The Robotaxi event is a potential big catalyst for Tesla stock, and the excitement surrounding this technology is palpable. As the world eagerly awaits the arrival of self-driving cars, Tesla, a pioneer in electric vehicles and autonomous driving, stands poised to capitalize on this revolution.

The company’s advanced Autopilot system and extensive data collection capabilities position it as a frontrunner in the race to develop a fully autonomous ride-hailing service. The potential impact of a successful robotaxi launch on Tesla’s stock price, revenue streams, and market valuation is immense.

The robotaxi market is rapidly evolving, with numerous players vying for a piece of the pie. However, Tesla’s existing infrastructure and technological prowess give it a significant edge. The company’s vast network of Supercharger stations could easily be adapted to support a robotaxi fleet, and its vehicles are already equipped with the hardware necessary for autonomous driving.

Tesla’s ability to leverage its existing assets and expertise could accelerate its entry into the robotaxi market, potentially giving it a first-mover advantage.

Robotaxi Market Overview

The robotaxi market is a burgeoning industry poised for significant growth in the coming years. This market encompasses the development, deployment, and operation of autonomous vehicles specifically designed for ride-hailing services. Key players, technological advancements, and regulatory frameworks are shaping this rapidly evolving landscape.

Key Players and Technologies

Several companies are actively involved in the development and deployment of robotaxi services. These companies employ various technologies, including advanced sensor systems, powerful computing platforms, and sophisticated algorithms, to enable their vehicles to navigate complex environments safely and efficiently.

- Waymo: A subsidiary of Alphabet (Google’s parent company), Waymo is a pioneer in the robotaxi space, having launched its first commercial robotaxi service in Phoenix, Arizona, in 2020. Waymo utilizes a fleet of self-driving Chrysler Pacifica minivans equipped with lidar, radar, and cameras to perceive their surroundings.

- Cruise: A subsidiary of General Motors, Cruise is another leading player in the robotaxi market. The company has deployed its self-driving Chevrolet Bolt EVs in San Francisco and has plans to expand its services to other cities. Cruise’s vehicles are equipped with a suite of sensors, including lidar, radar, and cameras, and rely on advanced machine learning algorithms for navigation.

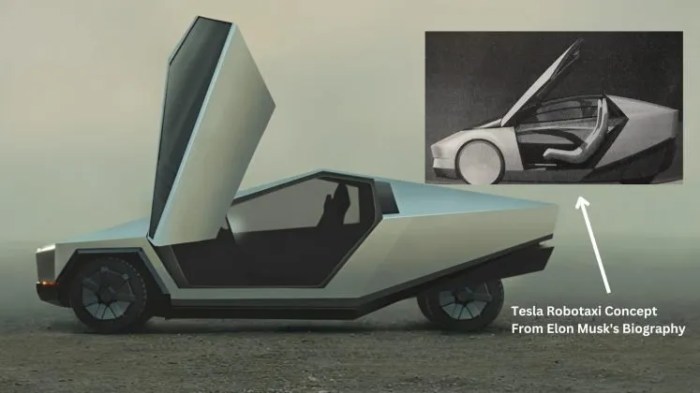

- Tesla: While primarily known for its electric vehicles, Tesla is also actively developing its Autopilot and Full Self-Driving (FSD) technologies, which are expected to eventually enable robotaxi services. Tesla’s vehicles rely heavily on cameras and artificial intelligence (AI) for autonomous driving capabilities.

- Zoox: Founded in 2014, Zoox is a company focused on developing a purpose-built robotaxi platform. The company has designed its own self-driving vehicles, which are equipped with a comprehensive suite of sensors and are designed for optimal passenger experience.

Regulatory Landscape

The regulatory landscape for robotaxi services is still evolving. Governments worldwide are grappling with the legal and ethical implications of autonomous vehicles, including issues related to liability, safety, and data privacy.

- United States: The National Highway Traffic Safety Administration (NHTSA) is responsible for setting safety standards for autonomous vehicles in the US. Several states, including California, Arizona, and Nevada, have passed legislation allowing for the testing and deployment of robotaxi services.

- China: China is a major player in the development of autonomous vehicles and has established a regulatory framework for testing and deployment of robotaxi services. The country’s Ministry of Industry and Information Technology (MIIT) is responsible for setting standards and issuing permits for autonomous vehicles.

