Novo Nordisk shares fall after Monlunabant phase 2a trial results; Viking jumps sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with captivating storytelling language style and brimming with originality from the outset.

The recent phase 2a trial results for Monlunabant, Novo Nordisk’s experimental obesity drug, sent shockwaves through the pharmaceutical industry, causing a dramatic shift in the market. While Novo Nordisk’s stock took a tumble, Viking Therapeutics, a smaller competitor with a similar obesity treatment pipeline, experienced a surge in its share price.

This unexpected turn of events has sparked a debate about the future of obesity treatment and the competitive landscape of this rapidly evolving market.

The Monlunabant trial, though still in its early stages, provided valuable insights into the drug’s potential efficacy and safety. While the results were not as positive as initially hoped for, they have ignited a conversation about the challenges and opportunities in developing effective obesity treatments.

The trial’s findings have also shed light on the complex interplay between different drug candidates and their potential impact on the market. This dynamic situation is not only captivating for investors but also for patients seeking innovative solutions for managing their weight.

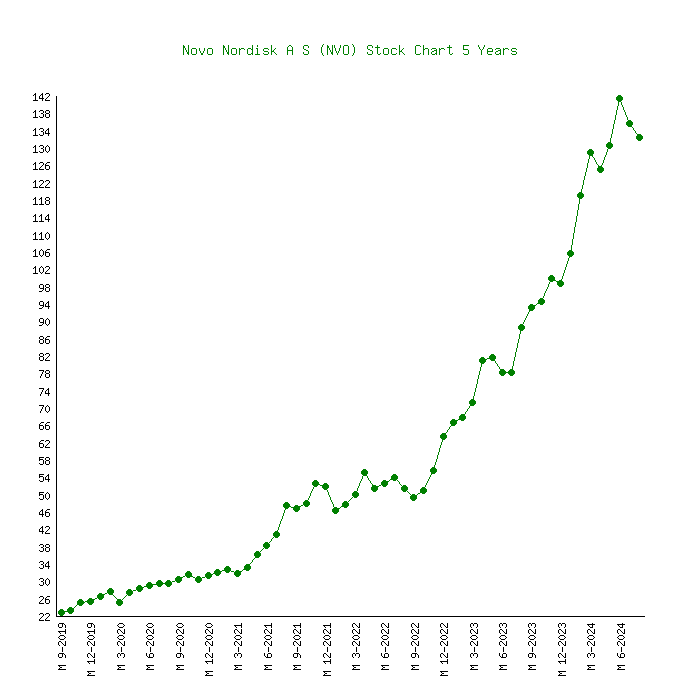

Novo Nordisk Share Performance

Novo Nordisk’s share price took a hit following the release of the Monlunabant phase 2a trial results. The market reacted negatively to the news, sending the company’s stock down by a significant margin. This decline highlights the high stakes involved in clinical trials and the impact that trial outcomes can have on a company’s valuation.

Share Price Movement

The decline in Novo Nordisk’s share price can be attributed to the disappointing results of the Monlunabant phase 2a trial. This trial aimed to assess the efficacy and safety of Monlunabant, a potential new treatment for obesity. The results, however, did not meet expectations, leading investors to question the drug’s future prospects.

Comparison with Other Pharmaceutical Companies

It is important to note that Novo Nordisk’s share price decline is not an isolated event. Other pharmaceutical companies have also experienced similar share price fluctuations in response to clinical trial outcomes. For example, a recent failed clinical trial for a new cancer drug led to a significant drop in the share price of a major pharmaceutical company.

These events underscore the inherent risks associated with drug development and the potential for market volatility.

You also will receive the benefits of visiting Cargo therapeutics CEO sells over $250k in company stock today.

Factors Contributing to Share Price Decline, Novo Nordisk shares fall after Monlunabant phase 2a trial results; Viking jumps

Several factors could have contributed to the decline in Novo Nordisk’s share price following the Monlunabant trial results. These factors include:

- Investor Sentiment:The negative trial results likely dampened investor sentiment, leading to a sell-off in the company’s shares. Investors may be concerned about the future prospects of Monlunabant and its potential impact on Novo Nordisk’s overall revenue and profitability.

- Market Volatility:The pharmaceutical sector is known for its volatility, and clinical trial outcomes are a major driver of this volatility. Investors often react quickly to news, which can lead to significant share price swings.

- Competition:Novo Nordisk faces stiff competition in the obesity treatment market. The failure of Monlunabant may have led investors to question the company’s ability to compete effectively in this market.

Obesity Treatment Landscape

The obesity treatment landscape is rapidly evolving, with a growing number of players and diverse treatment options emerging. This shift is driven by the increasing prevalence of obesity globally and the growing understanding of its complex underlying mechanisms.

Key Players in the Obesity Treatment Market

The obesity treatment market is characterized by a diverse range of players, including pharmaceutical companies, medical device manufacturers, and technology companies.

| Company | Area of Focus | Key Products/Services |

|---|---|---|

| Novo Nordisk | GLP-1 Receptor Agonists | Semaglutide (Ozempic, Wegovy), Liraglutide (Saxenda) |

| Eli Lilly and Company | GLP-1 Receptor Agonists | Tirzepatide (Mounjaro), |

| Pfizer | Anti-Obesity Medications | Orlistat (Xenical, Alli), Lorcaserin (Belviq) |

| Boehringer Ingelheim | GLP-1 Receptor Agonists | Albiglutide (Tanzeum) |

| Amgen | Anti-Obesity Medications | Evolus (Belviq XR) |

| Gilead Sciences | Anti-Obesity Medications | Selonsertib (Simtuzumab) |

| Weight Watchers | Lifestyle Modification Programs | Weight Watchers Reimagined |

| Noom | Digital Weight Loss Programs | Noom Coaching App |

Comparison of Obesity Treatment Options

Obesity treatment options vary significantly in their mechanisms of action, efficacy, and side effects.

