Golden Entertainment director sells over $346k in company stock, a move that has sent ripples through the gaming and entertainment industry. This significant transaction raises questions about the director’s motivations and potential implications for Golden Entertainment’s future. The director’s decision to part ways with a substantial chunk of their company stock, coupled with the current state of the gaming industry, invites speculation about the future trajectory of both the director and the company.

The director’s identity and role within Golden Entertainment are crucial pieces of the puzzle. Understanding their position and responsibilities, along with their history with the company, provides valuable insights into the potential motivations behind this stock sale. The exact details of the transaction, including the amount of stock sold and the method of sale, offer further clues into the director’s intentions.

Executive Summary

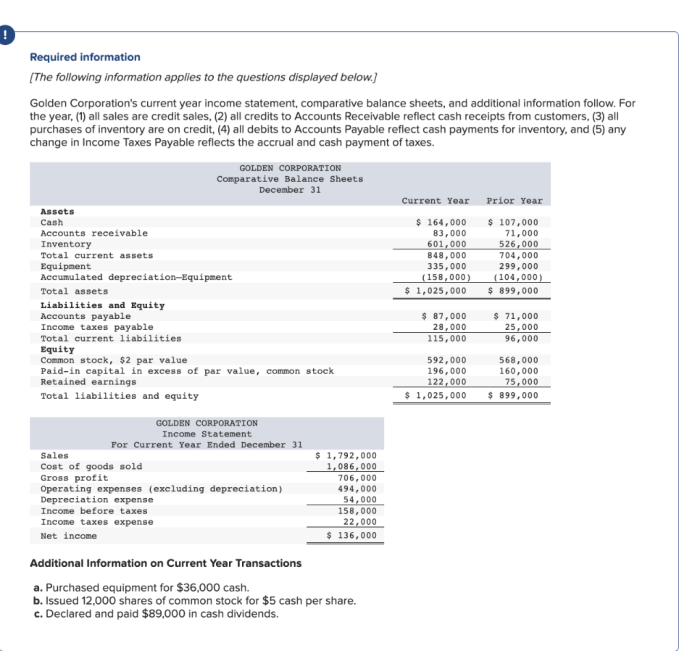

A director at Golden Entertainment, a prominent gaming and entertainment company, recently sold over $346,000 worth of company stock. This significant transaction has sparked interest among investors and analysts, prompting speculation about the potential implications for the company’s future.While the director’s motivations for selling remain unclear, the transaction itself could signal a shift in sentiment within the company’s leadership.

This move may reflect an internal belief that Golden Entertainment’s stock price is likely to decline in the near future, potentially due to market conditions, industry trends, or the company’s own financial performance.

Potential Implications of the Stock Sale, Golden Entertainment director sells over 6k in company stock

The director’s stock sale raises several questions about the future direction of Golden Entertainment. Investors and analysts will closely scrutinize the company’s financial reports and strategic plans to assess the potential impact of this transaction. Here are some potential implications:

- A Loss of Confidence:The sale could indicate a loss of confidence in the company’s future prospects by a key insider. This could negatively impact investor sentiment and lead to a decline in the stock price.

- Potential for Strategic Shifts:The director’s actions might suggest that Golden Entertainment is considering strategic changes, such as acquisitions, divestitures, or a shift in business focus. Investors will be looking for clues about the company’s future direction.

- Market Factors:It’s crucial to consider the broader market context. If the gaming and entertainment industry is facing headwinds, the director’s sale might be a reflection of these challenges rather than a specific concern about Golden Entertainment.

It’s important to note that the director’s stock sale is just one data point in a complex picture. Further analysis is needed to fully understand the implications of this transaction for Golden Entertainment.

The Director’s Identity and Role

The director who sold over $346,000 worth of Golden Entertainment stock is Glenn A. Christenson, a seasoned executive with a significant history within the company. He holds the position of Chief Executive Officer (CEO), making him the highest-ranking executive and responsible for the overall strategy, operations, and performance of Golden Entertainment.

This transaction raises questions about his confidence in the company’s future, especially given his long-standing involvement and the substantial amount of stock sold.

Learn about more about the process of Nvidia CFO Colette Kress sells shares worth over $7.7 million in the field.

Glenn Christenson’s Tenure and Stock Transactions

Understanding Glenn Christenson’s history with Golden Entertainment is crucial to interpreting the recent stock sale. He joined the company in 2008as the Chief Operating Officer (COO), a position he held for several years before being promoted to CEO in 2015. During his tenure, Christenson has overseen significant changes within Golden Entertainment, including the expansion of its casino portfolio and the development of new properties.

He has also played a key role in navigating the company through various economic cycles and industry challenges.Christenson’s previous stock transactions provide valuable context. While specific details about his past stock transactions are not readily available, his history with the company suggests a strong commitment to Golden Entertainment’s success.

“Glenn Christenson is a seasoned executive with a proven track record of success in the gaming industry. His leadership has been instrumental in Golden Entertainment’s growth and expansion.”

