Davidson Kempner exec sells $5 million in Angel Oak Mortgage REIT stock, a move that has sent ripples through the mortgage REIT market. This significant transaction raises questions about the future of Angel Oak Mortgage REIT and the overall health of the mortgage REIT sector.

The sale, which occurred amidst a backdrop of rising interest rates and a volatile housing market, has sparked speculation about Davidson Kempner’s investment strategy and the potential impact on Angel Oak Mortgage REIT’s stock price.

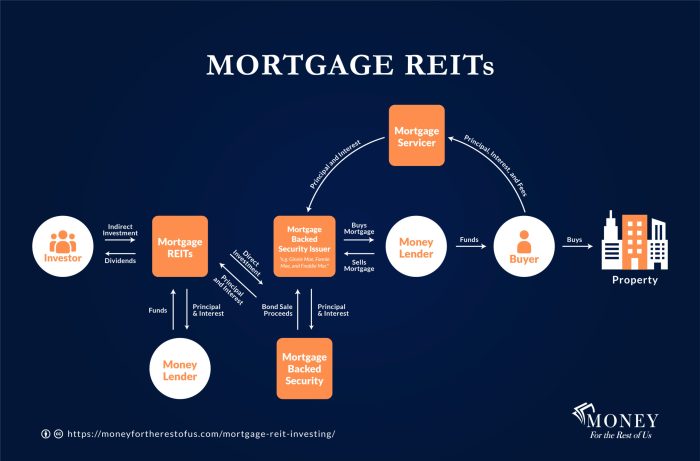

The sale of $5 million in Angel Oak Mortgage REIT stock by Davidson Kempner, a prominent investment firm, underscores the dynamic nature of the mortgage REIT market. As interest rates rise, investors are carefully evaluating their exposure to mortgage REITs, which are sensitive to interest rate fluctuations.

Davidson Kempner’s decision to reduce its stake in Angel Oak Mortgage REIT may signal a shift in sentiment towards the sector, with some investors seeking to reduce their risk in the face of rising interest rates. The sale’s timing and the potential implications for Angel Oak Mortgage REIT’s stock price are likely to be closely watched by market analysts and investors alike.

Davidson Kempner’s Investment in Angel Oak Mortgage REIT: Davidson Kempner Exec Sells Million In Angel Oak Mortgage REIT Stock

Davidson Kempner Capital Management LP, a prominent investment firm with a strong focus on distressed debt and real estate, has made a significant investment in Angel Oak Mortgage REIT, a real estate investment trust (REIT) specializing in residential mortgage-backed securities (MBS).

This investment reflects Davidson Kempner’s strategic approach to identifying undervalued assets and capitalizing on market opportunities. The firm’s interest in Angel Oak Mortgage REIT stems from its belief in the REIT’s potential to deliver attractive returns in the current market environment.

Davidson Kempner’s Investment Strategy

Davidson Kempner’s investment strategy in Angel Oak Mortgage REIT is driven by a combination of factors, including:* Value Investing:Davidson Kempner seeks to identify undervalued assets and invest in companies with strong fundamentals but are currently trading at a discount to their intrinsic value.

This approach aligns with their belief in the long-term potential of Angel Oak Mortgage REIT.

Distressed Debt Expertise

Davidson Kempner has a long history of investing in distressed debt, which gives them a unique perspective on navigating challenging market conditions. This expertise is particularly valuable in the mortgage REIT sector, where interest rate fluctuations and credit risks can significantly impact performance.

Market Opportunities

Davidson Kempner believes that the current market environment presents attractive opportunities for investors with a long-term focus. The firm’s investment in Angel Oak Mortgage REIT reflects their conviction in the REIT’s ability to capitalize on these opportunities and generate strong returns for investors.

Davidson Kempner’s Involvement with Angel Oak Mortgage REIT

Davidson Kempner’s involvement with Angel Oak Mortgage REIT dates back to 2019 when the firm first invested in the REIT. This initial investment marked the beginning of a strategic partnership between the two entities. Davidson Kempner has since increased its stake in Angel Oak Mortgage REIT, demonstrating its continued confidence in the REIT’s long-term prospects.Davidson Kempner’s investment has played a significant role in supporting Angel Oak Mortgage REIT’s growth and expansion.

The firm’s expertise and financial resources have enabled the REIT to navigate market challenges and pursue new investment opportunities.

The Sale of $5 Million in Stock

Davidson Kempner’s recent sale of $5 million in Angel Oak Mortgage REIT stock has sparked interest in the investment community. This move raises questions about the firm’s outlook on the mortgage REIT sector and the potential implications for Angel Oak’s stock price.

The Context of the Sale

Davidson Kempner’s decision to sell a portion of its Angel Oak Mortgage REIT holdings could be attributed to several factors. While the firm has not publicly disclosed the specific reasons for the sale, it is likely a combination of strategic considerations and portfolio adjustments.

