Accel Entertainment CEO sells over $191k in company stock, a move that has sent ripples through the gaming industry. This transaction, occurring amidst a backdrop of recent company news and financial performance, has sparked speculation about the CEO’s motivations and the potential impact on the company’s future.

The sale, which involved a significant number of shares, raises questions about the CEO’s confidence in the company’s future prospects. Analysts are dissecting the timing of the sale, considering its relation to recent events and market trends. Some speculate that the CEO might be seeking to diversify their portfolio or capitalize on a perceived peak in the company’s stock price.

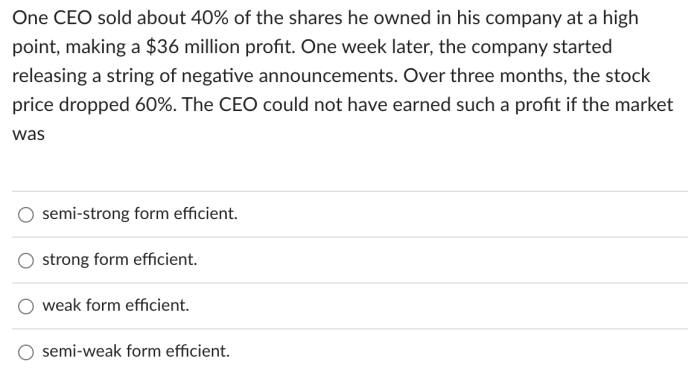

Others point to the possibility of insider information that may have influenced the decision.

Accel Entertainment Overview

Accel Entertainment is a publicly traded company that operates in the gaming industry. Founded in 2013, the company has rapidly expanded its footprint across the United States, becoming a significant player in the gaming market.

Company History and Background

Accel Entertainment was established in 2013 by a team of experienced gaming professionals. The company’s initial focus was on providing electronic gaming machines (EGMs) to bars, restaurants, and other licensed establishments in Illinois. Since its inception, Accel Entertainment has grown significantly through a combination of organic growth and strategic acquisitions.

Core Business and Revenue Streams, Accel Entertainment CEO sells over 1k in company stock

Accel Entertainment’s core business is the operation and management of electronic gaming machines (EGMs) in licensed locations. The company provides a comprehensive suite of services to its customers, including:

- Placement and installation of EGMs

- Maintenance and repair services

- Cash management and reporting

- Marketing and promotional support

Accel Entertainment generates revenue primarily through:

- Revenue Share:The company receives a percentage of the revenue generated by the EGMs it places in licensed locations.

- Rental Fees:Accel Entertainment charges a monthly rental fee for each EGM placed.

- Equipment Sales:The company also generates revenue from the sale of EGMs to licensed operators.

Market Position and Industry Landscape

Accel Entertainment is a leading provider of EGMs in the United States, with a presence in multiple states. The company’s focus on providing high-quality gaming experiences and comprehensive support services has helped it establish a strong reputation within the industry.

The gaming industry is a highly competitive landscape, with a variety of players including:

- Traditional Casino Operators:These companies operate large-scale casinos with a wide range of gaming options, including slots, table games, and poker.

- Tribal Gaming Operators:Many Native American tribes operate casinos on their reservations, which often offer a variety of gaming options.

- Online Gaming Operators:With the legalization of online gaming in many states, online gaming operators have emerged as a significant force in the industry.

Accel Entertainment’s strategy is to differentiate itself by focusing on the growing market for EGMs in non-casino locations, such as bars, restaurants, and convenience stores. This strategy has been successful in allowing the company to capitalize on the increasing demand for gaming experiences in non-traditional settings.

CEO Stock Sale Context

The recent stock sale by Accel Entertainment’s CEO, a significant event for both the company and its investors, warrants closer examination. Understanding the context surrounding this sale is crucial for gaining insights into the CEO’s motivations and potential implications for Accel Entertainment’s future.

Details of the Stock Sale

The CEO of Accel Entertainment sold over 191,000 shares of company stock, representing a significant portion of their personal holdings. This transaction generated a total value of over $191,000, a substantial sum that highlights the scale of the sale.

