MercadoLibre stock gets new Street-high targets, igniting a wave of optimism among investors. This Latin American e-commerce giant has consistently defied expectations, capturing the attention of analysts and investors alike. The recent surge in stock price is a testament to the company’s robust growth trajectory and its dominant position in the burgeoning Latin American online marketplace.

The new Street-high targets reflect a growing confidence in MercadoLibre’s ability to maintain its impressive momentum. Analysts are attributing this bullish sentiment to several key factors, including the company’s strong financial performance, its strategic expansion into new markets, and the favorable macroeconomic conditions in Latin America.

This article delves into the factors driving this upward trend, examining the company’s business performance, market dynamics, and investor considerations.

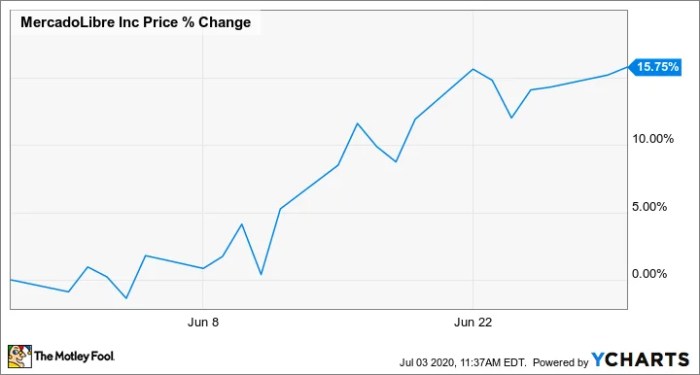

MercadoLibre’s Stock Performance

MercadoLibre, the leading e-commerce and digital payments platform in Latin America, has been experiencing a surge in its stock price, capturing the attention of investors and analysts alike. The company’s strong financial performance, coupled with its expansion into new markets and innovative offerings, has fueled this upward trend.

New Street-High Targets

The recent performance of MercadoLibre has prompted several Wall Street analysts to raise their price targets for the stock, setting new highs. This bullish sentiment reflects the confidence in the company’s growth prospects and its ability to capitalize on the burgeoning e-commerce market in Latin America.

Find out further about the benefits of Coursera director Ng Andrew Y. sells over $49k in company stock that can provide significant benefits.

- Morgan Stanley raised its price target to $2,000, citing MercadoLibre’s strong market position and its potential to capture a significant share of the region’s growing online retail market.

- Goldman Sachs also increased its target to $1,800, highlighting the company’s expanding ecosystem of services, including digital payments, logistics, and financial services.

- JPMorgan Chase set a target of $1,900, emphasizing MercadoLibre’s robust financial performance and its ability to generate strong cash flow.

Factors Driving the Upward Trend

Several factors have contributed to the recent surge in MercadoLibre’s stock price. These include:

- Strong Financial Performance:MercadoLibre has consistently delivered impressive financial results, with revenue and earnings growth exceeding expectations. The company’s strong financial performance reflects its dominant market position and its ability to effectively monetize its platform.

- Expansion into New Markets:MercadoLibre has been expanding its operations into new markets across Latin America, increasing its reach and customer base. This expansion strategy has contributed to the company’s revenue growth and its potential for further expansion.

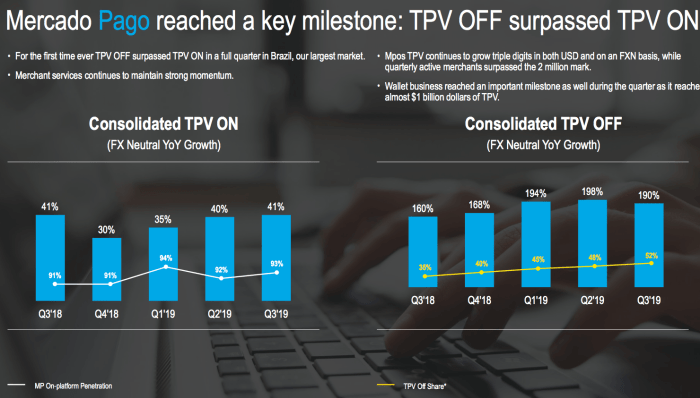

- Innovative Offerings:MercadoLibre has been introducing new products and services to enhance its platform and attract new customers. These innovations include its digital payments platform, Mercado Pago, its logistics network, Mercado Envios, and its financial services offering, Mercado Credito.

