Coinbase director Gokul Rajaram sells .5k in stock – Coinbase director Gokul Rajaram recently sold $64.5k worth of company stock, raising eyebrows in the crypto community. The sale, which took place on [Date of the sale], involved [Number of shares sold] shares at a price of [Price per share].

This move comes at a time when Coinbase is navigating a challenging market landscape, facing volatility and regulatory scrutiny. Rajaram, a veteran of the tech industry with experience at companies like Facebook and Twitter, joined Coinbase in 2021, bringing a wealth of expertise in product development and growth strategy.

While the sale itself may seem insignificant on the surface, it has sparked speculation about potential shifts in market sentiment and the company’s future trajectory. Some analysts believe that the sale could be a sign of Rajaram’s confidence in Coinbase’s long-term prospects, while others view it as a potential indicator of upcoming challenges.

Potential Reasons for the Stock Sale: Coinbase Director Gokul Rajaram Sells .5k In Stock

Gokul Rajaram, a director at Coinbase, recently sold $64.5k worth of company stock. While this transaction might seem insignificant on its own, it’s worth exploring potential reasons behind this move, especially considering Rajaram’s role at the company.

Possible Explanations for the Stock Sale

Several factors could have influenced Rajaram’s decision to sell some of his Coinbase stock. These reasons are not mutually exclusive, and a combination of factors might be at play.

- Diversification of Personal Investments:Individuals often diversify their investment portfolios to mitigate risk. Rajaram might be seeking to reduce his exposure to Coinbase stock and allocate his capital across various asset classes. This strategy helps to protect against potential losses in any single investment.

- Financial Planning:The stock sale could be part of Rajaram’s personal financial planning, such as funding future expenses, paying off debt, or contributing to retirement savings. These are common reasons for individuals to sell stocks, especially when they have significant holdings in a single company.

Find out about how Russia stocks higher at close of trade; MOEX Russia up 0.88% can deliver the best answers for your issues.

- Market Sentiment:Changes in market sentiment can influence investment decisions. Rajaram might have observed a decline in Coinbase’s stock price or a shift in market trends that led him to believe that the stock might not perform well in the near future.

This could have prompted him to sell some of his holdings.

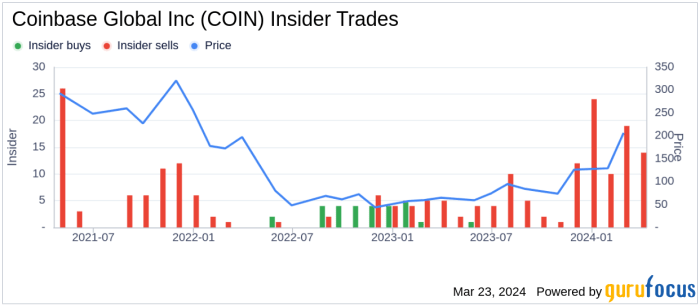

Comparison with Other Insider Stock Transactions

It’s important to compare Rajaram’s sale with other recent insider stock transactions at Coinbase. Examining the volume and timing of these transactions can provide insights into the broader market sentiment and insider confidence in the company.

- Similarities:If other Coinbase executives have also sold stock recently, it could indicate a general trend of insider selling, potentially reflecting concerns about the company’s future prospects or market conditions. This trend might signal a shift in sentiment and could impact investor confidence.

- Differences:Conversely, if Rajaram’s sale is an isolated incident, it might not necessarily reflect a broader trend within the company. It’s crucial to analyze the specific reasons behind the sale and compare it to other transactions to determine its significance.

Potential Impact on Coinbase’s Stock Price and Investor Confidence, Coinbase director Gokul Rajaram sells .5k in stock

Insider stock sales can sometimes influence investor confidence. While Rajaram’s sale is relatively small, its impact on Coinbase’s stock price and investor sentiment will depend on several factors:

- Market Context:The overall market conditions and investor sentiment towards Coinbase will play a significant role in determining the impact of the sale. If the market is already experiencing volatility, even a small sale could amplify concerns and lead to further price fluctuations.

- Transparency and Communication:Coinbase’s response to the sale and its communication with investors will be crucial. Transparency and clear explanations about the reasons behind the sale can help to mitigate any negative impact on investor confidence.

- Company Performance:Ultimately, Coinbase’s stock price and investor confidence will be driven by the company’s performance. Strong earnings, growth, and positive developments will likely outweigh the impact of a single insider sale.

Insider Trading Regulations and Disclosure Requirements

The sale of stock by Coinbase director Gokul Rajaram has raised questions about insider trading regulations and the company’s compliance with these rules. Insider trading, the buying or selling of securities based on non-public information, is strictly prohibited and heavily regulated.

The Securities and Exchange Commission (SEC) plays a pivotal role in enforcing these regulations to ensure fair and transparent markets.

SEC’s Rules and Guidelines

The SEC’s rules and guidelines aim to prevent individuals from gaining an unfair advantage by trading on non-public information. These regulations apply to all publicly traded companies, including Coinbase. The SEC’s primary rules and guidelines relevant to insider trading include:

- Rule 10b-5:This rule prohibits any fraudulent, deceptive, or manipulative acts in connection with the purchase or sale of securities. It applies to insider trading, where individuals with non-public information use it to their advantage.

- Form 4:This form requires company insiders, including directors, officers, and significant shareholders, to report their stock transactions within two business days of the trade. This allows the public to monitor insider activity and assess potential conflicts of interest.

