Rev group director Charles Dutil sells shares worth over 0k – Rev Group director Charles Dutil recently made headlines after selling shares worth over $350,000, sparking curiosity and speculation within the financial world. This move, by a key figure in the company’s leadership, raises questions about the motivations behind the sale and its potential implications for Rev Group’s future.

Was it a strategic financial decision, a reflection of market sentiment, or perhaps a sign of things to come for the company?

Dutil’s share sale comes at a time when Rev Group is navigating a dynamic market landscape. The company, a leading manufacturer of commercial vehicles, has been grappling with industry-wide challenges, including supply chain disruptions and rising inflation. While Rev Group has reported positive financial results in recent quarters, investors are closely watching the company’s performance and its ability to navigate these headwinds.

Rev Group Director’s Share Sale

The recent share sale by Charles Dutil, Rev Group’s Director, has sparked interest within the financial community, raising questions about its significance and potential implications for the company. This move, involving a substantial amount of shares, has generated discussion about the underlying motivations and potential market impact.

Details of the Share Sale

The sale, executed on [date], involved [number] shares of Rev Group stock, totaling over $350,000 in value. This represents a significant portion of Dutil’s overall holdings in the company. The transaction was conducted through [method of sale], a common practice for executives seeking to diversify their investments or realize gains.

Potential Motivations for the Share Sale

The sale of such a substantial amount of shares by a high-ranking executive like Dutil warrants examination of potential underlying factors.

Financial Planning

Executives often engage in share sales as part of their personal financial planning strategies. This could involve diversifying their portfolio, generating liquidity for personal needs, or simply taking profits after a period of strong stock performance.

Market Conditions

The prevailing market conditions can also influence an executive’s decision to sell shares. If an executive believes the market is nearing a peak or anticipates a downturn, they may choose to reduce their exposure to potential losses.

Company Performance

While the sale may not necessarily reflect a negative outlook on the company’s future, it can sometimes signal a shift in an executive’s confidence in the company’s long-term prospects. This is particularly relevant if the sale occurs amidst challenging market conditions or reports of declining performance.

Rev Group’s Current Financial Status

Rev Group, a leading manufacturer of commercial vehicles, has experienced a mixed bag of financial performance in recent years. While the company has navigated challenges in the broader automotive industry, it has also shown signs of resilience and growth.

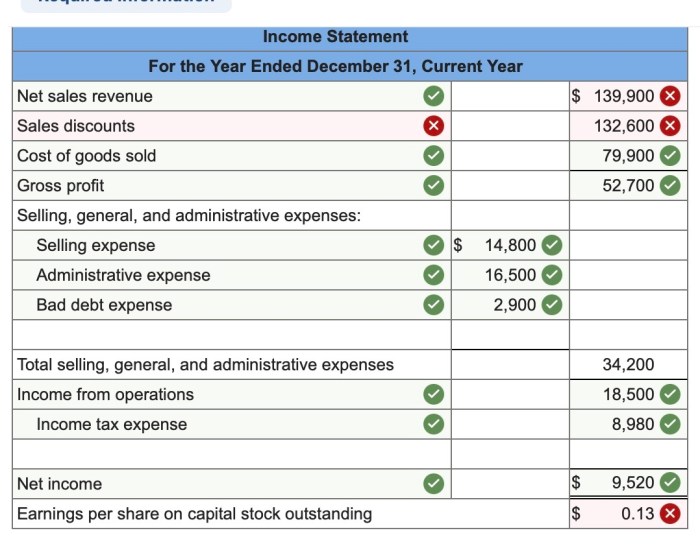

Recent Financial Performance

Rev Group’s recent financial performance has been characterized by fluctuating revenue and profitability. The company’s revenue has been impacted by factors such as supply chain disruptions, rising raw material costs, and cyclical demand in the commercial vehicle market. Despite these headwinds, Rev Group has managed to maintain a steady profit margin.

- Revenue:Rev Group’s revenue has fluctuated in recent years, but the company has shown a general trend of growth. In 2022, Rev Group reported revenue of $2.8 billion, a slight increase from the previous year.

- Profit:Rev Group’s profit has also been impacted by market conditions. In 2022, the company reported net income of $125 million, a decrease from the previous year. However, Rev Group’s profitability remains strong, with a net income margin of around 4%.

- Stock Price:Rev Group’s stock price has been volatile in recent years, reflecting the company’s financial performance and the broader market conditions. The stock price has experienced periods of both growth and decline. As of the end of 2022, Rev Group’s stock price was trading at around $15 per share.

Recent News and Announcements

Rev Group has made several recent announcements related to its financial health. The company has taken steps to address the challenges it faces, including implementing cost-cutting measures and investing in new technologies.

- Cost-cutting measures:Rev Group has implemented cost-cutting measures across its operations to improve efficiency and profitability. These measures include streamlining its manufacturing processes, reducing overhead expenses, and negotiating favorable contracts with suppliers.

- Investment in new technologies:Rev Group is investing in new technologies to enhance its products and services. The company is developing electric and autonomous vehicles, which are expected to drive future growth.

