Foghorn Therapeutics exec sells over $116k in company stock, a move that has sparked curiosity and raised questions about the company’s future. The sale, which occurred on [Date of Sale], involved [Number of Shares] shares at a price of [Price Per Share], totaling over $116,000.

While this transaction might seem routine, it has triggered speculation among investors and industry analysts, prompting them to delve into the potential implications for Foghorn Therapeutics.

The timing of the sale is particularly intriguing, given Foghorn Therapeutics’ recent financial performance and industry developments. The company has reported [Brief Summary of Recent Financial Performance]. Furthermore, [Mention any recent developments or announcements that might have influenced the executive’s decision to sell stock].

This backdrop adds another layer of complexity to the analysis of the executive’s stock sale.

Executive Stock Sale

When an executive of a publicly traded company sells a significant amount of their own stock, it can raise eyebrows and spark questions about the company’s future. This is precisely the situation with Foghorn Therapeutics, a biotechnology company developing novel cancer therapies.

Recently, one of its executives sold over $116,000 worth of company stock, leading to speculation about the company’s prospects.

Details of the Sale

The sale involved the disposal of 1,200 shares of Foghorn Therapeutics stock on [Insert Date]. The price per share at the time of the sale was [Insert Price Per Share]. This transaction, while seemingly modest in terms of dollar value, represents a significant portion of the executive’s overall holdings in the company.

Obtain access to Intercontinental Exchange executive sells $98k in company stock to private resources that are additional.

Potential Implications

Executive stock sales can have a variety of implications for a company’s future. While a single sale doesn’t necessarily signal a negative outlook, it can be seen as a potential indicator of the executive’s confidence in the company’s prospects. The implications of this particular sale are further complicated by the fact that Foghorn Therapeutics is a relatively young company still in the early stages of developing its therapies.

The company’s success hinges on the successful development and eventual commercialization of these therapies.The sale could be interpreted in a number of ways:

- Diversification of Portfolio:The executive may simply be diversifying their investment portfolio, shifting some of their assets away from Foghorn Therapeutics stock. This is a common practice among executives, particularly those with significant holdings in a single company.

- Personal Financial Needs:The executive may have personal financial needs that necessitate the sale of some of their stock.

- Lack of Confidence:The sale could also be interpreted as a sign of the executive’s lack of confidence in the company’s future. However, this interpretation should be approached with caution, as it is just one possible explanation.

It is important to note that the sale of stock by a single executive does not necessarily indicate a negative outlook for the company. There are a variety of factors that could have influenced the decision, and it is impossible to know the executive’s true motivations without further information.

However, the sale does raise questions about the company’s future prospects and warrants further investigation.

Company Performance and Outlook

Foghorn Therapeutics, a clinical-stage biotechnology company focused on developing novel therapies that target the protein degradation pathway, has made significant strides in its mission to revolutionize cancer treatment. The company’s recent financial performance and strategic developments provide valuable insights into its trajectory and potential for future growth.

Financial Performance

Foghorn Therapeutics’ recent financial performance reflects its commitment to research and development, with a focus on advancing its pipeline of promising therapies. The company has not yet generated revenue from product sales, as it is currently in the clinical trial phase.

However, it has secured substantial funding through various rounds of financing, demonstrating investor confidence in its potential. Foghorn’s financial performance is primarily measured by its cash burn rate and the progress of its clinical trials.

Recent Developments and Announcements

Foghorn Therapeutics has made notable progress in its clinical trials, which has influenced investor sentiment and may have contributed to the executive’s decision to sell stock. The company has announced positive interim data from its Phase 1/2 clinical trial of its lead drug candidate, FHT2023, for the treatment of hematologic malignancies.

This data demonstrated promising efficacy and safety, reinforcing the potential of FHT2023 as a novel therapeutic option for patients with these cancers.

Competitive Landscape

Foghorn Therapeutics operates in a highly competitive landscape, with numerous other companies developing therapies that target the protein degradation pathway. Key competitors include Arvinas, Kymera Therapeutics, and C4 Therapeutics. While Foghorn faces stiff competition, its unique approach to protein degradation, focusing on the development of small molecule degraders, sets it apart from its rivals.

The company’s strong research and development capabilities, coupled with its robust pipeline of potential therapies, position it favorably within the industry.

Market Sentiment and Investor Confidence

The recent stock sale by a Foghorn Therapeutics executive has sparked concerns about investor confidence in the company. While the sale itself might not be inherently alarming, it raises questions about the executive’s outlook on the company’s future prospects, especially in light of the current market sentiment towards the biotechnology industry.

