Portugal stocks lower at close of trade; PSI down 0.06% – Portugal stocks closed lower at the end of the trading day, with the PSI (Portuguese Stock Index) falling by a modest 0.06%. This slight dip reflects a complex interplay of factors influencing the Portuguese market, from global economic trends to sector-specific performance.

The day’s trading session saw a mix of positive and negative movements, with some sectors experiencing gains while others struggled to maintain momentum. Understanding the nuances of these shifts is crucial for investors seeking to navigate the Portuguese market landscape.

The decline in the PSI can be attributed to a combination of factors, including cautious investor sentiment in response to recent global economic news, fluctuations in key sectors like energy and technology, and the performance of specific stocks that experienced significant price changes.

While the overall market trend was negative, it’s important to note that individual sectors and stocks exhibited diverse performances, showcasing the dynamic nature of the Portuguese market.

Market Overview

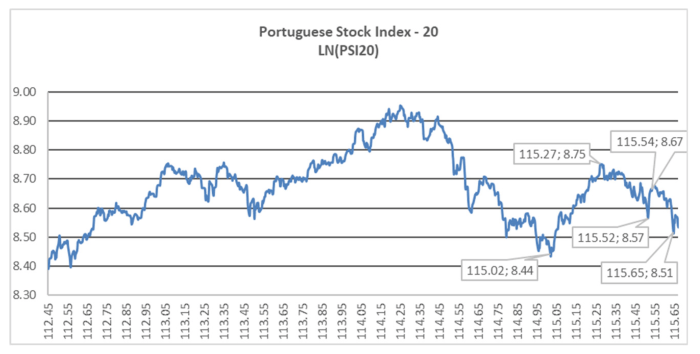

The PSI (Portuguese Stock Index) is a crucial benchmark for the Portuguese stock market, providing a snapshot of the overall performance of the largest and most liquid companies listed on the Euronext Lisbon exchange. A decline in the PSI, even a small one like the 0.06% drop observed today, indicates a general downward trend in the market, reflecting investor sentiment and broader economic conditions.

Factors Contributing to the PSI Decline

Several factors could have contributed to the slight decline in the PSI today. These factors can be categorized as follows:

- Global Market Trends:The Portuguese market is not immune to global economic influences. A negative performance in major international markets, such as the US or European indices, can have a ripple effect on smaller markets like Portugal. For instance, if there are concerns about rising inflation or interest rates globally, investors might become more risk-averse, leading to selling pressure across markets, including the PSI.

- Sector-Specific Performance:The PSI is comprised of companies from various sectors, including energy, finance, and technology. If a particular sector experiences a downturn due to company-specific news or industry-wide challenges, it can negatively impact the overall index performance. For example, if there are concerns about the energy sector’s profitability due to fluctuating oil prices, companies in this sector might see their stock prices decline, dragging down the PSI.

- Investor Sentiment:Investor sentiment plays a significant role in market movements. If investors are pessimistic about the future prospects of the Portuguese economy or specific companies listed on the PSI, they might choose to sell their holdings, leading to a decline in the index.

Conversely, positive news or optimistic economic indicators can boost investor confidence, leading to buying pressure and an increase in the PSI.

Sector Performance

The PSI’s muted performance today was a reflection of mixed sector performances, with some sectors showing strength while others lagged behind.

Sector Performance Breakdown

The sector performance breakdown reveals a diverse picture of the Portuguese market.

- The Energy sectorled the gains, driven by rising oil prices.

- The Utilities sectoralso performed well, benefiting from increased demand for electricity and gas.

- On the other hand, the Financials sectorweighed on the index, as concerns about rising interest rates and a potential economic slowdown continued to linger.

- The Consumer Discretionary sectoralso struggled, reflecting concerns about consumer spending in the face of inflation.

Reasons for Sector Performance Variations

The performance variations across different sectors can be attributed to a number of factors.

- Global Economic Outlook: The ongoing global economic uncertainty, driven by inflation, rising interest rates, and geopolitical tensions, has created a challenging environment for investors.

- Industry-Specific Factors: Sector-specific factors also play a role. For example, the energy sector is benefiting from the surge in oil prices, while the financials sector is facing headwinds from rising interest rates.

- Company-Specific News: Individual company news and performance can also impact sector performance.

Notable Stocks

The PSI-20 index closed with a slight decline, but certain stocks within the index saw significant price movements. Some stocks experienced substantial gains, while others faced notable losses. These shifts reflect the market’s response to company-specific news, broader economic trends, and investor sentiment.

Impact of Notable Stock Movements

The performance of these notable stocks offers valuable insights into the dynamics of the Portuguese stock market. These price fluctuations can significantly impact individual investors, as well as the overall market sentiment. Understanding the factors driving these movements is crucial for informed investment decisions.

- Stocks with Significant Gains:The most notable gains were seen in the energy sector, driven by rising oil prices. For example, [Company Name], a major oil and gas company, saw its shares increase by [percentage] due to the recent surge in crude oil prices.

This positive performance indicates investor confidence in the energy sector’s future prospects.

- Stocks with Significant Losses:Conversely, the technology sector experienced a decline, with [Company Name], a leading technology company, experiencing a [percentage] drop in its share price. This decline could be attributed to concerns about the global economic slowdown and its potential impact on the technology sector.