- Europe: The European Union is developing a comprehensive regulatory framework for autonomous vehicles, including robotaxi services. The framework addresses issues related to safety, liability, and data protection.

Market Growth Trajectory, The Robotaxi event is a potential big catalyst for Tesla stock

The robotaxi market is projected to experience significant growth in the coming years. Several factors are driving this growth, including increasing urbanization, growing demand for mobility solutions, and technological advancements.

- Urbanization: As cities continue to grow and become more congested, the demand for efficient and reliable transportation solutions is increasing. Robotaxi services offer a potential solution to these challenges by providing a convenient and cost-effective alternative to traditional transportation modes.

- Demand for Mobility Solutions: The rise of ride-hailing services like Uber and Lyft has demonstrated a strong demand for on-demand mobility solutions. Robotaxi services are expected to further cater to this demand by offering a more efficient and affordable alternative.

- Technological Advancements: Continuous advancements in artificial intelligence, sensor technology, and computing power are enabling the development of more sophisticated and reliable autonomous driving systems. These advancements are paving the way for the widespread adoption of robotaxi services.

Challenges

Despite the promising growth prospects, the robotaxi market faces several challenges that need to be addressed. These challenges include:

- Safety Concerns: Public perception of the safety of autonomous vehicles remains a major concern. The industry needs to demonstrate the reliability and safety of robotaxi services to gain public trust and acceptance.

- Regulatory Uncertainty: The regulatory landscape for robotaxi services is still evolving, creating uncertainty for companies seeking to deploy these services. Clear and consistent regulations are crucial for the growth of the market.

- Infrastructure Limitations: Existing infrastructure, such as roads and traffic signals, may not be fully compatible with autonomous vehicles. Investments in infrastructure upgrades are necessary to support the widespread deployment of robotaxi services.

Tesla’s Position in the Robotaxi Market: The Robotaxi Event Is A Potential Big Catalyst For Tesla Stock

Tesla is not just an electric car manufacturer; it’s a leading contender in the burgeoning robotaxi market. Its ambition to revolutionize transportation with autonomous vehicles has captured the attention of investors and the public alike. Tesla’s position in this space is characterized by a unique blend of existing capabilities and strategic initiatives, positioning it for potential dominance.

Tesla’s Existing Capabilities

Tesla’s existing capabilities are a strong foundation for its robotaxi ambitions. Its self-driving technology, extensive vehicle fleet, and growing network infrastructure are key pillars supporting its entry into this market.

- Self-Driving Technology:Tesla’s Autopilot and Full Self-Driving (FSD) systems are at the forefront of autonomous driving technology. They leverage a combination of cameras, radar, and ultrasonic sensors to perceive the environment, and neural networks to interpret data and make driving decisions.

While FSD is still under development and faces regulatory hurdles, its progress demonstrates Tesla’s commitment to autonomous driving.

- Vehicle Fleet:Tesla has a rapidly growing fleet of electric vehicles, which are well-suited for robotaxi operations. These vehicles are equipped with the necessary hardware and software for autonomous driving, and their electric powertrains offer advantages in terms of efficiency and environmental friendliness.

- Network Infrastructure:Tesla’s Supercharger network provides a robust charging infrastructure for its vehicles, which is crucial for robotaxi operations. The network’s widespread availability ensures that robotaxis can be quickly and efficiently recharged, minimizing downtime and maximizing operational efficiency.

Tesla’s Strategies for Entering the Robotaxi Market

Tesla has Artikeld a multi-pronged strategy for entering the robotaxi market. This includes partnerships, pilot programs, and market expansion plans, aimed at establishing a robust and scalable robotaxi service.

- Partnerships:Tesla has engaged in strategic partnerships to leverage external expertise and accelerate its robotaxi rollout. For example, its partnership with the ride-hailing giant, Uber, explores potential integration of Tesla vehicles into Uber’s platform, expanding the reach of Tesla’s autonomous driving technology.

- Pilot Programs:Tesla is conducting pilot programs in select locations to test and refine its robotaxi technology in real-world scenarios. These programs provide valuable data and insights that inform the development and deployment of its autonomous driving systems.

- Market Expansion Plans:Tesla aims to expand its robotaxi services to new markets as its technology matures and regulatory approval is secured. Its global presence and existing infrastructure provide a solid foundation for rapid market expansion.

