Why Citi analysts say shelter inflation may see volatility in the coming months is a question that has many scratching their heads. The housing market, a cornerstone of the economy, is teetering on the edge of uncertainty, with rising interest rates and shifting supply-demand dynamics casting a shadow over future price trends.

This volatility is not just a concern for homeowners and renters, but also for policymakers who are navigating a complex economic landscape.

Citi analysts, known for their astute market insights, have identified key factors driving this potential volatility. They point to the delicate balance between rising interest rates, which are impacting housing demand, and the ongoing challenges of supply chain disruptions and construction costs.

This confluence of factors is creating a dynamic environment where predicting the trajectory of shelter inflation is becoming increasingly difficult.

Citi Analyst’s Perspective on Shelter Inflation Volatility

Citi analysts have highlighted several factors that could contribute to volatility in shelter inflation in the coming months, underscoring the dynamic nature of the housing market and its impact on the broader economy. These factors, stemming from the current state of the housing market, suggest that shelter inflation may experience fluctuations, potentially leading to uncertainty in inflation projections.

Current State of the Housing Market and its Impact on Shelter Inflation

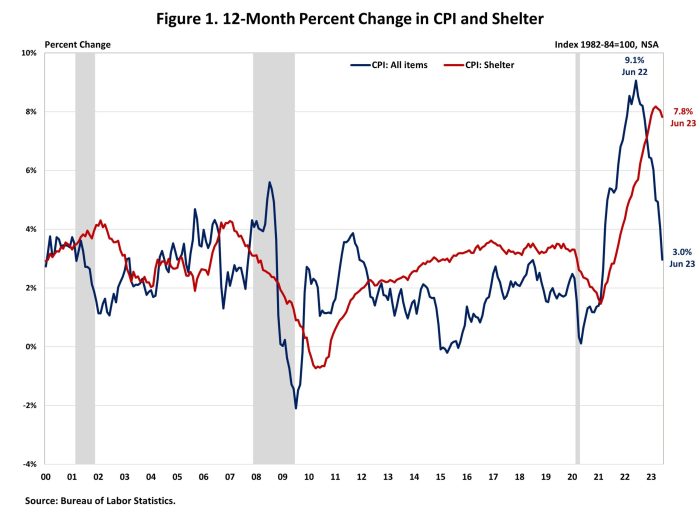

The current housing market is characterized by a complex interplay of factors, including rising interest rates, inventory levels, and demand dynamics. These factors have a significant impact on shelter inflation, which is a major component of the Consumer Price Index (CPI).

The Federal Reserve’s aggressive interest rate hikes have led to a sharp increase in mortgage rates, making homeownership more expensive. This has resulted in a cooling effect on the housing market, with home sales declining and price growth slowing down.

The impact of these changes on shelter inflation is complex and multifaceted. While rising mortgage rates have slowed down home price growth, they have also contributed to a decrease in the supply of available homes. This is because some homeowners are reluctant to sell their homes at a lower price than they paid for them, particularly if they have locked in low mortgage rates during a previous period.

Furthermore, the demand for housing remains strong, driven by factors such as population growth and a shortage of affordable housing. This strong demand, coupled with limited supply, has kept prices elevated in many markets, even as overall home price growth has slowed down.

Citi Analyst’s Concerns about Volatility in Shelter Inflation

Citi analysts have expressed concerns about the potential for volatility in shelter inflation, citing the following factors:

- Lag Effect of Interest Rates:The impact of rising interest rates on shelter inflation is often delayed, with changes in mortgage rates typically taking several months to fully reflect in rent and home price data. This lag effect means that shelter inflation may continue to rise in the coming months, even as the housing market cools down.

- Rent Growth:Rent growth has been a significant contributor to shelter inflation in recent months. Citi analysts are concerned that rent growth may remain elevated in the coming months, as landlords continue to pass on higher costs to tenants.

- Home Price Growth:While home price growth has slowed down in recent months, it remains elevated in many markets. Citi analysts are concerned that home price growth may accelerate again if demand remains strong and supply remains constrained.

