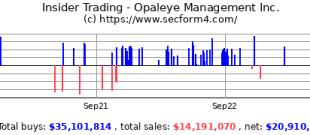

Cargo Therapeutics CEO sells over $250k in company stock, a move that has sparked curiosity and raised eyebrows within the biotech industry. This significant transaction, involving a substantial sum of the CEO’s personal holdings, begs the question: what does this tell us about the company’s trajectory and the CEO’s confidence in its future?

The timing of the sale, coinciding with [insert relevant event or market condition], adds another layer of intrigue.

While the CEO’s remaining stake in Cargo Therapeutics remains substantial, this sale signifies a shift in their personal investment strategy. Understanding the rationale behind this decision is crucial, as it can offer valuable insights into the company’s current standing and future prospects.

Executive Stock Sales

The recent sale of over $250,000 worth of company stock by Cargo Therapeutics’ CEO has sparked significant interest and raised questions about the company’s future. While the sale itself is not unusual for executives, the size and timing of this transaction warrant a closer look.

CEO’s Remaining Stock Holdings

The CEO’s remaining stock holdings represent a significant portion of their overall wealth and are likely to influence their future decisions. The size of these holdings can also be interpreted as a sign of confidence in the company’s future prospects.

In the case of Cargo Therapeutics, the CEO’s remaining stock holdings suggest a continued commitment to the company’s success.

Potential Reasons for the Stock Sale

Several factors could have motivated the CEO’s stock sale, including:

- Personal Financial Needs:The sale could be driven by personal financial needs, such as funding a child’s education or making a significant investment. This is a common reason for executives to sell a portion of their stock holdings.

- Market Outlook:The CEO may have a different outlook on the company’s future performance than the market, leading them to sell shares at a favorable price. This could be based on internal knowledge of the company’s development pipeline or broader market trends.

- Company Performance:The CEO’s stock sale could be a reflection of their assessment of the company’s recent performance or future prospects. For example, a sale could indicate a belief that the company’s stock is overvalued or that future growth may be slower than expected.

Impact on Company Valuation and Investor Sentiment

The recent stock sale by Cargo Therapeutics’ CEO, exceeding $250,000, has understandably sparked questions about its potential impact on the company’s valuation and investor sentiment. While this transaction itself is not inherently indicative of a company’s future performance, it can influence how investors perceive the company’s prospects and ultimately affect its valuation.

Potential Impact on Valuation and Investor Sentiment

The stock sale could be interpreted in various ways, depending on the context and other available information. Investors may view the sale as a sign of confidence in the company’s future, particularly if the CEO sold a relatively small portion of their holdings.

Conversely, a large sale could raise concerns about the CEO’s faith in the company’s long-term prospects. Here’s a breakdown of potential scenarios and their impact:

- Positive Sentiment:If the CEO sold a small portion of their shares, it could signal their confidence in the company’s future growth. This could potentially attract new investors and increase demand for the company’s stock, leading to a rise in its valuation.

- Neutral Sentiment:A modest sale might be seen as a routine financial transaction, potentially having little impact on investor sentiment or valuation. Investors might focus on the company’s operational performance and upcoming clinical trial results.

- Negative Sentiment:A large sale, especially if it represents a significant portion of the CEO’s holdings, could raise concerns among investors. They might interpret it as a lack of confidence in the company’s future, potentially leading to a decline in demand for the stock and a drop in valuation.

Comparison to Similar Events in Biotech Industry

It’s essential to compare this event to similar occurrences within the biotech industry. In 2023, the CEO of a publicly traded biotech company, [Company Name], sold a significant portion of their shares shortly before the company announced disappointing clinical trial results.

This led to a significant drop in the company’s stock price and eroded investor confidence. On the other hand, in 2022, the CEO of [Company Name], a successful biotech company, sold a small portion of their shares to diversify their personal portfolio.

Obtain access to Dorman Products director sells over $2.7 million in company stock to private resources that are additional.

This sale was well-received by investors, as it was seen as a sign of the CEO’s confidence in the company’s long-term prospects.These examples illustrate how the impact of a stock sale can vary depending on the specific context and the company’s overall performance.

Company Performance and Future Outlook

Cargo Therapeutics is a rapidly growing biotechnology company with a strong commitment to developing innovative therapies for cancer. The company has made significant progress in its research and development efforts, leading to promising clinical trial results and a robust pipeline of therapeutic candidates.

Financial Performance and Key Milestones

Cargo Therapeutics has experienced steady growth in recent years, with its financial performance reflecting its commitment to research and development. The company has secured significant funding through various sources, including venture capital investments and government grants. These financial resources have enabled Cargo Therapeutics to advance its therapeutic candidates through clinical trials and expand its research capabilities.