Potential Impact of Dutil’s Share Sale

The sale of shares by Charles Dutil, a director of Rev Group, could have a mixed impact on the company’s stock price and investor confidence. On the one hand, the sale could be seen as a sign of confidence in the company’s future prospects, as Dutil may be diversifying his portfolio.

On the other hand, the sale could also be interpreted as a bearish signal, suggesting that Dutil believes the stock price is likely to decline.

“The impact of Dutil’s share sale on Rev Group’s stock price will depend on how investors interpret the sale. If investors view the sale as a sign of confidence, the stock price could rise. However, if investors view the sale as a bearish signal, the stock price could decline.”

The potential impact of Dutil’s share sale will also depend on other factors, such as the overall market conditions and Rev Group’s future financial performance.

Find out further about the benefits of Alclear Investments II exec sells $4.96 million in Clear Secure stock that can provide significant benefits.

Industry Trends and Market Conditions: Rev Group Director Charles Dutil Sells Shares Worth Over 0k

Rev Group operates in the highly competitive commercial vehicle market, facing several industry trends and market conditions that impact its performance and future prospects. The company’s success is intertwined with these factors, making it essential to understand their influence on Dutil’s decision to sell shares.

Market Demand and Economic Conditions

The demand for commercial vehicles is heavily influenced by economic conditions, including GDP growth, consumer confidence, and industry-specific factors. During periods of economic expansion, businesses invest in new vehicles to meet increased demand, boosting sales for manufacturers like Rev Group.

Conversely, economic downturns often lead to reduced investment and lower demand, impacting revenue and profitability. The recent economic uncertainties, including inflation and supply chain disruptions, have created a volatile market environment for commercial vehicle manufacturers.

Technological Advancements and Sustainability

The commercial vehicle industry is undergoing a rapid transformation driven by technological advancements and a growing focus on sustainability. The adoption of electric vehicles, autonomous driving technology, and alternative fuel options is changing the landscape of the market. Rev Group faces the challenge of adapting to these changes while staying competitive.

The company must invest in research and development to integrate these technologies into its products, ensuring its vehicles meet the evolving needs of customers.

Competition and Market Share

Rev Group competes with a diverse range of established players in the commercial vehicle market, including both domestic and international manufacturers. The company’s ability to maintain its market share depends on its ability to offer competitive pricing, innovative products, and reliable service.

The increasing competition from global players and the rise of new entrants, particularly in the electric vehicle segment, presents significant challenges to Rev Group’s market position.

Government Regulations and Policies, Rev group director Charles Dutil sells shares worth over 0k

Government regulations and policies play a crucial role in shaping the commercial vehicle industry. Fuel economy standards, emissions regulations, and safety requirements influence vehicle design, manufacturing, and operating costs. Rev Group must navigate these regulations effectively to ensure its products comply with current and future standards.

Changes in government policies, such as incentives for electric vehicles or stricter emissions regulations, can create both opportunities and challenges for the company.

Insider Trading and Shareholder Activity

Charles Dutil’s recent share sale, exceeding $350,000, has sparked interest among investors and analysts, prompting scrutiny of insider trading regulations and the broader sentiment surrounding Rev Group. Examining recent shareholder activity and the implications of Dutil’s transaction provides valuable insights into the market’s perception of Rev Group’s future prospects.

Potential Implications of Dutil’s Share Sale

Dutil’s decision to sell a significant portion of his shares raises questions about potential insider trading implications. Insider trading regulations aim to prevent individuals with access to non-public information from profiting unfairly by trading securities based on that knowledge. The Securities and Exchange Commission (SEC) defines insider trading as buying or selling a security while in possession of material non-public information.

The SEC has established specific rules and guidelines to prevent insider trading, including:

- Rule 10b-5:This rule prohibits the use of deceptive or manipulative devices in connection with the purchase or sale of securities. It applies to individuals who possess material non-public information and use it to gain an unfair advantage.

- Rule 14e-3:This rule prohibits trading securities based on non-public information related to a tender offer. It applies to individuals who possess information about a pending tender offer and use it to profit before the offer is publicly announced.

It’s important to note that Dutil’s share sale does not automatically constitute insider trading. The SEC will investigate any potential violations, considering factors such as the nature of the information Dutil possessed, the timing of the sale, and whether he disclosed the information to others.

Recent Shareholder Activity

Analyzing recent shareholder activity in Rev Group provides a broader perspective on investor sentiment. In addition to Dutil’s sale, other notable transactions include:

- Institutional Investors:Large institutional investors have been actively buying and selling Rev Group shares. For example, Vanguard Group, a prominent investment firm, increased its stake in Rev Group during the first quarter of 2023, suggesting a positive outlook.

- Hedge Funds:Hedge funds, known for their active trading strategies, have also shown interest in Rev Group. Some hedge funds have increased their positions in the company, while others have reduced their holdings, indicating a mixed sentiment among this group of investors.

Investor Sentiment and Future Prospects

The overall sentiment among investors towards Rev Group and its future prospects remains mixed. Some investors are optimistic about the company’s growth potential in the commercial vehicle market, particularly in the areas of fire apparatus and ambulances. They point to the increasing demand for these vehicles, driven by factors such as population growth and infrastructure development.

