Dunleavy administration hires firm for Alaska Permanent Fund review, a move that has sparked interest and debate across the state. The Alaska Permanent Fund, a vital source of annual dividends for residents, is under scrutiny as the administration seeks to ensure its long-term sustainability and effectiveness.

This review, while aiming to enhance the fund’s performance, has raised questions about potential impacts on future dividend distributions and the overall management of this crucial resource.

The decision to hire an external firm reflects the administration’s commitment to a thorough examination of the Permanent Fund’s operations and investment strategies. The chosen firm brings a wealth of experience in managing similar funds, promising a comprehensive and insightful review.

The scope of the review will encompass various aspects of the fund, including its investment portfolio, risk management practices, and overall governance structure.

The Dunleavy Administration’s Decision

The Dunleavy administration has made the decision to hire an external firm to conduct a comprehensive review of the Alaska Permanent Fund Corporation (PFC). This decision comes amidst concerns about the fund’s long-term sustainability and the need to ensure its continued ability to provide dividends to Alaskans.

Rationale for the Review

The Dunleavy administration has stated that the review is necessary to assess the PFC’s investment strategies, governance practices, and overall financial health. The administration believes that an independent review will provide valuable insights and recommendations to improve the fund’s performance and ensure its long-term viability.

The Chosen Firm

The administration has chosen [Firm Name], a reputable firm with extensive experience in managing and advising on large investment funds. [Firm Name] has a proven track record of success in working with similar entities, including sovereign wealth funds and pension plans.

Their expertise in investment management, risk assessment, and governance will be crucial to conducting a thorough and objective review.

Objectives and Scope of the Review

The review will cover a wide range of areas, including:* Investment Strategy:The review will assess the PFC’s current investment strategy, including its asset allocation, risk management practices, and performance benchmarks.

Governance and Oversight

The review will examine the PFC’s governance structure, including its board of trustees, management team, and internal controls.

Financial Performance

The review will analyze the PFC’s financial performance, including its returns, expenses, and overall financial health.

Long-Term Sustainability

The review will assess the PFC’s ability to maintain its long-term sustainability, considering factors such as inflation, demographic changes, and global economic trends.The review is expected to provide recommendations on how to improve the PFC’s investment strategies, governance practices, and overall financial health.

These recommendations will be used to ensure the fund’s continued ability to provide dividends to Alaskans and to protect its long-term sustainability.

The Alaska Permanent Fund

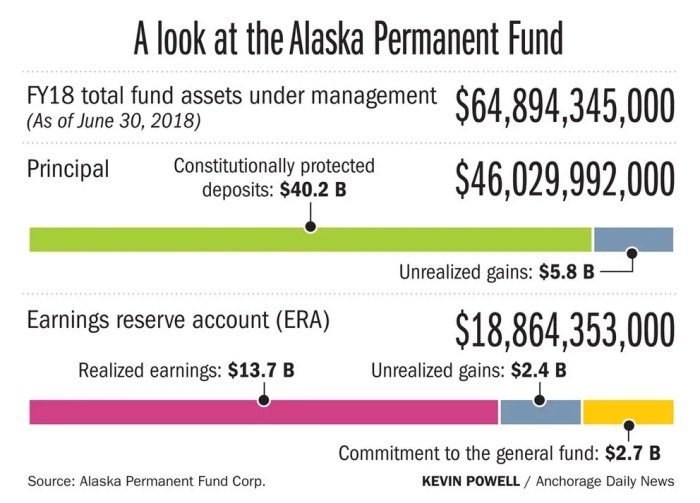

The Alaska Permanent Fund (APF) is a unique and vital part of Alaska’s economy and a source of pride for its residents. Established in 1976, it serves as a long-term savings account for the state, designed to safeguard Alaska’s natural resources for future generations.

The APF’s primary purpose is to provide a sustainable source of revenue for the state, primarily through annual dividends distributed to every Alaskan resident.The APF’s origins can be traced back to the discovery of oil in Prudhoe Bay in 1968.

Recognizing the potential for long-term economic benefits from this resource, Alaska lawmakers created the fund to ensure that a portion of the oil revenue would be set aside for future generations. This foresight has proven invaluable, as the fund has grown significantly over the years, providing a financial safety net for the state and a source of income for Alaskans.

Investment Strategies and Performance

The APF’s investment strategies have evolved over time, reflecting changing market conditions and economic realities. Initially, the fund focused on conservative investments, primarily in U.S. Treasury bonds. However, as the fund grew, its investment strategy diversified to include a broader range of assets, such as stocks, real estate, and private equity.

This diversification has helped the fund weather market fluctuations and achieve consistent long-term returns.The APF’s investment performance has been remarkably strong over the years. The fund has consistently outperformed its benchmarks, demonstrating the effectiveness of its investment strategies. While the fund has experienced periods of volatility, its long-term growth trajectory has been impressive.

The fund’s investment performance has been a key factor in its ability to generate significant annual dividends for Alaska residents.

