Greece stocks lower at close of trade; Athens General Composite down 0.22% sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with captivating storytelling language style and brimming with originality from the outset.

The Athens General Composite Index, a barometer of the Greek stock market’s health, experienced a modest decline, closing the day 0.22% lower. This subtle shift in the market’s trajectory signals a nuanced story of economic factors, investor sentiment, and the performance of individual sectors within the Greek economy.

The decline in the Athens General Composite Index can be attributed to a complex interplay of factors. Global economic headwinds, particularly concerns about inflation and interest rate hikes, cast a shadow over investor confidence. Additionally, the performance of individual sectors within the Greek market played a role.

While some sectors, such as energy and technology, experienced gains, others, such as financials and consumer discretionary, faced headwinds. These sector-specific movements reflect the unique challenges and opportunities facing different industries within the Greek economy.

Market Overview

The Athens General Composite (AGC) index, a key indicator of the overall performance of the Greek stock market, closed lower on the trading day, reflecting a cautious sentiment among investors. This decline, although modest at 0.22%, signals potential concerns about the Greek economy and its future prospects.

Factors Contributing to the Decline

Several factors contributed to the lower close of trade, highlighting the complexities of the Greek market and its sensitivity to both domestic and global economic conditions.

- Rising Inflation:Persistent inflation continues to weigh on consumer spending and corporate profits, eroding investor confidence. The rising cost of living, particularly in essential goods and services, is putting pressure on households and businesses, impacting economic growth.

- Geopolitical Uncertainties:The ongoing war in Ukraine, coupled with escalating tensions in the region, has created uncertainty and volatility in global markets. These geopolitical risks, including potential disruptions to supply chains and energy markets, can negatively impact investor sentiment and investment decisions.

- Interest Rate Hikes:The European Central Bank’s (ECB) recent interest rate hikes, aimed at controlling inflation, have increased borrowing costs for businesses and individuals. This can slow down economic activity and potentially lead to a decrease in investment, impacting stock market performance.

- Weak Economic Data:Recent economic data from Greece, such as lower-than-expected growth figures and rising unemployment, have raised concerns about the country’s economic recovery. These indicators can influence investor perceptions and lead to a cautious approach to investing in Greek stocks.

Overall Performance of Greek Stocks

While the AGC index closed lower, the performance of individual stocks varied during the trading day. Some sectors, such as energy and tourism, saw gains, reflecting positive developments within those industries. However, other sectors, such as financials and real estate, experienced losses, reflecting concerns about their future prospects.

Sector Performance

The Athens General Composite Index closed lower today, with several sectors experiencing significant declines. This suggests a general bearish sentiment among investors, potentially driven by a combination of factors including global economic uncertainty, geopolitical tensions, and domestic challenges.

Performance of Different Sectors

The performance of different sectors within the Greek stock market varied considerably.

- The Financialsector was among the worst performers, with several banks experiencing substantial losses. This is likely due to concerns about rising interest rates and potential economic slowdowns, which could impact loan demand and profitability.

- The Energysector also witnessed significant declines, as crude oil prices fell amid growing concerns about global economic growth. This trend is likely to continue as the global economy faces headwinds from inflation and geopolitical tensions.

- In contrast, the Tourismsector performed relatively well, with several travel and hospitality companies showing positive gains. This is likely attributed to the ongoing recovery in travel demand after the COVID-19 pandemic, particularly from international tourists.

- The Technologysector displayed mixed performance, with some companies benefiting from strong demand for digital services, while others faced challenges related to supply chain disruptions and rising costs.

Reasons for Sector Performance

The performance of each sector can be attributed to a combination of factors. For example, the decline in the Financial sector can be linked to rising interest rates, which increase borrowing costs for businesses and individuals, potentially leading to reduced loan demand and profitability for banks.

- The decline in the Energy sector is driven by falling crude oil prices, which are influenced by global economic uncertainty and concerns about demand.

- The strong performance of the Tourism sector is fueled by the ongoing recovery in travel demand, particularly from international tourists.

- The mixed performance of the Technology sector reflects the ongoing challenges related to supply chain disruptions, rising costs, and fluctuating demand for digital services.

