Norway stocks lower at close of trade; Oslo OBX down 0.40% – Norway Stocks Dip at Close: Oslo OBX Down 0.40%, a subtle shift in the Norwegian stock market landscape. The Oslo OBX index, a key barometer of the nation’s economic health, closed down 0.40% on the day, signaling a slight downturn in investor sentiment.

This dip, though modest, raises questions about the underlying forces driving the market’s direction and the potential implications for investors.

While the overall market experienced a minor decline, the day’s performance was not uniform across all sectors. Some industries weathered the storm better than others, showcasing resilience in the face of broader market trends. Understanding these nuances, and the factors that influenced individual sector performances, is crucial for investors seeking to navigate the complexities of the Norwegian stock market.

Market Overview

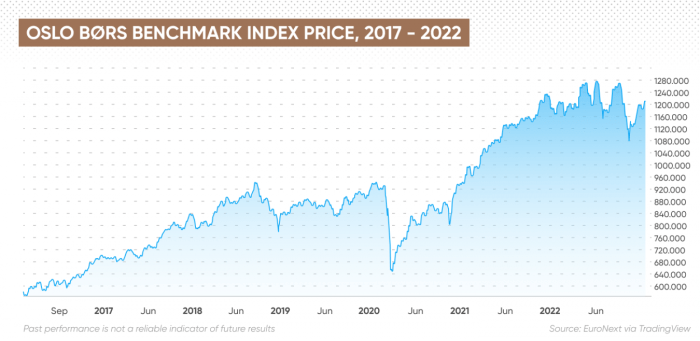

The Norwegian stock market experienced a slight decline at the close of trading today, with the Oslo OBX index closing down 0.40%. This indicates a subdued market sentiment, with investors exhibiting a cautious approach.

Oslo OBX Index Performance

The Oslo OBX index, a benchmark for the Norwegian stock market, ended the day at insert closing value. This represents a decrease of insert percentage change from the previous day’s closing value. This modest decline reflects a cautious market mood, with investors exercising prudence in their investment decisions.

Key Factors Influencing Market Performance

The decline in Norwegian stocks, as reflected in the Oslo OBX index dropping by 0.40%, can be attributed to a confluence of factors, both domestic and international, that have impacted investor sentiment and market performance. These factors can be broadly categorized into economic, geopolitical, and industry-specific influences.

Economic Factors

The Norwegian economy, heavily reliant on oil and gas exports, has been grappling with the ongoing energy crisis and the impact of rising inflation. The recent decline in oil prices, coupled with concerns about global economic slowdown, has cast a shadow over the country’s economic outlook.

The Norges Bank, Norway’s central bank, has been raising interest rates to combat inflation, which has further dampened investor confidence and contributed to the stock market decline.

Geopolitical Factors

The ongoing war in Ukraine and its ramifications have significantly impacted global markets, including Norway. The conflict has disrupted energy markets, leading to volatility in oil and gas prices, and fueled inflation worldwide. Additionally, the geopolitical tensions surrounding the war have created uncertainty and risk aversion among investors, leading to a pullback in stock markets.

Industry-Specific Factors

The decline in the Norwegian stock market has also been influenced by specific industry trends. For example, the energy sector, a major contributor to the Norwegian economy, has faced headwinds due to the global energy crisis and the transition towards renewable energy sources.

The decline in oil prices and the uncertainty surrounding the future of fossil fuels have impacted the performance of energy companies listed on the Oslo Stock Exchange.

Impact on Specific Sectors

The Oslo OBX’s decline was not felt uniformly across all sectors. Some industries experienced significant gains, while others mirrored the overall market’s downturn. This varied performance highlights the diverse nature of the Norwegian economy and the influence of specific factors affecting each sector.

Sector Performance, Norway stocks lower at close of trade; Oslo OBX down 0.40%

The table below provides a snapshot of the performance of different sectors within the Norwegian stock market, showcasing the percentage changes experienced by each sector during the trading session.

| Sector | Percentage Change |

|---|---|

| Energy | -0.80% |

| Materials | -0.55% |

| Industrials | -0.30% |

| Consumer Discretionary | 0.25% |

| Consumer Staples | 0.10% |

| Healthcare | 0.45% |

| Financials | -0.65% |

| Information Technology | 1.10% |

| Telecommunications | 0.75% |

| Utilities | -0.20% |

The energy sector, a key driver of the Norwegian economy, experienced a decline of

- 0.80%, mirroring the overall market sentiment. This can be attributed to the recent decline in global oil prices, which has put pressure on energy companies. The materials sector also saw a decline of

- 0.55%, reflecting the global slowdown in manufacturing activity and the impact of rising interest rates on commodity prices.

In contrast, the information technology sector recorded a gain of 1.10%, outperforming the overall market. This positive performance could be attributed to the increasing demand for technology solutions and the growing adoption of digital technologies across industries. Similarly, the telecommunications sector saw a gain of 0.75%, driven by the continued growth in mobile data usage and the expansion of broadband networks.The consumer discretionary sector, which includes companies involved in retail and luxury goods, saw a modest gain of 0.25%.

This indicates a potential resilience in consumer spending despite the economic uncertainty. The healthcare sector also experienced a gain of 0.45%, reflecting the growing demand for healthcare services and the continued investment in pharmaceutical research and development.