Potential Impact of Robotaxi Event on Tesla Stock

A successful robotaxi launch by Tesla could act as a significant catalyst for its stock price, potentially sending ripples throughout the automotive and technology industries. This event could unlock a new revenue stream for Tesla, bolster investor confidence, and potentially reshape the company’s market valuation.

Short-Term Impact on Tesla Stock

A successful robotaxi launch could trigger a surge in Tesla’s stock price in the short term. Investors are likely to respond positively to the demonstration of Tesla’s technological prowess and its potential to disrupt the transportation industry. This could lead to increased demand for Tesla shares, driving the price higher.

For example, when Tesla announced its “Full Self-Driving” (FSD) Beta program in 2020, the stock price experienced a significant upward trend, indicating investor enthusiasm for the company’s progress in autonomous driving technology.

Long-Term Impact on Tesla Stock

The long-term impact of a successful robotaxi launch on Tesla’s stock price is likely to be even more significant. The potential for a new revenue stream from robotaxi services could substantially increase Tesla’s earnings and profitability. This could lead to a higher valuation for the company, as investors anticipate future growth and revenue generation from this new business segment.

For instance, if Tesla were to successfully launch a robotaxi service that generates significant revenue, it could potentially surpass its current valuation, making it one of the most valuable companies in the world.

Impact on Investor Sentiment

A successful robotaxi launch would significantly boost investor sentiment towards Tesla. It would demonstrate the company’s leadership in autonomous driving technology and its ability to execute on its vision for the future of transportation. This could attract new investors and increase the confidence of existing shareholders, leading to increased demand for Tesla shares.

For example, the success of Waymo’s robotaxi service in Phoenix, Arizona, has contributed to a positive perception of the autonomous driving industry, attracting investments and interest from various stakeholders.

Impact on Revenue Streams

A robotaxi service could unlock a new and potentially substantial revenue stream for Tesla. By offering ride-hailing services using its autonomous vehicles, Tesla could generate recurring revenue from passengers, potentially exceeding its current automotive sales. This could significantly diversify Tesla’s revenue streams and enhance its financial stability.

Do not overlook explore the latest data about Zenas BioPharma CEO acquires $360k worth of company shares.

For example, General Motors’ Cruise division is currently operating a robotaxi service in San Francisco, generating revenue and contributing to the company’s overall profitability.

Impact on Market Valuation

A successful robotaxi launch could significantly impact Tesla’s market valuation. The potential for a new and profitable business segment, combined with the demonstration of Tesla’s technological prowess, could lead to a re-evaluation of the company’s value by investors. This could result in a higher market capitalization for Tesla, solidifying its position as a leader in the autonomous driving industry.

For example, the market valuation of companies like Waymo and Cruise has significantly increased following their successful launches of robotaxi services, reflecting investor confidence in the potential of this market.

Key Considerations for Investors

Navigating the potential impact of a robotaxi event on Tesla stock requires a nuanced understanding of the market dynamics and Tesla’s strategic position. Investors should consider several key factors to make informed decisions.

Market Dynamics and Tesla’s Role

The robotaxi market is rapidly evolving, with multiple players vying for dominance. Investors should analyze the competitive landscape, considering factors such as:

- Market Share and Growth:The market share and projected growth rate of various players, including Tesla, Waymo, Cruise, and others, will be crucial indicators of future success.

- Technological Advancements:The pace of innovation and advancements in autonomous driving technology will directly impact the timeline for widespread robotaxi adoption.

- Regulatory Landscape:The evolving regulatory environment, including permitting and safety standards, will significantly influence the deployment and expansion of robotaxi services.

- Public Perception and Acceptance:Public trust and acceptance of autonomous vehicles are essential for the successful rollout of robotaxi services.

Potential Risks and Rewards

Investing in Tesla based on the potential of robotaxi services involves both potential rewards and risks.

- Potential Rewards:

- Increased Revenue and Profitability:Robotaxi services could significantly expand Tesla’s revenue streams and enhance profitability by generating new revenue streams from ride-hailing services.

- Enhanced Brand Value and Market Leadership:Early success in the robotaxi market could solidify Tesla’s position as a leader in autonomous driving technology, boosting its brand value and market dominance.

- Increased Demand for Electric Vehicles:The widespread adoption of robotaxis could drive increased demand for electric vehicles, benefiting Tesla’s core business.

- Potential Risks:

- Technological Challenges:Developing and deploying reliable and safe autonomous driving technology is complex and expensive. Delays or setbacks could impact Tesla’s timeline and profitability.