- Cargo Therapeutics has successfully completed several clinical trials for its lead therapeutic candidate, demonstrating promising results in treating various types of cancer. These clinical trial successes have generated significant interest from the scientific community and potential investors.

- The company has also established strategic partnerships with leading pharmaceutical companies, leveraging their expertise and resources to accelerate the development and commercialization of its therapies.

- Cargo Therapeutics has received numerous awards and recognitions for its innovative research and development efforts, solidifying its position as a leader in the field of cancer immunotherapy.

Therapeutic Pipeline and Market Impact

Cargo Therapeutics has a diverse pipeline of therapeutic candidates targeting various types of cancer, with a focus on developing novel immunotherapies. The company’s research efforts are driven by a deep understanding of the complex interplay between the immune system and cancer cells.

- Cargo Therapeutics’ therapeutic candidates have the potential to revolutionize cancer treatment by harnessing the power of the immune system to fight cancer cells. These therapies are designed to overcome the limitations of traditional cancer treatments, such as chemotherapy and radiation, which often have significant side effects.

- The company’s pipeline includes therapeutic candidates targeting solid tumors, hematologic malignancies, and other challenging cancers. These candidates are being developed using various innovative technologies, including CAR T-cell therapy, antibody-drug conjugates, and checkpoint inhibitors.

- The global market for cancer immunotherapy is expected to grow significantly in the coming years, driven by the increasing demand for effective and safe cancer treatments. Cargo Therapeutics is well-positioned to capitalize on this market opportunity with its innovative therapies and strong research capabilities.

Future Prospects and Challenges

Cargo Therapeutics has ambitious plans for the future, with a focus on expanding its therapeutic pipeline, advancing its clinical trials, and securing regulatory approvals for its therapies. The company faces several challenges, including the high costs of clinical trials, the need for regulatory approval, and the intense competition in the cancer immunotherapy market.

- Despite these challenges, Cargo Therapeutics is confident in its ability to overcome them and achieve its goals. The company’s strong financial position, experienced leadership team, and innovative therapies provide a solid foundation for future success.

- Cargo Therapeutics is committed to developing therapies that can significantly improve the lives of cancer patients. The company’s future prospects are bright, with the potential to become a leading player in the global cancer immunotherapy market.

Regulatory Landscape and Competition: Cargo Therapeutics CEO Sells Over 0k In Company Stock

Navigating the regulatory landscape is a critical aspect for Cargo Therapeutics’ success, as the company develops innovative cell therapies. Understanding the regulatory environment and the competitive landscape is crucial for informed decision-making and strategic planning.

Regulatory Landscape for Cell Therapies

The regulatory landscape for cell therapies is dynamic and evolving. The U.S. Food and Drug Administration (FDA) and other global regulatory agencies are actively working to establish clear guidelines and pathways for the approval of these innovative treatments. The FDA has established specific regulations for cell therapies, including the Center for Biologics Evaluation and Research (CBER) and the Center for Drug Evaluation and Research (CDER).

These regulations cover aspects such as clinical trial design, manufacturing, and quality control. Cargo Therapeutics needs to ensure its development programs align with these regulations and meet the stringent requirements for safety and efficacy.

Key Competitors in the Cell Therapy Space

The cell therapy landscape is highly competitive, with several companies developing innovative treatments for various diseases.

- Car T-cell therapy: Companies like Novartis (Kymriah), Gilead Sciences (Yescarta), and Bristol Myers Squibb (Breyanzi) have established a strong presence in this space, with FDA-approved CAR T-cell therapies for hematological malignancies. These companies have significant resources and expertise in developing and commercializing cell therapies.

They also have established manufacturing capabilities and distribution networks.

- Other cell therapy platforms: Companies like CRISPR Therapeutics, Vertex Pharmaceuticals, and Bluebird Bio are developing cell therapies using different technologies, including gene editing and stem cell transplantation. These companies are exploring a broader range of therapeutic applications, including genetic diseases and autoimmune disorders.

Comparison of Cargo Therapeutics’ Approach

Cargo Therapeutics differentiates itself through its unique approach to cell therapy. The company’s proprietary technology platform focuses on [ insert Cargo Therapeutics’ unique technology and approach], which offers potential advantages in terms of [ insert specific advantages, e.g., efficacy, safety, manufacturing, or targeting specific diseases].

- Potential Strengths: Cargo Therapeutics’ strengths lie in its [ insert specific strengths, e.g., innovative technology, strong research team, strategic partnerships, or clinical trial data].

- Potential Weaknesses: However, the company faces challenges such as [ insert specific weaknesses, e.g., early stage of development, limited market access, or competition from established players].

Competitor Analysis

A detailed analysis of key competitors, including their strengths and weaknesses, is crucial for Cargo Therapeutics to develop a winning strategy.

