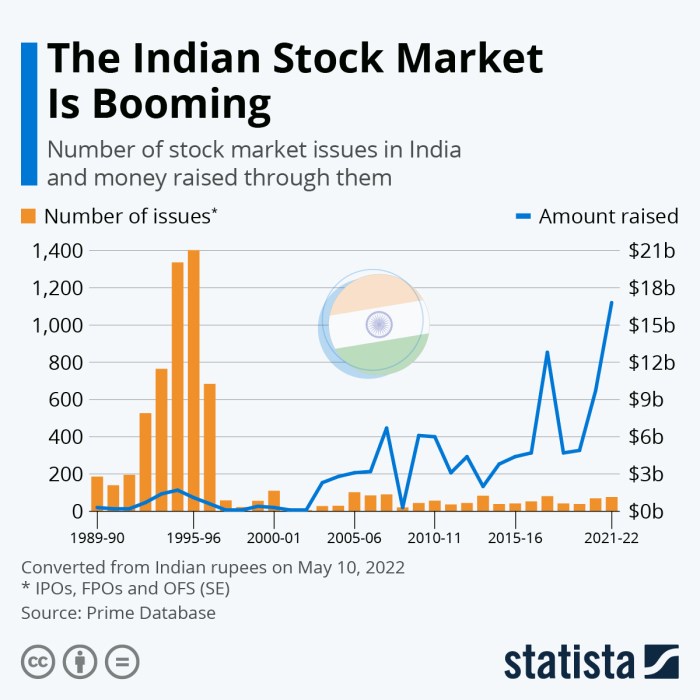

Global Money Is Chasing Indian Stocks Again as Bull Run Extends, a trend driven by a confluence of factors, including a robust economy, attractive valuations, and a growing middle class. This surge in foreign investment is propelling the Indian stock market to new heights, attracting global attention and sparking interest in the country’s economic potential.

The Indian stock market is experiencing a remarkable bull run, fueled by a combination of strong economic fundamentals, attractive valuations, and a growing middle class. This surge in foreign investment has propelled the market to new highs, attracting global attention and sparking interest in the country’s economic potential.

From technology and consumer goods to financials and energy, various sectors are experiencing strong growth, attracting global investors seeking to capitalize on India’s burgeoning economy.

Impact on the Indian Economy: Global Money Is Chasing Indian Stocks Again As Bull Run Extends

The influx of foreign investment into Indian stocks has a significant impact on the Indian economy. It acts as a catalyst for growth, influencing various sectors and contributing to employment generation. This positive sentiment, fueled by the stock market’s performance, can lead to economic prosperity.

Effect on Different Sectors

The stock market’s performance directly impacts various sectors of the Indian economy. When the market is bullish, investors tend to allocate funds to specific sectors, boosting their growth and attracting further investment. For example, the technology sector, which has been a significant beneficiary of the recent bull run, has seen increased investment, leading to job creation and economic growth.

Similarly, sectors like consumer durables, automobiles, and pharmaceuticals have also witnessed positive effects.

Enhance your insight with the methods and methods of NY toddler gets kidney transplant, reunites with medical team.

Impact on Employment and Economic Growth

Foreign investment plays a crucial role in generating employment opportunities. When companies attract foreign investment, they expand their operations, leading to an increase in workforce requirements. This, in turn, contributes to higher economic growth as more people are employed and contribute to the economy.

Key Sectors Benefiting from the Bull Run, Global Money Is Chasing Indian Stocks Again as Bull Run Extends

The following table highlights key sectors that have benefited from the recent bull run in the Indian stock market:| Sector | Impact ||—|—|| Technology | Increased investment, job creation, and growth in the sector. || Consumer Durables | Rise in demand, leading to increased production and employment.

|| Automobiles | Increased sales and production, boosting the manufacturing sector. || Pharmaceuticals | Growing demand for healthcare products, contributing to sector growth. || Financial Services | Increased activity in the financial markets, creating job opportunities. |

Final Thoughts

The Indian stock market’s bull run, fueled by global money chasing opportunities, presents both exciting prospects and potential challenges. While the growth story remains compelling, investors need to be aware of potential risks and diversify their portfolios to mitigate exposure.

As the Indian economy continues its upward trajectory, the stock market is poised to play a pivotal role in driving growth and attracting foreign investment, further solidifying India’s position as a global economic powerhouse.

Frequently Asked Questions

What are the key sectors driving the Indian stock market’s bull run?

The technology, consumer goods, financials, and energy sectors are experiencing strong growth, attracting global investors.

What are the potential risks to the Indian stock market’s bull run?

Potential risks include global economic uncertainties, inflation, and geopolitical tensions.

How can investors diversify their portfolios within the Indian stock market?

Investors can diversify by investing in a mix of sectors, companies, and asset classes within the Indian market.

CentralPoint Latest News

CentralPoint Latest News