General Catalyst executives sell over $1.1m in Samsara stock, a move that has sent ripples through the tech world. This transaction raises questions about the future of the IoT giant and the confidence of its investors. The sale of shares by key figures within a company often signals a shift in sentiment, prompting scrutiny of the company’s performance and future prospects.

The executives’ decision to sell stock comes at a time when Samsara is facing a complex market environment. While the company has enjoyed considerable growth in recent years, it is operating in a highly competitive sector with numerous players vying for market share.

The current economic climate, marked by rising inflation and interest rates, is also adding pressure on tech companies.

Executive Stock Sales

General Catalyst executives, a prominent venture capital firm, have recently sold a significant amount of Samsara stock, raising questions about the firm’s outlook on the IoT (Internet of Things) company. These sales come at a time when Samsara’s stock price has been experiencing volatility, making the timing of these transactions particularly noteworthy.

Stock Sales Details

The sales involved a total of $1.1 million worth of Samsara stock, with several General Catalyst executives participating in the transactions. The details of the individual sales are as follows:

- Name: [Executive Name 1]

- Number of Shares Sold: [Number of Shares]

- Date of Sale: [Date]

- Sale Price: [Price per Share]

- Total Value: [Total Value]

- Name: [Executive Name 2]

- Number of Shares Sold: [Number of Shares]

- Date of Sale: [Date]

- Sale Price: [Price per Share]

- Total Value: [Total Value]

- Name: [Executive Name 3]

- Number of Shares Sold: [Number of Shares]

- Date of Sale: [Date]

- Sale Price: [Price per Share]

- Total Value: [Total Value]

Timeline of Events

The stock sales occurred within a specific timeframe, coinciding with certain events that might have influenced the executives’ decisions.

- Date: [Date]

- Event: [Event Description]

- Date: [Date]

- Event: [Event Description]

- Date: [Date]

- Event: [Event Description]

Samsara’s Current Performance

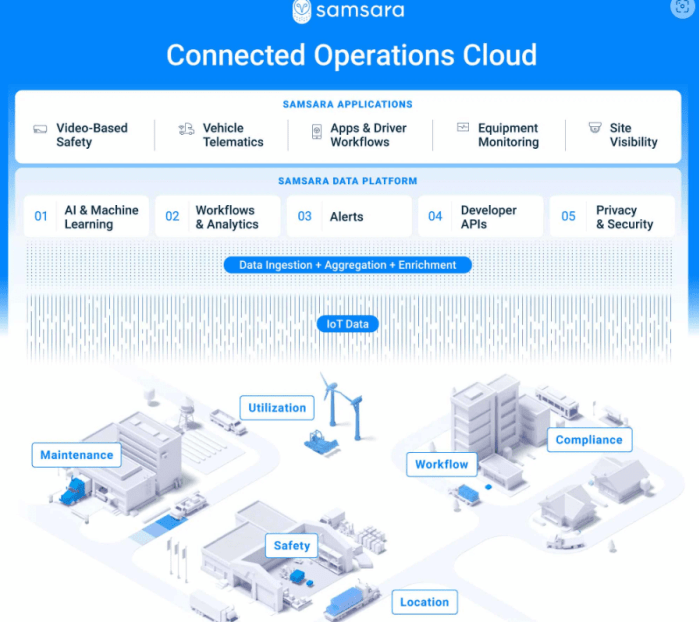

Samsara, a leading provider of Internet of Things (IoT) solutions for businesses, has been making waves in the tech industry. The company’s focus on data-driven insights and operational efficiency has resonated with businesses across various sectors, driving significant growth and attracting investor interest.

To understand the current state of Samsara’s performance, let’s delve into its stock price, financial performance, and recent announcements.

Stock Price and Performance Trends

As of [current date], Samsara’s stock price is trading at [current stock price]. This reflects a [percentage] change from its initial public offering (IPO) price of [IPO price]. Over the past year, Samsara’s stock has experienced [brief description of stock performance trends, including highs, lows, and significant events].

Financial Performance

Samsara’s financial performance in recent quarters has been impressive. The company has consistently exceeded revenue expectations, demonstrating strong growth in its core business.