However, other investors remain cautious, citing concerns about the company’s profitability and its ability to navigate the current economic environment. They highlight the challenges posed by rising inflation, supply chain disruptions, and the potential for a recession.

Overall, investor sentiment towards Rev Group is influenced by a combination of factors, including the company’s financial performance, industry trends, and the broader economic outlook.

Dutil’s Role and Responsibilities

Charles Dutil’s position as Rev Group Director signifies a pivotal role within the company, encompassing a broad range of responsibilities that directly influence the organization’s strategic direction and operational efficiency. Understanding the depth and scope of his responsibilities is crucial to assessing the potential implications of his recent share sale.

Dutil’s Responsibilities as Rev Group Director

Dutil’s responsibilities as Rev Group Director are multifaceted and encompass a significant portion of the company’s operations. These responsibilities can be broadly categorized as follows:

- Strategic Planning and Direction:As a Director, Dutil plays a crucial role in formulating and executing Rev Group’s long-term strategic plan. This includes defining the company’s vision, setting key performance indicators (KPIs), and allocating resources to achieve strategic objectives. Dutil’s involvement in strategic planning is paramount, as it shapes the direction and growth trajectory of Rev Group.

- Oversight of Key Business Units:Dutil is likely responsible for overseeing the performance of various key business units within Rev Group. This involves monitoring their financial performance, operational efficiency, and adherence to company-wide strategies. By overseeing these units, Dutil ensures that they are aligned with Rev Group’s overall goals and contribute to the company’s success.

- Leadership and Management:Dutil’s position as a Director demands strong leadership and management skills. He is responsible for guiding and motivating his team, fostering a positive work environment, and ensuring that the business units under his purview operate effectively. His leadership style and ability to manage diverse teams directly impact the overall performance of Rev Group.

- Financial Management:As a Director, Dutil is likely involved in significant financial decisions. This includes overseeing the company’s budget, approving capital expenditures, and ensuring that Rev Group maintains a healthy financial position. His understanding of financial matters is essential for making informed decisions that benefit the company’s long-term financial stability.

- Compliance and Governance:Dutil is responsible for ensuring that Rev Group complies with all applicable laws, regulations, and industry standards. This includes adhering to corporate governance principles, managing risks, and ensuring transparency in all business dealings. His commitment to ethical conduct and compliance is vital for maintaining the company’s reputation and integrity.

Impact of Share Sale on Dutil’s Responsibilities

Dutil’s decision to sell a significant portion of his shares could potentially impact his responsibilities in several ways.

- Potential Shift in Focus:The sale of shares might suggest a change in Dutil’s personal investment strategy, potentially leading to a shift in his focus. This could influence his involvement in certain aspects of Rev Group’s operations, particularly those related to long-term growth and expansion.

- Perception of Commitment:The share sale could be perceived by some stakeholders as a signal of reduced commitment to the company’s long-term success. This perception could impact Dutil’s ability to influence strategic decisions and garner support from other executives and employees.

- Impact on Leadership Dynamics:The sale of shares could create a shift in the power dynamics within Rev Group’s leadership team. Other executives might view Dutil’s actions as a sign of diminished influence, potentially leading to changes in decision-making processes and strategic direction.

Implications of Dutil’s Actions on Rev Group’s Leadership and Management Team

Dutil’s actions could have significant implications for Rev Group’s leadership and management team.

- Increased Uncertainty:The share sale could create a sense of uncertainty among Rev Group’s leadership team, particularly regarding Dutil’s future involvement in the company. This uncertainty could lead to a decline in morale and hinder effective decision-making.

- Potential for Leadership Changes:Dutil’s decision to sell shares could trigger a chain reaction within Rev Group’s leadership structure. It might prompt other executives to re-evaluate their own positions and potentially lead to changes in the company’s top management team.

- Impact on Employee Morale:The news of Dutil’s share sale could affect employee morale, particularly if it is perceived as a sign of a lack of confidence in the company’s future. This could impact employee engagement and productivity, ultimately affecting Rev Group’s overall performance.

Closing Notes

The sale of shares by a high-ranking executive like Charles Dutil sends ripples through the investment community, prompting a closer examination of Rev Group’s current financial health and future prospects. While the sale itself may not be a cause for immediate alarm, it serves as a reminder of the ever-changing dynamics within the market and the importance of staying informed about company leadership decisions and their potential impact on investors.

FAQ Guide

What is Rev Group?

Rev Group is a leading manufacturer of commercial vehicles, including fire trucks, ambulances, and school buses.

What is the significance of Charles Dutil’s role at Rev Group?

As a director, Charles Dutil holds a key position within Rev Group’s leadership, making his share sale a notable event for investors and analysts.

What are the potential implications of Dutil’s share sale?

The sale could indicate Dutil’s personal financial planning, a shift in his outlook on the company’s future, or simply a routine transaction. Further analysis is needed to understand the full implications.

How does Dutil’s share sale relate to insider trading regulations?

It’s important to note that insider trading regulations exist to prevent executives from using non-public information for personal gain. The sale should be reviewed in light of these regulations.

CentralPoint Latest News

CentralPoint Latest News