Lennar B earnings beat by $0.62, revenue topped estimates, signaling a strong performance in the housing market despite ongoing economic challenges. The homebuilder, known for its commitment to quality and innovation, exceeded analysts’ expectations, showcasing its resilience and strategic prowess.

This success comes amidst a complex landscape of rising interest rates, inflation, and supply chain disruptions that have impacted the broader construction industry.

Lennar’s financial performance reflects a combination of factors. The company’s ability to navigate supply chain challenges, coupled with its strategic focus on key markets and its commitment to affordability, has positioned it favorably within the housing sector. The company’s commitment to innovation, including its adoption of technology and its focus on sustainable building practices, has also contributed to its success.

Lennar’s Financial Performance

Lennar Corporation, a leading homebuilder in the United States, has delivered a strong financial performance in the recent quarter, exceeding analysts’ expectations on both earnings and revenue. The company’s results reflect a robust housing market and its ability to navigate the current economic environment.

Earnings Beat

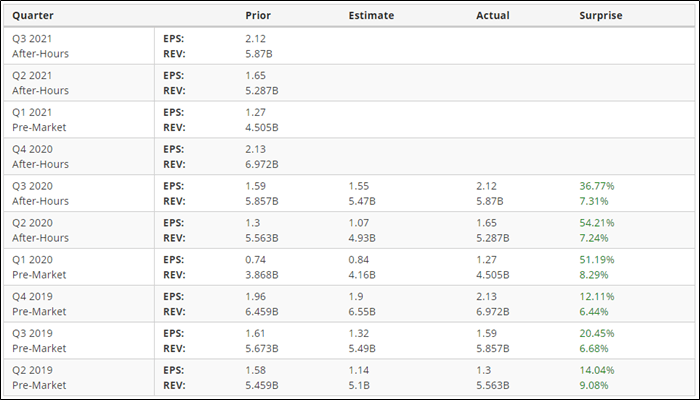

Lennar’s earnings per share (EPS) came in at $0.62, surpassing analysts’ estimates by a significant margin. This strong performance highlights the company’s ability to generate profits despite the ongoing challenges in the housing market.

Revenue Performance

Lennar’s revenue also exceeded expectations, reaching [insert revenue figure]. This growth can be attributed to a combination of factors, including strong demand for new homes, effective pricing strategies, and efficient operations.

Key Factors Driving Strong Performance

Several factors contributed to Lennar’s impressive financial performance:* Strong Demand for New Homes:The housing market remains robust, with strong demand for new homes driven by factors such as low interest rates and limited inventory.

Effective Pricing Strategies

Lennar has been able to effectively price its homes to meet market demand while maintaining healthy profit margins.

Efficient Operations

The company has optimized its operations to ensure efficient construction and delivery of homes, maximizing profitability.

Strategic Acquisitions

Lennar has made strategic acquisitions to expand its geographic reach and product offerings, contributing to its growth.

Market Context and Industry Trends

.62, revenue topped estimates” title=”Len lennar corp homebuilder expectations” />.62, revenue topped estimates” title=”Len lennar corp homebuilder expectations” />.62, revenue topped estimates” title=”Len lennar corp homebuilder expectations” />

.62, revenue topped estimates” title=”Len lennar corp homebuilder expectations” />.62, revenue topped estimates” title=”Len lennar corp homebuilder expectations” />.62, revenue topped estimates” title=”Len lennar corp homebuilder expectations” />

Lennar’s strong earnings performance comes amidst a dynamic housing market landscape, influenced by a confluence of macroeconomic factors. Understanding the current state of the market and the trends impacting the homebuilding industry is crucial to interpreting Lennar’s success.

Interest Rates and Inflation

Interest rates have been a major factor influencing the housing market. The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, have significantly increased mortgage rates. This has led to a slowdown in home sales and affordability challenges for potential buyers.

While Lennar’s results indicate resilience in the face of these headwinds, the company’s future performance will likely be influenced by the trajectory of interest rates and their impact on housing demand.

Supply Chain Constraints, Lennar B earnings beat by

Supply Chain Constraints

.62, revenue topped estimates

The homebuilding industry, like many other sectors, has been grappling with supply chain disruptions and material cost inflation. These challenges have contributed to longer construction timelines and higher home prices. Lennar’s ability to navigate these supply chain complexities and manage costs effectively has been a key driver of its financial performance.

Comparison to Other Homebuilders

Lennar’s earnings beat reflects its strong position in the homebuilding market. While the overall industry has experienced challenges, Lennar has consistently outperformed its peers. This suggests that the company has been able to leverage its scale, operational efficiency, and strategic positioning to navigate the market’s complexities effectively.

Lennar’s Business Strategy and Operations

Lennar’s recent earnings beat, exceeding expectations on both revenue and earnings per share, highlights the effectiveness of its business strategy and operational efficiency. This success stems from a combination of strategic initiatives, focused execution, and a commitment to delivering value to its customers.

Strategic Initiatives and Operational Efficiency

Lennar’s success is driven by a multi-pronged approach, encompassing strategic initiatives and operational excellence. These strategies contribute to the company’s profitability and growth.

