The rise of decentralized finance (DeFi) and its implications have sent shockwaves through the traditional financial world. It’s like a wild west of finance, where cowboys (or should we say code jockeys) are building new financial systems on the blockchain, free from the shackles of banks and intermediaries.

Imagine a world where you can lend, borrow, and trade cryptocurrencies without needing a bank, all thanks to the magic of smart contracts. DeFi is not just a fad; it’s a revolution in the making, and it’s time to saddle up and join the ride.

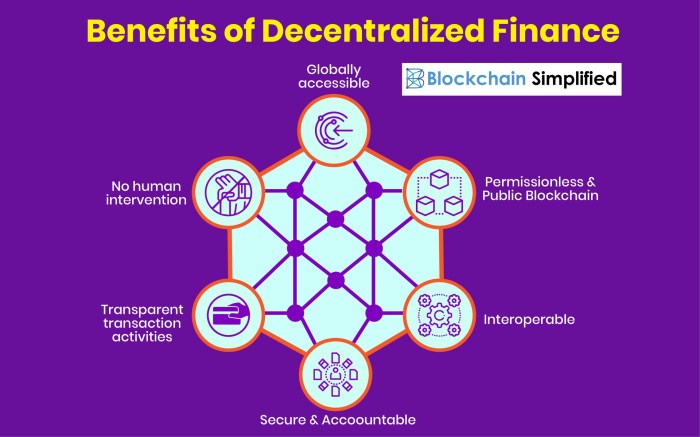

At its core, DeFi is about giving power back to the people. It empowers individuals to control their own finances, offering transparency, accessibility, and even a touch of financial freedom. Think of it as a digital financial playground where anyone can participate, from seasoned investors to everyday users.

While it’s still early days, the potential of DeFi is vast, promising to reshape the financial landscape as we know it.

Introduction to Decentralized Finance (DeFi)

Imagine a financial system where banks and intermediaries are a distant memory, replaced by a network of code and smart contracts. That’s the essence of Decentralized Finance (DeFi). It’s a new and exciting way to access financial services, cutting out the middlemen and empowering individuals to control their money.DeFi is built on the principles of transparency, accessibility, and security, leveraging the power of blockchain technology.

It’s like a digital playground for finance, offering a wide range of services from lending and borrowing to trading and insurance, all powered by smart contracts.

Differences Between Traditional Finance and DeFi

The core difference between traditional finance and DeFi lies in the way they operate. Traditional finance relies on centralized institutions, such as banks and financial institutions, to manage and control financial services. DeFi, on the other hand, uses decentralized, open-source protocols that run on blockchain networks, eliminating the need for intermediaries.

This decentralized nature brings about several key distinctions:

- Transparency:All transactions on DeFi platforms are recorded on a public ledger, making them transparent and auditable by anyone.

- Accessibility:DeFi services are accessible to anyone with an internet connection, regardless of location or financial background.

- Security:DeFi protocols are built on secure blockchain networks, making them resistant to fraud and manipulation.

- Open Source:The code behind DeFi applications is open source, allowing anyone to inspect and contribute to its development.

Examples of DeFi Applications

DeFi is a rapidly evolving landscape with a wide range of applications, constantly expanding and innovating. Here are some of the most prominent examples:

- Decentralized Exchanges (DEXs):DEXs allow users to trade cryptocurrencies directly with each other, eliminating the need for centralized exchanges. Popular DEXs include Uniswap and SushiSwap.

- Lending and Borrowing:DeFi platforms like Aave and Compound enable users to lend and borrow cryptocurrencies, earning interest on their assets or accessing loans with low collateral requirements.

- Stablecoins:Stablecoins are cryptocurrencies pegged to a stable asset like the US dollar, providing price stability and reducing volatility. Popular stablecoins include Tether (USDT) and USD Coin (USDC).

- Decentralized Insurance:DeFi insurance protocols like Nexus Mutual offer coverage against smart contract risks and other potential losses.

Key Components of DeFi: The Rise Of Decentralized Finance (DeFi) And Its Implications

DeFi, or Decentralized Finance, is a rapidly growing sector that aims to revolutionize traditional financial systems by leveraging the power of blockchain technology. It encompasses a wide range of applications, including lending, borrowing, trading, and more, all without the need for intermediaries.

