Colombia stocks higher at close of trade; COLCAP up 1.02% – Colombia stocks closed higher at the end of the trading day, with the COLCAP index, a benchmark for the Colombian stock market, rising by a robust 1.02%. This upward trajectory signals a positive sentiment among investors, reflecting a combination of economic indicators and market trends that propelled the Colombian stock market to new heights.

The rise in the COLCAP can be attributed to several factors, including strong economic fundamentals, positive investor sentiment, and a favorable global market environment. The Colombian economy has shown resilience in recent months, with key economic indicators demonstrating growth and stability.

This has boosted investor confidence, leading to increased investment in the Colombian stock market. Additionally, the global stock market has been performing well, with investors seeking opportunities in emerging markets like Colombia. This confluence of factors has created a positive environment for the Colombian stock market to thrive.

Market Performance Overview

The Colombian stock market closed the trading day on a positive note, with the COLCAP index, a key indicator of the overall performance of the Colombian stock market, surging by 1.02%. This upward trend signifies investor confidence in the Colombian economy and its potential for growth.

COLCAP Index Performance

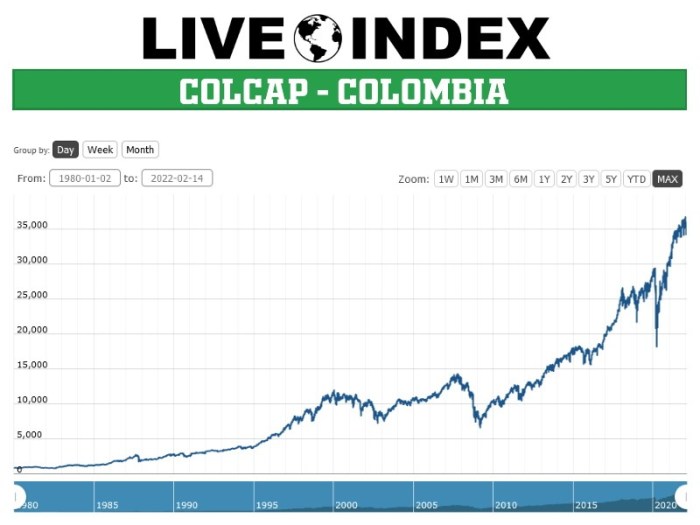

The COLCAP index, or the “Índice General de la Bolsa de Valores de Colombia,” serves as a benchmark for the Colombian stock market. It reflects the weighted average performance of the 20 most actively traded companies on the Colombian Stock Exchange (BVC).

The index’s 1.02% increase suggests a broad-based positive sentiment among investors, indicating their optimism about the future of Colombian businesses and the overall economy.

Factors Contributing to the Rise

Several factors contributed to the COLCAP’s positive performance. The Colombian economy has shown resilience in recent months, with strong economic indicators, such as robust consumer spending and steady growth in key sectors. This economic strength has attracted foreign investors, who see Colombia as a promising emerging market.

Additionally, the recent decline in global oil prices has benefited Colombia, a major oil producer, as it reduces production costs and increases profitability for energy companies. These positive economic fundamentals have boosted investor confidence, leading to increased buying activity in the stock market.

Notable Sector Performances

The energy sector, buoyed by the decline in oil prices, performed exceptionally well during the trading session. Several energy companies saw significant gains, reflecting investors’ optimism about the sector’s future prospects. The financial sector also performed strongly, driven by robust earnings reports from major banks.

These reports indicated healthy loan growth and strong capital positions, signaling a positive outlook for the financial sector.

Key Factors Influencing Market Performance

The Colombian stock market’s positive performance today can be attributed to a confluence of factors, including a favorable economic outlook, positive investor sentiment, and a global market environment that is generally supportive of emerging markets.

Obtain access to Intuitive Machines executive sells shares worth over $2.47 million to private resources that are additional.

Economic Indicators and Events

The recent economic data released in Colombia has been positive, indicating a strong and resilient economy. For instance, the latest inflation figures showed a continued decline, suggesting that the central bank’s monetary policy is effectively controlling inflation. This, in turn, has led to increased confidence among investors that the Colombian economy is on a solid footing.

Sector-Specific Performance

The Colombian stock market saw a broad-based rally today, with most sectors participating in the upward trend. However, certain sectors outperformed others, demonstrating the diverse nature of the market’s growth.