- Regulation FD:This regulation requires companies to disclose material non-public information to the public simultaneously when they disclose it to analysts or institutional investors. This prevents selective disclosure and ensures a level playing field for all investors.

Importance of Transparency in Insider Stock Transactions

Transparency in insider stock transactions is crucial for maintaining investor confidence and ensuring fair market practices. When insiders trade, the public needs to be informed about their transactions, allowing them to:

- Assess potential conflicts of interest:Knowing an insider’s stock transactions can help investors understand if the insider’s actions are aligned with the company’s best interests or if they are motivated by personal gain.

- Monitor potential insider trading:By tracking insider transactions, investors can identify unusual patterns or suspicious activities that might indicate insider trading.

- Make informed investment decisions:Transparency in insider transactions provides valuable information for investors to make informed decisions about their investments.

Potential Consequences of Non-Compliance

Non-compliance with insider trading regulations can have severe consequences, including:

- Civil penalties:The SEC can impose substantial civil penalties on individuals and companies that violate insider trading rules.

- Criminal charges:In cases of egregious violations, individuals can face criminal charges, including imprisonment and fines.

- Reputational damage:Non-compliance with insider trading regulations can damage a company’s reputation and erode investor trust.

Implications for Coinbase’s Compliance

The sale of stock by Coinbase director Gokul Rajaram raises questions about Coinbase’s compliance with insider trading regulations. The SEC will likely scrutinize the transaction to determine:

- Whether Rajaram had material non-public information at the time of the sale:If he did, the sale could be considered insider trading.

- Whether the sale was properly disclosed:Rajaram is required to file a Form 4 within two business days of the sale, disclosing the details of the transaction.

- Whether Coinbase has adequate policies and procedures in place to prevent insider trading:The SEC will assess Coinbase’s internal controls to determine if they are effective in preventing insider trading.

Impact on Coinbase’s Future

The sale of Coinbase stock by Gokul Rajaram, a director, could have a mixed impact on the company’s future. While it’s essential to avoid reading too much into a single transaction, it does raise questions about investor confidence and potential strategic shifts.

The timing of the sale, coinciding with a period of market volatility and a decline in cryptocurrency prices, might suggest a cautious outlook on the company’s near-term prospects. However, it’s crucial to consider that this sale might be unrelated to any specific concerns about Coinbase’s future.

It could be driven by personal financial needs or a desire to diversify investments.

Impact on Coinbase’s Future Plans and Strategies

The sale could potentially impact Coinbase’s future plans and strategies in several ways.

- Reduced Appetite for Growth Initiatives:A large stock sale by a key executive might signal a more conservative approach to future growth investments. This could mean scaling back on ambitious expansion plans or delaying new product launches.

- Focus on Cost Optimization:The sale could reflect a focus on cost optimization and efficiency, particularly in the face of a challenging market environment. Coinbase might prioritize streamlining operations and reducing expenses to ensure financial stability.

- Strategic Partnerships:The sale might indicate a shift towards strategic partnerships and collaborations to drive growth. This could involve working with other companies in the crypto space or exploring new markets and services.

Impact on Coinbase’s Ability to Attract and Retain Talent

The sale could have a mixed impact on Coinbase’s ability to attract and retain talent.

- Potential for Lowered Morale:A large stock sale by a director might be perceived as a lack of confidence in the company’s future, potentially impacting employee morale and motivation.

- Impact on Hiring:The sale could make it more challenging for Coinbase to attract top talent, especially in a competitive market where compensation packages are often linked to stock options and performance.

- Retention Challenges:Employees might be more likely to seek opportunities elsewhere if they perceive the company’s future as uncertain or less promising.

Potential Risks and Opportunities for Coinbase

The sale of Coinbase stock by a director highlights the inherent risks and opportunities facing the company in the coming months and years.

- Regulatory Uncertainty:The crypto industry remains subject to significant regulatory uncertainty, which could impact Coinbase’s operations and growth prospects.

- Competition:Coinbase faces intense competition from other cryptocurrency exchanges and platforms, both established players and new entrants.

- Market Volatility:The cryptocurrency market is known for its volatility, which can impact Coinbase’s revenue and profitability.

- Innovation and Adoption:Coinbase’s success will depend on its ability to innovate and adapt to evolving trends in the crypto space, as well as the broader adoption of cryptocurrencies and blockchain technology.

Ultimate Conclusion

The sale of stock by a high-profile Coinbase director is a significant event that warrants attention. While it’s impossible to definitively interpret the motivations behind the transaction, it provides a glimpse into the complex dynamics of the crypto market and the challenges facing companies like Coinbase.

As the industry continues to evolve, the impact of such insider transactions will undoubtedly be a topic of ongoing scrutiny and debate.

Quick FAQs

Why did Gokul Rajaram sell his Coinbase stock?

The exact reasons behind the sale are unknown, but it’s likely related to a combination of factors such as personal financial planning, diversification of investments, or potential changes in market sentiment.

What impact could this sale have on Coinbase’s stock price?

The impact of this sale on Coinbase’s stock price is difficult to predict. Some investors may view it as a negative signal, while others may not be concerned. Ultimately, the stock price will be influenced by a range of factors, including market sentiment, company performance, and regulatory developments.

Is this sale considered insider trading?

Insider trading is a serious offense, and companies are required to disclose such transactions to the SEC. It’s important to note that Rajaram’s sale was likely disclosed in accordance with regulatory requirements, and there is no indication of any wrongdoing.

CentralPoint Latest News

CentralPoint Latest News