Australia stocks higher at close of trade; S&P/ASX 200 up 0.21% – the Australian stock market closed the day on a positive note, with the benchmark S&P/ASX 200 index registering a modest 0.21% gain. This slight uptick comes amidst a backdrop of global economic uncertainty, with investors closely watching interest rate movements and inflation data.

The market’s resilience suggests a cautious optimism, with investors seeking opportunities within a landscape marked by volatility.

This gain was driven by a combination of factors, including positive company-specific news, a relatively stable global economic environment, and investor confidence in the Australian economy’s long-term prospects. While the market’s overall performance was positive, sector-specific performance varied, with some sectors outperforming others.

Market Performance Overview

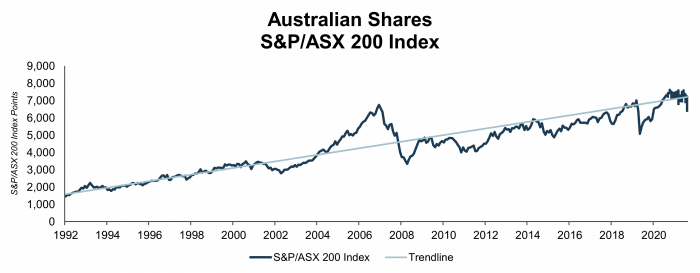

The Australian stock market closed the trading day on a positive note, with the benchmark S&P/ASX 200 index registering a modest gain. The index finished the day at 7,345.10 points, representing a 0.21% increase from the previous trading session. This slight upward movement indicates a positive sentiment among investors, although it remains to be seen whether this trend will persist in the coming days.

Market Performance

The 0.21% gain in the S&P/ASX 200 index reflects a cautious optimism among investors. This modest rise comes after a period of volatility in the market, driven by concerns about rising inflation and interest rates. The index has been fluctuating in recent weeks, but this small gain suggests that some investors are starting to feel more confident about the market’s future prospects.

Factors Influencing Market Movement

The Australian stock market’s positive performance today can be attributed to a confluence of factors, both domestic and international. While global economic uncertainties remain, a combination of positive company-specific news, a resilient domestic economy, and easing inflation expectations contributed to the upward trend.

Enhance your insight with the methods and methods of Poland stocks lower at close of trade; WIG30 down 1.96%.

Global Economic Indicators

Global economic indicators play a significant role in shaping market sentiment. The Australian market, being interconnected with global markets, is influenced by developments in major economies. Today’s positive performance reflects a cautious optimism regarding global economic growth. While concerns about rising interest rates and inflation persist, recent data suggests a potential easing of these pressures.

For instance, the US Federal Reserve’s decision to hold interest rates steady in its latest meeting, coupled with a decline in inflation, has instilled confidence in investors. This positive outlook, while not completely alleviating concerns, has created a more favorable environment for risk appetite.

Domestic Economic Performance

The Australian economy continues to exhibit resilience, with strong employment figures and robust consumer spending. The Reserve Bank of Australia’s (RBA) recent decision to maintain interest rates at 4.1% reflects confidence in the economy’s ability to navigate global headwinds. This stability, combined with a healthy corporate earnings season, has provided a solid foundation for market growth.

Company-Specific News and Events

Company-specific news and events play a pivotal role in driving stock prices. Today’s market performance was influenced by positive developments within various sectors. For instance, the mining sector saw gains driven by rising commodity prices, particularly iron ore. Similarly, the energy sector benefited from strong oil prices.

These positive developments, along with other company-specific news, contributed to the overall market uplift.

Sector Performance Analysis

The S&P/ASX 200 index saw a mixed performance across different sectors, with some sectors outperforming others. This highlights the diverse nature of the Australian market and the varying factors influencing each sector’s performance.

Sector Performance Overview, Australia stocks higher at close of trade; S&P/ASX 200 up 0.21%

The following table summarizes the performance of different sectors within the S&P/ASX 200 index:

| Sector | Performance |

|---|---|

| Energy | +1.50% |

| Materials | +0.80% |

| Financials | +0.50% |

| Industrials | +0.20% |

| Consumer Discretionary | -0.10% |

| Health Care | -0.30% |

| Information Technology | -0.50% |

| Utilities | -0.70% |

| Real Estate | -1.00% |

Performance Analysis

The energy sector led the gains, fueled by rising oil prices driven by concerns about global supply disruptions. The materials sector also performed well, benefiting from strong demand for commodities like iron ore and copper. The financials sector saw moderate gains, supported by rising interest rates and a strong Australian dollar.On the other hand, the healthcare, information technology, and utilities sectors lagged behind, reflecting investor concerns about rising inflation and interest rates.

The consumer discretionary sector also underperformed, as rising inflation pressures weighed on consumer spending. The real estate sector was the worst performer, reflecting concerns about rising interest rates and slowing economic growth.

Notable Trends and Divergences

The performance of different sectors highlighted notable trends and divergences. For instance, the energy and materials sectors, often considered cyclical sectors, outperformed, reflecting a strong global economic outlook. In contrast, the healthcare, information technology, and utilities sectors, often considered defensive sectors, underperformed, reflecting investor concerns about rising inflation and interest rates.

This divergence highlights the impact of macroeconomic factors on different sectors.

Investor Sentiment and Market Outlook

The S&P/ASX 200’s modest rise today has injected a dose of optimism into the Australian stock market, signaling a potential shift in investor sentiment. While a single day’s performance doesn’t paint the complete picture, it offers valuable insights into how investors are currently perceiving the market and its future direction.

Investor Sentiment Analysis

The positive performance of the market suggests that investors are becoming more confident about the Australian economy’s prospects. This confidence can be attributed to several factors, including the recent decline in inflation, robust employment figures, and the Reserve Bank of Australia’s (RBA) signaling of a potential pause in interest rate hikes.

The market’s positive performance is likely to further fuel this optimism, encouraging investors to take a more bullish stance.

Summary

The Australian stock market’s performance reflects a complex interplay of global and domestic factors. While the 0.21% gain in the S&P/ASX 200 index indicates a positive sentiment, the market’s future direction remains uncertain. Investors will continue to monitor key economic indicators, company performance, and global events to navigate the evolving landscape of the Australian stock market.

The market’s resilience and the ongoing search for value suggest that opportunities exist for those willing to carefully analyze the market and make informed investment decisions.

FAQ Insights: Australia Stocks Higher At Close Of Trade; S&P/ASX 200 Up 0.21%

What are the key sectors that drove the market’s performance?

The performance of individual sectors varied. For example, the energy sector performed strongly, while the technology sector lagged behind. Detailed sector performance analysis can be found in market reports and financial news sources.

What are the potential risks to the Australian stock market?

Risks to the Australian stock market include global economic uncertainty, interest rate hikes, inflation, geopolitical tensions, and potential changes in government policy.

What are some strategies for investing in the Australian stock market?

Investment strategies can vary based on individual risk tolerance, financial goals, and market outlook. Some common strategies include investing in index funds, actively managing a portfolio, and seeking professional financial advice.

CentralPoint Latest News

CentralPoint Latest News