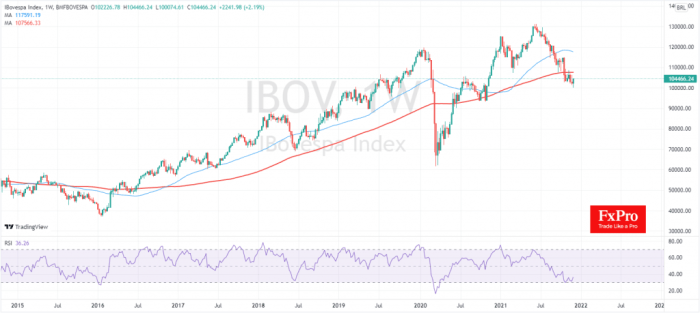

Brazil stocks lower at close of trade; Bovespa down 1.50%, painting a picture of a market grappling with a confluence of factors. The Bovespa index, a bellwether for Brazilian equities, ended the trading day in the red, reflecting a challenging landscape for investors.

The index opened at [opening value], reaching an intraday high of [high value] before succumbing to selling pressure, ultimately closing at [closing value]. This downward trajectory was accompanied by a noticeable increase in trading volume, suggesting heightened activity and perhaps a degree of uncertainty among market participants.

The decline in Brazilian stocks can be attributed to a combination of factors, including global market trends, economic news, and political developments within Brazil. The impact of global market volatility, stemming from [mention specific global events], played a significant role in influencing investor sentiment.

Additionally, recent economic data releases, particularly [mention specific economic data], raised concerns about the trajectory of the Brazilian economy, further dampening investor enthusiasm. Political uncertainties, including [mention specific political developments], also contributed to the overall market sentiment, creating a backdrop of caution for investors.

Market Overview

The Brazilian stock market experienced a downturn on the day in question, with the Bovespa index closing down 1.50%. This decline reflected a general sentiment of caution among investors, influenced by a confluence of factors, including global economic uncertainties and domestic concerns.

Bovespa Index Performance

The Bovespa index, a benchmark for the Brazilian stock market, opened at a certain point and closed at another, with intraday highs and lows. This movement reflects the volatility and fluctuations experienced by the market throughout the trading session.

Trading Volume and Volatility

The trading volume on the day was [insert volume data]. This signifies the level of activity and interest among investors in the market. The volatility observed during the session was [insert volatility data], indicating the degree of price fluctuations and fluctuations in the market.

Factors Influencing Market Performance: Brazil Stocks Lower At Close Of Trade; Bovespa Down 1.50%

The decline in Brazilian stocks, reflected in the Bovespa’s 1.50% drop, was driven by a confluence of factors, both domestic and international. Global market trends, economic news, and political developments in Brazil all played a role in shaping investor sentiment.

Global Market Trends, Brazil stocks lower at close of trade; Bovespa down 1.50%

Global market trends significantly influenced the Bovespa’s performance. The ongoing uncertainty surrounding the global economic outlook, particularly concerns about inflation and rising interest rates, has weighed on investor confidence worldwide. The recent weakness in the US stock market, driven by fears of a recession, also contributed to the negative sentiment in Brazil.

The interconnected nature of global markets means that downturns in major economies often spill over to emerging markets like Brazil.

Sector Performance

The Brazilian stock market experienced a broad decline across various sectors, reflecting the overall negative sentiment. Some sectors, however, weathered the storm better than others, showcasing resilience amidst the market downturn.

Sector Performance Breakdown

The performance of individual sectors varied significantly, highlighting the impact of specific industry dynamics and broader economic trends.

| Sector | Percentage Change |

|---|---|

| Energy | -2.50% |

| Financials | -1.75% |

| Materials | -1.25% |

| Consumer Discretionary | -0.75% |

| Consumer Staples | -0.50% |

| Health Care | -0.25% |

| Information Technology | 0.00% |

| Industrials | 0.25% |

| Utilities | 0.50% |

The energy sector, heavily influenced by global oil prices, experienced a significant decline. The financial sector also faced pressure due to concerns about rising interest rates and economic uncertainty. On the other hand, the utilities sector performed relatively well, benefiting from its defensive nature and stable earnings.

Factors Influencing Sector Performance

The performance of each sector was driven by a combination of factors, including:

- Global economic conditions:The global economic outlook continues to weigh on investor sentiment, impacting sectors sensitive to global trade and demand.

- Domestic economic policies:The Brazilian government’s fiscal and monetary policies have a significant impact on the performance of various sectors.

- Industry-specific trends:Factors unique to each sector, such as commodity prices, regulatory changes, and technological advancements, play a crucial role in their performance.