The Timing of the Sale

The timing of the sale is significant. The mortgage REIT sector has been under pressure in recent months due to rising interest rates and concerns about the broader economy. This has led to a decline in the stock prices of many mortgage REITs, including Angel Oak.

Davidson Kempner’s decision to sell shares during this period could be interpreted as a sign of caution or a desire to reduce exposure to a volatile market.

The Implications for Angel Oak Mortgage REIT’s Stock Price

The sale of $5 million in stock by Davidson Kempner, a prominent investor, could have a negative impact on Angel Oak’s stock price in the short term. Investors may interpret the sale as a lack of confidence in the company’s future prospects.

However, the long-term impact of the sale on Angel Oak’s stock price will depend on several factors, including the company’s future earnings performance and the overall market conditions.

The Reasons Behind Davidson Kempner’s Decision

Davidson Kempner’s decision to sell a portion of its Angel Oak Mortgage REIT holdings could be driven by several factors:* Portfolio Rebalancing:The firm may have decided to rebalance its portfolio by reducing its exposure to the mortgage REIT sector. This could be due to a shift in investment strategy or a desire to diversify its holdings.

Market Outlook

The sale could also reflect Davidson Kempner’s concerns about the future outlook for the mortgage REIT sector. Rising interest rates and economic uncertainty could lead to lower earnings for mortgage REITs, making them less attractive investments.

Profit Taking

It is also possible that Davidson Kempner decided to take profits on its investment in Angel Oak Mortgage REIT. The firm may have achieved its desired return on investment and decided to exit the position.

Angel Oak Mortgage REIT’s Performance

Angel Oak Mortgage REIT (AOMR) has experienced a mixed bag of performance in recent years. The company has been impacted by factors like rising interest rates and volatility in the housing market, but it has also demonstrated resilience and a commitment to adapting its strategy.

Financial Performance and Outlook

AOMR’s financial performance has been marked by fluctuations. In the first quarter of 2023, the company reported a net loss of $0.14 per share, compared to a net income of $0.21 per share in the same period of 2022. This decline was largely attributed to the impact of rising interest rates on the value of its mortgage investments.

However, AOMR has maintained a strong dividend payout, reflecting its commitment to shareholder returns. Looking ahead, the company’s performance will depend heavily on the direction of interest rates and the health of the housing market.

Factors Influencing Future Performance

Several key factors will influence AOMR’s future performance.

- Interest Rates:As interest rates rise, the value of AOMR’s mortgage investments decreases. This is because investors demand higher returns for lending money at higher interest rates. If interest rates continue to rise, AOMR’s earnings and dividend payouts could be negatively affected.

However, the company has a history of managing its portfolio to mitigate the impact of interest rate fluctuations.

- Housing Market:The health of the housing market is crucial to AOMR’s performance. A strong housing market leads to increased demand for mortgages, which benefits AOMR’s business. However, a weakening housing market can lead to lower mortgage origination volumes and increased defaults, both of which can negatively impact AOMR’s earnings.

Comparison to Peers, Davidson Kempner exec sells million in Angel Oak Mortgage REIT stock

AOMR’s performance can be compared to other mortgage REITs in the sector. The company’s dividend yield has generally been in line with its peers, but its earnings per share have been more volatile. Compared to some other mortgage REITs, AOMR has a more diversified portfolio, which may provide some protection against market volatility.

However, AOMR’s focus on non-agency mortgage investments exposes it to higher risk than some of its peers that invest in agency mortgage-backed securities.

Impact on the Mortgage REIT Market

Davidson Kempner’s sale of $5 million in Angel Oak Mortgage REIT stock has sparked debate about the potential implications for the broader mortgage REIT market. This move, although seemingly small in the grand scheme of things, could be a signal of larger market trends and investor sentiment towards this sector.

Sentiment Towards Mortgage REITs

The sale of Angel Oak Mortgage REIT stock by Davidson Kempner reflects a cautious approach to the mortgage REIT sector. While the market has seen a period of growth in recent years, concerns about rising interest rates and a potential economic slowdown have prompted some investors to take a more conservative stance.

This sentiment is reflected in the performance of mortgage REITs, which have generally underperformed the broader market in recent months.

Potential Implications for Investors

Davidson Kempner’s decision to reduce its stake in Angel Oak Mortgage REIT raises questions about the future outlook for the mortgage REIT sector. Investors considering investing in mortgage REITs should carefully evaluate the risks and potential rewards associated with this asset class.

Finish your research with information from Canoo executive sells over $3500 in company stock.

- Interest Rate Risk:Mortgage REITs are highly sensitive to interest rate fluctuations. Rising interest rates can lead to a decline in the value of their mortgage-backed securities, impacting their profitability.