Impact of Rising Interest Rates: Why Citi Analysts Say Shelter Inflation May See Volatility In The Coming Months

The Federal Reserve’s aggressive interest rate hikes have had a significant impact on the housing market, influencing both demand and prices. As interest rates rise, borrowing becomes more expensive, leading to a potential decrease in housing demand and subsequently impacting shelter inflation.

The Relationship Between Interest Rates and Shelter Inflation

Higher interest rates directly impact the cost of borrowing money for mortgages. As rates climb, the monthly mortgage payments increase, making homeownership less affordable for many potential buyers. This reduced affordability can lead to a decrease in demand for housing, which can in turn put downward pressure on prices.

Conversely, lower interest rates make borrowing cheaper, stimulating demand and potentially driving up prices.

Potential Scenarios for Shelter Inflation

The trajectory of shelter inflation will depend on the future path of interest rates.

- Scenario 1: Continued Rate Hikes: If the Federal Reserve continues to raise interest rates aggressively, the housing market could experience a more pronounced slowdown. This could lead to a decrease in home prices and potentially a decline in shelter inflation. For instance, in 2022, the average 30-year fixed-rate mortgage rose from around 3% to over 7%, significantly impacting affordability.

This led to a cooling of the housing market in many areas, with price growth slowing down or even declining in some regions.

- Scenario 2: Interest Rate Stabilization: If the Fed pauses or slows down its rate hikes, the housing market could stabilize, with a more moderate impact on shelter inflation. This scenario could see a gradual adjustment in housing prices and a more balanced demand-supply dynamic.

The housing market in 2023 provides a real-life example. While interest rates remain higher than in 2022, the pace of increases has slowed down. This has resulted in a more stable housing market, with price growth moderating in many areas.

- Scenario 3: Interest Rate Cuts: If the Fed were to cut interest rates, this could potentially stimulate demand in the housing market, leading to an increase in home prices and shelter inflation. However, this scenario is less likely in the near term, as the Fed is focused on bringing down inflation.

Supply and Demand Dynamics in the Housing Market

The interplay of supply and demand in the housing market plays a pivotal role in shaping shelter inflation. Understanding these dynamics is crucial for comprehending the fluctuations in housing costs and their impact on the broader economy.The current housing market is characterized by a persistent imbalance between supply and demand, with demand outpacing supply in many regions.

Discover how ZipRecruiter president reports stock sales totaling $598k has transformed methods in this topic.

This imbalance is primarily driven by factors such as low inventory levels, strong population growth, and limited new construction. The limited availability of homes for sale, coupled with strong buyer demand, has pushed prices higher, contributing to the rise in shelter inflation.

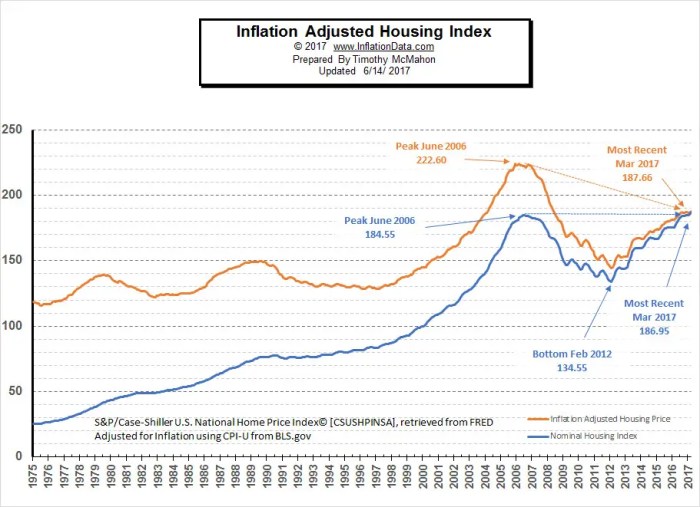

Historical Trends and Similarities

The current housing market bears some resemblance to historical trends, particularly the periods leading up to the housing bubbles of the late 1990s and early 2000s. During these periods, low interest rates and an influx of new buyers fueled strong demand, leading to a surge in home prices.

However, there are also significant differences. For instance, the current housing market is characterized by a more constrained supply of land and construction materials, coupled with a more challenging regulatory environment, making it more difficult to build new homes.