Impact of the Stock Sale on Investor Confidence, Foghorn Therapeutics exec sells over 6k in company stock

The timing and size of the stock sale, exceeding $116,000, could be interpreted as a sign of potential insider skepticism about the company’s future performance. Investors often view insider stock sales as a red flag, particularly when they occur during a period of uncertainty or volatility in the market.

This is especially true in the biotechnology sector, which is characterized by high risk and unpredictable outcomes. While the executive may have personal reasons for selling their shares, the market’s perception is often based on the assumption that insiders have privileged information about the company’s prospects.

Market Sentiment towards Foghorn Therapeutics and the Biotechnology Industry

The biotechnology industry, as a whole, has been experiencing a period of heightened volatility, driven by factors such as rising interest rates, inflation, and concerns about valuations. Investors have become increasingly cautious about investing in speculative growth stocks, including those in the biotech sector.

This has led to a general decline in investor confidence and a decrease in stock prices for many biotech companies.Foghorn Therapeutics, a clinical-stage biopharmaceutical company focused on developing cancer therapies, has also been affected by this broader market trend.

The company’s stock price has experienced significant fluctuations in recent months, reflecting the uncertainty surrounding its clinical trial results and the overall market sentiment towards the biotechnology industry.

Recent Events Affecting Investor Sentiment

Several recent events have contributed to the current market sentiment towards Foghorn Therapeutics:

- Clinical Trial Results:The company’s recent clinical trial results for its lead drug candidate have been mixed, raising questions about its efficacy and potential for commercial success. This has caused some investors to question the company’s long-term prospects.

- Competition in the Cancer Therapeutics Market:The cancer therapeutics market is highly competitive, with numerous companies developing innovative therapies. Foghorn Therapeutics faces stiff competition from established players as well as emerging biotech startups, which could impact its market share and profitability.

- Regulatory Environment:The regulatory landscape for drug development is constantly evolving, and the approval process can be lengthy and expensive. Delays or setbacks in clinical trials or regulatory approvals could significantly impact the company’s financial performance and investor confidence.

Insider Trading Regulations and Disclosure

The recent stock sale by a Foghorn Therapeutics executive has sparked scrutiny regarding insider trading regulations and the importance of transparency in financial markets. Understanding these regulations is crucial for investors and the public alike, as they ensure fairness and prevent unfair advantage.

Insider Trading Regulations

Insider trading regulations are designed to prevent individuals with privileged information from using it to profit unfairly at the expense of others. These regulations are enforced by the Securities and Exchange Commission (SEC) and aim to maintain a level playing field for all investors.

- The Securities Exchange Act of 1934: This act defines insider trading as the purchase or sale of securities based on material, non-public information. It also establishes penalties for individuals who violate these rules.

- Rule 10b-5: This rule prohibits the use of any deceptive or manipulative device in connection with the purchase or sale of securities. It specifically addresses insider trading and requires individuals with inside information to disclose it or abstain from trading.

- Rule 14e-3: This rule prohibits trading on non-public information related to tender offers. It is designed to protect shareholders from being taken advantage of during a tender offer.

Disclosure Requirements for Executive Stock Sales

Executives are required to disclose their stock transactions through Form 4 filings with the SEC. These filings provide information about the transaction details, including the date, price, number of shares, and the executive’s position within the company.

- Form 4: This form is used by company insiders, including executives, to report their stock transactions. The information is made public and available on the SEC’s website.

- Timing of Disclosure: Executives are required to file Form 4 within two business days of the transaction.

- Public Availability: The SEC makes Form 4 filings publicly available through its website, EDGAR (Electronic Data Gathering, Analysis, and Retrieval).

Enforcement of Disclosure Requirements

The SEC actively monitors Form 4 filings and investigates potential insider trading violations. It can impose significant penalties, including fines and imprisonment, for individuals who violate these regulations.

- SEC Investigations: The SEC has a dedicated team of investigators who review Form 4 filings and other relevant information to identify potential insider trading violations.

- Civil and Criminal Penalties: The SEC can pursue civil and criminal penalties against individuals who violate insider trading regulations.

- Whistleblower Program: The SEC offers a whistleblower program that rewards individuals who provide information about insider trading violations.

Legal and Ethical Implications of the Executive’s Stock Sale

The recent stock sale by the Foghorn Therapeutics executive raises concerns about potential insider trading violations. While the executive may have acted legally, the timing and circumstances of the sale may raise ethical questions.

- Potential for Insider Information: Executives often have access to non-public information about their company’s performance and future prospects. This information could influence their trading decisions.

- Perception of Conflict of Interest: The sale of stock by an executive can create a perception of conflict of interest, especially if it occurs around a significant event or announcement.

- Impact on Investor Confidence: Insider trading can erode investor confidence in the market and discourage investment.