This section will delve into the key components that make DeFi possible.

Smart Contracts

Smart contracts are self-executing contracts stored on a blockchain. They are essentially lines of code that automatically execute when predefined conditions are met. In DeFi, smart contracts play a crucial role in facilitating transactions, automating processes, and ensuring transparency.For instance, in a lending protocol, a smart contract would define the terms of the loan, including interest rates, repayment schedule, and collateral requirements.

When the borrower meets the repayment conditions, the smart contract automatically releases the collateral back to them. This eliminates the need for a central authority to oversee the process, making it more efficient and secure.

Blockchain Technology

Blockchain technology is the backbone of DeFi. It provides a secure, transparent, and immutable ledger that records all transactions. This immutability ensures that data cannot be altered or deleted, fostering trust and accountability.Each transaction on a blockchain is grouped into a block, which is then linked to the previous block in a chain.

This chain of blocks is distributed across a network of computers, making it extremely difficult to tamper with. The decentralized nature of blockchain also makes it resistant to censorship and single points of failure.

DeFi Protocols

DeFi protocols are the building blocks of the DeFi ecosystem. They provide various functionalities, such as lending, borrowing, trading, and insurance. Here are some of the most popular DeFi protocols:

- Lending Protocols: These protocols allow users to lend and borrow cryptocurrencies. Popular examples include Aave, Compound, and MakerDAO. They use smart contracts to automate the lending process, allowing borrowers to access funds quickly and efficiently.

- Decentralized Exchanges (DEXs): DEXs facilitate the trading of cryptocurrencies without the need for a central authority. They leverage smart contracts to execute trades directly between users, ensuring privacy and security. Popular examples include Uniswap, SushiSwap, and PancakeSwap.

- Stablecoins: Stablecoins are cryptocurrencies pegged to a stable asset, such as the US dollar. They aim to mitigate the volatility of cryptocurrencies, making them more suitable for everyday use. Popular examples include Tether (USDT) and USD Coin (USDC).

- Decentralized Insurance: These protocols offer insurance coverage against various risks, such as smart contract vulnerabilities or price fluctuations. They leverage smart contracts to automate the claims process, making it faster and more transparent.

DeFi Protocols Comparison

| Protocol | Features | Functionalities ||—|—|—|| Aave | Lending, borrowing, flash loans | Allows users to lend and borrow cryptocurrencies, including flash loans for arbitrage opportunities. || Compound | Lending, borrowing | Enables users to lend and borrow cryptocurrencies with variable interest rates based on market demand.

|| MakerDAO | Collateralized lending, stablecoin issuance | Allows users to borrow Dai, a stablecoin, by providing collateral in the form of ETH. || Uniswap | Decentralized exchange | Facilitates the trading of cryptocurrencies directly between users without intermediaries. || SushiSwap | Decentralized exchange | Similar to Uniswap but offers additional features, such as liquidity mining and governance tokens.

|| Tether (USDT) | Stablecoin | Pegged to the US dollar, providing stability and reducing volatility. || USD Coin (USDC) | Stablecoin | Another stablecoin pegged to the US dollar, widely used in DeFi applications. || Nexus Mutual | Decentralized insurance | Offers insurance coverage against smart contract vulnerabilities and other risks.

|

Rise of DeFi

The rise of decentralized finance (DeFi) has been nothing short of meteoric. It’s like watching a tiny sprout in a neglected garden suddenly blossom into a vibrant, sprawling jungle. But what’s driving this rapid growth? Let’s explore the factors that have propelled DeFi into the financial spotlight.

Factors Contributing to DeFi Growth

The rise of DeFi is a fascinating story of innovation, accessibility, and a growing distrust of traditional financial institutions. Here are some key factors that have fueled its growth:

- Blockchain Technology:DeFi’s foundation lies in blockchain technology, a distributed ledger that enables transparent and secure transactions. This trustless system eliminates the need for intermediaries, allowing for direct peer-to-peer interactions. Think of it like a digital trust network where everyone can see the transactions, but no one can control them.