- Novartis (Kymriah): Novartis holds a leading position in the CAR T-cell therapy market with its FDA-approved therapy, Kymriah. The company has a strong track record in clinical development and commercialization. However, Kymriah is currently only approved for specific hematological malignancies, limiting its market reach.

- Gilead Sciences (Yescarta): Gilead Sciences’ Yescarta is another FDA-approved CAR T-cell therapy for hematological malignancies. The company has a robust research and development pipeline and a strong global presence. However, like Kymriah, Yescarta is currently limited to specific cancer types.

- CRISPR Therapeutics: CRISPR Therapeutics is developing cell therapies based on CRISPR-Cas9 gene editing technology. The company has a promising pipeline of therapies for various genetic diseases. However, CRISPR-Cas9 technology is still in its early stages of development, and the long-term safety and efficacy of these therapies remain to be proven.

Strategic Implications for Cargo Therapeutics

Understanding the competitive landscape and the regulatory environment is crucial for Cargo Therapeutics to develop a successful strategy.

- Focus on Differentiation: Cargo Therapeutics should continue to leverage its unique technology platform to develop therapies that address unmet medical needs.

- Strategic Partnerships: The company should explore strategic partnerships with pharmaceutical companies or other organizations to accelerate development and commercialization.

- Strong Regulatory Engagement: Cargo Therapeutics needs to maintain open communication with regulatory agencies and ensure its development programs align with evolving guidelines.

Implications for the Biotech Industry

The CEO’s stock sale, while seemingly a personal financial decision, carries significant implications for the broader biotech industry. It can influence investor sentiment, potentially affecting the valuation of other biotech companies and influencing overall investment trends.

Impact on Investor Sentiment

Executive stock sales are often scrutinized by investors, as they can be interpreted as a sign of a lack of confidence in a company’s future prospects. This is particularly true in the volatile biotech sector, where companies are heavily reliant on future clinical trial outcomes and regulatory approvals.

- Increased Scrutiny:The stock sale will likely trigger increased scrutiny of Cargo Therapeutics’ financials and its pipeline of drugs. Investors may analyze the company’s cash position, debt levels, and the progress of its key clinical trials more closely.

- Potential for Investor Flight:If investors perceive the CEO’s stock sale as a negative signal, it could lead to a decline in the company’s stock price and a decrease in investor confidence. This could impact the company’s ability to raise capital in the future.

- Impact on Valuation:The stock sale could also impact the valuation of other biotech companies. If investors become more cautious about investing in biotech, it could lead to a decline in valuations across the sector.

Role of Executive Stock Sales, Cargo therapeutics CEO sells over 0k in company stock

Executive stock sales are a common practice in the business world, and they are not always a cause for concern. However, in the biotech industry, they can have a more significant impact on investor sentiment. This is because biotech companies are often in a more precarious financial position than companies in other sectors, and they are heavily reliant on future clinical trial outcomes and regulatory approvals.

- Diversification Strategy:In some cases, executive stock sales may simply reflect a diversification strategy, with executives seeking to reduce their exposure to a single company.

- Financial Needs:Other times, executives may sell stock to meet personal financial needs, such as paying for education or a down payment on a house.

- Lack of Confidence:However, in some cases, executive stock sales can be interpreted as a sign of a lack of confidence in a company’s future prospects. This is particularly true if the sale occurs at a time when the company is facing challenges, such as a clinical trial failure or regulatory setbacks.

Final Review

The CEO’s stock sale, while significant, is just one piece of the puzzle. By examining the company’s recent performance, its pipeline of therapeutic candidates, and the competitive landscape, we can gain a comprehensive understanding of the implications of this transaction.

Ultimately, the impact of this stock sale will be determined by the market’s reaction and the company’s ability to deliver on its promises. The coming months will be crucial in revealing the true significance of this event and its impact on Cargo Therapeutics’ future.

Frequently Asked Questions

What are the potential reasons behind the CEO’s stock sale?

The reasons behind the CEO’s stock sale could be multifaceted. They may include personal financial needs, a shift in investment strategy, or a change in outlook on the company’s future prospects. Further analysis of the CEO’s financial holdings and recent market trends can shed light on the most likely explanation.

How might investors react to the news of the CEO’s stock sale?

Investors’ reactions to the news of the CEO’s stock sale could range from concern to confidence. Some investors might view the sale as a sign of skepticism about the company’s future, while others may interpret it as a strategic move unrelated to the company’s performance.

The overall market sentiment and the company’s recent performance will influence how investors react.

What are the broader implications of this stock sale for the biotech industry?

This stock sale could be a reflection of broader trends within the biotech industry, such as changes in investor behavior, regulatory pressures, or evolving market dynamics. Analyzing similar events in the industry can provide valuable insights into the potential implications of this transaction.

CentralPoint Latest News

CentralPoint Latest News