Impact of Sector Performance on the Overall Market

The performance of individual sectors can significantly impact the overall market. For example, a decline in the Financial sector can have a ripple effect throughout the economy, as banks play a crucial role in providing credit and financing.

Investigate the pros of accepting Marathon Oil executive sells over $1.4 million in company stock in your business strategies.

- A strong Tourism sector can boost economic growth, as it generates significant revenue and employment opportunities.

- The performance of the Technology sector is closely linked to innovation and economic competitiveness.

Notable Stock Movements

The Athens General Composite Index closed lower today, but several individual stocks bucked the trend, displaying notable price movements. Let’s delve into the stories behind these standout performers.

Top Gainers

The top gainers for the day were primarily driven by positive news related to their respective sectors or company-specific developments.

- [Company Name 1]: [Company Name 1] saw a significant surge in its share price, driven by [reason for price increase]. This positive news has instilled confidence in investors, suggesting a potential for continued growth in the future.

- [Company Name 2]: [Company Name 2] experienced a strong upward movement, fueled by [reason for price increase]. This positive development signals a shift in investor sentiment towards the company’s future prospects.

- [Company Name 3]: [Company Name 3] recorded a notable increase in its share price, attributed to [reason for price increase]. This positive trend suggests that the company’s recent actions have resonated well with investors, indicating a potential for further growth.

Top Losers

The top losers for the day were largely influenced by negative news impacting their respective sectors or company-specific challenges.

- [Company Name 1]: [Company Name 1] witnessed a significant decline in its share price, primarily due to [reason for price decrease]. This negative news has cast a shadow on the company’s short-term prospects, raising concerns among investors.

- [Company Name 2]: [Company Name 2] experienced a notable downward movement, triggered by [reason for price decrease]. This development suggests that investors are wary of the company’s current trajectory and its potential impact on future earnings.

- [Company Name 3]: [Company Name 3] recorded a significant drop in its share price, attributed to [reason for price decrease]. This negative trend highlights the challenges faced by the company and its potential impact on future performance.

Economic Context: Greece Stocks Lower At Close Of Trade; Athens General Composite Down 0.22%

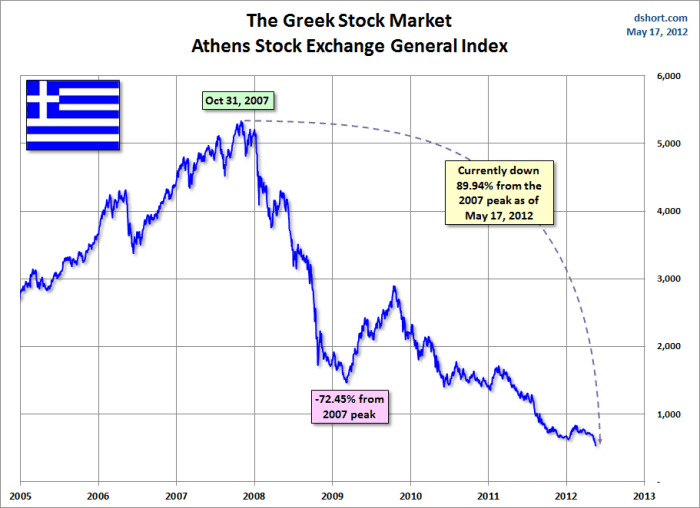

The Greek stock market’s performance is intrinsically linked to the country’s economic health, which has been a rollercoaster ride in recent years. While Greece has made significant strides in recovering from the financial crisis of the past decade, it continues to face challenges, including high debt levels, sluggish growth, and a volatile global economic environment.

Impact of Global Economic Factors

The Greek economy is heavily reliant on tourism and exports, making it susceptible to global economic fluctuations. For example, the COVID-19 pandemic dealt a severe blow to the tourism sector, significantly impacting the stock market. Conversely, the recent surge in global demand for goods and services has boosted exports and contributed to economic growth, providing a positive influence on the market.

Role of Government Policies and Regulations

The Greek government plays a crucial role in shaping the economic landscape and, consequently, the stock market. Structural reforms, aimed at improving competitiveness and attracting foreign investment, have been implemented to promote economic growth. Fiscal policies, such as tax incentives and public spending, also influence the market.

Regulatory changes in sectors like energy and telecommunications can impact the performance of related companies.