- Open-Source Nature:The open-source nature of DeFi protocols allows developers and users to contribute to the ecosystem. This collaborative spirit fosters innovation and attracts a diverse community of builders and users.

- Accessibility and Inclusivity:DeFi offers financial services to a wider audience, including those who are underserved by traditional systems. Imagine a world where anyone with an internet connection can access financial tools, regardless of their location or credit history. That’s the promise of DeFi.

- Yield Farming:This concept allows users to earn interest on their crypto assets by lending them out or participating in liquidity pools. It’s like earning interest on your savings, but with the potential for higher returns. This has attracted many users seeking to maximize their returns.

- Smart Contracts:These self-executing contracts automate financial processes, eliminating the need for intermediaries and reducing the risk of fraud. Imagine a contract that automatically executes a loan repayment based on pre-defined conditions. That’s the power of smart contracts.

Impact of the COVID-19 Pandemic on DeFi Adoption

The COVID-19 pandemic, a global crisis that shook the world, surprisingly acted as a catalyst for DeFi adoption. It’s like a fire that, while destructive, also cleared the way for new growth. Here’s how:

- Increased Demand for Decentralized Solutions:As traditional financial systems struggled to adapt to the pandemic’s disruptions, people sought out alternative solutions. DeFi offered a lifeline, providing access to financial services without the need for physical interaction.

- Stimulus Packages and Crypto Adoption:Government stimulus packages injected liquidity into the economy, leading to increased interest in cryptocurrencies, including those used in DeFi. This influx of capital further fueled the growth of the DeFi ecosystem.

- Remote Work and Global Accessibility:The shift to remote work during the pandemic made DeFi’s global accessibility even more appealing. People could access financial services from anywhere in the world, breaking down traditional barriers.

Role of Regulatory Frameworks in Shaping the DeFi Landscape

The DeFi landscape is evolving rapidly, and regulatory frameworks are playing a crucial role in shaping its future. It’s like a dance between innovation and oversight, where both parties need to find a rhythm that allows for growth while maintaining stability.

- Addressing Concerns:Regulators are working to address concerns related to consumer protection, financial stability, and anti-money laundering (AML) in the DeFi space. This involves defining rules and guidelines for DeFi protocols, ensuring transparency and accountability.

- Promoting Innovation:While regulation is necessary, it’s crucial to strike a balance that encourages innovation. Overly restrictive regulations could stifle the growth of DeFi, limiting its potential to revolutionize the financial system.

- Global Coordination:As DeFi operates on a global scale, international cooperation is essential to establish consistent regulatory frameworks. This collaborative approach ensures that DeFi can flourish without facing conflicting regulations across different jurisdictions.

Growth of DeFi vs. Traditional Finance

DeFi is challenging the status quo, but how does it stack up against traditional finance? It’s like a race between a nimble sprinter and a seasoned marathon runner. Both have their strengths, but the landscape is changing.

- Market Capitalization:While traditional finance still holds a significant lead in terms of market capitalization, DeFi is growing rapidly. As of 2023, the total value locked (TVL) in DeFi protocols has reached billions of dollars, demonstrating the growing adoption of these decentralized solutions.

- User Adoption:DeFi is experiencing a surge in user adoption, attracting millions of users globally. This indicates a growing preference for decentralized and transparent financial services. It’s like a wave of users embracing a new paradigm, seeking greater control over their finances.

When investigating detailed guidance, check out Stay physically active for a longer lifespan and better health now.

- Future Potential:DeFi’s potential to disrupt traditional finance is undeniable. Its ability to provide more accessible, transparent, and efficient financial services is attracting increasing attention from both investors and users. This is a revolution that is just beginning.

DeFi Applications

DeFi’s potential extends far beyond just being a new way to manage your money. It’s revolutionizing the financial landscape, offering innovative solutions across various sectors, including lending, borrowing, trading, and insurance. This section explores the diverse applications of DeFi and how it is transforming traditional financial systems.

Lending and Borrowing

DeFi platforms have democratized access to lending and borrowing, making it easier and faster for individuals and institutions to access capital. These platforms operate on a peer-to-peer (P2P) model, eliminating the need for intermediaries like banks. Here are some examples of how DeFi is changing the lending and borrowing landscape:

- Flash Loans: These loans are granted and repaid within a single transaction, allowing users to execute complex strategies on decentralized exchanges (DEXs) or participate in arbitrage opportunities.