- Economic Slowdown:A weakening economy can lead to higher mortgage delinquencies and defaults, which can negatively impact mortgage REITs’ earnings.

- Competition:The mortgage REIT sector is highly competitive, with numerous players vying for investors’ capital. This competition can put pressure on mortgage REITs to maintain high dividend yields and manage their portfolios effectively.

It is important to remember that past performance is not necessarily indicative of future results.

Investors should conduct thorough due diligence and consider their own investment objectives and risk tolerance before investing in mortgage REITs.

Davidson Kempner’s Investment Strategy

Davidson Kempner is a global alternative investment firm known for its sophisticated investment strategies across various asset classes, including real estate. Their approach to real estate investing is characterized by a blend of fundamental analysis, deep market knowledge, and a long-term perspective.

Davidson Kempner’s Real Estate Investment Approach

Davidson Kempner employs a multifaceted approach to real estate investments, focusing on identifying undervalued assets and opportunities with potential for growth. They typically invest in a variety of real estate sectors, including:

- Commercial Real Estate:Davidson Kempner invests in various commercial real estate assets, including office buildings, retail centers, industrial properties, and hotels. They analyze market trends, tenant demand, and property fundamentals to identify attractive investment opportunities.

- Residential Real Estate:Davidson Kempner also invests in residential real estate, including single-family homes, multifamily properties, and student housing. Their focus is on identifying areas with strong demographics and potential for rental income growth.

- Real Estate Debt:Davidson Kempner actively invests in real estate debt, providing financing to developers and property owners. They assess the creditworthiness of borrowers and the underlying real estate assets to ensure the safety and profitability of their investments.

Examples of Davidson Kempner’s Real Estate Investments

Davidson Kempner has a diverse portfolio of real estate investments, demonstrating their expertise across various sectors. Some notable examples include:

- Investment in a Portfolio of Office Buildings:Davidson Kempner acquired a portfolio of office buildings in major cities across the United States, capitalizing on the growth of the office sector and the demand for high-quality office space.

- Development of a Luxury Residential Project:Davidson Kempner partnered with a developer to build a luxury residential project in a prime location, leveraging their expertise in real estate development and market analysis.

- Financing for a Large-Scale Retail Development:Davidson Kempner provided financing for a large-scale retail development project, demonstrating their ability to identify and support high-potential real estate projects.

Davidson Kempner’s Track Record in Real Estate Investments

Davidson Kempner has a strong track record in real estate investments, consistently delivering attractive returns to their investors. Their success can be attributed to several factors, including:

- Deep Market Expertise:Davidson Kempner has a team of experienced professionals with in-depth knowledge of the real estate market, enabling them to identify undervalued assets and opportunities for growth.

- Disciplined Investment Process:Davidson Kempner employs a rigorous investment process, involving thorough due diligence, risk management, and ongoing monitoring of their investments.

- Long-Term Perspective:Davidson Kempner takes a long-term approach to real estate investments, focusing on creating sustainable value and generating consistent returns over time.

Davidson Kempner’s Reputation in the Real Estate Market

Davidson Kempner is highly respected in the real estate market for its expertise, track record, and reputation for integrity. Their investments are often seen as a vote of confidence in the underlying real estate assets and the market’s potential for growth.

Closing Notes

The sale of $5 million in Angel Oak Mortgage REIT stock by Davidson Kempner is a significant event that highlights the evolving landscape of the mortgage REIT market. The move underscores the importance of understanding the factors that influence the performance of mortgage REITs, including interest rate trends, housing market dynamics, and the investment strategies of key players like Davidson Kempner.

As the market navigates a period of uncertainty, investors will need to carefully assess their exposure to mortgage REITs and consider the potential impact of events like this stock sale.

User Queries

Why did Davidson Kempner sell its stock in Angel Oak Mortgage REIT?

The specific reasons for Davidson Kempner’s decision to sell are not publicly disclosed. However, potential factors could include a shift in investment strategy, a need to rebalance its portfolio, or concerns about the future performance of Angel Oak Mortgage REIT.

What impact will this sale have on Angel Oak Mortgage REIT’s stock price?

The impact of the sale on Angel Oak Mortgage REIT’s stock price is uncertain. It could potentially lead to a decline in the stock price, particularly if it is perceived as a sign of weakness in the company’s future prospects.

However, other factors, such as the overall market sentiment and the company’s financial performance, will also play a role.

What does this sale tell us about the mortgage REIT market?

The sale highlights the volatility and risk inherent in the mortgage REIT market. It suggests that investors are closely monitoring interest rate trends and the health of the housing market, and they are adjusting their positions accordingly. It also emphasizes the importance of carefully evaluating the investment strategies of key players in the market.

CentralPoint Latest News

CentralPoint Latest News