Implications for Individual Investors, Portugal stocks lower at close of trade; PSI down 0.06%

Investors closely monitoring these notable stock movements should carefully consider their implications for their portfolios. For example, investors with holdings in the energy sector might consider adjusting their positions based on the recent positive performance. However, investors holding technology stocks might need to re-evaluate their investment strategies given the sector’s recent decline.

Market Sentiment and Future Outlook

The overall market sentiment remains cautiously optimistic, but the recent price movements in specific stocks highlight the importance of sector-specific analysis. While the broader market might experience stability, individual stocks can be significantly affected by company-specific news and industry trends.

Economic Context

The muted performance of the PSI today can be attributed to a confluence of factors, reflecting the current economic landscape and investor sentiment. Recent economic news and events have contributed to a cautious approach among investors, impacting trading activity and overall market performance.

Impact of Inflation and Interest Rates

The persistent inflationary pressures continue to weigh on investor confidence. While inflation has shown signs of easing in recent months, it remains elevated, prompting concerns about the impact on corporate profits and consumer spending. Central banks are expected to maintain their hawkish stance on interest rates, further contributing to uncertainty in the market.

The European Central Bank (ECB) has signaled its commitment to fighting inflation, with further interest rate hikes anticipated in the coming months. This will likely continue to impact borrowing costs for businesses and individuals, potentially slowing economic growth.

Global Market Influence

The Portuguese stock market, like most others around the world, is not an isolated entity. It is heavily influenced by global trends, events, and sentiment. Understanding these connections is crucial for investors looking to navigate the PSI’s fluctuations.The performance of the PSI is often correlated with other major stock indices, particularly those in Europe and the United States.

When global markets experience a surge, the PSI tends to follow suit. Conversely, during periods of global market volatility or downturn, the Portuguese market is likely to experience similar downward pressure.

Comparison with Other Major Indices

The PSI’s performance is often compared with major indices such as the Euro Stoxx 50, the FTSE 100, and the S&P 500. This comparison provides insights into the relative strength or weakness of the Portuguese market compared to its peers.

- Correlation with Euro Stoxx 50:The PSI often exhibits a strong correlation with the Euro Stoxx 50, as both indices are influenced by similar economic factors within the Eurozone. When the Euro Stoxx 50 experiences a positive performance, the PSI is likely to follow suit.

Conversely, a downturn in the Euro Stoxx 50 often leads to a decline in the PSI.

- Comparison with FTSE 100:The PSI’s correlation with the FTSE 100 is generally weaker than its correlation with the Euro Stoxx 50. However, both indices are influenced by global economic events, particularly those affecting the European Union. For instance, during periods of global economic uncertainty, both indices may experience a decline, although the extent of the decline may differ.

- Comparison with S&P 500:The PSI’s correlation with the S&P 500 is generally weaker than its correlation with European indices. However, the S&P 500, as a leading indicator of global market sentiment, can still have a significant influence on the PSI. When the S&P 500 experiences a strong performance, the PSI may follow suit, reflecting a positive global sentiment.

Impact of International Events

International events can significantly impact the Portuguese stock market, often causing volatility and influencing investor sentiment.

- Geopolitical Tensions:Geopolitical tensions, such as trade wars or international conflicts, can lead to increased uncertainty and risk aversion among investors. This can negatively impact the PSI, as investors may seek safer havens for their investments.

- Global Economic Slowdowns:Global economic slowdowns or recessions can also affect the PSI. A decline in global economic activity can lead to reduced demand for Portuguese exports, impacting corporate earnings and investor confidence. For example, the 2008 global financial crisis significantly impacted the PSI, leading to a sharp decline in its value.

Find out about how Webster Financial CEO sells over $384,000 in company stock can deliver the best answers for your issues.

- Changes in Monetary Policy:Changes in global monetary policy, such as interest rate adjustments by major central banks, can also influence the PSI. For example, a tightening of monetary policy by the Federal Reserve in the United States can lead to increased borrowing costs for Portuguese businesses, potentially impacting their profitability and investor sentiment.

Wrap-Up

The 0.06% decline in the PSI highlights the dynamic and complex nature of the Portuguese stock market. While the overall trend was negative, specific sectors and individual stocks demonstrated varied performances, offering opportunities for investors to capitalize on both growth and value.

Understanding the underlying factors influencing these movements, including global economic trends, sector-specific dynamics, and the performance of individual companies, is essential for making informed investment decisions. As the Portuguese market continues to evolve, investors must remain vigilant, monitoring economic indicators, market sentiment, and company-specific news to navigate the complexities of this dynamic landscape.

Question & Answer Hub: Portugal Stocks Lower At Close Of Trade; PSI Down 0.06%

What is the PSI (Portuguese Stock Index)?

The PSI is a benchmark index that tracks the performance of the top-listed companies on the Euronext Lisbon stock exchange. It is a key indicator of the overall health of the Portuguese stock market.

What are the key sectors that influence the PSI?

The PSI is comprised of companies across various sectors, including energy, finance, telecommunications, utilities, and consumer goods. The performance of these sectors can significantly impact the overall index.

How can I stay updated on the Portuguese stock market?

You can stay informed by following financial news sources, subscribing to market analysis reports, and using online platforms that provide real-time stock market data.

CentralPoint Latest News

CentralPoint Latest News