The APF’s investment performance has been remarkably strong over the years. The fund has consistently outperformed its benchmarks, demonstrating the effectiveness of its investment strategies. While the fund has experienced periods of volatility, its long-term growth trajectory has been impressive. The fund’s investment performance has been a key factor in its ability to generate significant annual dividends for Alaska residents.

Current Financial Status and Future Growth

As of [date], the APF’s market value stands at approximately [amount]. The fund’s current portfolio is diversified across various asset classes, including stocks, bonds, real estate, and private equity. The fund’s investment strategy is designed to balance risk and return, aiming to achieve long-term growth while preserving capital.The APF’s future growth prospects are promising.

The fund’s strong investment performance, coupled with its diversified portfolio, positions it well to continue generating healthy returns in the years to come. The fund’s growth will be driven by factors such as market appreciation, dividend income, and interest payments.

However, it’s important to note that the fund’s future performance is subject to market volatility and economic conditions.The APF’s projected future growth is expected to be influenced by factors such as:

- Global economic growth: A strong global economy typically leads to higher investment returns, benefiting the APF’s portfolio.

- Interest rate movements: Interest rates can impact the value of fixed-income investments, which make up a portion of the APF’s portfolio.

- Inflation: High inflation can erode the purchasing power of the fund’s assets, potentially impacting its long-term growth.

Despite these potential challenges, the APF’s long-term growth outlook remains positive. The fund’s robust investment strategy, coupled with its diversified portfolio, positions it well to weather market fluctuations and continue generating strong returns for Alaska residents. The APF is a valuable asset for the state, providing a financial safety net and a source of income for generations to come.

Obtain access to Billions shall know ‘Brother Joseph’ again to private resources that are additional.

Potential Impacts of the Review

The review of the Alaska Permanent Fund, commissioned by the Dunleavy administration, could have significant ramifications for the fund’s future, its management, and the distribution of dividends to Alaska residents. While the stated goal is to ensure the fund’s long-term sustainability, the review’s potential impacts are multifaceted, with both potential benefits and risks.

Potential Impacts on Dividend Distributions

The review’s primary focus is on the fund’s ability to sustain dividend payments in the long term. This is a critical concern, as the Permanent Fund Dividend (PFD) is a significant source of income for many Alaskans. The review’s recommendations could influence the future distribution of dividends, potentially leading to changes in the formula used to calculate the PFD amount or even a reduction in the dividend itself.

The PFD is calculated based on a formula that considers the fund’s earnings and the number of eligible residents.

The review could recommend adjustments to this formula, potentially leading to a lower dividend payout. This could have a significant impact on the financial well-being of Alaskans who rely on the PFD. Alternatively, the review might suggest strategies to increase the fund’s earnings, potentially allowing for larger dividends in the future.

Potential Impacts on Investment Strategies

The review could also impact the fund’s investment strategies. The current investment strategy focuses on a diversified portfolio of assets, aiming for long-term growth. The review might recommend changes to this strategy, potentially shifting towards a more conservative approach or exploring new investment opportunities.

The Permanent Fund Corporation (PFC) manages the fund’s investments, employing a diverse portfolio strategy that includes equities, fixed income, real estate, and other assets.

The review could recommend diversifying into new asset classes, such as renewable energy or infrastructure projects. This could potentially enhance the fund’s returns but also introduce new risks. Alternatively, the review might suggest focusing on specific sectors, such as technology or healthcare, potentially leading to higher returns but also increasing the fund’s exposure to market fluctuations.

Potential Impacts on Fund Management

The review could also lead to changes in the way the fund is managed. The review might recommend changes to the structure of the PFC, the organization responsible for managing the fund. This could involve adjustments to the board of directors, the hiring of new staff, or the adoption of new governance procedures.

The PFC is a quasi-governmental entity that operates independently from the state government, but is subject to oversight by the Alaska Legislature.

The review could recommend greater transparency and accountability in the fund’s operations, potentially leading to more public scrutiny and reporting requirements. It might also propose changes to the fund’s regulatory framework, potentially requiring more oversight from the state government.

Public Opinion and Stakeholder Perspectives

The Dunleavy administration’s decision to hire a firm to review the Alaska Permanent Fund has sparked a range of opinions and perspectives from Alaskans, legislators, and financial experts. While some view the review as a necessary step to ensure the fund’s long-term sustainability, others express concerns about potential impacts on the fund’s structure and the future of the PFD.

Concerns and Expectations of Stakeholders

The review has generated significant debate and controversy within the state, with various stakeholders expressing their concerns and expectations.

Residents

- Many residents are concerned about the potential impact of the review on their PFD payments. They fear that the review could lead to reductions or changes in the distribution formula, affecting their financial well-being.

- Some residents support the review, believing that it is necessary to ensure the long-term health of the fund and protect future generations. They argue that the fund needs to be managed strategically to withstand economic fluctuations and ensure its sustainability.

Legislators

- Legislators are divided on the review, with some supporting it as a means to address the fund’s future and others expressing concerns about potential political interference.