Sector Performance Summary

The following table provides a snapshot of the performance of key sectors in the Colombian stock market:

| Sector | Performance | Notable Gains/Losses | Reasons |

|---|---|---|---|

| Financials | +1.54% | Banco de Bogotá (Bbg.co) up 2.3%, Bancolombia (Bcolombia.co) up 1.8% | Stronger-than-expected earnings reports from major banks, indicating a positive outlook for the financial sector. |

| Energy | +0.87% | Ecopetrol (Ecopetrol.co) up 1.2%, Cenit (Cenit.co) up 0.5% | Rising oil prices globally boosted the energy sector, leading to increased investor confidence. |

| Consumer Discretionary | +1.21% | Almacenes Exito (Exito.co) up 2.1%, Grupo Sura (Sura.co) up 1.3% | Strong retail sales figures and a positive outlook for consumer spending drove gains in the sector. |

| Materials | +0.45% | Cementos Argos (Argos.co) up 0.7%, Minera Gran Colombia (Grancolombia.co) up 0.3% | Increased demand for construction materials and rising commodity prices contributed to the sector’s performance. |

Top-Performing Stocks

Here are the top-performing stocks during the trading session, highlighting their significant gains:

| Stock | Ticker | Performance | Reason |

|---|---|---|---|

| Banco de Bogotá | Bbg.co | +2.3% | Stronger-than-expected earnings report, signaling positive growth prospects. |

| Almacenes Exito | Exito.co | +2.1% | Robust retail sales figures and a positive outlook for consumer spending. |

| Grupo Sura | Sura.co | +1.3% | Positive outlook for the insurance and financial services sectors. |

| Ecopetrol | Ecopetrol.co | +1.2% | Rising oil prices globally, driving increased investor confidence. |

Investor Sentiment and Outlook: Colombia Stocks Higher At Close Of Trade; COLCAP Up 1.02%

The Colombian stock market closed higher today, reflecting a generally positive sentiment among investors. This upward trend suggests a growing confidence in the country’s economic prospects and the potential for continued growth in the corporate sector.

Factors Influencing Investor Confidence, Colombia stocks higher at close of trade; COLCAP up 1.02%

Several factors are contributing to the current optimistic outlook for the Colombian stock market.

- Economic Recovery:Colombia’s economy is showing signs of recovery after the pandemic, with strong growth in key sectors like manufacturing and services. This positive economic environment is boosting investor confidence, as companies are expected to perform better and generate higher returns.

- Government Policies:The Colombian government has implemented policies aimed at attracting foreign investment and promoting economic growth. These policies, such as tax incentives and infrastructure development, are seen as favorable for businesses and investors.

- Commodity Prices:Colombia is a major exporter of commodities, and the recent rise in prices for oil and other raw materials has benefited the country’s economy. This increase in commodity prices has translated into higher profits for Colombian companies, further supporting investor confidence.

Expert Opinions and Forecasts

Analysts and experts generally hold a positive outlook for the Colombian stock market in the short to medium term. They cite the country’s strong economic fundamentals, government initiatives, and the potential for continued growth in key sectors as reasons for optimism.

- Short-term Outlook:Experts anticipate continued growth in the Colombian stock market in the coming months, driven by factors such as improving economic conditions and strong corporate earnings.

- Long-term Outlook:The long-term outlook for the Colombian stock market remains positive, with experts highlighting the country’s potential for sustained economic growth and its attractiveness to foreign investors.

Ultimate Conclusion

The surge in Colombian stocks, with the COLCAP index closing higher, reflects a positive outlook for the Colombian economy and the stock market. Investors are optimistic about the future performance of Colombian companies, driven by strong economic fundamentals and a favorable global market environment.

While the market may experience fluctuations in the short term, the long-term outlook for Colombian stocks remains positive, attracting investors seeking growth opportunities in emerging markets.

FAQ Compilation

What is the COLCAP index?

The COLCAP index is a benchmark for the Colombian stock market, representing the performance of the largest and most liquid companies listed on the Colombian Stock Exchange (BVC).

What are the key sectors that contributed to the COLCAP’s rise?

The performance of the COLCAP is influenced by various sectors, including financials, energy, materials, and consumer discretionary. Analyzing the performance of each sector can provide insights into the drivers of the overall market movement.

What are the potential risks to the Colombian stock market?

While the Colombian stock market has shown positive momentum, investors should be aware of potential risks such as global economic uncertainty, political instability, and changes in interest rates. These factors can impact investor sentiment and market performance.

CentralPoint Latest News

CentralPoint Latest News