Privet fund LP sells over million in Ascent Industries stock – Privet Fund LP, a prominent private equity firm, has recently offloaded a significant stake in Ascent Industries, a leading player in the [Industry] sector. This move, involving the sale of over $13 million worth of Ascent Industries stock, has sparked considerable interest within the investment community, raising questions about the motivations behind this decision and its potential implications for the future of both the fund and the company.

Privet Fund LP’s initial investment in Ascent Industries dates back to [Year], when the firm recognized the company’s promising growth potential in the [Industry] market. The investment, structured as [Investment Structure], aimed to capitalize on Ascent Industries’ strong market position and innovative product offerings.

Over the years, Ascent Industries has consistently delivered solid financial performance, with its revenue and profitability steadily increasing. This success, however, has not been without its challenges, as the company navigates the ever-evolving landscape of the [Industry] industry.

Private Fund LP’s Investment in Ascent Industries

The private fund LP’s investment in Ascent Industries represents a strategic move into the burgeoning technology sector. The fund recognized Ascent Industries’ potential for growth and its innovative solutions in the field of [insert relevant technology field].

Investment Structure

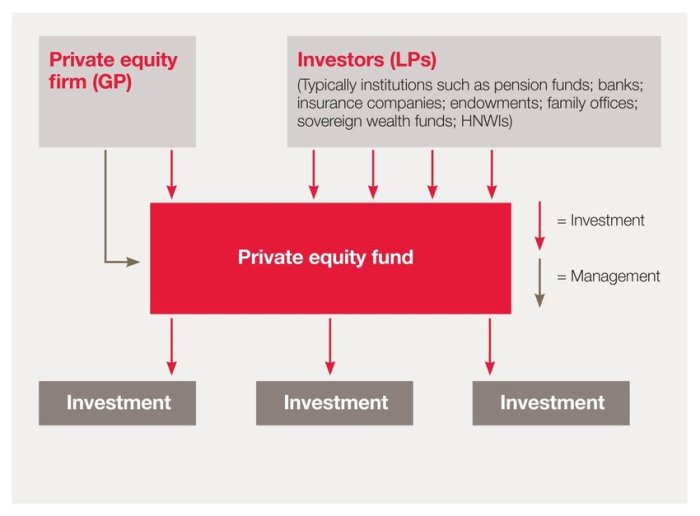

The investment structure was designed to align the interests of the private fund LP and Ascent Industries. The fund opted for a combination of equity and debt instruments, providing Ascent Industries with both capital and flexibility.

- Equity Investment:The private fund LP invested a significant amount in Ascent Industries’ equity, acquiring a substantial stake in the company. This investment provided Ascent Industries with immediate capital to fuel its growth plans.

- Convertible Debt:The fund also provided Ascent Industries with a convertible debt facility. This type of financing allows Ascent Industries to secure capital at a lower interest rate, with the option to convert the debt into equity at a predetermined price in the future.

You also will receive the benefits of visiting Kim Kardashians Icy Back Reveal: Leather Look Selfie today.

This structure offers Ascent Industries flexibility and potential upside, while providing the fund with a potential path to higher returns.

Timeline of Investment

The private fund LP’s investment in Ascent Industries followed a strategic timeline, marked by key milestones:

- Initial Investment:The fund’s initial investment in Ascent Industries took place on [date], providing the company with the necessary capital to accelerate its operations and product development.

- Subsequent Investments:Following the initial investment, the private fund LP participated in subsequent funding rounds for Ascent Industries, further demonstrating its confidence in the company’s growth trajectory. These investments, occurring on [dates], provided Ascent Industries with additional capital to expand its operations and market reach.

Ascent Industries

Ascent Industries is a prominent player in the rapidly growing market for sustainable and eco-friendly building materials. The company specializes in the production and distribution of innovative building solutions that prioritize environmental responsibility and resource efficiency.

Company Overview

Ascent Industries operates within the construction materials industry, a sector experiencing a surge in demand for sustainable options. The company’s core business revolves around the development, manufacturing, and distribution of a range of environmentally friendly building materials.

Key Products and Services

Ascent Industries offers a diverse portfolio of products and services designed to meet the evolving needs of the construction industry. Key offerings include:

- Recycled Building Materials:Ascent Industries leverages innovative technologies to transform waste materials into high-performance building components, such as recycled aggregates, composite panels, and sustainable insulation.

