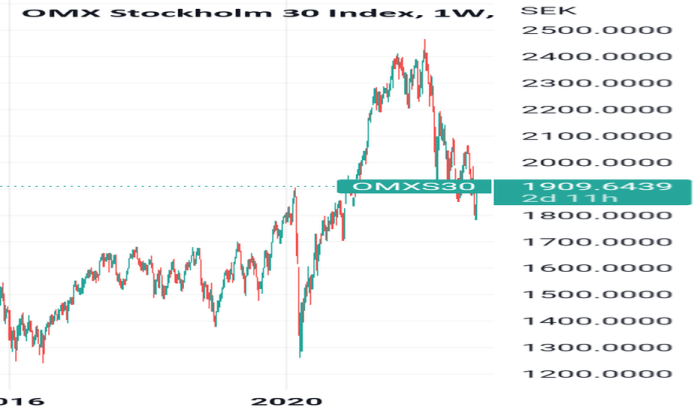

Sweden stocks lower at close of trade; OMX Stockholm 30 down 0.53% – Sweden stocks closed lower at the end of the trading day, with the OMX Stockholm 30 index dropping by 0.53%. This downturn, while not drastic, reflects a broader trend of market volatility that has been gripping global markets in recent weeks.

As investors navigate a complex landscape of economic uncertainty, the Swedish stock market is feeling the pressure, with key sectors experiencing significant declines.

The decline in the OMX Stockholm 30 index is a reflection of several factors, including concerns about rising inflation, the potential for interest rate hikes, and the ongoing geopolitical tensions. The Swedish economy, while relatively strong, is not immune to the global economic headwinds.

This downward trend in the Swedish stock market is a reminder that even robust economies are susceptible to global market fluctuations.

Market Overview: Sweden Stocks Lower At Close Of Trade; OMX Stockholm 30 Down 0.53%

The OMX Stockholm 30 index, a benchmark for the Swedish stock market, experienced a decline of 0.53% at the close of trade today. This downward movement reflects a broader trend in global markets, where investors are grappling with a complex mix of economic uncertainties.

Factors Contributing to the Decline

The decline in the OMX Stockholm 30 index can be attributed to a confluence of factors, including:

- Rising Inflation:Persistent inflation continues to weigh on investor sentiment, as it erodes purchasing power and increases the cost of doing business. The Swedish central bank, Riksbanken, has been raising interest rates to combat inflation, which can slow economic growth and dampen corporate earnings.

- Geopolitical Tensions:The ongoing war in Ukraine, coupled with heightened geopolitical tensions in other parts of the world, has created uncertainty and volatility in financial markets. The conflict has disrupted supply chains, driven up energy prices, and fueled concerns about global economic stability.

- Economic Slowdown Fears:Fears of a global economic slowdown are also contributing to market jitters. Central banks are aggressively tightening monetary policy, which could lead to a recession in some countries. This uncertainty is causing investors to become more cautious and pull back from riskier assets.

Market Sentiment and Future Stock Performance

The overall market sentiment remains cautious, with investors closely monitoring economic data and geopolitical developments. The decline in the OMX Stockholm 30 index suggests that investors are becoming increasingly risk-averse and seeking safer havens for their investments.The future performance of the Swedish stock market will depend on a number of factors, including the trajectory of inflation, the outcome of the war in Ukraine, and the pace of global economic growth.

If inflation starts to moderate and geopolitical tensions ease, the market could rebound. However, if economic growth slows significantly or geopolitical risks escalate, further declines in the OMX Stockholm 30 index are possible.

Key Sector Performance

The Swedish stock market experienced a broad-based decline today, with several sectors contributing to the overall downturn. Notably, the energy and materials sectors faced significant pressure, reflecting broader concerns about the global economic outlook and commodity prices.

Explore the different advantages of Colombia stocks higher at close of trade; COLCAP up 0.02% that can change the way you view this issue.

Performance of Key Sectors, Sweden stocks lower at close of trade; OMX Stockholm 30 down 0.53%

The energy sector, which has been a strong performer in recent months, experienced a notable pullback today. This decline can be attributed to several factors, including concerns about slowing global economic growth, potential price caps on Russian oil, and the recent weakness in crude oil prices.

- Swedish Match AB (SWMA.ST), a leading manufacturer of tobacco products, saw its shares decline by 2.5% as investors took profits following recent gains.

- Lundin Energy AB (LUNE.ST), an oil and gas exploration and production company, experienced a similar decline, with its shares falling by 2.3%.

The materials sector also faced significant headwinds, as investors expressed concerns about slowing global demand for commodities and rising interest rates.

- Boliden AB (BOL.ST), a leading mining and smelting company, saw its shares fall by 1.8% as investors took profits following recent gains.

- SSAB AB (SSAB.ST), a steel producer, also experienced a decline, with its shares falling by 1.5%.

Comparison with Other Global Markets

The Swedish stock market’s performance today was in line with other major global markets, which also experienced declines amid concerns about slowing economic growth and rising inflation. The US stock market, as measured by the S&P 500 index, fell by 0.7%, while the German DAX index declined by 0.6%.

“The Swedish stock market’s performance today reflects broader concerns about the global economic outlook, with investors seeking safe haven assets amid rising inflation and interest rates,” said a market analyst.