- Over-collateralized Loans: Users can borrow cryptocurrencies by depositing an equivalent or higher value of another cryptocurrency as collateral. This system provides security for lenders and flexibility for borrowers.

- Under-collateralized Loans: This type of loan allows users to borrow more than the value of their collateral, based on their credit score or other factors. These loans are often offered by platforms that use sophisticated risk assessment models.

Trading

DeFi platforms have introduced innovative trading mechanisms, offering greater transparency, liquidity, and efficiency compared to traditional exchanges. Here are some examples of how DeFi is revolutionizing trading:

- Decentralized Exchanges (DEXs): These platforms allow users to trade cryptocurrencies directly with each other without the need for a centralized intermediary. DEXs provide greater privacy and security, as users retain control of their assets.

- Automated Market Makers (AMMs): AMMs use smart contracts to facilitate trades, providing constant liquidity and price discovery. They allow for the creation of trading pairs between any two cryptocurrencies, even those not listed on traditional exchanges.

- Yield Farming: This involves providing liquidity to DeFi platforms by depositing assets into liquidity pools. In return, users receive rewards in the form of tokens or interest payments.

Insurance

DeFi is also disrupting the insurance industry, offering innovative solutions that are more transparent, accessible, and efficient. Here are some examples of how DeFi is changing the insurance landscape:

- Decentralized Insurance Protocols: These platforms allow users to pool their funds to create a shared risk pool. When a user experiences a covered event, they can file a claim and receive compensation from the pool.

- Smart Contract-Based Insurance: Insurance policies are written on smart contracts, ensuring automated and transparent payouts. These contracts eliminate the need for manual processing and reduce the risk of fraud.

- Parametric Insurance: This type of insurance pays out automatically based on predefined events, such as a drop in cryptocurrency prices. This eliminates the need for manual claims processing and ensures faster payouts.

DeFi in Emerging Markets and Developing Economies

DeFi has the potential to significantly impact emerging markets and developing economies, providing access to financial services for millions of people who are currently underserved or excluded from traditional financial systems.

- Financial Inclusion: DeFi platforms can provide access to financial services, such as lending, savings, and payments, for individuals and businesses in emerging markets without bank accounts or access to traditional financial institutions.

- Economic Growth: By facilitating cross-border payments and remittances, DeFi can promote trade and economic growth in developing countries.

- Access to Capital: DeFi can provide access to capital for small businesses and entrepreneurs in emerging markets, fostering innovation and job creation.

DeFi and Financial Inclusion

DeFi can play a crucial role in promoting financial inclusion by providing access to financial services for underserved populations, including those in rural areas, the unbanked, and those with limited credit history.

- Microloans: DeFi platforms can facilitate microloans, allowing individuals and small businesses in developing countries to access small amounts of capital for business ventures or personal needs.

- Savings and Investment: DeFi platforms can provide secure and transparent options for individuals to save and invest their money, even in countries with limited financial infrastructure.

- Cross-border Payments: DeFi can facilitate low-cost and fast cross-border payments, enabling remittances and reducing the cost of sending money back home for migrant workers.

Challenges and Opportunities in DeFi

![]()

DeFi, with its promise of an open and accessible financial system, is not without its challenges. While the potential for disruption is undeniable, navigating the complexities of security, regulation, and scalability is crucial for DeFi’s long-term success.

Security Vulnerabilities

DeFi protocols, being built on open-source code, are susceptible to security vulnerabilities. Smart contracts, the backbone of DeFi, can be exploited by malicious actors, leading to significant financial losses.

- Exploits and Hacks:The decentralized nature of DeFi makes it difficult to track and prevent malicious activities. High-profile hacks, like the Poly Network hack in 2021, highlight the vulnerability of DeFi protocols to sophisticated attacks.

- Smart Contract Bugs:Errors in the code of smart contracts can be exploited by hackers, leading to the loss of funds. Thorough auditing and security testing are crucial to mitigate these risks.

