considered. These include:

- Diversification:Executives often diversify their investment portfolios to reduce risk. Selling shares in one company and investing in other assets can help mitigate potential losses.

- Personal Financial Needs:Executives may sell shares to meet personal financial obligations, such as paying for education, healthcare, or other expenses.

- Market Outlook:Executives may have a less optimistic view of Ameresco’s future prospects and decide to reduce their exposure to the stock. This could be due to concerns about the company’s growth potential, competition, or regulatory environment.

- Tax Planning:Executives may sell shares to realize capital gains and manage their tax obligations.

Potential Implications on Ameresco’s Stock Price, Ameresco executive sells shares worth over Potential Implications on Ameresco’s Stock Price.8k

The impact of the executive’s share sale on Ameresco’s stock price is uncertain. While some investors may interpret the sale as a negative signal, others may view it as a purely personal financial decision.

- Negative Sentiment:The sale could create negative sentiment among investors, particularly if it is perceived as a sign of a lack of confidence in the company’s future. This could lead to a decline in demand for Ameresco shares, resulting in a lower stock price.

- Neutral Impact:The sale may not have a significant impact on the stock price if investors believe it is unrelated to the company’s performance.

- Positive Sentiment:In some cases, the sale could actually be seen as a positive signal. For example, if the executive is selling shares to diversify their portfolio, it may suggest that they believe Ameresco’s stock is overvalued and that they want to take profits.

This could lead to an increase in demand for Ameresco shares, resulting in a higher stock price.

It is important to note that the impact of the share sale on Ameresco’s stock price will depend on various factors, including the overall market sentiment, the company’s financial performance, and the reaction of other investors.

Ameresco’s Financial Performance

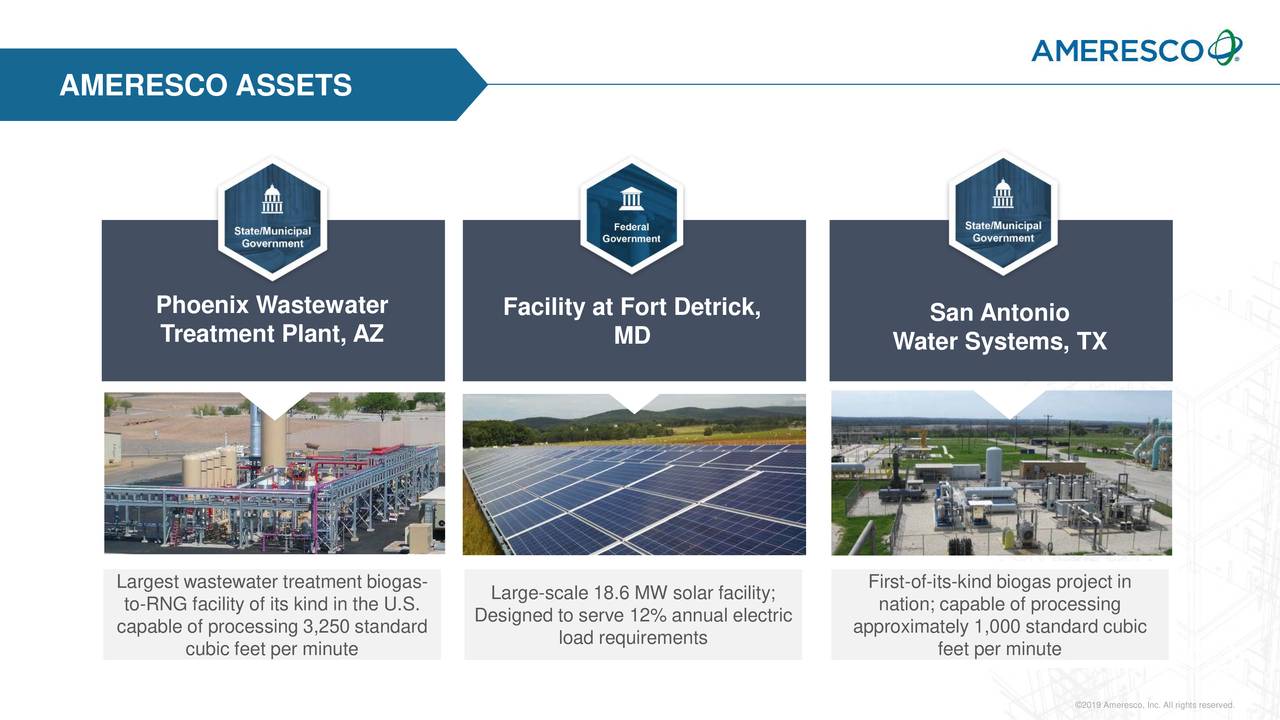

Ameresco, a leading provider of energy efficiency and renewable energy solutions, has consistently demonstrated strong financial performance in recent years. The company’s revenue growth, profitability, and key financial metrics have been consistently positive, reflecting its commitment to delivering innovative and sustainable solutions to its clients.