- Regulatory Uncertainty:The evolving regulatory landscape could create uncertainty and hinder the rollout of robotaxi services.

- Competition:The robotaxi market is highly competitive, with established players and emerging startups vying for market share. Tesla’s ability to maintain its competitive edge will be crucial.

- Public Acceptance and Safety Concerns:Public acceptance and concerns about safety could pose challenges to the widespread adoption of robotaxi services.

Future Outlook

The potential of robotaxis extends far beyond just a new mode of transportation. It signifies a paradigm shift in urban planning, societal norms, and the very fabric of how we interact with our cities. As robotaxis become more prevalent, their impact will ripple across various aspects of our lives, creating a future that is both exciting and challenging.

Impact on Transportation

The advent of robotaxis holds the promise of revolutionizing urban transportation systems. By automating driving, robotaxis can offer several advantages:* Increased efficiency:Robotaxis can operate 24/7, maximizing vehicle utilization and reducing traffic congestion.

Enhanced safety

Autonomous vehicles are expected to have lower accident rates than human drivers, leading to a safer transportation system.

Accessibility

Robotaxis can provide mobility solutions for those who are unable to drive, such as seniors, people with disabilities, and children.

Reduced emissions

By optimizing routes and reducing traffic congestion, robotaxis can contribute to a more sustainable transportation system.

“By 2030, autonomous vehicles could account for up to 15% of all miles driven in the United States, leading to significant reductions in traffic congestion and greenhouse gas emissions.”

McKinsey & Company

Impact on Urban Planning

The widespread adoption of robotaxis will necessitate a rethinking of urban planning strategies.* Reduced need for parking:With robotaxis, the demand for parking spaces will decrease significantly, allowing for more efficient use of urban space.

Prioritization of pedestrian and cyclist infrastructure

Cities can allocate more space for pedestrian and cyclist infrastructure, creating more livable and sustainable urban environments.

Development of new transportation hubs

Robotaxis will likely necessitate the development of new transportation hubs specifically designed for autonomous vehicles, potentially leading to a shift in urban design.

Impact on Societal Norms

The emergence of robotaxis will also impact societal norms and behaviors.* Shifting ownership patterns:As robotaxis become more accessible, traditional car ownership may decline, leading to a shift in how people view transportation.

Impact on employment

The automation of driving could lead to job displacement in the transportation sector, requiring retraining and new employment opportunities.

Increased accessibility and inclusivity

Robotaxis can provide greater accessibility for people with disabilities, promoting inclusivity and social mobility.

“The rise of robotaxis could lead to a significant shift in urban design, creating more walkable and bike-friendly cities with less reliance on personal vehicles.”

The World Economic Forum

Last Recap

The potential of robotaxis to transform the transportation landscape is undeniable. As the technology matures and regulations evolve, the robotaxi market is poised for explosive growth. For investors, the key question is whether Tesla can successfully navigate the challenges and capitalize on this opportunity.

If the company can successfully launch a profitable robotaxi service, it could unlock significant value for shareholders. However, investors should also be mindful of the risks associated with this emerging technology, including regulatory hurdles, technological challenges, and the potential for disruption from competitors.

The future of Tesla’s stock price may hinge on the success of its robotaxi ambitions, making this a pivotal moment for the company and its investors.

Questions and Answers

What are the potential risks associated with investing in Tesla based on the robotaxi event?

Investing in Tesla based on its robotaxi ambitions comes with inherent risks. These include regulatory uncertainties, technological challenges in achieving fully autonomous driving, competition from established players, and the potential for unforeseen delays or setbacks. Investors should carefully weigh these risks before making investment decisions.

How might the robotaxi event impact Tesla’s revenue streams?

A successful robotaxi launch could significantly impact Tesla’s revenue streams. It could create a new revenue stream through ride-hailing services, potentially exceeding traditional vehicle sales. Additionally, the demand for Tesla vehicles as part of a robotaxi fleet could boost sales, further contributing to revenue growth.

What are the potential long-term implications of the robotaxi market for the broader automotive industry?

The emergence of robotaxis could fundamentally transform the automotive industry. It could lead to a shift from individual vehicle ownership to ride-hailing services, potentially reducing demand for traditional vehicles. Additionally, the rise of robotaxis could create new opportunities for automotive companies in areas such as software development, data analytics, and fleet management.

CentralPoint Latest News

CentralPoint Latest News