Potential Motivations for the Stock Sale

The decision by a Golden Entertainment director to sell over $346,000 worth of company stock raises questions about the motivations behind this move. While the director may have various reasons for selling, it’s crucial to consider potential factors that could have influenced this decision.

Personal Financial Needs

Personal financial needs can play a significant role in stock sales. A director might be selling shares to fund personal expenses, such as paying for education, healthcare, or a down payment on a home. These needs can be especially pressing in situations where individuals are facing unexpected financial burdens or are planning for retirement.

Diversification Strategies

Directors might choose to diversify their investment portfolios by reducing their exposure to a single company’s stock. Diversification helps spread risk and can be a strategic move, especially when considering market volatility or potential changes in a company’s performance.

Changes in Market Outlook

A director’s decision to sell stock could reflect a change in their outlook on the company’s future performance. If a director believes the company’s stock is overvalued or anticipates a downturn in the market, they might choose to sell shares to minimize potential losses.

This decision can also be influenced by factors such as industry trends, regulatory changes, or competitive pressures.

Recent Company Announcements or Events

Recent company announcements or events can significantly influence a director’s decision to sell stock. For example, a director might sell shares following a negative earnings report, a decline in revenue, or a significant restructuring announcement. These events can create uncertainty about the company’s future prospects and lead to a decrease in investor confidence.

Impact on Golden Entertainment

The director’s sale of a substantial amount of Golden Entertainment stock could have significant implications for the company’s financial health and overall market performance. This transaction could influence investor sentiment and potentially impact the company’s stock price, affecting its ability to raise capital and execute future business strategies.

Potential Impact on Stock Price and Market Performance

The sale of a large number of shares by a director can be interpreted as a negative signal by investors, suggesting a lack of confidence in the company’s future prospects. This perception could lead to a decline in the stock price, particularly if the sale is perceived as a “sell signal” by other investors.

The market may react negatively to the director’s actions, especially if the sale is made at a time when the company is facing challenges or uncertainty.

Implications for Investor Confidence and Financial Stability

Investor confidence is crucial for a company’s financial stability. A director’s stock sale can erode investor confidence, particularly if it is perceived as a lack of faith in the company’s future. This could lead to decreased investor interest in the company’s stock, potentially impacting its ability to raise capital for future projects and expansion.

Moreover, a decline in investor confidence can also affect the company’s creditworthiness, potentially leading to higher borrowing costs.

Consequences for the Director’s Role within the Company

The director’s stock sale could raise questions about their commitment to the company’s success and their future role within the organization. The sale may be perceived as a sign of disengagement, especially if the director’s holdings were significant. The board of directors may need to address the sale and provide clarity to investors regarding the director’s future involvement in the company.

In some cases, the sale could lead to the director’s resignation or a change in their responsibilities within the organization.

Industry Context

The gaming and entertainment industry is a dynamic and competitive sector, constantly evolving with new technologies, consumer preferences, and regulatory landscapes. Understanding the current state of the industry and its key trends is crucial to assessing the implications of Golden Entertainment’s stock sale.

Performance of Golden Entertainment Compared to its Competitors

The gaming industry is characterized by intense competition, with numerous large and regional operators vying for market share. Golden Entertainment’s performance can be compared to its competitors based on key metrics such as revenue, profitability, and market capitalization. Golden Entertainment operates primarily in Nevada and operates casinos, hotels, and other entertainment venues.

To analyze Golden Entertainment’s performance compared to its competitors, consider factors such as revenue growth, operating margins, and return on invested capital. This comparison should include key players in the Nevada market, such as Wynn Resorts, MGM Resorts International, and Caesars Entertainment.

Industry Trends and Regulatory Changes

The gaming and entertainment industry is subject to various trends and regulatory changes that can significantly impact the sector’s performance. Here are some notable trends and changes that could impact Golden Entertainment:

- Growing popularity of online gaming:The rise of online gaming platforms has led to increased competition for traditional casinos. Golden Entertainment must adapt to this trend by developing its online gaming presence or partnering with existing online gaming providers.

- Focus on customer experience:Casinos are increasingly focused on providing a unique and personalized customer experience. This involves investing in technology, entertainment options, and personalized services to attract and retain customers.

- Regulatory changes:The gaming industry is subject to strict regulations, which can vary by jurisdiction. Golden Entertainment must be aware of and comply with these regulations to avoid penalties and maintain its license to operate.

- Economic conditions:The gaming industry is cyclical, with its performance often tied to economic conditions. Economic downturns can lead to reduced consumer spending on discretionary activities such as gambling.

Investor Perspective

The director’s sale of a significant amount of company stock raises concerns for investors, prompting them to reassess their investment strategy regarding Golden Entertainment. This event could influence investor decisions, potentially impacting the company’s stock price. Understanding the implications of this sale is crucial for investors considering Golden Entertainment as an investment opportunity.

Potential Investor Reactions

The news of a director selling a significant portion of their stock could trigger various reactions among investors. These reactions could be influenced by factors such as the director’s past performance, the company’s current financial standing, and the overall market sentiment.