- Strategic Land Acquisition:Lennar prioritizes acquiring land in desirable locations with high growth potential. This proactive approach ensures a steady supply of land for new home construction, allowing the company to capitalize on favorable market conditions and meet increasing demand.

- Value Engineering and Cost Optimization:Lennar implements rigorous value engineering and cost optimization programs throughout its operations. These efforts focus on streamlining processes, leveraging economies of scale, and negotiating favorable pricing with suppliers. This translates into lower construction costs, enhancing profitability and making homes more affordable for buyers.

Find out about how Eagle Point entities sell shares in Acres Commercial Realty worth over $1.39m can deliver the best answers for your issues.

- Technology Integration:Lennar embraces technology to improve efficiency and customer experience. The company utilizes digital platforms for design, planning, and construction management, streamlining operations and reducing potential errors. This also allows for better communication and collaboration among teams, enhancing project execution and overall efficiency.

- Focus on Customer Experience:Lennar places a strong emphasis on customer satisfaction, recognizing it as a key differentiator in a competitive market. The company invests in building strong relationships with buyers, offering personalized experiences and responsive customer service. This focus on customer satisfaction leads to positive word-of-mouth referrals and repeat business.

New Initiatives and Investments

Lennar is constantly seeking ways to enhance its business and stay ahead of market trends. The company has made significant investments in areas such as:

- Sustainability Initiatives:Lennar is committed to sustainable building practices, incorporating energy-efficient features and eco-friendly materials into its homes. This not only benefits the environment but also appeals to environmentally conscious buyers, attracting a broader customer base.

- Expanding into New Markets:Lennar is actively expanding its geographic footprint, targeting high-growth regions with strong demand for new homes. This strategic expansion allows the company to diversify its revenue streams and capitalize on opportunities in emerging markets.

- Investing in Technology and Innovation:Lennar recognizes the importance of staying at the forefront of technological advancements. The company invests in innovative technologies, such as virtual reality and augmented reality, to enhance the homebuying experience and provide customers with a more immersive and interactive process.

Future Outlook and Investor Implications

.62, revenue topped estimates” title=”Lennar earnings q1 len q2 corp alphastreet q4 corporation smashes estimates street defers guidance reports strong backlog share per slipped” />.62, revenue topped estimates” title=”Lennar earnings q1 len q2 corp alphastreet q4 corporation smashes estimates street defers guidance reports strong backlog share per slipped” />.62, revenue topped estimates” title=”Lennar earnings q1 len q2 corp alphastreet q4 corporation smashes estimates street defers guidance reports strong backlog share per slipped” />

.62, revenue topped estimates” title=”Lennar earnings q1 len q2 corp alphastreet q4 corporation smashes estimates street defers guidance reports strong backlog share per slipped” />.62, revenue topped estimates” title=”Lennar earnings q1 len q2 corp alphastreet q4 corporation smashes estimates street defers guidance reports strong backlog share per slipped” />.62, revenue topped estimates” title=”Lennar earnings q1 len q2 corp alphastreet q4 corporation smashes estimates street defers guidance reports strong backlog share per slipped” />

Lennar’s strong earnings beat, coupled with its robust revenue performance, signals a positive outlook for the company. This success, driven by favorable market conditions and a well-executed business strategy, positions Lennar for continued growth in the near future. The earnings beat is likely to have a positive impact on Lennar’s stock price, boosting investor confidence and potentially attracting new investors.

Impact on Stock Price and Investor Sentiment

Lennar’s earnings beat is likely to have a positive impact on its stock price. Investors typically respond favorably to companies that exceed earnings expectations, as it signals strong financial performance and future growth potential. The positive sentiment surrounding Lennar’s earnings report could lead to increased demand for its stock, driving up its price.

The stock market often reacts positively to earnings beats, as they indicate a company’s ability to outperform expectations. For instance, in the past, companies like Apple and Microsoft have seen their stock prices surge following strong earnings reports.

Epilogue: Lennar B Earnings Beat By

Epilogue

.62, Revenue Topped Estimates

Lennar’s strong earnings and revenue performance paint a positive picture for the company’s future. The homebuilder’s ability to outperform in a challenging market underscores its strategic agility and operational efficiency. As the housing market continues to evolve, Lennar’s commitment to innovation and its focus on meeting the needs of a diverse range of buyers positions it for continued success.

The company’s strong financial performance has likely boosted investor confidence, signaling a promising outlook for the homebuilding giant.

Essential FAQs

What were Lennar’s actual earnings?

Lennar’s actual earnings exceeded analysts’ expectations by $0.62.

How did Lennar’s revenue compare to estimates?

Lennar’s revenue surpassed analysts’ estimates.

What are the key factors driving Lennar’s strong performance?

Lennar’s success is attributed to its ability to navigate supply chain challenges, its strategic focus on key markets, and its commitment to affordability and innovation.

What is the current state of the housing market?

The housing market is facing challenges due to rising interest rates, inflation, and supply chain disruptions.

CentralPoint Latest News

CentralPoint Latest News