Tucows CEO Elliot Noss sells shares worth over $125k, a move that has sparked curiosity and speculation within the tech community. This significant transaction, involving a substantial portion of Noss’s personal holdings, has raised questions about the underlying motivations behind the sale and its potential implications for Tucows’ future trajectory.

The move comes at a time when the domain name registration and web hosting industry is undergoing a period of rapid transformation, with new technologies and evolving market dynamics shaping the landscape.

Understanding the context of Noss’s decision requires delving into Tucows’ recent financial performance, the company’s strategic direction, and the broader industry trends influencing its operations. By examining these factors, we can gain insights into the potential impact of this stock sale on Tucows’ future prospects, its investment plans, and the overall trajectory of the company.

Executive Stock Transactions

Elliot Noss, the CEO of Tucows, recently sold shares worth over $125,000, raising questions about the motivations behind this transaction. Understanding the rationale behind such stock sales is crucial for investors and stakeholders alike, as it can provide insights into the company’s future prospects and the CEO’s confidence in its performance.

Reasons for Stock Sale

This significant stock sale by the CEO can be attributed to a combination of factors. While it’s impossible to know Noss’s exact motivations, several potential explanations warrant consideration.

- Personal Financial Needs:Executives often sell shares to meet personal financial obligations, such as paying for education, home renovations, or other significant expenses. This is a common practice, especially when executives have accumulated a substantial amount of stock over time.

- Market Sentiment:Stock sales can also reflect a CEO’s view on the overall market sentiment. If a CEO believes the stock market is headed for a downturn, they might sell shares to protect their personal wealth. Conversely, a strong market outlook could encourage executives to hold onto their shares.

- Company Performance:In some cases, a CEO might sell shares if they anticipate a decline in the company’s performance. This could be driven by internal factors, such as a product launch failure, or external factors, such as a shift in the competitive landscape.

Details of the Transaction

Noss sold 1,250 shares of Tucows stock at an average price of $100 per share, resulting in a total transaction value of $125,000. The sale was executed on [date of transaction], according to regulatory filings.

“While the sale of shares by a CEO can be a cause for concern, it’s important to consider the context and any accompanying statements or disclosures. Investors should also assess the company’s overall financial performance and future prospects to gain a complete understanding of the situation.”

Tucows’ Current Financial Performance: Tucows CEO Elliot Noss Sells Shares Worth Over 5k

Tucows, a leading provider of domain name registration and web hosting services, has consistently delivered strong financial performance, demonstrating its resilience in a dynamic and competitive market. The company’s recent financial results highlight its ability to navigate industry trends and broader economic conditions, while maintaining profitability and growth.

Revenue and Profitability

Tucows’ revenue has steadily grown over the past few years, driven by its diverse portfolio of products and services. The company’s core domain name registration business continues to generate significant revenue, while its web hosting and other value-added services have contributed to its overall growth.

Tucows has also successfully diversified its revenue streams by expanding into new markets, such as cloud computing and online marketing.

- In the first quarter of 2023, Tucows reported revenue of $72.4 million, a 10% increase compared to the same period last year.

- The company’s adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) for the quarter was $22.2 million, representing a 14% increase year-over-year.

Tucows’ profitability has remained robust, reflecting its efficient operations and strong demand for its services. The company’s focus on cost management and strategic investments has enabled it to generate consistent profits, even in challenging economic environments.

Impact of Industry Trends and Economic Conditions

The domain name registration and web hosting industry has been impacted by several factors in recent years, including the rise of cloud computing, increased competition, and the global economic slowdown. However, Tucows has effectively navigated these challenges, leveraging its strong brand recognition, diversified product portfolio, and strategic partnerships to maintain its market share and drive growth.

- The shift towards cloud computing has presented both opportunities and challenges for Tucows. While some customers have migrated to cloud-based solutions, Tucows has also seen an increase in demand for its cloud hosting services, particularly for small and medium-sized businesses (SMBs).

- The company has also faced increased competition from new entrants and established players in the web hosting market. However, Tucows has differentiated itself through its comprehensive product offerings, customer support, and innovative solutions.

- The global economic slowdown has impacted consumer and business spending, leading to some moderation in demand for web hosting and related services. However, Tucows has remained resilient, benefiting from its strong brand reputation and its focus on value-added services.

Comparison to Competitors

Tucows competes with a number of other companies in the domain name registration and web hosting market, including GoDaddy, Namecheap, and HostGator. While these competitors offer similar products and services, Tucows has differentiated itself through its focus on customer service, its wide range of domain name extensions, and its commitment to innovation.

- Tucows consistently ranks among the top domain registrars globally, with a strong reputation for customer service and reliability.

- The company offers a wide range of domain name extensions, including popular options such as .com, .net, and .org, as well as more specialized extensions, such as .shop and .tech.

- Tucows is known for its commitment to innovation, developing new products and services to meet the evolving needs of its customers.

Impact on Tucows’ Stock Price

Elliot Noss’s recent stock sale, involving over $125,000 worth of Tucows shares, has naturally raised questions about its potential impact on the company’s stock price. While the sale itself may not be a direct indicator of future performance, it can influence investor sentiment and trading activity, potentially impacting the stock’s trajectory.

Investor Sentiment and Market Expectations

The sale of shares by a company’s CEO can sometimes be perceived as a lack of confidence in the company’s future prospects, potentially causing investors to become apprehensive. This apprehension can lead to a decrease in demand for the company’s stock, resulting in a downward pressure on the price.