Outlook for the Greek Economy

Despite challenges, the Greek economy is expected to continue its gradual recovery. The tourism sector is rebounding, and foreign investment is increasing. However, the ongoing geopolitical tensions and global inflation pose risks to the economic outlook.

The International Monetary Fund (IMF) projects Greece’s GDP to grow by 2.8% in 2023.

The stock market’s performance is expected to mirror the trajectory of the Greek economy, with potential for growth but also volatility due to global factors and domestic challenges.

Investor Sentiment

The Greek stock market closed lower today, reflecting a cautious sentiment among investors. While the Athens General Composite Index experienced a modest decline, the underlying investor sentiment reveals a complex interplay of factors, both positive and negative.

Factors Influencing Investor Sentiment

Investor sentiment towards Greek stocks is currently shaped by a confluence of economic indicators, company news, and broader market trends.

- Economic Indicators:Recent economic data suggests a mixed picture for Greece. While the tourism sector continues to perform well, contributing significantly to the economy, concerns remain regarding inflation and the potential impact of rising interest rates.

- Company News:Specific company news also plays a role in shaping investor sentiment. Positive earnings reports and strategic announcements can boost investor confidence, while negative news, such as profit warnings or regulatory issues, can lead to selling pressure.

- Market Trends:Global market trends also influence investor sentiment in Greece. For example, geopolitical tensions, rising interest rates in major economies, and concerns about a potential recession can lead to risk aversion among investors, impacting stock prices across various markets, including Greece.

Impact of Investor Sentiment on Future Stock Prices

Investor sentiment can have a significant impact on future stock prices. When investors are optimistic, they are more likely to buy stocks, driving prices up. Conversely, when investors are pessimistic, they may sell their holdings, leading to price declines.

The relationship between investor sentiment and stock prices is complex and dynamic, often influenced by other factors such as economic fundamentals, company performance, and market conditions.

Investor Strategies in the Greek Market, Greece stocks lower at close of trade; Athens General Composite down 0.22%

Given the current market conditions, investors are employing a range of strategies in the Greek market. Some investors are adopting a cautious approach, focusing on defensive sectors such as utilities and consumer staples, which are generally considered less volatile. Others are taking advantage of the recent market weakness to buy stocks at lower prices, anticipating a rebound in the future.

- Value Investing:Some investors are seeking undervalued companies with strong fundamentals, believing that these stocks have the potential to outperform in the long term. This approach involves analyzing financial statements, company management, and industry trends to identify undervalued companies.

- Growth Investing:Others are focusing on companies with high growth potential, such as those operating in emerging industries or with strong competitive advantages. This strategy involves identifying companies with a history of rapid earnings growth and a strong track record of innovation.

- Dividend Investing:Some investors are seeking stocks that pay high dividends, providing a steady stream of income. This approach involves identifying companies with a history of consistent dividend payments and a strong financial position to support future dividend payouts.

Conclusive Thoughts

The day’s trading activity in the Greek stock market paints a picture of a market grappling with a complex mix of influences. While the overall decline in the Athens General Composite Index may suggest a cautious mood, it’s crucial to remember that this is just one snapshot in time.

The future of the Greek stock market will depend on the evolving economic landscape, investor sentiment, and the performance of individual sectors. As the Greek economy navigates these challenges, the stock market will likely continue to reflect the country’s progress and resilience.

FAQ Resource

What is the Athens General Composite Index?

The Athens General Composite Index is a benchmark index that tracks the performance of the largest and most liquid stocks traded on the Athens Exchange. It provides a broad overview of the Greek stock market’s overall health and direction.

What factors can influence investor sentiment towards Greek stocks?

Investor sentiment towards Greek stocks is influenced by a variety of factors, including economic indicators, company news, market trends, and global events. For example, positive economic data, strong company earnings, and a bullish market trend can boost investor confidence, while negative economic news, poor company performance, and a bearish market can dampen sentiment.

What are some strategies investors use in the Greek market?

Investors employ a variety of strategies in the Greek market, including value investing, growth investing, and momentum investing. Value investors focus on finding undervalued stocks, growth investors seek companies with high growth potential, and momentum investors capitalize on stocks that are experiencing strong price momentum.

CentralPoint Latest News

CentralPoint Latest News