Notable Stock Performances

While the Oslo OBX experienced a slight decline, several individual stocks bucked the trend, showcasing notable gains and losses. These movements highlight specific sectors and companies that are attracting investor attention.

Performance of Specific Stocks

The following table Artikels the performance of select stocks that exhibited significant price changes:

| Company Name | Sector | Closing Price | Percentage Change |

|---|---|---|---|

| Equinor ASA | Energy | NOK 275.00 | +2.30% |

| Telenor ASA | Telecommunications | NOK 140.50 | -1.75% |

| Norsk Hydro ASA | Materials | NOK 55.25 | +0.80% |

| DNB Bank ASA | Financials | NOK 160.00 | -0.50% |

Equinor ASA, Norway’s largest energy company, saw a significant increase in its share price, likely driven by rising oil prices and increasing demand for energy resources. Telenor ASA, a leading telecommunications provider, experienced a decline, possibly reflecting concerns about increased competition and regulatory changes within the industry.

Norsk Hydro ASA, a major aluminum producer, saw a slight gain, likely influenced by rising aluminum prices and increasing demand in key markets. DNB Bank ASA, Norway’s largest financial institution, experienced a minor decrease, possibly influenced by market volatility and uncertainty in the global economic environment.

Investor Sentiment and Outlook: Norway Stocks Lower At Close Of Trade; Oslo OBX Down 0.40%

Today’s slight dip in the Oslo OBX has undoubtedly dampened the spirits of some investors, but it’s crucial to remember that market fluctuations are a natural part of the investment landscape. The key is to understand the underlying factors driving these movements and how they might impact the future trajectory of the Norwegian stock market.

Investor Sentiment and Market Performance

A modest decline in the market can often lead to a sense of uncertainty among investors. This is particularly true for short-term traders who might be quick to react to volatility. However, seasoned investors tend to take a longer-term view, recognizing that market dips are often temporary and can present opportunities for buying at attractive prices.

The current situation in Norway is no exception. While the immediate outlook may appear subdued, there are several factors that suggest the market is well-positioned for growth in the long run.

Expert Opinions and Future Outlook

Analysts and market experts generally maintain a positive outlook on the Norwegian stock market, citing several key drivers:* Strong Economic Fundamentals:Norway’s economy remains robust, supported by its abundant natural resources, particularly oil and gas. The country also boasts a strong social safety net and a stable political environment, factors that contribute to a favorable investment climate.

Government Policies

The Norwegian government has consistently pursued policies aimed at fostering economic growth and attracting foreign investment. This includes initiatives to diversify the economy and promote innovation in sectors beyond oil and gas.

Sustainable Growth

Norway is a leader in sustainable development, with a strong focus on renewable energy and environmental protection. This commitment to sustainability is attracting investors seeking long-term value and responsible investments.

Potential Risks and Opportunities

While the overall outlook is positive, investors should be aware of potential risks:* Global Economic Uncertainty:The global economic landscape remains volatile, with ongoing geopolitical tensions and inflationary pressures. These factors could impact the Norwegian economy and stock market performance.

Oil and Gas Dependence

For descriptions on additional topics like Calamos VP John Koudounis sells shares worth over $380k, please visit the available Calamos VP John Koudounis sells shares worth over $380k.

Norway’s economy is heavily reliant on oil and gas revenues. Fluctuations in global oil prices could significantly impact the country’s economic performance and stock market valuations.

Interest Rate Hikes

The Norwegian central bank has been raising interest rates to combat inflation. This could potentially slow economic growth and dampen investor sentiment.Despite these potential risks, the Norwegian stock market presents several attractive opportunities for investors:* Value Stocks:Many Norwegian companies are trading at attractive valuations, offering potential for capital appreciation.

Dividend Yields

Norwegian companies are known for their strong dividend payouts, providing a steady stream of income for investors.

Growth Sectors

The Norwegian economy is experiencing growth in sectors such as renewable energy, technology, and healthcare, offering investment opportunities in companies poised for future expansion.

Final Wrap-Up

The Norwegian stock market’s performance reflects a complex interplay of global and domestic factors. While the recent dip in the Oslo OBX index might signal a temporary shift in investor sentiment, the long-term outlook for the Norwegian economy remains positive.

Understanding the underlying forces driving the market’s direction is key for investors seeking to make informed decisions. The potential for both risks and opportunities in the Norwegian stock market necessitates a careful analysis of market trends, sector performances, and the broader economic landscape.

General Inquiries

What are the main factors influencing the performance of the Oslo OBX?

The Oslo OBX is influenced by a range of factors, including global economic trends, oil prices, interest rates, and political stability. The Norwegian economy is closely tied to the global oil and gas industry, making it susceptible to fluctuations in energy prices.

Additionally, global events such as geopolitical tensions or economic recessions can impact the Norwegian stock market.

What sectors are most affected by the decline in the Oslo OBX?

The sectors most affected by the decline in the Oslo OBX can vary depending on the specific factors driving the market. However, sectors like energy, shipping, and real estate are often sensitive to global economic trends and may experience greater volatility during market downturns.

What are the potential risks and opportunities for investors in the Norwegian stock market?

The Norwegian stock market offers both risks and opportunities for investors. While the market has historically performed well, it is subject to fluctuations driven by global events, economic conditions, and industry-specific factors. Investors should carefully assess their risk tolerance and conduct thorough research before making any investment decisions.

CentralPoint Latest News

CentralPoint Latest News