Factors Shaping Shelter Inflation

Several factors contribute to the dynamics of supply and demand in the housing market and ultimately shape shelter inflation:

New Construction

The pace of new home construction is a key determinant of housing supply. Limited new construction can exacerbate housing shortages and contribute to price increases. This can be influenced by factors such as the availability of land, construction costs, and regulatory hurdles.

Housing Inventory

The level of housing inventory, or the number of homes available for sale, is a crucial indicator of market tightness. Low inventory levels, indicating a shortage of homes available for purchase, often lead to higher prices as buyers compete for a limited number of options.

Affordability

Housing affordability, the relationship between housing costs and household income, plays a significant role in shaping demand. As housing prices rise, affordability becomes a challenge for many potential buyers, limiting their ability to enter the market and impacting demand.

Impact of Inflation on Shelter Costs

Inflation, a general increase in prices for goods and services, can significantly influence shelter costs. This impact is multifaceted, encompassing the costs of building materials, labor, and the overall cost of living, ultimately affecting both home prices and rental rates.

Rising Construction Costs, Why Citi analysts say shelter inflation may see volatility in the coming months

Inflation directly impacts the cost of building materials, labor, and other inputs required for new home construction. As prices for these components rise, the overall cost of building a new home increases.

- Increased Material Costs:The price of lumber, steel, concrete, and other essential building materials has experienced significant fluctuations in recent years, often driven by supply chain disruptions and increased demand. These price increases directly translate to higher construction costs, pushing up the final price of new homes.

- Labor Shortages and Wage Growth:The construction industry, like many others, has faced labor shortages, leading to increased wages for skilled workers. These higher labor costs contribute to the overall cost of building new homes.

- Transportation and Logistics:Inflationary pressures also affect transportation and logistics costs, increasing the price of delivering building materials to construction sites. These added costs are ultimately reflected in the final price of homes.

Impact on Rental Costs

Inflationary pressures can also influence rental costs. As the cost of living rises, landlords may increase rents to offset their own rising expenses, including property taxes, utilities, and maintenance costs.

- Rising Property Taxes:Inflation can lead to higher property taxes, which landlords may pass on to tenants in the form of increased rents. This can create a feedback loop where rising rents contribute to higher inflation.

- Increased Utility Costs:Inflation can impact the cost of utilities, such as electricity, gas, and water, which landlords may factor into their rent calculations. As utility costs rise, landlords may need to increase rents to maintain profitability.

- Maintenance and Repairs:Inflation also affects the cost of materials and labor for maintenance and repairs. Landlords may need to increase rents to cover these rising costs.

“Shelter inflation is a complex issue influenced by a multitude of factors, including broader economic trends, supply and demand dynamics in the housing market, and the cost of construction. Understanding the interplay of these forces is crucial for assessing the potential for volatility in shelter inflation.”

Potential Consequences of Shelter Inflation Volatility

The unpredictable nature of shelter inflation can have far-reaching consequences for the economy, affecting consumer spending, household budgets, and overall economic growth. Understanding these potential ramifications is crucial for policymakers, businesses, and individuals alike.

Impact on Consumer Spending

Significant volatility in shelter inflation can significantly impact consumer spending, a key driver of economic growth. As shelter costs rise, households may be forced to allocate a larger portion of their income towards housing expenses, leaving less disposable income for other goods and services.

This can lead to a decline in consumer spending, potentially slowing down economic growth. For example, if a family experiences a sudden spike in rent, they may have to cut back on discretionary spending, such as dining out, entertainment, or vacations.

This decrease in discretionary spending can have a ripple effect throughout the economy, affecting businesses in various sectors.

Impact on Household Budgets

Shelter inflation can also strain household budgets, leading to increased financial stress and reduced savings. When housing costs rise faster than income, families may struggle to make ends meet, potentially leading to increased debt or a decrease in savings. This can have long-term consequences for financial stability and economic well-being.

For instance, a family facing rising mortgage payments may find it challenging to save for retirement or their children’s education. This can create a cycle of financial insecurity, hindering their ability to participate fully in the economy.