- Flash Loan Attacks:These attacks exploit the speed of DeFi transactions to manipulate market prices and extract profits from unsuspecting users.

Regulatory Uncertainty

The decentralized nature of DeFi presents challenges for regulators seeking to ensure financial stability and protect consumers.

- Lack of Clear Regulations:The absence of specific regulations for DeFi creates uncertainty for both developers and users, hindering widespread adoption.

- Jurisdictional Differences:Different countries have varying regulatory frameworks for cryptocurrencies and DeFi, making it difficult for DeFi protocols to operate globally.

- Cross-Border Enforcement:Enforcing regulations across borders is challenging, as DeFi operates on a global network.

Scalability Issues

The increasing popularity of DeFi has led to scalability challenges, particularly with regard to transaction speeds and costs.

- Network Congestion:As more users participate in DeFi, blockchains like Ethereum can become congested, leading to slower transaction speeds and higher fees.

- Limited Throughput:The current infrastructure of some blockchains cannot handle the volume of transactions required for widespread DeFi adoption.

- Gas Fees:High gas fees, particularly on Ethereum, can deter users from participating in DeFi applications, especially for smaller transactions.

Disruption of Traditional Financial Institutions

DeFi has the potential to disrupt traditional financial institutions by offering alternative financial services with lower costs, increased transparency, and greater accessibility.

- Decentralized Lending and Borrowing:DeFi protocols like Aave and Compound allow users to lend and borrow cryptocurrencies directly, eliminating the need for intermediaries.

- Automated Trading and Investment:DeFi platforms offer automated trading strategies and decentralized investment opportunities, reducing reliance on traditional brokers and fund managers.

- Alternative Payment Systems:Stablecoins and other cryptocurrencies can facilitate cross-border payments, challenging traditional payment systems.

Future of DeFi

The future of DeFi holds significant promise for revolutionizing the financial industry.

- Increased Adoption:As the technology matures and regulatory clarity emerges, DeFi is expected to see wider adoption, with more users and applications.

- Integration with Traditional Finance:DeFi protocols are likely to integrate with traditional financial systems, offering new opportunities for collaboration and innovation.

- New Financial Products and Services:DeFi is expected to spawn new financial products and services, such as decentralized insurance, derivatives, and asset management.

Key Challenges and Opportunities in DeFi, The rise of decentralized finance (DeFi) and its implications

| Challenge | Opportunity |

|---|---|

| Security vulnerabilities | Enhanced security measures, including smart contract audits and security testing |

| Regulatory uncertainty | Collaboration with regulators to develop clear and comprehensive frameworks |

| Scalability issues | Adoption of layer-2 solutions and advancements in blockchain technology |

| Disruption of traditional financial institutions | Increased competition and innovation in the financial services sector |

| Future of DeFi | Expansion of DeFi applications, integration with traditional finance, and the emergence of new financial products |

Final Summary

The rise of DeFi is a fascinating story of innovation, disruption, and a glimpse into a future where finance is more accessible, transparent, and ultimately, more user-centric. While challenges remain, the potential of DeFi to transform the financial world is undeniable.

So, buckle up and get ready for a wild ride as DeFi continues to break down barriers and redefine the way we think about money.

Question Bank

What are some of the biggest challenges facing DeFi?

DeFi faces challenges like security vulnerabilities, regulatory uncertainty, and scalability issues. It’s like the Wild West, but with code! While the technology is advancing rapidly, the ecosystem is still maturing and needs to address these issues to reach its full potential.

Is DeFi really safe?

Security is a major concern in the DeFi space. Just like any new technology, DeFi platforms are susceptible to hacks and exploits. It’s crucial to research and choose platforms with strong security measures in place. Think of it as being extra careful when you’re riding a wild horse! You don’t want to get thrown off.

How does DeFi compare to traditional finance?

DeFi offers several advantages over traditional finance, including greater transparency, accessibility, and lower fees. It’s like comparing a dusty old stagecoach to a sleek, modern train. However, DeFi also faces challenges like regulatory uncertainty and volatility, making it a riskier option for some.

It’s a trade-off, just like choosing between a comfortable stagecoach and a thrilling train ride.

CentralPoint Latest News

CentralPoint Latest News