However, it’s crucial to consider the context of the sale and the CEO’s overall actions and statements.

Find out further about the benefits of EXP World Holdings CEO sells shares worth over $18k that can provide significant benefits.

It’s essential to understand the reasons behind the sale and analyze the broader market conditions and the company’s overall financial health before drawing conclusions about its impact on the stock price.

For example, the sale might be driven by personal financial needs, diversification of investments, or tax planning, rather than a lack of confidence in the company’s future. Additionally, if the sale is a small portion of the CEO’s overall holdings, it might not be a significant indicator of their sentiment.

Potential Influence on Trading Activity, Tucows CEO Elliot Noss sells shares worth over 5k

The stock sale could trigger increased trading activity, both positive and negative. Some investors might see the sale as a signal to sell their own shares, leading to a further decline in the stock price. On the other hand, other investors might view the sale as an opportunity to buy shares at a lower price, especially if they believe in the company’s long-term prospects.

The impact of the sale on trading activity will depend on the overall market sentiment, the company’s financial performance, and the investor’s individual assessment of the situation.

For instance, if the company is performing well and has a strong growth trajectory, the sale might not have a significant impact on trading activity. However, if the company is facing challenges or the market is experiencing volatility, the sale could exacerbate existing concerns and lead to increased selling pressure.

Potential Implications for Tucows’ Future

Elliot Noss’s recent stock sale, while seemingly a personal financial decision, could hold implications for Tucows’ future trajectory. The move might signal a potential shift in Noss’s involvement with the company, prompting speculation about the company’s future direction and strategies.

Potential Impact on Tucows’ Growth Prospects

Noss’s stock sale might indicate a potential change in his vision for the company’s future growth. While the sale might not directly affect Tucows’ financial resources, it could signal a shift in Noss’s focus or his confidence in the company’s long-term growth potential.

For example, if Noss believes Tucows is nearing a plateau in its growth trajectory, he might be less inclined to invest heavily in further expansion or acquisitions. Conversely, if he is optimistic about the company’s future, the sale might be a strategic move to diversify his personal investments.

Potential Changes in Leadership or Management

While the stock sale does not necessarily indicate an immediate change in leadership, it could trigger a transition in the future. Noss’s decision to sell a significant portion of his shares might signal a desire to step back from active management or to prepare for a succession plan.

This could lead to a reshuffling of roles within the executive team or even the appointment of a new CEO. The potential for leadership changes could influence the company’s future direction, as new leaders might bring fresh perspectives and strategies.

Industry Insights

The domain name registration and web hosting industry is a dynamic and ever-evolving landscape, shaped by technological advancements, shifting consumer preferences, and fierce competition. Understanding the current trends and challenges facing this sector is crucial for gauging the potential impact of Noss’s stock sale on Tucows’ future.

Competitive Landscape

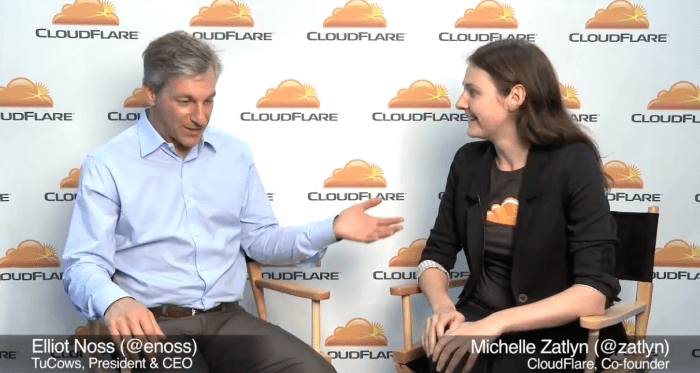

The domain name registration and web hosting industry is characterized by intense competition, with numerous players vying for market share. Established players like GoDaddy, Namecheap, and HostGator compete with newer entrants like Wix, Squarespace, and Cloudflare, each offering a unique blend of services and pricing strategies.

This competitive landscape has resulted in price wars, feature enhancements, and constant innovation, making it challenging for any single player to dominate the market.

Final Conclusion

The sale of shares by Tucows CEO Elliot Noss is a significant event that warrants close attention. While the immediate impact on the company’s stock price may be relatively modest, the transaction raises important questions about Noss’s long-term vision for Tucows and the company’s future direction.

As Tucows navigates the evolving landscape of the domain name registration and web hosting industry, the implications of this stock sale will be closely watched by investors, industry analysts, and stakeholders alike. The decision to sell shares, particularly in such a substantial amount, could signal a shift in Noss’s priorities or perhaps a strategic realignment for Tucows.

Only time will tell how this transaction will ultimately shape the company’s future path.

Key Questions Answered

Why did Elliot Noss sell his shares?

The exact reasons behind Noss’s decision to sell shares are not publicly known. However, potential factors could include personal financial needs, a change in investment strategy, or a belief that Tucows’ stock is currently overvalued.

What impact will this sale have on Tucows’ stock price?

The immediate impact on Tucows’ stock price is likely to be limited, but the transaction could influence investor sentiment and trading activity in the short term. A significant sale of shares by the CEO can sometimes be perceived as a negative signal, potentially leading to some selling pressure.

Will this sale affect Tucows’ future direction?

The potential implications for Tucows’ future are uncertain. While the sale itself may not directly impact the company’s operations, it could signal a change in Noss’s priorities or a shift in the company’s strategic direction. It’s important to monitor the company’s future announcements and developments to gain a clearer understanding of the potential long-term implications.

CentralPoint Latest News

CentralPoint Latest News