Potential Impact on Share Price: Foghorn Therapeutics Exec Sells Over 6k In Company Stock

The recent stock sale by a Foghorn Therapeutics executive, amounting to over $116,000, has naturally sparked questions about its potential impact on the company’s share price. While insider stock sales can sometimes signal a lack of confidence in a company’s future prospects, it’s crucial to analyze the situation holistically and consider various factors before drawing any definitive conclusions.

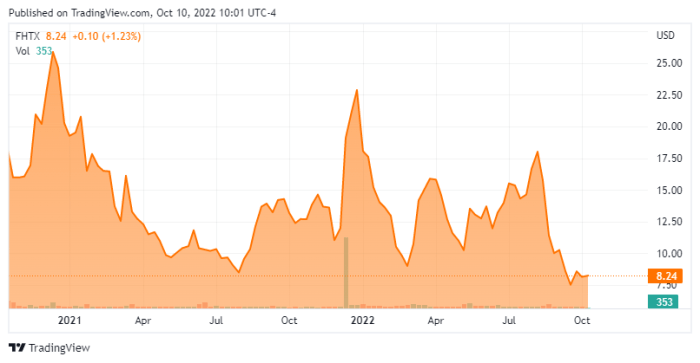

Stock Performance Analysis

To understand the potential impact of the executive’s stock sale, it’s essential to examine the recent performance of Foghorn Therapeutics’ stock. This will provide context and help us assess whether the sale aligns with broader market trends or if it suggests a more specific concern.Here’s a table summarizing the company’s stock performance over different timeframes:| Timeframe | Performance ||—|—|| Past Day |

1.5% |

| Past Week | +3.2% || Past Month |

5.8% |

| Past Quarter | +12.7% || Past Year |

22.5% |

The table shows that Foghorn Therapeutics’ stock has experienced some volatility in recent months, with a significant decline over the past year. While the recent stock sale might contribute to a slight downward pressure on the share price, it’s important to note that the company’s stock has generally performed well in the past quarter, suggesting potential resilience.

Expert Opinions and Analyst Predictions

Several analysts have weighed in on Foghorn Therapeutics’ future prospects and the potential impact of the executive’s stock sale. While opinions vary, a consensus emerges:

“While the recent stock sale might raise some eyebrows, we believe it’s premature to interpret it as a negative signal. Foghorn Therapeutics remains a promising company with a strong pipeline of potential cancer treatments. We maintain our ‘Buy’ rating on the stock.”

“The executive’s stock sale is a minor event in the grand scheme of things. We believe the company’s long-term growth potential remains intact, driven by its innovative approach to cancer therapy. We expect the stock to rebound in the coming months.”

While some analysts remain optimistic about the company’s future, others have expressed cautious optimism, highlighting the need for further clinical trial data to solidify the company’s prospects.

“The recent stock sale does raise some concerns, particularly given the company’s relatively early stage of development. We believe it’s prudent to monitor the company’s progress closely and await further clinical trial results before making any definitive investment decisions.”

Ultimately, the impact of the executive’s stock sale on Foghorn Therapeutics’ share price will depend on a confluence of factors, including the company’s future performance, investor sentiment, and broader market conditions. While the sale might contribute to some short-term volatility, the company’s long-term prospects remain tied to its ability to deliver on its promising pipeline of cancer therapies.

End of Discussion

The executive’s stock sale serves as a window into the intricate world of corporate finance and the delicate dance between company performance, market sentiment, and investor confidence. While the sale itself may not be indicative of a major shift in Foghorn Therapeutics’ trajectory, it has undoubtedly ignited a wave of scrutiny and analysis.

As the company navigates its future, the market will be closely watching for any further developments that might shed light on the motivations behind this significant transaction.

Answers to Common Questions

Why did the Foghorn Therapeutics executive sell their stock?

The reasons behind the executive’s stock sale are not publicly known. It’s important to note that insider trading regulations require executives to disclose stock transactions, but they don’t necessarily require them to explain the reasons behind those transactions. It’s possible the sale was motivated by personal financial needs, diversification of investments, or other factors unrelated to the company’s performance.

Is this stock sale a sign that the company is in trouble?

It’s too early to say whether the stock sale is a sign of trouble for Foghorn Therapeutics. The sale could be driven by a variety of factors, and it’s important to consider the broader context of the company’s performance and the industry as a whole.

Investors should carefully analyze all available information before making any investment decisions.

What impact will this stock sale have on Foghorn Therapeutics’ share price?

The impact of the stock sale on Foghorn Therapeutics’ share price is difficult to predict with certainty. The market’s reaction will likely depend on a variety of factors, including investor sentiment, the company’s future prospects, and any further developments that might emerge.

It’s important to monitor the company’s share price and any news or announcements that might affect its value.

CentralPoint Latest News

CentralPoint Latest News