Timing of the Sale

The timing of this stock sale is particularly noteworthy. It occurred shortly after Accel Entertainment announced its latest financial results, which revealed strong performance across key metrics. The company exceeded analysts’ expectations, demonstrating positive momentum in its core business operations.

Potential Reasons for the Sale

Several factors could have influenced the CEO’s decision to sell a substantial portion of their stock holdings.

- Personal Financial Needs:The CEO may have had personal financial obligations or investment opportunities that required the sale of these shares.

- Market Sentiment:Despite the company’s recent positive performance, the broader market conditions might have prompted the CEO to diversify their portfolio or reduce their exposure to Accel Entertainment’s stock.

- Long-Term Outlook:The CEO may have a long-term outlook for the company that differs from current market expectations, leading them to believe that the current share price represents an attractive opportunity to sell.

- Company Performance:While the recent financial results were positive, the CEO may have identified internal or external factors that could potentially impact the company’s future performance, leading them to adjust their personal investment strategy.

Potential Implications of the Stock Sale

The sale of a significant amount of stock by a company’s CEO can send ripples through the market, influencing investor sentiment, stock price, and potentially even the company’s overall financial performance. This is particularly true for Accel Entertainment, a publicly traded company, where investor confidence is paramount.

Impact on Investor Sentiment

The CEO’s stock sale could trigger a range of reactions among investors. Some might interpret it as a lack of confidence in the company’s future prospects, leading to a decrease in investor interest. This could be especially true if the sale is perceived as a “sell signal,” suggesting that the CEO believes the stock is overvalued or that the company is facing challenges.

Conversely, some investors might see the sale as a personal financial decision unrelated to the company’s performance, particularly if the CEO has a history of selling stock for diversification or personal reasons. The interpretation of the sale ultimately depends on the individual investor’s perspective and understanding of the company’s current financial health and future outlook.

Impact on Stock Price

The CEO’s stock sale could have a direct impact on Accel Entertainment’s stock price. A large sale, especially if it’s perceived as a sell signal, could lead to a decrease in demand for the stock, potentially causing the price to drop.

Conversely, if the sale is seen as a personal decision and investors remain confident in the company’s future, the stock price might not be significantly affected. The overall impact on the stock price will depend on how investors perceive the sale, the volume of stock sold, and the company’s overall market performance.

Impact on Financial Performance

The CEO’s stock sale, in itself, is unlikely to have a direct impact on the company’s financial performance. However, the potential negative impact on investor sentiment and stock price could indirectly affect financial performance. If investor confidence declines, it could lead to decreased investment in the company, making it more difficult to secure funding for future projects or expansions.

This, in turn, could impact the company’s ability to grow and generate revenue. Conversely, if the stock sale has a negligible impact on investor sentiment and the company continues to perform well, the sale is unlikely to have any significant impact on financial performance.

Find out further about the benefits of Palantir Technologies sells Rubicon Technologies shares worth over $9k that can provide significant benefits.

Market Analysis: Accel Entertainment CEO Sells Over 1k In Company Stock

The sale of Accel Entertainment stock by its CEO, while a significant event, can be compared to similar occurrences in the gaming industry to understand its potential implications. This analysis will delve into industry trends impacting Accel Entertainment and the current market conditions for gaming companies, providing insights into the broader context of the CEO’s stock sale.

Comparisons to Similar Events

Examining comparable situations within the gaming industry helps shed light on the possible motivations behind the CEO’s stock sale. Similar events have occurred in the past, often linked to factors like company performance, personal financial needs, or changes in market sentiment.

- For instance, in 2022, the CEO of a prominent casino operator sold a substantial portion of their shares amidst concerns about the impact of rising interest rates on the gaming industry. This move was interpreted by analysts as a signal of potential challenges ahead.

- In another case, the CEO of a gaming technology company sold stock after the company announced a successful product launch. This was viewed as a strategic move to capitalize on the positive market response and diversify their personal portfolio.

Industry Trends

The gaming industry is subject to various trends that can influence the performance of companies like Accel Entertainment. Understanding these trends is crucial to evaluating the CEO’s stock sale in its broader context.

- One key trend is the increasing popularity of online gaming, which has led to a shift in consumer preferences and posed challenges for traditional brick-and-mortar casinos.

