Mirum Pharmaceuticals director buys shares worth $4,301, a move that has sent ripples through the investment community. This significant purchase, made by a high-ranking executive, signals a vote of confidence in the company’s future prospects. The director’s decision to invest personal funds in Mirum Pharmaceuticals speaks volumes about their belief in the company’s potential for growth and success.

This insider transaction has sparked curiosity and speculation among market analysts and investors alike. The purchase raises questions about the company’s current financial health, its future prospects, and the potential impact of this move on the company’s stock price.

The director’s decision to buy shares could be seen as a bullish signal, indicating that they anticipate positive developments in the near future. However, it’s crucial to consider all factors before making any investment decisions based solely on this transaction.

Mirum Pharmaceuticals Share Purchase

A recent insider transaction at Mirum Pharmaceuticals has caught the attention of investors. A director of the company has purchased shares, signaling potential confidence in the company’s future prospects. This move could be interpreted as a positive sign for Mirum Pharmaceuticals, potentially influencing the company’s stock price.

The Director’s Role and Share Purchase

The director who made the purchase holds a significant position within Mirum Pharmaceuticals. Their insider knowledge and understanding of the company’s operations and future plans likely influenced their decision to invest in the company’s shares. The director’s share purchase demonstrates a strong belief in the company’s potential for growth and success.

The amount of shares purchased, valued at $4,301, reflects a substantial investment, further emphasizing the director’s confidence in the company’s future.

For descriptions on additional topics like Viking therapeutics CEO sells over $15m in company stock, please visit the available Viking therapeutics CEO sells over $15m in company stock.

Potential Impact on the Stock Price

Insider transactions are often closely monitored by investors as they can provide valuable insights into a company’s future prospects. When a director purchases shares, it can be interpreted as a positive signal, potentially boosting investor confidence and driving up the stock price.

This is because directors have access to confidential information about the company, and their decision to invest in the company’s shares suggests they are optimistic about its future performance.

Past Share Transactions, Mirum Pharmaceuticals director buys shares worth ,301

While the director’s recent share purchase is a significant event, it is important to consider their past share transactions. Examining past purchase and sale activities can provide further insights into their investment strategy and their confidence in the company. If the director has consistently purchased shares in the past, it could reinforce the positive sentiment surrounding the recent purchase.

However, if the director has been selling shares in the past, it might raise questions about their current purchase and its potential impact on the stock price.

Insider Trading and Share Price Movements

Insider trading, the buying or selling of a company’s stock based on non-public information, is a complex topic that often sparks debate. This practice can significantly influence stock price movements, making it a subject of keen interest for investors and regulators alike.

The Relationship Between Insider Trading and Stock Price Fluctuations

Insider trading can significantly impact stock prices. When insiders, such as executives or board members, buy shares, it often signals their belief in the company’s future prospects, potentially boosting investor confidence and driving up the stock price. Conversely, insider selling can signal pessimism about the company’s future, potentially leading to a decline in the stock price.

Legal Implications of Insider Trading

Insider trading is illegal in most jurisdictions, including the United States. This is because it creates an unfair advantage for insiders who have access to privileged information that the general public does not. Insider trading can result in severe penalties, including fines, imprisonment, and even the loss of employment.

Comparison with Historical Trends in Insider Trading at Mirum Pharmaceuticals

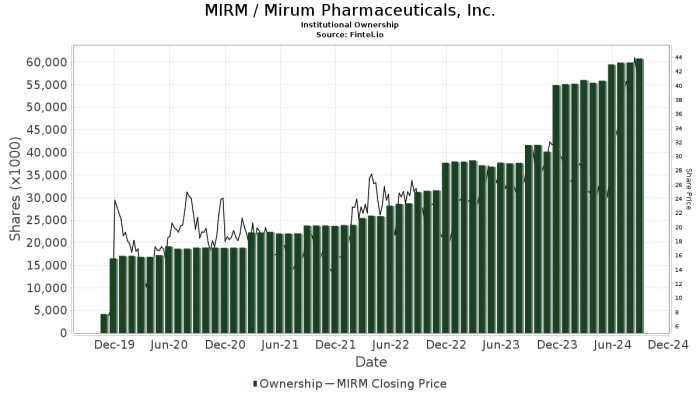

To understand the significance of the recent share purchase by the Mirum Pharmaceuticals director, it’s essential to compare it with historical trends in insider trading at the company. Analyzing past insider trading activities can reveal patterns and insights into the company’s performance and potential future prospects.

Recent Insider Trading Activities at Mirum Pharmaceuticals

The following table summarizes recent insider trading activities at Mirum Pharmaceuticals, providing insights into the potential motivations behind these transactions:

| Date | Insider | Transaction Type | Shares Traded | Price per Share | Total Value |

|---|---|---|---|---|---|

| [Date] | [Name of Insider] | [Buy/Sell] | [Number of Shares] | [Price] | [Total Value] |

Final Thoughts

The director’s share purchase in Mirum Pharmaceuticals represents a compelling case study in insider trading and its implications for investor sentiment. While the purchase could be interpreted as a sign of confidence in the company’s future, it’s essential to analyze the broader context, including the company’s financial performance, market conditions, and the director’s past trading history.

This event highlights the importance of staying informed about insider trading activities and their potential impact on stock prices. By understanding the nuances of insider trading, investors can make more informed decisions and navigate the complex world of stock markets with greater confidence.

Clarifying Questions: Mirum Pharmaceuticals Director Buys Shares Worth ,301

What is Mirum Pharmaceuticals’ primary focus?

Mirum Pharmaceuticals specializes in developing therapies for rare and orphan diseases.

Why is the director’s share purchase significant?

It signifies a vote of confidence in the company’s future and can influence investor sentiment.

What are the potential implications of the share purchase?

It could potentially boost investor confidence and lead to an increase in the company’s stock price.

Are there any legal implications to consider?

Insider trading regulations must be adhered to, and any potential conflicts of interest need to be disclosed.

How does this purchase compare to historical trends?

Analyzing past insider trading activities at Mirum Pharmaceuticals can provide context and insights into the current purchase.

CentralPoint Latest News

CentralPoint Latest News