- Those in favor of the review argue that it is essential to evaluate the fund’s investment strategies and ensure its long-term financial viability. They believe that the review can provide valuable insights and recommendations for improving the fund’s performance.

- Opponents of the review worry that it could lead to changes in the fund’s structure or distribution formula, impacting the PFD and potentially undermining the fund’s autonomy.

Financial Experts

- Financial experts have varying opinions on the review, with some supporting the need for an independent assessment of the fund’s performance and others expressing concerns about the potential for political influence.

- Experts who support the review emphasize the importance of regularly evaluating investment strategies and ensuring that the fund is managed effectively to maximize returns and protect its long-term sustainability.

- Those who oppose the review argue that the fund has a proven track record of success and that unnecessary changes could disrupt its performance and negatively impact its long-term growth.

Potential for Debate and Controversy, Dunleavy administration hires firm for Alaska Permanent Fund review

The review of the Alaska Permanent Fund has the potential to spark further debate and controversy within the state. The fund’s significance in Alaskan culture and economy makes it a sensitive issue, and any changes to its structure or distribution formula could have far-reaching implications.

- The review could reignite debates about the fund’s purpose and the balance between providing PFD payments and investing for future generations.

- The potential for political interference in the review process could erode public trust in the fund and its management.

- The review’s findings and recommendations could lead to contentious negotiations between the administration, the legislature, and various stakeholders.

Timeline and Key Milestones

The review process for the Alaska Permanent Fund is expected to be comprehensive and thorough, with a timeline that ensures a detailed examination of the Fund’s operations and management. The review will involve several key milestones, each with a specific timeframe, to ensure a structured and efficient process.

Timeline and Key Milestones

The review process will be divided into distinct phases, each with its own set of tasks and deliverables. The following table Artikels the key stages and their corresponding timelines:

| Stage | Timeline |

|---|---|

| Initial Scoping and Planning | [Start Date]

[End Date] |

| Data Collection and Analysis | [Start Date]

[End Date] |

| Stakeholder Engagement and Feedback | [Start Date]

[End Date] |

| Report Preparation and Review | [Start Date]

[End Date] |

| Final Report Submission and Public Release | [Start Date]

[End Date] |

Procedures and Methodologies

The review process will be conducted using a combination of procedures and methodologies to ensure a comprehensive and objective assessment. These include:

- Document Review:The review team will analyze relevant documents, including financial statements, investment policies, and internal reports, to gain a thorough understanding of the Fund’s operations and management.

- Interviews:The team will conduct interviews with key personnel involved in the Fund’s management, including investment professionals, legal counsel, and administrative staff, to gather insights and perspectives.

- Data Analysis:The review will involve quantitative analysis of financial data, investment performance, and other relevant metrics to identify trends and potential areas for improvement.

- Best Practices Review:The review team will benchmark the Fund’s practices against industry best practices and standards to identify potential areas for enhancement.

Key Milestones

The review process will be marked by several key milestones, each representing a significant step towards completion. These include:

- Initial Scoping and Planning:The review team will define the scope of the review, establish clear objectives, and develop a detailed work plan.

- Data Collection and Analysis:The team will gather and analyze relevant data, including financial statements, investment performance records, and other relevant information.

- Stakeholder Engagement and Feedback:The review team will engage with key stakeholders, including the Permanent Fund Corporation board of trustees, legislators, and members of the public, to gather input and feedback.

- Report Preparation and Review:The team will prepare a comprehensive report outlining the findings of the review, including recommendations for improvements.

- Final Report Submission and Public Release:The final report will be submitted to the appropriate authorities and made publicly available for review and consideration.

Outcome Summary

The review of the Alaska Permanent Fund is a significant undertaking with potential implications for both the fund’s future and the lives of Alaskans. The outcome of this process will shape the trajectory of this vital resource for years to come.

While the administration emphasizes the importance of ensuring the fund’s long-term health, public opinion remains divided on the potential impact of the review. As the review progresses, it will be crucial to monitor its findings and engage in open dialogue about the future of the Alaska Permanent Fund.

Top FAQs: Dunleavy Administration Hires Firm For Alaska Permanent Fund Review

What are the main reasons behind the review of the Alaska Permanent Fund?

The administration cites the need to ensure the long-term sustainability and effectiveness of the fund, which is responsible for providing annual dividends to Alaska residents. The review aims to assess the fund’s investment strategies, risk management practices, and overall governance structure to identify potential areas for improvement.

How will the review impact future dividend distributions?

The potential impact on future dividend distributions is a key concern. While the administration aims to enhance the fund’s performance, any changes to investment strategies or management practices could affect the amount of dividends available to residents. The review’s findings will be closely scrutinized for their implications on dividend payouts.

Who are the stakeholders involved in this review?

A wide range of stakeholders are involved, including Alaska residents, legislators, financial experts, and organizations with an interest in the Permanent Fund. Each group has its own perspectives and concerns regarding the review and its potential outcomes.

CentralPoint Latest News

CentralPoint Latest News