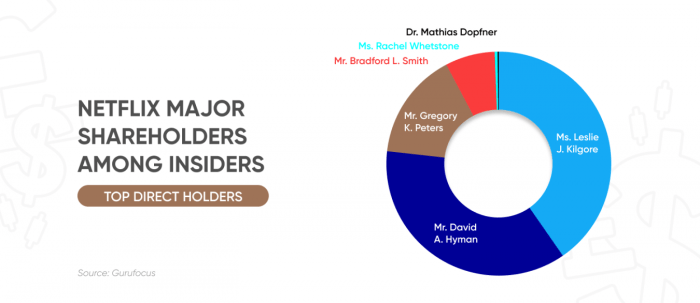

Netflix director Leslie J. Kilgore sells shares worth over 0k – Netflix director Leslie J. Kilgore, a key figure in the streaming giant’s success, has made headlines by selling shares worth over $300,000. This move, coming amidst a turbulent period for Netflix, has sparked speculation and raised questions about the company’s future trajectory.

Kilgore, known for her involvement in notable Netflix productions, has been a driving force behind some of the platform’s most popular shows, solidifying her position as a respected industry leader. Her decision to part ways with a portion of her Netflix stock, however, has sent ripples through the streaming landscape, prompting investors and analysts to dissect the potential implications for both Kilgore and the company.

The timing of the sale is particularly intriguing, occurring at a time when Netflix is facing growing competition and a slowing subscriber growth rate. While Kilgore’s sale could be attributed to personal financial planning or a desire to diversify her portfolio, it also raises questions about her confidence in Netflix’s long-term prospects.

Analysts are scrutinizing the details of the sale, seeking clues about the company’s internal dynamics and potential future strategies. The broader market is also closely watching, with investors seeking to understand how this move might influence Netflix’s stock price and the overall sentiment surrounding the streaming industry.

The Significance of the Share Sale

Leslie J. Kilgore, a director at Netflix, recently sold shares worth over $300,000, prompting speculation about the motivations behind this decision. Understanding the context of this sale requires considering the current state of Netflix’s market performance and Kilgore’s overall stake in the company.

The Potential Reasons Behind Kilgore’s Share Sale

Kilgore’s decision to sell shares could be attributed to various factors. It’s important to note that insider trading regulations require executives to disclose stock transactions, but these disclosures don’t necessarily reveal the specific reasons behind the sale.

- Diversification of Portfolio:Executives often diversify their investments to mitigate risk. Selling some Netflix shares could be a strategy to allocate capital to other assets, balancing their overall portfolio.

- Personal Financial Needs:Executives may sell shares to meet personal financial obligations, such as paying for education, home renovations, or other expenses.

- Market Outlook:While not explicitly stated, the sale could reflect a cautious outlook on Netflix’s future performance. If an executive believes the stock price might decline, they may choose to sell some shares to secure profits.

The Timing of the Sale in Relation to Netflix’s Current Market Performance

The timing of Kilgore’s share sale coincides with a period of volatility in Netflix’s stock price. The company has faced challenges in recent quarters, including slowing subscriber growth and increased competition in the streaming market. This has led to a decline in Netflix’s share price, potentially influencing Kilgore’s decision.

Comparison of the Sale Amount to Kilgore’s Overall Shareholdings in Netflix

The $300,000 sale represents a relatively small portion of Kilgore’s overall shareholdings in Netflix. This suggests that the sale might not be a significant indicator of their overall confidence in the company’s long-term prospects.

Impact on Netflix Stock and Market Sentiment: Netflix Director Leslie J. Kilgore Sells Shares Worth Over 0k

The sale of shares by Leslie J. Kilgore, a Netflix director, could potentially influence the stock price and investor sentiment surrounding the streaming giant. While a single director’s share sale doesn’t necessarily indicate a negative outlook for the company, it can trigger speculation and market reactions.

Potential Impact on Netflix’s Stock Price

The impact of Kilgore’s share sale on Netflix’s stock price is difficult to predict with certainty. However, several factors could contribute to its potential influence:

- Market Perception:Investors often interpret insider stock sales as a sign of a lack of confidence in a company’s future prospects. This perception could lead to a decrease in demand for Netflix shares, potentially causing the stock price to decline. For example, in 2022, Tesla’s stock price experienced a significant drop after CEO Elon Musk sold a large portion of his shares, prompting concerns about his faith in the company’s future.

- Market Sentiment:The overall market sentiment towards Netflix also plays a role. If the market is already bearish on Netflix, Kilgore’s share sale could amplify those sentiments, leading to a more pronounced decline in the stock price. However, if the market is bullish on Netflix, the impact of the sale might be less significant.