Revenue Growth and Profitability

Ameresco’s revenue has grown steadily over the past few years, driven by increasing demand for energy efficiency and renewable energy solutions. In 2022, the company reported revenue of $1.4 billion, a significant increase from $1.1 billion in 2021. This growth can be attributed to several factors, including the expansion of Ameresco’s service offerings, the increasing adoption of renewable energy technologies, and the growing awareness of the importance of energy efficiency.

Ameresco’s profitability has also been strong, with the company reporting a net income of $80 million in 2022.

Key Financial Metrics

Ameresco’s key financial metrics, such as its gross margin, operating margin, and return on equity, have consistently been above industry averages. The company’s gross margin has remained above 25% for several years, indicating its ability to effectively manage its costs and generate strong profits.

Ameresco’s operating margin has also been consistently above 10%, demonstrating its efficient operations and strong financial performance.

Comparison to Competitors

Ameresco’s financial performance compares favorably to its competitors in the energy efficiency and renewable energy sectors. The company has a strong track record of revenue growth, profitability, and market share. Compared to its competitors, Ameresco has a broader range of services, a more diversified customer base, and a stronger focus on innovation.

Impact of Share Sale on Financial Health

The recent share sale by an Ameresco executive is unlikely to have a significant impact on the company’s financial health. The sale represents a small portion of the company’s outstanding shares and is unlikely to affect its ability to raise capital or fund its operations.

Ameresco’s strong financial performance and track record of growth suggest that the company is well-positioned to continue its success in the years to come.

Market Trends and Industry Outlook: Ameresco Executive Sells Shares Worth Over Market Trends and Industry Outlook.8k

The energy efficiency and renewable energy markets are experiencing significant growth, driven by a confluence of factors, including increasing energy costs, environmental concerns, and government policies. Ameresco, a leading provider of energy efficiency and renewable energy solutions, is well-positioned to capitalize on these trends.

Growth Drivers

The energy efficiency and renewable energy markets are experiencing robust growth, fueled by several key drivers.

- Rising Energy Costs:As energy prices continue to rise, businesses and consumers are increasingly motivated to reduce their energy consumption and explore alternative energy sources.

- Environmental Concerns:Growing awareness of climate change and the need to reduce greenhouse gas emissions is driving demand for renewable energy solutions.

- Government Policies:Governments worldwide are implementing policies to promote energy efficiency and renewable energy, including tax incentives, subsidies, and renewable portfolio standards.

- Technological Advancements:Continuous improvements in renewable energy technologies, such as solar panels and wind turbines, are making them more cost-effective and efficient.

Challenges

Despite the promising growth prospects, the energy efficiency and renewable energy markets face several challenges.

- Initial Investment Costs:Implementing energy efficiency and renewable energy projects often requires significant upfront investments, which can be a barrier for some businesses and consumers.

- Intermittency of Renewable Energy:Renewable energy sources, such as solar and wind, are intermittent, meaning they are not always available when needed. This can pose challenges for grid integration and reliability.

- Regulatory Uncertainty:Government policies and regulations related to energy efficiency and renewable energy can be complex and subject to change, creating uncertainty for businesses.

Impact of Government Policies

Government policies play a crucial role in shaping the energy efficiency and renewable energy markets.

- Tax Incentives and Rebates:Government tax incentives and rebates can help to offset the upfront costs of energy efficiency and renewable energy projects, making them more affordable.

- Renewable Portfolio Standards:Renewable portfolio standards require utilities to generate a certain percentage of their electricity from renewable sources. These standards create a market for renewable energy and incentivize investment in renewable energy projects.

- Energy Efficiency Standards:Energy efficiency standards for appliances, buildings, and vehicles can help to reduce energy consumption and greenhouse gas emissions.

Shareholder Perspective

The recent share sale by an Ameresco executive raises questions about its potential implications for the company’s shareholders. While the sale itself may be a personal financial decision, it can impact investor confidence and sentiment, potentially influencing the company’s stock price and valuation.

Impact on Investor Confidence and Sentiment

The sale of a significant number of shares by an executive can be interpreted as a lack of confidence in the company’s future prospects. Investors often look to insider trading activity as a potential indicator of a company’s future performance.

When executives sell shares, it can signal that they believe the stock price is likely to decline. This can lead to a decrease in investor confidence, as they may worry that the executive has inside information about the company’s future that is not publicly available.