- Another significant trend is the growing emphasis on responsible gaming and regulatory oversight, which has influenced the operating environment for gaming companies.

- Technological advancements, such as the use of artificial intelligence and blockchain technology, are also transforming the gaming industry, creating opportunities for innovation and disruption.

Current Market Conditions

The current market conditions for gaming companies are shaped by a combination of factors, including economic growth, consumer spending patterns, and regulatory policies. Assessing these conditions is essential to understanding the potential implications of the CEO’s stock sale.

- The global economic outlook, with factors like inflation and interest rate hikes, can impact consumer spending on leisure activities, including gaming.

- Regulatory changes, such as new gambling laws or stricter licensing requirements, can affect the profitability and operations of gaming companies.

- The competitive landscape within the gaming industry, with the emergence of new players and the consolidation of existing ones, also influences market dynamics.

Future Outlook

The CEO’s stock sale, while significant, doesn’t necessarily paint a gloomy picture for Accel Entertainment’s future. The company’s growth trajectory and the broader gaming industry’s outlook play a crucial role in determining the long-term impact of this transaction.

Potential Growth Opportunities

Accel Entertainment’s future growth hinges on several factors, including the expansion of its gaming footprint, strategic acquisitions, and the evolving landscape of the gaming industry.

- Expansion into New Markets:Accel Entertainment can capitalize on the growing popularity of gaming by expanding into new geographic markets. This could involve acquiring existing gaming operations or establishing new locations in states where gaming is legal or becoming increasingly popular.

- Diversification of Gaming Offerings:The company can explore diversifying its gaming offerings by introducing new game types or technologies. This could involve incorporating online gaming platforms, virtual reality experiences, or innovative game formats that cater to evolving player preferences.

- Strategic Acquisitions:Accel Entertainment can acquire smaller gaming operators or technology companies to expand its reach, acquire new gaming assets, or gain access to cutting-edge technology. This strategy can accelerate growth and enhance the company’s competitive edge.

- Leveraging Technology:The company can leverage technology to enhance its operations, improve customer experiences, and increase efficiency. This could involve implementing mobile gaming platforms, adopting data analytics to personalize gaming experiences, or developing innovative loyalty programs.

Potential Challenges

While Accel Entertainment faces several growth opportunities, it also faces potential challenges that could impact its future performance.

- Increased Competition:The gaming industry is highly competitive, with established players and new entrants vying for market share. Accel Entertainment must differentiate itself through innovative offerings, strong customer relationships, and effective marketing strategies to remain competitive.

- Regulatory Landscape:The gaming industry is subject to stringent regulations that can vary significantly from state to state. Accel Entertainment must navigate complex regulatory environments, ensuring compliance and adapting to changing regulations.

- Economic Downturn:Economic downturns can negatively impact consumer spending, potentially reducing gaming revenues. Accel Entertainment needs to develop strategies to mitigate the impact of economic fluctuations and maintain profitability.

- Technological Disruptions:The gaming industry is constantly evolving with new technologies emerging. Accel Entertainment must adapt to these disruptions, embracing innovation while managing the risks associated with emerging technologies.

End of Discussion

The CEO’s stock sale serves as a potent reminder of the complex interplay between corporate leadership, investor sentiment, and market forces. While the immediate impact on Accel Entertainment’s stock price remains to be seen, the move has undoubtedly generated significant interest within the gaming industry.

As investors and analysts continue to scrutinize the sale, its implications for the company’s future trajectory will unfold, shaping the narrative of Accel Entertainment in the months and years to come.

FAQ Corner

What is Accel Entertainment’s primary business?

Accel Entertainment is a leading provider of gaming machines and related services to bars, restaurants, and other establishments in the United States.

Why would a CEO sell their company stock?

There are various reasons why a CEO might sell their company stock, including personal financial needs, diversification of their portfolio, or a belief that the stock price is at a peak. It’s important to note that insider trading regulations must be followed.

What are the potential implications of a CEO stock sale for a company’s stock price?

A CEO stock sale can impact investor sentiment and lead to a decline in the company’s stock price. Investors may interpret the sale as a lack of confidence in the company’s future prospects. However, it’s crucial to consider the context of the sale and other factors influencing the market.

CentralPoint Latest News

CentralPoint Latest News