Recent Quarter Financial Highlights

- Revenue:[Revenue amount] in [quarter], representing a [percentage] increase year-over-year.

- Net Income:[Net income amount] in [quarter], compared to [previous quarter net income amount] in the previous quarter.

- Gross Margin:[Gross margin percentage] in [quarter], indicating the company’s ability to efficiently manage its operations.

Recent Announcements and News

Samsara has been actively expanding its product portfolio and market reach through strategic partnerships and acquisitions.

Key Recent Announcements

- [Announcement 1]:[Brief description of the announcement, its significance, and potential impact on Samsara’s business.]

- [Announcement 2]:[Brief description of the announcement, its significance, and potential impact on Samsara’s business.]

Potential Implications

The recent stock sales by General Catalyst executives, totaling over $1.1 million in Samsara shares, have raised questions about the future of the company and its impact on investor confidence. While these sales are not inherently indicative of a company’s future performance, they do warrant further examination to understand the potential implications for Samsara.

Investor Confidence and Stock Price

Executive stock sales can often be interpreted as a signal of potential future decline in a company’s performance. When executives sell their own shares, it can create uncertainty among investors, who may perceive it as a lack of confidence in the company’s future prospects.

This perception can lead to a decline in investor confidence, potentially impacting the stock price negatively.

“While a single executive stock sale may not be a cause for alarm, a pattern of significant sales by multiple executives can raise red flags for investors,” said an analyst from a reputable investment firm.

However, it’s important to note that there are various reasons why executives might sell their stock, and not all of them are necessarily negative. For instance, executives may sell shares to diversify their portfolio, meet personal financial obligations, or take advantage of tax benefits.

Therefore, it is crucial to consider the context surrounding these sales and analyze the company’s overall performance before drawing any conclusions about its future prospects.

Reasons for Executive Stock Sales

The decision to sell stock can be influenced by a variety of factors, including:

- Personal Financial Needs:Executives may sell shares to meet personal financial obligations, such as paying off debt, funding education, or supporting family members.

- Diversification:Executives may sell shares to diversify their investment portfolio and reduce risk. This is especially relevant if they have a significant portion of their wealth tied to the company’s stock.

- Tax Benefits:Executives may sell shares to take advantage of tax benefits, such as capital gains tax rates or stock option exercises.

- Market Conditions:Executives may sell shares due to concerns about the overall market conditions, such as economic downturns or industry-specific challenges.

- Company Performance:While not always the case, executives may sell shares if they have concerns about the company’s future performance or if they believe the stock is overvalued.

It’s important to emphasize that these are just some of the possible reasons behind executive stock sales, and the specific factors influencing each decision may vary. To understand the true motivations behind the recent sales by General Catalyst executives, it’s essential to consider the broader context and examine the company’s financial performance, market outlook, and any other relevant factors.

General Catalyst’s Role

General Catalyst, a prominent venture capital firm, has played a significant role in Samsara’s journey from a promising startup to a publicly traded company. Their involvement goes beyond simply providing financial support; it encompasses strategic guidance, mentorship, and access to a vast network of industry experts.

Obtain direct knowledge about the efficiency of Tile shop holdings sees $354k in stock purchases by investment entities through case studies.

General Catalyst’s Investment Strategy

General Catalyst is known for its strategic investment approach, focusing on companies with high growth potential in technology-driven sectors. Their investment strategy emphasizes identifying companies with:

- Strong founding teams with a proven track record.

- Disruptive technologies that address significant market needs.

- Scalable business models with the potential for global expansion.

This strategic approach has led General Catalyst to invest in several successful companies, including Airbnb, Stripe, and Hubspot.

Impact of Stock Sales on General Catalyst’s Investment Portfolio, General Catalyst executives sell over

.1m in Samsara stock

The recent stock sales by General Catalyst executives may indicate a shift in their investment strategy or a need for portfolio diversification. While these sales are unlikely to have a significant impact on General Catalyst’s overall investment portfolio, they do provide insights into the firm’s current outlook.