Here’s a breakdown of potential investor reactions and their implications:

- Increased Scrutiny:Investors may become more cautious and scrutinize the company’s financials and future prospects more closely. This heightened scrutiny could lead to a deeper analysis of the company’s growth potential, debt levels, and competitive landscape.

- Sell-Off Pressure:The news could create sell-off pressure, as investors may interpret the sale as a sign of a lack of confidence in the company’s future. This could lead to a decline in the stock price, especially if the sale coincides with other negative news or market trends.

- Reduced Investor Confidence:Investors may lose confidence in the company’s leadership, especially if the sale is perceived as a lack of faith in the company’s future. This could lead to a decrease in investor interest and potential investment opportunities.

Recommendations for Investors

Investors considering investing in Golden Entertainment should carefully evaluate the situation and consider the following recommendations:

- Thorough Due Diligence:Conduct a thorough analysis of the company’s financials, market position, and competitive landscape. This should include examining the company’s debt levels, revenue streams, and growth potential.

- Seek Additional Information:Reach out to the company for clarification regarding the director’s stock sale. Understanding the rationale behind the sale and the director’s continued commitment to the company can provide valuable insights.

- Monitor Market Sentiment:Keep a close eye on market sentiment surrounding Golden Entertainment and the gaming industry as a whole. This includes monitoring news reports, analyst ratings, and investor discussions to gauge the overall market perception of the company.

Future Outlook: Golden Entertainment Director Sells Over 6k In Company Stock

The recent stock sale by a Golden Entertainment director, while significant in terms of the dollar amount, might not necessarily reflect a negative outlook for the company. It is crucial to analyze the broader context and potential implications of this event to understand its impact on Golden Entertainment’s future.

Potential Impact on Growth and Profitability

The director’s stock sale could be interpreted as a sign of confidence in the company’s future prospects, particularly if the sale was motivated by personal financial needs rather than concerns about the company’s performance. However, it is essential to consider other factors that might influence Golden Entertainment’s growth and profitability.

For instance, the company’s recent financial performance, its strategic initiatives, and the overall economic environment will play a crucial role in shaping its future.

Challenges and Opportunities

Golden Entertainment, like any other company in the gaming and hospitality industry, faces a range of challenges and opportunities.

Challenges

- Competition:The gaming industry is highly competitive, with established players like Caesars Entertainment and Wynn Resorts vying for market share. Golden Entertainment must constantly innovate and differentiate itself to maintain its competitive edge.

- Economic Fluctuations:The gaming industry is sensitive to economic downturns. During economic recessions, consumer spending on entertainment and leisure activities tends to decline, which can impact Golden Entertainment’s revenue and profitability.

- Regulatory Environment:The gaming industry is subject to strict regulations that can vary by jurisdiction. Golden Entertainment must comply with these regulations and adapt to any changes in regulatory requirements.

Opportunities

- Expansion into New Markets:Golden Entertainment can explore opportunities to expand into new markets, both domestically and internationally, to diversify its revenue streams and reach new customer segments.

- Technological Advancements:The gaming industry is rapidly evolving with the adoption of new technologies such as online gaming, mobile gaming, and virtual reality. Golden Entertainment can leverage these advancements to enhance the customer experience and attract new players.

- Diversification:Golden Entertainment can explore opportunities to diversify its business beyond traditional casino gaming. This could include expanding into areas like hospitality, entertainment, and real estate.

Long-Term Implications

The long-term implications of the director’s stock sale for Golden Entertainment are difficult to predict with certainty. However, it is reasonable to assume that the company’s future success will depend on its ability to navigate the challenges and capitalize on the opportunities Artikeld above.

Concluding Remarks

The impact of this stock sale on Golden Entertainment’s stock price and overall market performance is a key area of concern. Investors will be closely watching to see how this news affects the company’s financial stability and future prospects. The industry context, including the current state of the gaming and entertainment industry and Golden Entertainment’s performance relative to its competitors, also plays a significant role in understanding the broader implications of this event.

Ultimately, the future outlook for Golden Entertainment hinges on how the company navigates this recent development and the broader market trends that are shaping the gaming and entertainment landscape.

FAQ

What is the potential impact of this stock sale on Golden Entertainment’s stock price?

The stock sale could potentially impact Golden Entertainment’s stock price in a number of ways. Investors may perceive the sale as a sign of a lack of confidence in the company’s future, which could lead to a decrease in the stock price.

On the other hand, the sale could also be seen as a positive sign, indicating that the director is diversifying their portfolio and taking profits. Ultimately, the impact of the stock sale on Golden Entertainment’s stock price will depend on how investors interpret the news.

What are the potential consequences for the director’s role within the company?

The stock sale could have potential consequences for the director’s role within the company, depending on the company’s internal policies and the director’s position. If the director’s stock sale was deemed to be a conflict of interest or a breach of fiduciary duty, it could lead to disciplinary action or even termination.

However, if the sale was deemed to be in line with company policy and the director’s responsibilities, it is unlikely to have any significant impact on their role within the company.

CentralPoint Latest News

CentralPoint Latest News