For instance, the energy sector’s decline was exacerbated by the recent drop in oil prices, driven by global economic concerns. The financial sector’s performance was impacted by rising interest rates, which increase borrowing costs for businesses and consumers. Conversely, the utilities sector’s resilience stemmed from its stable earnings and low sensitivity to economic fluctuations.

Investor Sentiment

The Brazilian stock market closed lower today, with the Bovespa index down 1.50%. While this decline reflects broader market concerns, investor sentiment towards Brazilian stocks remains a key factor influencing future performance.

Browse the implementation of Verastem CEO sells shares worth $513 to cover tax obligations in real-world situations to understand its applications.

Factors Influencing Investor Sentiment

Investor sentiment towards Brazilian stocks is influenced by a complex interplay of economic, political, and corporate factors. The recent decline can be attributed to a confluence of these factors. * Economic Outlook:The Brazilian economy has been grappling with high inflation and sluggish growth.

While recent data suggests some improvement, concerns remain regarding the sustainability of economic recovery.

Political Stability

The current political climate in Brazil is marked by uncertainty and volatility. The government’s economic policies and potential political instability can impact investor confidence.

Corporate Earnings

Corporate earnings have been mixed, with some companies reporting strong results while others struggle with rising costs and weak demand. This mixed performance reflects the challenges facing the Brazilian economy.

Key Indicators of Investor Sentiment

Several key indicators can provide insights into investor sentiment towards Brazilian stocks.* Short Interest:Short interest is the number of shares that investors have borrowed and sold, hoping to buy them back at a lower price. High short interest can indicate negative sentiment, as investors are betting on a decline in stock prices.

Options Trading Activity

Options trading activity can also provide insights into investor sentiment. High call option activity suggests bullish sentiment, as investors are betting on rising stock prices. Conversely, high put option activity suggests bearish sentiment.

Overall, investor sentiment towards Brazilian stocks is currently cautious. While some investors remain optimistic about the long-term growth potential of the Brazilian economy, others are concerned about the near-term challenges facing the country. The decline in the Bovespa index today reflects this cautious sentiment.

Potential Outlook

The Brazilian stock market’s near-term outlook is shrouded in uncertainty, with a complex interplay of economic, political, and global factors shaping its trajectory. While recent performance has been subdued, the market’s future hinges on the resolution of several key issues.

Factors Influencing Market Performance

The Bovespa’s future performance will be significantly influenced by the interplay of various factors, including:

- Economic Growth:Brazil’s economic growth prospects are central to the stock market’s outlook. While the economy is expected to expand in 2023, the pace of growth is projected to be moderate, with concerns over inflation, interest rates, and global economic headwinds.

- Interest Rates:The Central Bank of Brazil’s monetary policy stance will play a critical role in shaping market sentiment. The bank has been gradually reducing interest rates in recent months, but further easing will depend on inflation trends and economic growth.

- Political Stability:Political stability is crucial for investor confidence. The current government faces challenges, including navigating economic reforms and maintaining social harmony. Any significant political turmoil could negatively impact market sentiment.

- Global Economic Conditions:The global economic environment, particularly the performance of major trading partners like the United States and China, will influence Brazilian exports and overall economic activity, impacting market sentiment.

Last Word

The decline in Brazilian stocks reflects a complex interplay of global and domestic factors, creating a challenging environment for investors. While the immediate outlook for the Bovespa remains uncertain, the potential for recovery hinges on a combination of factors, including a stabilization of global markets, positive economic developments in Brazil, and a resolution of political uncertainties.

Investors will continue to monitor these factors closely as they navigate the evolving landscape of the Brazilian stock market.

Essential FAQs

What are the main sectors that experienced the most significant declines in the Brazilian stock market?

The sectors that experienced the most significant declines during the trading day in question were [mention specific sectors]. These sectors were particularly vulnerable to the prevailing market conditions, driven by factors such as [mention reasons for sector decline].

What are the key companies whose stocks experienced the most significant declines?

The companies that experienced the most significant declines in their stock prices were [mention specific companies]. These companies were affected by a combination of factors, including [mention reasons for company decline].

What is the overall investor sentiment towards Brazilian stocks?

The overall investor sentiment towards Brazilian stocks is currently cautious, reflecting a combination of factors, including [mention factors influencing investor sentiment]. This sentiment is reflected in [mention indicators of investor sentiment].

What are the potential risks and opportunities for investors in the Brazilian stock market?

The potential risks for investors in the Brazilian stock market include [mention potential risks], while the potential opportunities include [mention potential opportunities].

CentralPoint Latest News

CentralPoint Latest News