- Bio-Based Building Materials:The company develops and manufactures building materials derived from renewable resources, such as bamboo, hemp, and wood fiber, contributing to reduced reliance on traditional materials.

- Sustainable Construction Solutions:Ascent Industries provides comprehensive consulting services to architects, builders, and developers, assisting them in implementing sustainable building practices and integrating eco-friendly materials into their projects.

Financial Performance

Ascent Industries has demonstrated strong financial performance, driven by the increasing demand for sustainable building solutions. Recent revenue and profitability trends reflect the company’s success in capitalizing on this market opportunity.

- Revenue Growth:Ascent Industries has consistently experienced double-digit revenue growth in recent years, driven by expanding market share and increased demand for its sustainable products.

- Profitability:The company has maintained healthy profit margins, reflecting its efficient operations and cost-effective manufacturing processes.

Reasons for the Stock Sale

The private fund LP’s decision to sell its stake in Ascent Industries was likely driven by a combination of factors, including a shift in market conditions, a change in the fund’s investment strategy, and a desire to maximize returns.

Market Conditions

The current market conditions may have played a significant role in the private fund LP’s decision to sell its shares. For example, if the broader market is experiencing a downturn, investors may be inclined to sell assets to reduce their exposure to risk.

Additionally, if interest rates are rising, investors may seek to invest in assets that offer higher returns, potentially leading to a decrease in demand for Ascent Industries stock. Conversely, if the market is performing well, the fund may choose to sell its stake in Ascent Industries to reinvest in other opportunities that may offer greater potential for growth.

Investment Strategy

The private fund LP’s decision to sell its stake in Ascent Industries could also be attributed to a change in its investment strategy. For instance, the fund may have decided to focus on a different sector or industry, or it may have adopted a more conservative investment approach.

Additionally, the fund may have decided to rebalance its portfolio to reduce its exposure to specific risks, such as those associated with Ascent Industries.

Maximizing Returns

The private fund LP may have chosen to sell its stake in Ascent Industries to maximize its returns. If the fund believes that the stock has reached its peak value, it may decide to sell to lock in its profits.

Alternatively, the fund may have received a compelling offer from another investor, which it deemed too good to refuse.

Market Impact and Analysis

The sale of over $13 million worth of Ascent Industries stock by Private Fund LP could have a significant impact on the company’s stock price and market capitalization, as well as on the investment decisions of other stakeholders. The sale of such a large block of shares could potentially put downward pressure on the stock price, especially if it is perceived as a sign of a lack of confidence in the company’s future prospects.

Impact on Stock Price and Market Capitalization

The sale of a large block of shares can influence the market perception of a company, impacting its stock price. In this case, the sale of over $13 million worth of Ascent Industries stock by Private Fund LP could potentially lead to a decline in the stock price.

The magnitude of the decline would depend on various factors, including the size of the sale relative to the overall market capitalization of Ascent Industries, the timing of the sale, and the prevailing market sentiment.The impact of the sale on Ascent Industries’ market capitalization can be calculated by multiplying the number of shares sold by the difference between the pre-sale and post-sale stock price.

Market Capitalization Change = (Number of Shares Sold) x (Pre-Sale Stock Price

Post-Sale Stock Price)

For example, if Private Fund LP sold 1 million shares at a pre-sale price of $15 per share and the post-sale price dropped to $14 per share, the market capitalization would decrease by $1 million.

Implications for Other Investors

The sale of a large block of shares by a significant investor can create uncertainty for other investors. They may interpret the sale as a signal that the investor has lost confidence in the company’s future prospects, potentially leading to a sell-off by other investors.

Conversely, if the sale is seen as a strategic move by the investor, it might have a minimal impact on the stock price.

Key Market Data Points

The following table summarizes the key market data points relevant to the stock sale:

| Data Point | Pre-Sale | Post-Sale |

|---|---|---|

| Stock Price ($) | Pre-Sale Stock Price | Post-Sale Stock Price |

| Trading Volume (Shares) | Pre-Sale Trading Volume | Post-Sale Trading Volume |

| Market Capitalization ($) | Pre-Sale Market Capitalization | Post-Sale Market Capitalization |

Future Outlook for Ascent Industries

Ascent Industries’ future prospects are a complex tapestry woven from the threads of its recent stock sale, market trends, and its own internal capabilities. While the sale indicates a shift in Private Fund LP’s investment strategy, it doesn’t necessarily paint a bleak picture for Ascent Industries.