Economic Factors

The Swedish stock market, like any other, is deeply intertwined with the health of the underlying economy. Inflation, interest rates, and overall economic growth all play a significant role in influencing investor sentiment and driving stock prices.

Impact of Inflation and Interest Rates

Inflation and interest rates are two key economic indicators that have a profound impact on the Swedish stock market. High inflation erodes the purchasing power of consumers, leading to a decline in demand for goods and services. This can negatively affect corporate profits, potentially leading to lower stock prices.

Conversely, rising interest rates increase the cost of borrowing for businesses, which can also impact profitability and stock valuations. The Swedish Riksbank, the country’s central bank, closely monitors inflation and adjusts interest rates accordingly to maintain price stability.

Current State of the Swedish Economy

The Swedish economy has shown resilience in recent years, with a robust labor market and strong consumer spending. However, the country is not immune to global economic headwinds, such as the ongoing war in Ukraine and rising energy prices. These factors have contributed to an increase in inflation, prompting the Riksbank to raise interest rates.

The impact of these economic developments on the Swedish stock market is still unfolding, and investors are closely monitoring the situation.

Recent Economic News and Events

The Swedish government recently announced a series of measures aimed at addressing the rising cost of living, including tax cuts and subsidies for energy bills. These measures are expected to provide some relief to consumers and businesses, but their long-term impact on the economy remains to be seen.

The Swedish Riksbank also announced its latest interest rate decision, raising rates by 0.50% in an effort to curb inflation. This move is likely to impact borrowing costs for businesses and consumers, and its implications for the stock market will be closely watched.

Global Market Influences

The Swedish stock market, like many others, is intricately linked to global events and trends. Geopolitical tensions, economic policies, and international trade dynamics all play a role in shaping investor sentiment and influencing stock prices.

Geopolitical Influences

The current geopolitical landscape, marked by ongoing conflicts and heightened tensions, has a significant impact on investor confidence.

- The ongoing war in Ukraine has created uncertainty and volatility in global markets, prompting investors to seek safe-haven assets. This can lead to a flight of capital away from riskier assets, such as equities, potentially affecting the Swedish stock market.

- Escalating tensions between major powers, such as the US and China, can also impact global trade and investment flows. Trade wars and sanctions can disrupt supply chains and create economic uncertainty, affecting Swedish businesses with international operations.

International Trade Relations

Sweden’s economy is heavily reliant on international trade, making it particularly susceptible to shifts in global trade relations.

- Changes in trade agreements, tariffs, and quotas can significantly impact Swedish businesses operating in global markets. For example, the imposition of new tariffs on Swedish exports could negatively affect the profitability of certain sectors.

- The emergence of new trade blocs and regional trade agreements can also influence Swedish businesses. If Sweden is excluded from these agreements or faces barriers to entry, it could hinder its ability to compete in certain markets.

Investor Sentiment

The OMX Stockholm 30 index closed lower today, reflecting a cautious sentiment among investors. While the market saw some selling pressure, it’s crucial to consider the factors influencing investor behavior and their potential impact on the market’s future trajectory.

Investor Sentiment Analysis

Today’s trading activity suggests a mix of caution and uncertainty among investors. The decline in the OMX Stockholm 30 index reflects a preference for risk aversion, possibly driven by concerns about global economic uncertainties and rising inflation. However, it’s important to note that the decline was relatively modest, indicating that investors might be holding onto a degree of optimism about the long-term outlook.

Impact of Investor Expectations

Investor expectations play a significant role in shaping market performance. If investors anticipate a positive economic outlook, they are likely to be more bullish, leading to increased buying activity and potential market gains. Conversely, pessimistic expectations can lead to selling pressure and market declines.

In the current scenario, investor expectations are likely to be influenced by factors such as inflation trends, interest rate decisions by central banks, and the ongoing geopolitical landscape.

Notable Changes in Investor Behavior

During the trading session, there were some notable shifts in investor behavior. For instance, investors in the technology sector seemed to be more cautious, contributing to the decline in the OMX Stockholm 30 index. This could be attributed to concerns about the potential impact of rising interest rates on technology companies’ valuations.

Conversely, investors in the healthcare sector appeared to be more optimistic, with some stocks in this sector experiencing gains. This might reflect the perceived resilience of the healthcare sector amidst economic uncertainties.

Epilogue

The Swedish stock market’s performance is a microcosm of the larger global economic picture. While the recent decline may be concerning, it is important to remember that market fluctuations are a natural part of the investment cycle. Investors should remain informed and adapt their strategies accordingly, focusing on long-term goals and managing risk effectively.

The Swedish stock market, with its strong fundamentals and diverse industries, is poised to navigate these turbulent times and emerge stronger in the future.

Expert Answers

What are the main factors contributing to the decline in the Swedish stock market?

The decline is attributed to a combination of factors, including concerns about rising inflation, potential interest rate hikes, and geopolitical tensions.

How does the performance of the Swedish stock market compare to other global markets?

The Swedish stock market’s performance is in line with other major global markets, which have also experienced recent declines due to similar economic and geopolitical concerns.

What are the potential implications of this decline for Swedish businesses?

The decline in the stock market can impact Swedish businesses in various ways, including lower valuations, reduced access to capital, and potentially decreased investor confidence. However, the long-term impact will depend on the duration and severity of the decline, as well as the resilience of individual businesses.

CentralPoint Latest News

CentralPoint Latest News