- Timing and Volume:The timing and volume of the share sale can also influence its impact. If the sale occurs during a period of heightened market volatility, its impact could be amplified. Similarly, a large-volume sale might raise more concern among investors than a smaller sale.

Influence on Investor Confidence in Netflix, Netflix director Leslie J. Kilgore sells shares worth over 0k

Kilgore’s share sale could impact investor confidence in Netflix in several ways:

- Erosion of Trust:Investors often look to insiders for insights into a company’s future prospects. A director’s share sale can raise questions about their confidence in the company, potentially eroding investor trust. For instance, if a director sells shares shortly before a major announcement, it could raise concerns about the company’s performance.

- Signal of Concerns:While not always the case, insider stock sales can be interpreted as a signal of potential concerns about the company’s future. This could lead investors to re-evaluate their investment decisions, potentially reducing their confidence in Netflix. For example, if a director sells shares during a period of declining subscriber growth, it could raise concerns about the company’s ability to maintain its market position.

- Market Volatility:The share sale can also contribute to increased market volatility around Netflix stock. Investors might react with uncertainty, leading to price fluctuations as they try to assess the implications of the sale. This volatility can make it challenging for investors to make informed decisions about their investments.

Implications for the Streaming Industry

Kilgore’s share sale could have broader implications for the streaming industry:

- Competitive Landscape:The streaming industry is highly competitive, with companies like Disney+, Amazon Prime Video, and Apple TV+ vying for market share. A decline in Netflix’s stock price or investor confidence could weaken its position in this competitive landscape. For example, if investors perceive Netflix as struggling, they might allocate their capital to other streaming platforms, potentially impacting the company’s future growth.

- Industry Sentiment:The sale could also influence industry sentiment towards streaming. If investors perceive Netflix as facing challenges, it could create a sense of uncertainty and caution among other streaming companies. This could lead to a slowdown in investment and innovation within the industry, potentially impacting its overall growth.

Do not overlook explore the latest data about Warburg Pincus entities sell $10.2 million in Ring Energy stock.

- Market Valuation:The sale could impact the market valuation of streaming companies as a whole. If investors become less optimistic about the future of streaming, it could lead to a decline in the valuations of all streaming companies, not just Netflix. This could affect their ability to raise capital and invest in new content and technologies.

Insights into Netflix’s Internal Dynamics

The sale of shares by a Netflix director, Leslie J. Kilgore, offers a glimpse into the company’s internal decision-making processes and potential future strategies. This move, coupled with recent leadership changes, provides a context for analyzing the evolving dynamics within Netflix.

Impact of Share Sale on Netflix’s Future Strategies

The sale of shares by a director can be interpreted as a signal of potential future strategies. It is essential to consider the context of the sale, such as the director’s tenure, the company’s current financial performance, and the market conditions.

While a share sale doesn’t necessarily indicate a negative outlook, it can reflect a change in perception of the company’s future prospects.

Share Sale in the Context of Leadership Changes

Netflix has experienced a series of leadership changes in recent years, including the departure of co-CEO Reed Hastings. These changes may have influenced the decision-making processes within the company. It is important to consider the potential impact of these changes on the company’s culture, strategic direction, and overall performance.

“The sale of shares by a director can be a sign of potential changes in the company’s future strategy, but it’s crucial to analyze the context of the sale and consider other factors, such as the director’s tenure and the company’s overall performance.”

Last Word

Leslie J. Kilgore’s share sale has ignited a conversation about Netflix’s future, prompting speculation about the company’s internal dynamics and the potential for further changes within its leadership. While the sale might be a personal decision, it has undoubtedly added fuel to the fire of ongoing discussions about the future of streaming and the challenges faced by companies like Netflix in navigating a rapidly evolving market.

Whether this move signals a shift in the company’s direction or is simply a personal financial decision, the impact of Kilgore’s share sale will be closely watched as the streaming landscape continues to evolve.

Question Bank

What is Leslie J. Kilgore’s current role at Netflix?

Leslie J. Kilgore is a director at Netflix, responsible for overseeing various aspects of production and development.

What are the potential reasons behind Kilgore’s decision to sell shares?

The reasons behind Kilgore’s decision to sell shares are unknown, but they could include personal financial planning, diversification of her portfolio, or a change in her outlook on Netflix’s future prospects.

How might Kilgore’s share sale impact Netflix’s stock price?

The impact of Kilgore’s share sale on Netflix’s stock price is difficult to predict, but it could potentially lead to a decrease in investor confidence and a decline in the stock price.

What are the implications of the sale for Netflix’s future strategies?

The implications of the sale for Netflix’s future strategies are unclear, but it could potentially signal a shift in the company’s direction or a change in its leadership.

CentralPoint Latest News

CentralPoint Latest News