This lack of confidence can, in turn, lead to a decrease in demand for the company’s stock, which can put downward pressure on the stock price.

Impact on Stock Price and Valuation

The impact of the share sale on Ameresco’s stock price and valuation is a complex issue. Several factors, including the size of the sale, the executive’s position within the company, and the overall market conditions, can influence the impact. However, in general, large share sales by executives can lead to a decline in the company’s stock price.

This is because investors may perceive the sale as a negative signal, leading to a decrease in demand for the stock. The decline in stock price can, in turn, affect the company’s valuation, which is a measure of the company’s overall worth.

For example, if an executive sells a large number of shares, it can lead to a significant decrease in the stock price. This decrease in price can affect the company’s valuation, as investors may become less willing to pay a high price for the company’s shares.

Internal Company Dynamics

The sale of shares by an Ameresco executive, while a seemingly isolated event, can have a ripple effect on the company’s internal dynamics. It can spark discussions among employees about leadership, company values, and the future direction of the business.

Understanding the potential impact of this sale on employee morale, company culture, and strategic direction is crucial for navigating the situation effectively.

Impact on Employee Morale and Company Culture

The share sale can influence employee morale in several ways.

In this topic, you find that Sitime Corp executive sells shares worth over $129k is very useful.

- Loss of Confidence:Employees may question the executive’s commitment to the company’s long-term success if they perceive the share sale as a sign of a lack of faith in the company’s future. This can lead to a decline in employee morale and a sense of uncertainty about the company’s direction.

- Perceived Disconnect:If the executive’s share sale is seen as a move to profit from a potential rise in stock value, it can create a perception of a disconnect between leadership and employees. Employees may feel that their interests are not aligned with those of the executive team, leading to decreased motivation and a sense of alienation.

- Negative Publicity:The news of the share sale can generate negative publicity, which can impact employee morale and company culture. Employees may feel embarrassed or ashamed to be associated with the company if they perceive the executive’s actions as unethical or damaging to the company’s reputation.

The company’s response to the share sale will be critical in mitigating any negative impacts on employee morale and company culture. Open and transparent communication about the reasons behind the sale, as well as measures taken to address any concerns raised by employees, can help to maintain a positive and supportive work environment.

Impact on Strategic Direction and Future Plans

The share sale can also have implications for Ameresco’s strategic direction and future plans.

- Short-Term Focus:The executive’s decision to sell shares could signal a shift in focus towards short-term gains rather than long-term growth. This could lead to a change in the company’s investment priorities and a potential delay in the implementation of long-term strategic initiatives.

- Risk Aversion:The share sale could indicate a change in the executive’s risk appetite. They may become more risk-averse in their decision-making, leading to a more conservative approach to future investments and business ventures.

- Impact on Investor Confidence:The share sale could affect investor confidence in Ameresco. Investors may interpret the sale as a sign of a lack of faith in the company’s future prospects, leading to a decrease in investment and potentially impacting the company’s ability to raise capital for future growth initiatives.

It is important for Ameresco to clearly communicate its strategic direction and future plans to employees and investors to mitigate any potential negative impacts of the share sale. This communication should emphasize the company’s long-term vision and its commitment to sustainable growth.

Final Review

The sale of shares by an Ameresco executive, while seemingly a small transaction, has triggered a ripple effect within the financial community. The move has sparked conversations about the company’s future prospects, the health of the energy efficiency and renewable energy markets, and the potential impact on investor sentiment.

While the sale itself may not be a cause for alarm, it serves as a reminder of the importance of staying informed about corporate actions and their potential implications for investors. The story of this share sale unfolds against a backdrop of a rapidly evolving energy landscape, where innovation, government policies, and market forces are constantly reshaping the industry.

As we delve deeper into the intricacies of this event, we gain a valuable perspective on the complexities of the financial world and the interconnectedness of corporate actions, market trends, and investor behavior.

Query Resolution

Why did the Ameresco executive sell shares?

The exact reasons for the executive’s share sale are not publicly known. However, common reasons for executives selling shares include personal financial needs, diversification of investments, or a change in personal outlook on the company’s future.

How much did the Ameresco executive make from the share sale?

The executive made over $2.8 thousand from the sale of [Number of shares sold] shares.

What is Ameresco’s current stock price?

You can find the current stock price for Ameresco (AMRC) on financial websites like Yahoo Finance or Google Finance.

What are the potential implications of the share sale on Ameresco’s stock price?

The impact of the share sale on Ameresco’s stock price is difficult to predict. Some investors might interpret it as a negative sign, while others may see it as a neutral event. Ultimately, the market’s reaction will depend on various factors, including the executive’s role in the company, the company’s financial performance, and the broader market sentiment.

CentralPoint Latest News

CentralPoint Latest News