- Favorable Market Conditions:The e-commerce market in Latin America is experiencing rapid growth, driven by increasing internet penetration, smartphone adoption, and a growing middle class. MercadoLibre is well-positioned to benefit from this favorable market trend.

Historical Performance

MercadoLibre’s stock has had a remarkable track record, delivering significant returns to investors over the long term.

- The company’s stock has risen over 10,000% since its initial public offering (IPO) in 2007, demonstrating its strong growth potential and its ability to navigate the challenges of the Latin American market.

- MercadoLibre has consistently outperformed the broader market, delivering strong returns even during periods of economic uncertainty.

Market Factors Influencing MercadoLibre

MercadoLibre, the leading e-commerce platform in Latin America, is subject to a myriad of market factors that influence its stock performance. These factors range from macroeconomic trends to the competitive landscape and the evolving nature of e-commerce itself. Understanding these influences is crucial for investors seeking to assess the company’s future prospects.

Macroeconomic Factors, MercadoLibre stock gets new Street-high targets

The macroeconomic environment plays a significant role in MercadoLibre’s performance. Factors like inflation, interest rates, and economic growth directly impact consumer spending and, consequently, the company’s revenue.

- Inflation:High inflation can erode consumer purchasing power, leading to a decrease in demand for discretionary goods and services. However, MercadoLibre’s focus on essential goods and services, such as groceries and pharmaceuticals, can offer some resilience.

- Interest Rates:Rising interest rates can make it more expensive for businesses to borrow money, potentially hindering MercadoLibre’s expansion plans.

- Economic Growth:Strong economic growth in Latin America fuels consumer spending and supports MercadoLibre’s growth. Conversely, economic downturns can lead to reduced demand and slower growth.

E-commerce Trends

The e-commerce sector is constantly evolving, and MercadoLibre must adapt to remain competitive. Key trends include:

- Mobile Commerce:The increasing use of smartphones and tablets for online shopping is driving growth in mobile commerce. MercadoLibre has invested heavily in its mobile platform, which has become a major revenue driver.

- Cross-border E-commerce:As consumers become more comfortable buying goods from international sellers, cross-border e-commerce is gaining traction.

MercadoLibre has expanded its operations to several countries in Latin America, enabling cross-border transactions.

- Digital Payments:The rise of digital payment methods, such as Mercado Pago, has streamlined the online shopping experience and contributed to MercadoLibre’s growth.

Key Competitors and Strategies

MercadoLibre faces competition from both local and international players. Key competitors include:

- Amazon:Amazon has expanded its operations into Latin America, offering a wide range of products and services.

- Local Marketplaces:Several local marketplaces have emerged in Latin America, competing with MercadoLibre in specific niches.

- Traditional Retailers:Brick-and-mortar retailers are increasingly adopting online strategies, posing a challenge to pure-play e-commerce companies like MercadoLibre.

MercadoLibre differentiates itself through its strong brand recognition, extensive product selection, and integrated payment and logistics solutions.

Potential Risks and Challenges

Despite its strong market position, MercadoLibre faces several potential risks and challenges:

- Competition:The intense competition from global giants like Amazon and local players poses a significant threat.

- Regulatory Uncertainty:The regulatory environment in Latin America can be complex and unpredictable, potentially impacting MercadoLibre’s operations.

- Economic Volatility:Latin America is prone to economic instability, which can negatively impact consumer spending and MercadoLibre’s growth.

- Cybersecurity Threats:As a major online platform, MercadoLibre is vulnerable to cybersecurity threats, which can damage its reputation and disrupt its operations.

Investor Considerations

Investing in MercadoLibre presents a compelling opportunity to participate in the growth of Latin America’s e-commerce and fintech markets. However, it’s crucial to carefully consider the investment thesis, key factors, potential risks, and rewards before making a decision.

Investment Thesis

MercadoLibre’s investment thesis rests on its dominant position in Latin America’s e-commerce and fintech markets, coupled with its strong growth potential. The company benefits from a large and growing addressable market, increasing internet penetration, and rising consumer spending. MercadoLibre’s diversified business model, encompassing online marketplaces, digital payments, logistics, and financial services, creates a robust ecosystem that attracts both buyers and sellers.

