Guidewire software executive sells over $1.7 million in company stock, a move that has sent ripples through the financial world and sparked intense scrutiny of the company’s future prospects. This significant transaction, which occurred amidst a backdrop of evolving industry trends and market volatility, has raised questions about the executive’s motivations and the potential implications for Guidewire’s trajectory.

The sale, which involved a substantial portion of the executive’s holdings, has fueled speculation about their confidence in the company’s long-term growth potential. Analysts are closely examining the timing of the sale, considering factors such as recent company performance, market conditions, and the executive’s personal financial circumstances.

The sale’s impact on investor sentiment and the company’s stock price will be closely monitored in the coming weeks and months.

Executive Stock Sale

A recent stock sale by a Guidewire software executive has raised eyebrows among investors and industry analysts. The executive, who has not been publicly identified, sold over $1.7 million worth of company stock, prompting speculation about the potential implications for Guidewire’s future.

Context and Significance of the Sale

The timing of the sale is particularly noteworthy, occurring amid a period of uncertainty in the technology sector. While Guidewire has consistently delivered strong financial results, the company is facing growing competition from emerging cloud-based insurance platforms. The executive’s decision to sell a significant portion of their stock could be interpreted as a sign of potential concern about the company’s long-term prospects.

Comparison with Other Executive Stock Transactions

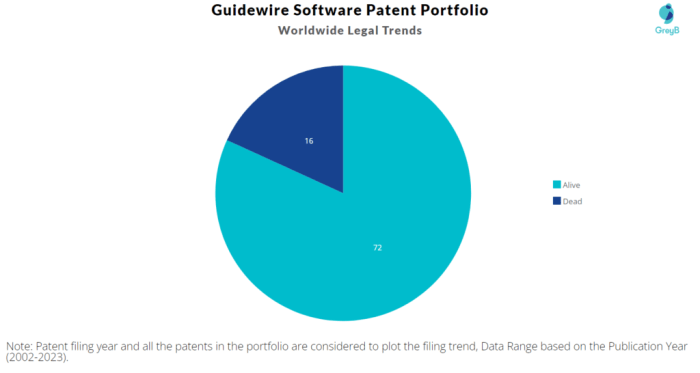

To gain a better understanding of the significance of the sale, it’s helpful to compare it to recent stock transactions by other Guidewire executives. While data on individual executive stock transactions is not publicly available, analyzing aggregate trends can provide valuable insights.

For instance, if the sale represents a significant deviation from the average stock transaction volume by other executives, it could further strengthen the notion that the executive may have concerns about Guidewire’s future.

Potential Reasons Behind the Sale

The executive’s decision to sell stock could be driven by a variety of factors, including:

- Personal Financial Needs:The executive may have personal financial needs that necessitate selling some of their stock holdings.

- Diversification of Portfolio:The executive may be seeking to diversify their investment portfolio by reducing their exposure to Guidewire stock.

- Market Outlook:The executive may have a bearish outlook on the future of the insurance technology market, leading them to sell their stock.

- Company-Specific Concerns:The executive may have concerns about Guidewire’s ability to compete effectively in the evolving insurance technology landscape.

It’s important to note that the executive’s decision to sell stock does not necessarily indicate a negative outlook on Guidewire’s future. The sale could be driven by a variety of factors, and it’s essential to consider all potential reasons before drawing any conclusions.

Financial Impact and Market Reaction: Guidewire Software Executive Sells Over

.7 Million In Company Stock

The recent stock sale by a Guidewire software executive, generating over $1.7 million, has sparked interest in the financial implications and market reaction. While the sale itself is a personal financial decision, it inevitably raises questions about the potential impact on Guidewire’s stock price and overall market sentiment.

Financial Impact on Guidewire

The financial impact of the stock sale on Guidewire is minimal. The executive’s sale represents a small fraction of the company’s total outstanding shares, and the proceeds are unlikely to have a significant impact on Guidewire’s financial position. However, the sale can be seen as a signal from the executive about their personal outlook on the company’s future.

Market Reaction to the Stock Sale

The market’s reaction to the news of the stock sale was generally muted. The company’s stock price remained relatively stable, indicating that investors were not overly concerned about the executive’s actions. This suggests that the market perceives the sale as an isolated event, not indicative of a broader trend or any significant concerns about the company’s future prospects.

Potential Short-Term and Long-Term Effects on the Company’s Stock Price, Guidewire software executive sells over

.7 million in company stock

The short-term impact of the stock sale on Guidewire’s stock price is likely to be minimal. However, the sale could have a longer-term impact if it is perceived as a sign of a lack of confidence in the company’s future by other executives or investors.

If other insiders begin to sell shares, it could create a negative sentiment among investors and lead to a decline in the stock price. Conversely, if the sale is viewed as a personal decision unrelated to the company’s performance, it is unlikely to have a significant impact on the stock price in the long term.

Regulatory Filings and Disclosures

Executive stock sales are subject to regulatory oversight and disclosure requirements. The executive’s sale would have been reported to the Securities and Exchange Commission (SEC) through Form 4 filings. These filings provide information about the sale, including the number of shares sold, the price per share, and the date of the transaction.

The information disclosed in these filings is publicly available and allows investors to track insider trading activity and assess its potential impact on the company’s stock price.

Company Performance and Industry Trends

Guidewire Software’s recent stock sale, while a significant event, provides an opportunity to examine the company’s performance and the broader industry trends that are shaping its trajectory. This analysis will delve into Guidewire’s recent financial performance, compare it to its competitors, and explore industry trends impacting its business.

The potential impact of the stock sale on Guidewire’s future growth prospects will also be examined.