| Treatment Option | Mechanism of Action | Efficacy | Side Effects |

|---|---|---|---|

| GLP-1 Receptor Agonists | Stimulate the release of insulin, suppress glucagon secretion, and slow gastric emptying | Significant weight loss, improved glycemic control, and reduced cardiovascular risk | Nausea, vomiting, diarrhea, and hypoglycemia |

| Bariatric Surgery | Restricts food intake and alters gut hormone production | Significant and sustained weight loss, improved metabolic health | Surgical complications, nutritional deficiencies, and long-term management requirements |

| Lifestyle Modifications | Changes in diet and exercise habits | Moderate weight loss, improved health outcomes | Requires sustained effort and commitment |

| Anti-Obesity Medications (Other than GLP-1 Receptor Agonists) | Various mechanisms, including appetite suppression, fat absorption inhibition | Moderate weight loss, limited long-term efficacy | Side effects vary depending on the specific medication |

Competitive Landscape for Obesity Treatments

The competitive landscape for obesity treatments is dynamic and evolving.

| Competitor | Strategy |

|---|---|

| Novo Nordisk | Dominate the GLP-1 Receptor Agonist market with a robust pipeline of new products |

| Eli Lilly and Company | Challenge Novo Nordisk’s market leadership with its own innovative GLP-1 Receptor Agonists |

| Pfizer | Focus on developing new anti-obesity medications with improved efficacy and safety profiles |

| Boehringer Ingelheim | Expand its GLP-1 Receptor Agonist portfolio to compete with Novo Nordisk and Eli Lilly |

| Amgen | Develop novel anti-obesity medications targeting specific pathways involved in weight regulation |

| Gilead Sciences | Investigate new drug candidates targeting the underlying causes of obesity |

| Weight Watchers | Leverage its established brand and extensive network to offer personalized weight loss programs |

| Noom | Provide a digital platform that combines behavioral therapy, nutrition education, and personalized coaching |

Potential Implications for the Future: Novo Nordisk Shares Fall After Monlunabant Phase 2a Trial Results; Viking Jumps

The mixed results from the Monlunabant phase 2a trial raise questions about its potential as a new obesity treatment and its impact on Novo Nordisk’s future in the obesity treatment market. The trial’s findings could have significant implications for the development of new obesity treatments, the future of Novo Nordisk’s obesity treatment portfolio, and the overall obesity treatment market.

Impact on the Development of New Obesity Treatments

The Monlunabant trial results highlight the complexities of developing effective and safe obesity treatments. While the trial demonstrated that Monlunabant could reduce weight and improve metabolic parameters, the observed side effects raise concerns about its safety and tolerability. This underscores the need for continued research and development to identify new obesity treatments that are both effective and safe.

The trial results may also encourage researchers to explore alternative targets and mechanisms of action for obesity treatment.

Impact on Novo Nordisk’s Obesity Treatment Portfolio

The trial results could have a significant impact on Novo Nordisk’s obesity treatment portfolio. While Novo Nordisk has a strong presence in the obesity treatment market with its GLP-1 receptor agonists, such as Wegovy and Saxenda, the company has been actively exploring new treatment options.

The failure of Monlunabant to meet its primary endpoint could lead Novo Nordisk to re-evaluate its investment in this specific area. However, the company may still continue to invest in other promising obesity treatments, such as those targeting other pathways or mechanisms of action.

Impact on the Overall Obesity Treatment Market

The Monlunabant trial results could have a ripple effect on the overall obesity treatment market. The failure of a new drug candidate could dampen investor enthusiasm for obesity treatment research and development. However, the growing prevalence of obesity and the unmet need for effective treatments suggest that the market will continue to grow.

The focus may shift towards treatments that have a more established safety profile and a broader therapeutic window.

Conclusion

The rollercoaster ride of Novo Nordisk and Viking Therapeutics shares following the Monlunabant trial results highlights the volatile nature of the pharmaceutical industry. The market’s reaction underscores the importance of clinical trial data in shaping investor sentiment and driving investment decisions.

The trial results have undoubtedly impacted the obesity treatment landscape, raising questions about the future of Monlunabant and the potential for alternative approaches. As the industry continues to evolve, it remains to be seen how these developments will ultimately shape the future of obesity treatment and the strategies of key players like Novo Nordisk and Viking Therapeutics.

FAQ Summary

What is Monlunabant?

Monlunabant is an experimental drug being developed by Novo Nordisk for the treatment of obesity. It is a GLP-1 receptor agonist, a class of drugs that mimic the effects of a naturally occurring hormone that helps regulate appetite and blood sugar levels.

Why did Novo Nordisk shares fall after the Monlunabant trial results?

The phase 2a trial results for Monlunabant were not as positive as expected, leading to concerns about the drug’s efficacy and potential for success in later-stage trials. This uncertainty caused investors to sell off Novo Nordisk shares.

What are the potential implications of the Monlunabant trial results for the obesity treatment market?

The trial results have raised questions about the effectiveness of GLP-1 receptor agonists for obesity treatment and may lead to a shift in focus towards other drug classes. The results could also encourage the development of new and innovative obesity treatments.

What is Viking Therapeutics?

Viking Therapeutics is a smaller pharmaceutical company that is also developing obesity treatments. The company’s pipeline includes several drug candidates that target different pathways involved in weight regulation.

Why did Viking Therapeutics shares jump after the Monlunabant trial results?

The Monlunabant trial results may have increased investor confidence in Viking Therapeutics’ obesity treatment pipeline. Investors may see Viking Therapeutics as a potential alternative to Novo Nordisk in the obesity treatment market.

CentralPoint Latest News

CentralPoint Latest News