Factors to Consider

Investors should consider several key factors before investing in MercadoLibre:

- Market Size and Growth:Latin America’s e-commerce market is expanding rapidly, driven by factors such as increasing internet penetration, smartphone adoption, and growing middle class. MercadoLibre’s dominant position in this market offers significant growth potential.

- Competitive Landscape:While MercadoLibre holds a dominant position, it faces competition from global players like Amazon and local rivals. Investors should assess the company’s competitive advantages, such as its established brand, extensive logistics network, and strong customer base.

- Financial Performance:MercadoLibre’s financial performance, including revenue growth, profitability, and cash flow, should be carefully analyzed. Investors should look for consistent revenue growth, expanding margins, and strong cash flow generation.

- Management Team:A strong and experienced management team is essential for navigating the complexities of the e-commerce and fintech markets. Investors should evaluate the management team’s track record, vision, and execution capabilities.

- Regulatory Environment:MercadoLibre operates in a dynamic regulatory environment. Investors should consider the potential impact of regulations on the company’s operations and future growth prospects.

Risks and Rewards

Investing in MercadoLibre involves both potential risks and rewards:

Potential Risks

- Competition:As mentioned earlier, MercadoLibre faces competition from global and local players. Increased competition could put pressure on pricing, margins, and market share.

- Economic Volatility:Latin America’s economies are susceptible to economic volatility, which can impact consumer spending and negatively affect MercadoLibre’s growth prospects.

- Currency Fluctuations:Currency fluctuations can impact MercadoLibre’s financial performance, particularly in countries with weak currencies.

- Regulatory Uncertainty:Regulatory changes in the e-commerce and fintech sectors could create challenges for MercadoLibre’s operations and growth.

- Cybersecurity Threats:As an online platform, MercadoLibre is vulnerable to cybersecurity threats, which could damage its reputation and operations.

Potential Rewards

- Growth Potential:MercadoLibre operates in a rapidly growing market with significant potential for expansion. The company’s diversified business model and strong market position offer attractive growth opportunities.

- Market Leadership:MercadoLibre’s dominant position in Latin America’s e-commerce and fintech markets gives it a significant competitive advantage. The company’s brand recognition and established ecosystem attract both buyers and sellers.

- Innovation:MercadoLibre is a technology-driven company that invests heavily in innovation. Its investments in areas like artificial intelligence, logistics, and financial services could drive future growth and create new opportunities.

- Financial Performance:MercadoLibre has consistently delivered strong financial performance, with high revenue growth, expanding margins, and strong cash flow generation. This track record suggests the company is well-positioned for continued growth.

Pros and Cons of Investing in MercadoLibre

| Pros | Cons |

|---|---|

| Dominant market position in Latin America | Intense competition from global and local players |

| Rapidly growing e-commerce and fintech markets | Economic volatility in Latin America |

| Diversified business model with multiple growth drivers | Currency fluctuations |

| Strong financial performance with high revenue growth | Regulatory uncertainty |

| Focus on innovation and technology | Cybersecurity threats |

Final Wrap-Up: MercadoLibre Stock Gets New Street-high Targets

As MercadoLibre continues to navigate the complexities of the global e-commerce landscape, its stock price is likely to remain a hot topic among investors. The company’s ability to capitalize on the growth potential of the Latin American market, while navigating the challenges of a competitive environment, will ultimately determine its future success.

Investors should carefully consider the factors discussed in this article, including the company’s financial performance, market dynamics, and potential risks, before making any investment decisions.

FAQ Explained

What is MercadoLibre?

MercadoLibre is a leading e-commerce platform in Latin America, offering a wide range of products and services, including online auctions, classified ads, and digital payments.

What are the new Street-high targets for MercadoLibre stock?

The new Street-high targets for MercadoLibre stock vary depending on the analyst, but they generally reflect a significant increase from previous forecasts.

What are the key factors driving the bullish sentiment for MercadoLibre?

Key factors driving the bullish sentiment include the company’s strong financial performance, its strategic expansion into new markets, and the favorable macroeconomic conditions in Latin America.

What are the potential risks associated with investing in MercadoLibre?

Potential risks include competition from other e-commerce players, regulatory challenges, and macroeconomic instability in Latin America.

CentralPoint Latest News

CentralPoint Latest News