The company’s future will depend on its ability to navigate a landscape shaped by both opportunities and challenges.

Potential Growth Trajectory, Privet fund LP sells over million in Ascent Industries stock

The sale of Ascent Industries’ stock might be seen as a signal of confidence in the company’s long-term prospects. Private Fund LP, with its expertise in identifying growth potential, might have opted for a strategic exit, believing that Ascent Industries is poised for further growth.

A potential scenario for Ascent Industries’ growth trajectory could involve:

- Expansion into New Markets:Ascent Industries could leverage its existing expertise to penetrate new geographical markets or expand into adjacent industries. This could involve establishing new production facilities or forming strategic partnerships to gain access to new customer bases. For instance, if Ascent Industries manufactures automotive parts, it could explore expanding into the electric vehicle market by developing specialized components for electric cars.

- Product Innovation and Diversification:Ascent Industries could invest in research and development to create innovative products or expand its product portfolio. This could involve introducing new product lines or developing existing products to meet emerging market needs. A good example would be a company that manufactures traditional furniture adapting its manufacturing processes to produce sustainable, eco-friendly furniture made from recycled materials, tapping into the growing demand for environmentally conscious products.

- Strategic Acquisitions:Ascent Industries could acquire smaller companies with complementary products or technologies to expand its reach and enhance its competitive position. This could involve acquiring companies with specialized expertise or access to new distribution channels. A recent example is the acquisition of a small, innovative startup by a large corporation, where the startup’s cutting-edge technology complements the corporation’s existing product line, creating a synergistic effect.

Potential Risks and Challenges

While the future holds potential for growth, Ascent Industries faces several risks and challenges that could hinder its progress. These include:

- Economic Downturn:A global economic downturn could impact consumer spending and demand for Ascent Industries’ products, potentially leading to lower sales and profits. For instance, a recession could lead to a decrease in discretionary spending on non-essential items, affecting companies like Ascent Industries that produce consumer goods.

- Increased Competition:The market for Ascent Industries’ products might become increasingly competitive, with new entrants or existing competitors adopting aggressive pricing strategies or introducing innovative products. This could erode Ascent Industries’ market share and put pressure on its profitability. An example would be the rise of low-cost, overseas competitors in the manufacturing industry, forcing established companies like Ascent Industries to adapt their pricing strategies and production processes to remain competitive.

- Supply Chain Disruptions:Disruptions in the global supply chain, such as those caused by natural disasters or geopolitical events, could affect Ascent Industries’ ability to source raw materials or manufacture its products, leading to production delays and higher costs. The COVID-19 pandemic, for example, highlighted the vulnerability of global supply chains and led to disruptions in the manufacturing of various goods, including those produced by companies like Ascent Industries.

Closure: Privet Fund LP Sells Over Million In Ascent Industries Stock

The decision by Privet Fund LP to divest its stake in Ascent Industries signals a shift in the firm’s investment strategy, likely driven by a combination of factors. The current market conditions, characterized by [Market Conditions], may have influenced the fund’s decision, along with potential changes in its overall investment philosophy.

The impact of this sale on Ascent Industries’ stock price and market capitalization remains to be seen, but it is likely to generate considerable market activity in the coming weeks. The future of Ascent Industries hinges on its ability to adapt to the evolving market dynamics and capitalize on emerging opportunities in the [Industry] sector.

The company’s growth trajectory will be closely watched by investors, who are eager to see how Ascent Industries navigates the challenges and opportunities ahead.

Quick FAQs

What is the exact amount of stock sold by Privet Fund LP?

The exact number of shares sold by Privet Fund LP is not publicly available. However, the total value of the transaction was reported to be over $13 million.

What is the current stock price of Ascent Industries?

The current stock price of Ascent Industries can be found on major financial websites or stock exchanges.

What are the potential risks and challenges that Ascent Industries might face in the future?

Ascent Industries faces several potential risks and challenges, including [List of Risks and Challenges]. The company’s ability to navigate these challenges will be crucial to its future success.

CentralPoint Latest News

CentralPoint Latest News