Impact on Overall Economic Growth

Unpredictable changes in shelter inflation can have a significant impact on overall economic growth. If shelter inflation is volatile, it can create uncertainty in the housing market, making it difficult for businesses to invest and plan for the future.

This uncertainty can lead to a slowdown in economic activity, potentially affecting job creation and overall economic growth. For example, if businesses are hesitant to invest in new construction projects due to concerns about future housing market volatility, it can lead to fewer job opportunities in the construction sector and a decrease in overall economic activity.

Strategies for Managing Shelter Inflation Volatility

Shelter inflation volatility can significantly impact individuals, businesses, and policymakers. Understanding the dynamics of this volatility and implementing appropriate strategies can help mitigate its negative effects.

Strategies for Mitigating Shelter Inflation Volatility

The following table Artikels potential strategies for mitigating the impact of shelter inflation volatility on individuals, businesses, and policymakers.

| Strategy | Description | Benefits | Potential Drawbacks |

|---|---|---|---|

| Rent Control | Government-imposed limits on rent increases, often tied to inflation or other economic indicators. | Protects tenants from excessive rent hikes, promotes affordability, and reduces housing instability. | Can discourage investment in rental properties, leading to a decrease in supply and potentially higher long-term rents. May also stifle innovation and improvements in rental properties. |

| Housing Subsidies | Direct financial assistance to low- and moderate-income households to help them afford housing. | Increases affordability, reduces homelessness, and provides a safety net for vulnerable populations. | Can be expensive for governments to implement and maintain. May create a dependency on government assistance and potentially lead to market distortions. |

| Increased Housing Supply | Policies that encourage the construction of new housing units, such as zoning reforms, streamlined permitting processes, and incentives for developers. | Increases housing options, reduces pressure on existing housing stock, and potentially lowers prices. | May require significant upfront investment and can take time to impact housing markets. Can also lead to displacement in some areas. |

| Financial Planning and Budgeting | Individuals and businesses can prepare for potential shelter inflation by creating a budget that accounts for potential increases in housing costs. | Helps individuals and businesses manage their finances more effectively and avoid financial stress. | Requires discipline and foresight. May be difficult to predict future inflation accurately. |

| Diversification of Housing Options | Individuals and businesses can explore alternative housing options, such as co-living, shared housing, or smaller units, to reduce their exposure to rising housing costs. | Offers more affordable options and can reduce the impact of rent increases. | May require lifestyle adjustments and may not be suitable for all individuals or families. |

| Investment in Affordable Housing | Policymakers and private investors can allocate resources to develop and maintain affordable housing units. | Increases housing options for low- and moderate-income households, promoting affordability and stability. | Requires significant upfront investment and ongoing maintenance. May be challenging to achieve long-term sustainability. |

Last Recap

The future of shelter inflation remains shrouded in uncertainty, but the insights provided by Citi analysts offer a valuable roadmap for understanding the potential challenges ahead. By closely monitoring the interplay of interest rates, supply and demand dynamics, and broader inflation trends, we can gain a clearer picture of the evolving landscape.

As the housing market navigates these turbulent waters, it’s crucial for individuals, businesses, and policymakers to stay informed and adapt their strategies accordingly.

Commonly Asked Questions

What are the specific concerns Citi analysts have raised about shelter inflation?

Citi analysts are concerned about the potential for a sharp increase in shelter inflation due to factors such as rising interest rates, supply chain disruptions, and labor shortages. They believe that these factors could lead to a surge in housing demand and a shortage of available units, driving up prices.

How do rising interest rates impact shelter inflation?

Rising interest rates make it more expensive to borrow money for mortgages, which can reduce demand for housing. This can lead to a slowdown in price growth or even a decline in prices. However, if the supply of housing remains tight, rising interest rates may not have a significant impact on shelter inflation.

What are the potential consequences of significant volatility in shelter inflation?

Significant volatility in shelter inflation could have a negative impact on consumer spending, household budgets, and overall economic growth. For example, if shelter costs rise sharply, consumers may have less money available to spend on other goods and services, which could slow down economic growth.

Additionally, unpredictable changes in shelter inflation could make it difficult for businesses to plan for the future and could lead to increased uncertainty in the economy.

CentralPoint Latest News

CentralPoint Latest News