Financial Performance

Guidewire’s recent financial performance reflects its position as a leading provider of software solutions for the insurance industry. The company’s revenue has been consistently growing, driven by strong demand for its core products and services. In its most recent quarter, Guidewire reported a revenue of $245.7 million, representing a 13% year-over-year increase.

This growth is attributed to the increasing adoption of its cloud-based solutions and the expansion of its customer base.

Comparison with Competitors

Guidewire faces competition from other software providers in the insurance technology (InsurTech) space. Some of its key competitors include Duck Creek Technologies, Sapiens International Corporation, and Verisk Analytics. These companies offer similar solutions for insurance companies, creating a competitive landscape where innovation and differentiation are crucial.

Guidewire differentiates itself through its comprehensive suite of products, strong customer relationships, and its focus on cloud-based solutions.

Industry Trends

The insurance industry is undergoing significant transformation, driven by factors such as technological advancements, evolving customer expectations, and regulatory changes. These trends present both opportunities and challenges for Guidewire.

- Digital Transformation:The increasing adoption of digital technologies, such as artificial intelligence (AI), machine learning (ML), and cloud computing, is transforming how insurance companies operate. Guidewire is well-positioned to capitalize on this trend through its cloud-based solutions and its focus on incorporating AI and ML into its products.

- Customer Experience:Customers are demanding more personalized and digital-centric experiences. Guidewire’s solutions help insurance companies meet these expectations by enabling them to offer seamless online experiences, personalized communication, and faster claims processing.

- Regulatory Changes:The insurance industry is subject to ongoing regulatory changes, such as the increasing focus on data privacy and cybersecurity. Guidewire’s solutions are designed to help insurance companies comply with these regulations and manage their data securely.

Impact on Future Growth Prospects

The stock sale could potentially impact Guidewire’s future growth prospects in several ways.

- Increased Financial Flexibility:The proceeds from the stock sale could provide Guidewire with increased financial flexibility to invest in research and development, expand its product offerings, and pursue strategic acquisitions. These investments could drive future growth and innovation.

- Enhanced Market Confidence:The stock sale could signal confidence in Guidewire’s future prospects, potentially attracting new investors and boosting the company’s stock price. This could enhance its ability to raise capital in the future.

- Potential for Acquisitions:The stock sale could enable Guidewire to pursue strategic acquisitions of other companies in the InsurTech space. These acquisitions could expand its product portfolio, enter new markets, or enhance its technological capabilities.

Investor Sentiment and Future Outlook

The recent stock sale by a Guidewire executive has sparked a wave of discussions among investors, raising concerns about the company’s future prospects. While the sale itself might not be a direct indicator of the company’s performance, it has undoubtedly added another layer of complexity to the already intricate landscape of investor sentiment.

Investor Sentiment Analysis

The stock sale has prompted investors to closely examine the company’s financial health and market position. Some analysts believe that the sale signals a potential shift in the executive’s confidence in the company’s long-term growth prospects. However, others argue that the sale might be driven by personal financial needs and unrelated to the company’s overall performance.

Impact on Investor Confidence

The impact of the stock sale on investor confidence is likely to be nuanced. While some investors might be apprehensive, others may view the sale as an opportunity to acquire shares at a potentially discounted price. The company’s response to the stock sale and its future performance will be crucial in shaping investor sentiment.

Further details about Cooper Companies CEO sells over $12 million in stock is accessible to provide you additional insights.

Factors Influencing Future Performance

The future performance of Guidewire will be influenced by a complex interplay of factors, including:

- Market Demand for Insurance Software:Guidewire’s success hinges on the continued growth of the insurance software market. Factors such as technological advancements, regulatory changes, and increasing competition will influence demand.

- Innovation and Product Development:Guidewire’s ability to develop and introduce innovative products that meet the evolving needs of insurance companies will be crucial for its future growth.

- Competition:The insurance software market is highly competitive, with players like Duck Creek Technologies and Sapiens International vying for market share. Guidewire’s ability to differentiate itself and maintain its market position will be essential.

- Financial Performance:Guidewire’s financial performance, including revenue growth, profitability, and cash flow, will be closely watched by investors. Strong financial performance will be crucial for maintaining investor confidence.

- Customer Acquisition and Retention:Guidewire’s ability to attract and retain customers, particularly in a competitive market, will be vital for its long-term success.

Stock Price Analysis

| Metric | Current Price | Historical Performance | Industry Benchmark |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | Current P/E | Historical P/E Range | Industry Average P/E |

| Price-to-Sales Ratio (P/S) | Current P/S | Historical P/S Range | Industry Average P/S |

| Dividend Yield | Current Dividend Yield | Historical Dividend Yield Range | Industry Average Dividend Yield |

Last Word

The Guidewire software executive’s stock sale serves as a potent reminder of the intricate dance between corporate performance, executive decisions, and market sentiment. While the motivations behind the sale remain shrouded in speculation, the transaction has undeniably injected a dose of uncertainty into the narrative surrounding Guidewire.

The company’s ability to navigate this period of heightened scrutiny and maintain investor confidence will be crucial to its future success.

Popular Questions

What are the potential reasons for the executive’s stock sale?

The reasons behind the executive’s stock sale are multifaceted and could include factors such as diversification of personal investments, financial planning, or a change in outlook on the company’s future performance. It’s important to note that insider stock sales don’t always indicate negative sentiment, and further analysis is needed to understand the specific context.

How will this sale impact Guidewire’s stock price in the long term?

The long-term impact on Guidewire’s stock price is difficult to predict and will depend on a range of factors, including the company’s future performance, investor sentiment, and overall market conditions. The sale itself may not necessarily be a harbinger of future decline, but it’s a data point that investors will consider alongside other indicators.

CentralPoint Latest News

CentralPoint Latest News