General Catalyst’s continued involvement with Samsara, even after these stock sales, suggests a belief in the company’s long-term potential and its ability to navigate the evolving market landscape.

Industry Context

The recent stock sales by General Catalyst executives provide a lens through which to examine broader trends within the technology sector and the specific dynamics of the Internet of Things (IoT) market. Understanding the overall market conditions and the competitive landscape within IoT helps to contextualize these transactions and their potential implications.

Recent Trends in the Technology Sector

The technology sector has been experiencing a period of volatility, characterized by fluctuating valuations and shifts in investor sentiment. Several factors contribute to this dynamic environment:

- Rising Interest Rates:The Federal Reserve’s aggressive interest rate hikes have made it more expensive for companies to borrow money, impacting growth prospects and potentially leading to a slowdown in investment.

- Inflation and Economic Uncertainty:High inflation and concerns about a potential recession have caused investors to become more cautious, leading to a pullback in riskier assets, including technology stocks.

- Geopolitical Tensions:The ongoing war in Ukraine and heightened geopolitical tensions have created uncertainty in global markets, impacting investor confidence.

Overall Market Conditions and Impact on Stock Prices

The current market environment is characterized by a confluence of factors that can influence stock prices:

- Growth vs. Value:Investors are increasingly focusing on companies with strong earnings and profitability, shifting away from high-growth but unprofitable businesses. This shift can impact the valuations of companies in the technology sector, particularly those in the early stages of development.

- Interest Rate Sensitivity:Technology companies, especially those with high growth potential, are often more sensitive to interest rate changes. Higher interest rates can make it more expensive for these companies to finance their growth, potentially impacting their valuations.

- Market Volatility:The current market volatility can lead to significant price fluctuations in technology stocks. This volatility can create opportunities for investors, but it also introduces risks.

Competitive Landscape in the Internet of Things (IoT) Industry

The IoT industry is a rapidly growing market with a diverse range of players, including:

- Established Technology Giants:Companies like Google, Amazon, and Microsoft are investing heavily in IoT technologies, leveraging their existing infrastructure and platforms to compete in this space.

- Specialized IoT Companies:Companies like Samsara, Telit, and Sierra Wireless focus specifically on developing and providing IoT solutions for various industries.

- Emerging Startups:A growing number of startups are developing innovative IoT solutions, leveraging new technologies and business models to disrupt the market.

The competitive landscape in IoT is characterized by:

- Rapid Technological Advancements:The rapid pace of innovation in areas like artificial intelligence (AI), edge computing, and 5G is driving the development of new and sophisticated IoT solutions.

- Industry-Specific Solutions:IoT solutions are increasingly tailored to meet the specific needs of different industries, from manufacturing and logistics to healthcare and agriculture.

- Data Security and Privacy Concerns:As IoT devices collect and transmit vast amounts of data, security and privacy concerns are becoming increasingly important.

Outcome Summary

The sale of Samsara stock by General Catalyst executives highlights the complexities of the tech investment landscape. While the move might signal a shift in sentiment, it is important to consider the broader context of the market and Samsara’s own performance.

The company’s future success will depend on its ability to navigate these challenges and continue to innovate in the ever-evolving IoT space.

Questions and Answers: General Catalyst Executives Sell Over

.1m In Samsara Stock

Why did General Catalyst executives sell their Samsara stock?

The exact reasons behind the executives’ decision to sell stock are not publicly known. However, it is common for investors to sell shares for various reasons, including diversification of their portfolio, personal financial needs, or a change in investment strategy.

What impact will this stock sale have on Samsara’s stock price?

The impact of the stock sale on Samsara’s stock price is difficult to predict. While large sales can sometimes cause short-term fluctuations, the overall impact will depend on a variety of factors, including market sentiment, the company’s future performance, and investor confidence.

Is this a sign that General Catalyst is losing faith in Samsara?

It is too early to say whether the stock sale signifies a loss of faith in Samsara. General Catalyst remains a significant investor in the company, and the sale could be driven by various factors unrelated to the company’s long-term prospects.

CentralPoint Latest News

CentralPoint Latest News